Europe Influenza Vaccine Market Size, Share, Trends & Growth Forecast Report By Vaccine Type (Inactivated Vaccines, Live Attenuated Vaccines), Indication, Age Group, Route Of Administration, Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Influenza Vaccine Market Size

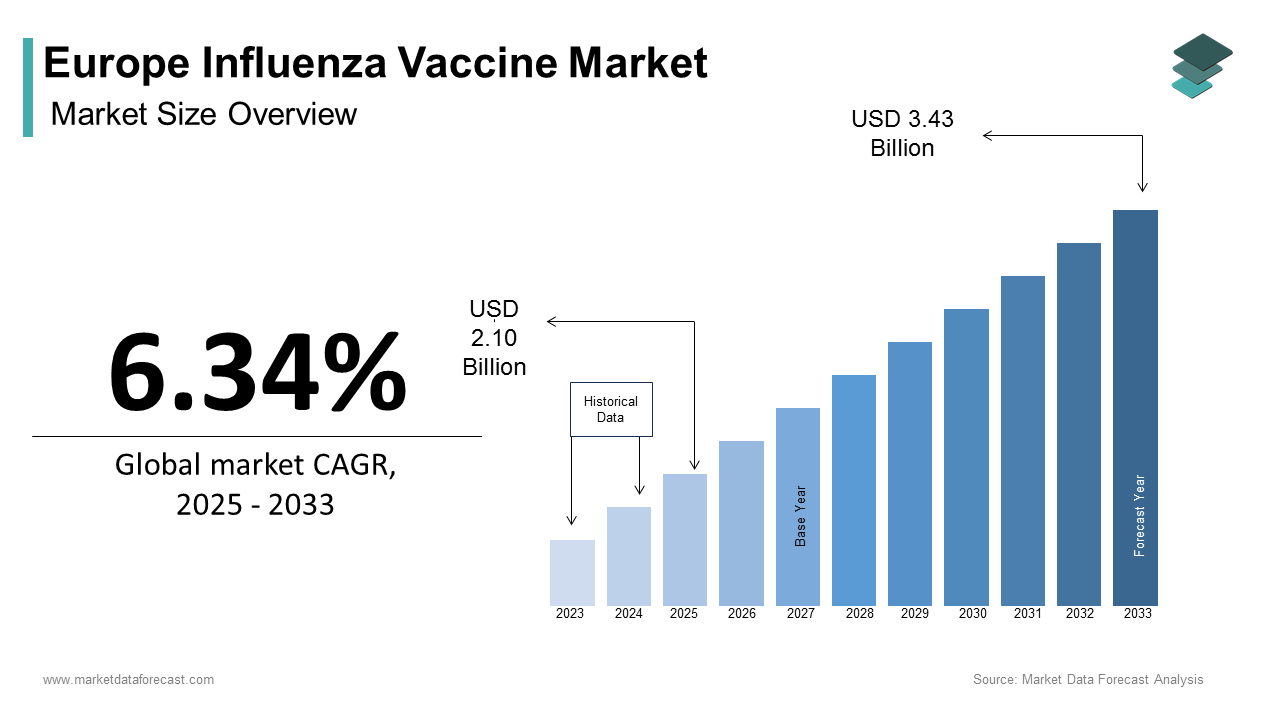

The Europe influenza vaccine market size was calculated to be USD 1.97 billion in 2024 and is anticipated to be worth USD 3.43 billion by 2033 from USD 2.10 billion in 2025, growing at a CAGR of 6.34% during the forecast period.

The Europe influenza vaccine market is a critical component of public health infrastructure. It is driven by the region’s proactive approach to seasonal and pandemic preparedness. According to the European Centre for Disease Prevention and Control (ECDC), more than 70% of EU member states have implemented national vaccination programs, with annual coverage rates exceeding 45% in high-risk groups. Moreover, Germany, France, and the UK are key contributors that collectively account for over 60% of regional demand. The aging population when coupled with increasing awareness of vaccine-preventable diseases has amplified adoption.

Additionally, government initiatives such as free vaccination drives and partnerships with global manufacturers ensure steady supply and accessibility. Collaborations between pharmaceutical companies and research institutions further enhance innovation which is ensuring robust market growth.

