Europe Instant Water Heater Market Size, Share, Trends & Growth Forecast Report By Application (Residential, Commercial, (College/University, Offices, Government/Military, Others)), Energy Source, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Instant Water Heater Market Size

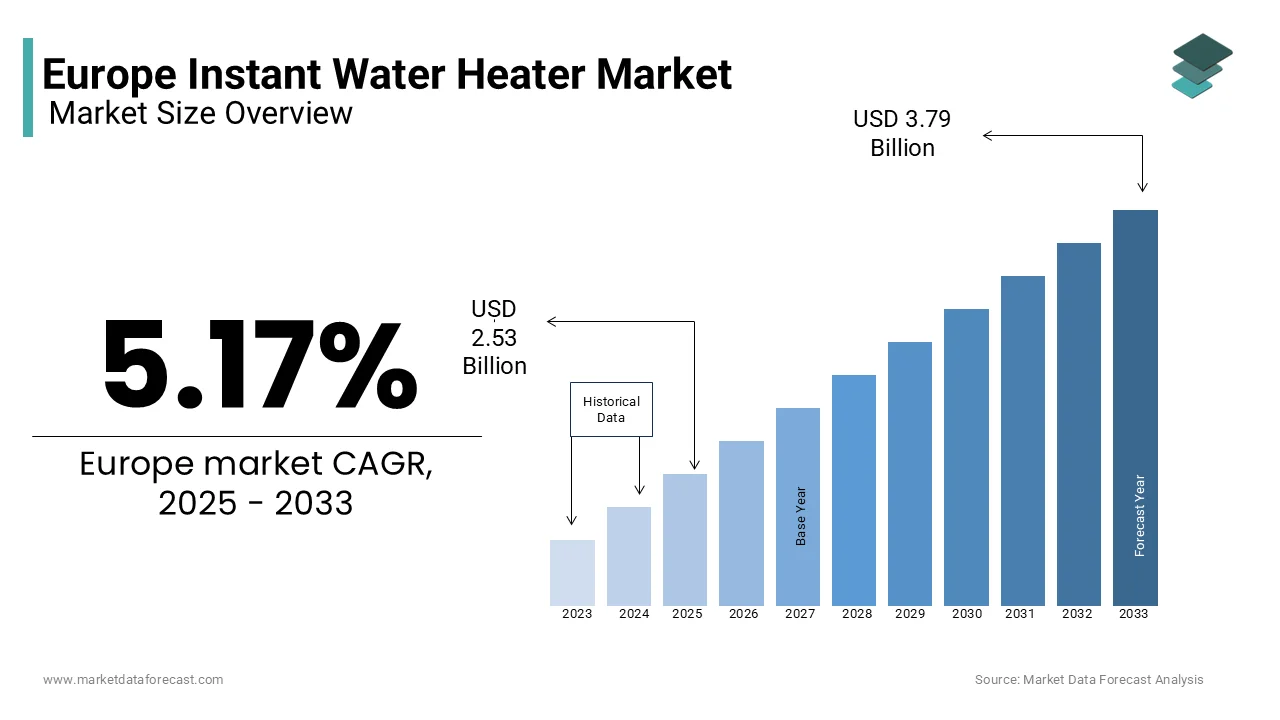

The instant water heater market size in Europe was valued at USD 2.41 billion in 2024. The European market is estimated to be worth USD 3.79 billion by 2033 from USD 2.53 billion in 2025, growing at a CAGR of 5.17% from 2025 to 2033.

The Europe instant water heater is compact and energy-efficient appliance that is gaining traction across residential, commercial, and industrial applications due to their ability to deliver immediate heating while minimizing energy wastage. Instant water heaters, also known as tankless water heaters, operate by heating water directly as it flows through the unit by offering significant advantages over traditional storage-based systems. According to Eurostat, approximately 40% of European households have adopted energy-efficient water heating solutions with instant water heaters accounting for a growing share of this transition.

The market is driven by increasing consumer awareness about sustainability and rising energy costs. As per the European Environment Agency, residential water heating accounts for nearly 15% of total household energy consumption by making energy-efficient alternatives like instant water heaters critical for reducing carbon footprints. Germany, France, and Italy are leading adopters, with Germany alone contributing over 25% of the regional market share. According to the International Energy Agency, the adoption of instant water heaters in Europe has grown at a CAGR of 6.2% over the past five years, reflecting steady demand.

Technological advancements, such as smart connectivity and integration with renewable energy systems, are further propelling market growth. As per the European Commission Directorate-General for Energy emphasizes the role of instant water heaters in achieving the EU’s 2050 net-zero emissions target. The instant water heater market is poised for sustained expansion with regulatory support and consumer preference for eco-friendly solutions.

MARKET DRIVERS

Increasing Energy Efficiency Regulations

The Europe instant water heater market growth is driven by the implementation of stringent energy efficiency regulations aimed at reducing carbon emissions. According to the European Commission Directorate-General for Energy, residential water heating accounts for approximately 15% of total household energy consumption by prompting policymakers to prioritize energy-saving technologies. Under the EU Ecodesign Directive, traditional storage-based water heaters are being phased out in favor of high-efficiency tankless systems, which consume up to 30% less energy. According to Eurostat, over 40% of households in Western Europe have already transitioned to energy-efficient solutions with instant water heaters playing a pivotal role. These regulations, coupled with subsidies like Germany’s BAFA program offering up to €300 per unit, incentivize adoption is driving market growth while aligning with the EU’s 2050 net-zero emissions goal.

Rising Consumer Awareness and Urbanization

The growing consumer awareness about sustainability and the impact of urbanization on housing infrastructure is another factor that is fuelling the growth rate of the market. According to the European Environment Agency, urban areas account for over 70% of Europe’s population, where space constraints and modern living preferences favor compact, on-demand solutions like instant water heaters. These systems occupy 50% less space than traditional models by making them ideal for densely populated cities such as Paris and Berlin. As per the International Energy Agency, rising energy costs, which increased by an average of 20% in 2022, have pushed consumers toward cost-effective alternatives. Instant water heaters reduce energy bills by up to €200 annually compared to conventional systems, according to the UK Department for Business, Energy & Industrial Strategy that further accelerating their adoption across Europe.

MARKET RESTRAINTS

High Initial Installation Costs

The high initial installation cost which limits widespread adoption among price-sensitive consumers. According to the European Commission Directorate-General for Energy, the upfront cost of installing an instant water heater can be up to 50% higher than traditional storage-based systems, with prices ranging from €800 to €2,500 depending on the model and capacity. For households in Eastern Europe, where disposable incomes are lower, this financial barrier is a major deterrent. According to the Eurostat, over 30 million Europeans face energy poverty by making it challenging for them to invest in premium heating solutions despite long-term savings. Additionally, retrofitting older homes with instant water heaters often requires significant plumbing modifications, which further increases the costs. This economic constraint slows market penetration, particularly in regions with weaker financial incentives.

Limited Awareness in Rural Areas

Another key restraint is the limited awareness and slower adoption of instant water heaters in rural areas, where traditional heating systems remain dominant. According to the European Environment Agency, rural households, which account for approximately 30% of Europe’s population, often lack access to information about modern energy-efficient technologies. In countries like Romania and Bulgaria, less than 10% of rural homes use advanced heating solutions, as per the International Energy Agency. This is compounded by inadequate infrastructure, such as insufficient gas supply networks, which restricts the feasibility of installing instant water heaters. Furthermore, cultural preferences for familiar technologies and resistance to change hinder progress. The rural market remains underserved by creating a significant barrier to achieving broader market growth across Europe.

MARKET OPPORTUNITIES

Integration with Renewable Energy Systems

A significant opportunity in the Europe instant water heater market lies in the growing integration with renewable energy systems, driven by the EU’s commitment to decarbonization. As per the European Commission Directorate-General for Energy, over 40% of European households are now equipped with renewable energy solutions like solar panels is creating a strong potential for hybrid heating systems. Instant water heaters can be seamlessly paired with solar thermal systems by reducing energy consumption by up to 50%, as per the International Energy Agency. This synergy aligns with the EU’s Renewable Energy Directive, which mandates a 42.5% share of renewables in energy consumption by 2030. Additionally, government incentives, such as Italy’s "Superbonus 110%" scheme, encourage homeowners to adopt energy-efficient technologies. This trend positions instant water heaters as a key component in sustainable home energy ecosystems.

Expansion in Retrofitting Projects

Another major opportunity is the increasing focus on retrofitting projects across Europe in older buildings requiring energy-efficient upgrades. According to the Eurostat, approximately 75% of residential buildings in the EU were constructed before 1990 by making them prime candidates for modernization. The UK Department for Business, Energy & Industrial Strategy emphasizes that retrofitting programs, such as the Green Homes Grant, have accelerated demand for compact and efficient instant water heaters. These systems offer a cost-effective solution for replacing outdated storage heaters, with installation costs offset by energy savings of up to €200 annually per household. Furthermore, the European Investment Bank has allocated €10 billion annually to support energy-efficient renovations that is driving demand for instant water heaters in retrofit projects and contributing to market growth.

MARKET CHALLENGES

Competition from Alternative Heating Technologies

The rising competition from alternative heating technologies, such as heat pumps and solar thermal systems is posing major challenges for the market to grow in the recent years. According to he International Energy Agency, heat pump installations in Europe surged by 35% in 2022, supported by government subsidies like Austria’s €6,000 grant per unit. These technologies are increasingly perceived as long-term sustainable solutions by overshadowing instant water heaters in markets with strong renewable energy adoption. The European Heat Pump Association predicts that heat pumps could meet 40% of Europe’s heating demand by 2030 that hinders the market growth. As per the European Commission Directorate-General for Energy, policies favoring electrification over fossil fuels create a challenging environment for instant water heaters, which rely heavily on natural gas by limiting their appeal in decarbonization-focused regions.

Dependence on Natural Gas Infrastructure

Another key challenge is the dependence on natural gas infrastructure, which restricts the adoption of instant water heaters in regions with limited or unreliable gas supply networks. According to the European Environment Agency, rural areas, particularly in Eastern Europe, often lack access to centralized gas grids by making it difficult to install gas-powered systems. For instance, less than 50% of households in Romania and Bulgaria are connected to natural gas networks, as reported by Eurostat. This limitation forces consumers in these regions to rely on electric or alternative heating solutions. Furthermore, geopolitical tensions, such as those involving Russia-Ukraine conflicts, have caused fluctuations in natural gas prices by increasing operational costs for gas-dependent appliances. These infrastructure and supply chain vulnerabilities pose significant barriers to market expansion in underserved regions across Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.17% |

|

Segments Covered |

By Application, Energy Source, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Ariston Holding N.V., Bosch Thermotechnology Corp., Bradford White Corporation, Ferroli, GE Appliances, Haier, Havells India, Heatrae Sadia, Jaquar India, Navien, Rinnai Corporation, Stiebel Eltron, Vaillant Group, Viessmann, and Whirlpool Corporation, and others. |

SEGMENTAL ANALYSIS

By Application Insights

The residential segment was the largest in the Europe instant water heater market with 65.1% of share in 2024. The rising demand for compact and energy-efficient solutions in over 220 million households across the EU is attributed to escalate the growth of the market. Residential water heating accounts for nearly 15% of household energy consumption by making instant water heaters critical for reducing energy costs. According to the European Commission Directorate-General for Energy, subsidies, such as Germany’s €300 BAFA incentive, have accelerated adoption. These systems offer a practical solution by saving up to €200 annually per household while aligning with EU sustainability goals.

The colleges/universities segment is projected to experience a CAGR of 7.8% from 2025 to 2033. This growth is driven by the need for energy-efficient systems in large educational facilities, where water heating constitutes 10% of energy use. Retrofitting programs, like those supported by the UK Department for Business, Energy & Industrial Strategy is elevating the growth of the market. Instant water heaters reduce energy consumption by up to 30% by making them ideal for institutions aiming to meet sustainability targets. Their ability to integrate with smart technologies further enhances operational efficiency with the growing importance in modernizing Europe’s education infrastructure while promoting eco-friendly practices.

By Energy Source Insights

The gas energy source segment was the largest by occupying 32.1% of the total share in 2024 due to their high efficiency, lower operational costs, and widespread natural gas infrastructure in urban areas. According to the UK Department for Business, Energy & Industrial Strategy, gas-powered systems reduce energy bills by up to €200 annually compared to traditional storage heaters. Countries like Germany and Italy further support adoption through subsidies and retrofitting programs. Their ability to deliver consistent and high-performance heating makes them critical in colder regions.

The electric energy source segment is likely to exhibit a fastest CAGR of 8.5% from 2025 to 2033. This growth is fueled by the EU’s electrification push and renewable energy integration, with over 40% of households adopting solar panels. As per the Eurostat, rural areas with limited gas infrastructure, such as Romania and Bulgaria, rely heavily on electric systems. These heaters are cost-effective, with installation costs averaging €500–€1,200, and align with decarbonization goals. Their compatibility with smart technologies enhances efficiency by making them vital for sustainable energy ecosystems. This segment’s rapid expansion reflects its importance in transitioning to eco-friendly heating solutions across Europe.

REGIONAL ANALYSIS

Germany was the out performer in the Europe instant water heater market with 25.4% share in 2024 owing to the robust energy efficiency policies and significant consumer awareness. According to the European Commission Directorate-General for Energy, Germany’s BAFA subsidies by offering up to €300 per unit that have accelerated adoption, particularly in urban areas. Germany prioritizes replacing outdated heating systems to meet its Green Deal targets with over 40 million households. The country’s well-established natural gas infrastructure further supports the dominance of gas-powered models, while increasing integration with renewable energy systems boosts electric variants. This combination of financial incentives, regulatory frameworks, and technological advancements positions Germany as a frontrunner in the regional market.

The UK is attributed in holding a significant CAGR of 5.9% in the foreseen years with the supported by strict carbon emission regulations and retrofitting initiatives. The UK Department for Business, Energy & Industrial Strategy emphasizes programs aimed at reducing household energy consumption is driving demand for energy-efficient solutions like instant water heaters. Rising energy costs, which surged by 20% in 2022, have pushed consumers toward cost-saving alternatives. Additionally, the phase-out of inefficient storage heaters aligns with the UK’s commitment to achieving net-zero emissions by 2050. The UK’s focus on sustainable heating solutions ensures steady growth is making it a key contributor to the Europe instant water heater market.

Italy is to showcase huge growth opportunities for the instant water heater market in the next coming years. The Italian Ministry of Economic Development notes that tax incentives like the "Superbonus 110%" scheme have spurred upgrades to modern, energy-efficient systems. This initiative allows homeowners to deduct up to 110% of renovation costs by including the installation of instant water heaters. Italy’s aging building infrastructure is coupled with growing consumer awareness about energy savings that further supports market expansion. Italy’s proactive approach to incentivizing sustainable heating solutions ensures its leading position in the regional market.

KEY MARKET PLAYERS

The major key players in Europe instant water heater market are Ariston Holding N.V., Bosch Thermotechnology Corp., Bradford White Corporation, Ferroli, GE Appliances, Haier, Havells India, Heatrae Sadia, Jaquar India, Navien, Rinnai Corporation, Stiebel Eltron, Vaillant Group, Viessmann, and Whirlpool Corporation, and others.

MARKET SEGMENTATION

This research report on the Europe instant water heater market is segmented and sub-segmented into the following categories.

By Application

- Residential

- Commercial

- College/University

- Offices

- Government/Military

- Others

By Energy Source

- Electric

- Gas

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size of the Europe Instant Water Heater Market?

The market is estimated to reach USD 3.79 billion by 2033, growing from USD 2.53 billion in 2025 at a CAGR of 5.17% from 2025 to 2033.

2. What are the key challenges faced by the Europe Instant Water Heater Market?

The market faces challenges such as high initial installation costs, fluctuating energy prices, limited availability of gas-powered models in certain regions, and competition from traditional storage water heaters.

3. Which regions in Europe have the highest demand for instant water heaters?

Key markets driving growth include Germany, the United Kingdom, France, Italy, and Spain, where demand is fueled by energy conservation initiatives, rapid urban development, and a preference for modern home appliances.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]