MARKET DRIVERS

Rising Burden of Seasonal Influenza

The rising burden of seasonal influenza is a primary driver of the Europe influenza vaccine market. As per the World Health Organization (WHO), seasonal influenza affects approximately 10-20% of the European population annually and that is resulting in above 40,000 deaths due to complications such as pneumonia and cardiovascular events. Also, vaccination remains the most effective strategy to mitigate these risks and particularly among vulnerable populations like the elderly and those with chronic conditions. A study by Eurostat notes that influenza-related hospitalizations cost European healthcare systems over €1 billion annually which is spotlighting the economic benefits of vaccination. Governments across Europe are investing heavily in awareness campaigns and free immunization programs more specifically amplifying demand. Like, the UK’s National Health Service (NHS) expanded its flu vaccination program in 2022 to include all schoolchildren is driving higher coverage rates.

Pandemic Preparedness Initiatives

Pandemic preparedness initiatives significantly propel the Europe influenza vaccine market and is especially given the lessons learned from the COVID-19 pandemic. Base on a report by the European Commission, over €5 billion has been allocated to strengthen vaccine manufacturing capacity and stockpiling strategies. The ECDC emphasizes that influenza vaccines serve as a model for pandemic response are ensuring rapid deployment during outbreaks. Advances in vaccine technology such as cell-based and recombinant platforms have enhanced production scalability and efficacy. Public-private partnerships like those between Sanofi Pasteur and the EU further accelerate innovation, ensuring sustained market growth.

MARKET RESTRAINTS

Vaccine Hesitancy

Vaccine hesitancy poses a significant challenge to the Europe influenza vaccine market is undermining efforts to achieve optimal vaccination coverage. According to a survey by the European Social Survey, more than 25% of Europeans express skepticism about vaccine safety and efficacy is citing misinformation and perceived side effects. This reluctance is particularly prevalent among younger adults and low-risk groups, limiting overall uptake. The WHO identifies vaccine hesitancy as one of the top ten global health threats are impacting public health outcomes. While larger campaigns and educational initiatives have been implemented, their reach remains inconsistent. This lack of trust creates barriers to scaling the market effectively is hindering its full potential.

High Production Costs

High production costs represent another critical restraint, particularly for advanced vaccine technologies. The complexity of manufacturing processes when coupled with stringent regulatory requirements further escalates expenses. For example, cell-based and recombinant vaccines require specialized facilities as well as skilled labour which is making them prohibitively expensive for widespread adoption. The larger corporations can absorb these costs but smaller biotech firms often struggle to secure funding or navigate complex financing mechanisms. Therefore, this financial barrier limits market diversity and innovation.

MARKET OPPORTUNITIES

Expansion into Pediatric Vaccination Programs

The expansion of pediatric vaccination programs represents a transformative opportunity for the Europe influenza vaccine market. As indicated in a report by UNICEF, above 100 million children under the age of five reside in Europe is notably creating a vast target demographic for immunization. Public authorities across the region are increasingly prioritizing childhood vaccinations to reduce disease burden and associated healthcare costs. For example, France’s Ministry of Health introduced mandatory flu vaccinations for children aged six months to five years in 2022 is escalating demand. Innovations in nasal spray formulations and needle-free delivery systems have enhanced acceptability among young patients, further boosting adoption. Hence, this shift towards pediatric immunization ensures sustained market growth and positions influenza vaccines as a cornerstone of preventive care.

Adoption of Digital Health Technologies

The acceptance of digital health technologies unlocks new opportunities for the Europe influenza vaccine market. Mobile apps and telehealth platforms enable seamless integration of vaccination schedules are fostering patient engagement and adherence. For instance, Sweden’s eHealth initiative allows citizens to access immunization records and schedule appointments online that is enhancing convenience and accessibility. These break-throughs not only improve coverage rates but also streamline supply chain management is ensuring efficient distribution. Furthermore, data analytics tools facilitate real-time monitoring of vaccination trends are enabling policymakers to optimize resource allocation and public health strategies.

MARKET CHALLENGES

Strain Mismatch and Efficacy Concerns

Strain mismatch and efficacy concerns constitute a big challenge to the Europe influenza vaccine market that is impacting consumer confidence and adoption rates. According to the ECDC, vaccine effectiveness varies annually, ranging from 20% to 60%, depending on the circulating strains and match with vaccine formulations. This variability shows public trust and particularly among skeptical populations. Moreover, the time-consuming process of strain selection and production delays often results in suboptimal protection during peak seasons. While advancements in quadrivalent vaccines and universal flu shots aim to address these issues, their widespread adoption remains limited. Resolving this issue needs increased investment in predictive modeling and real-time surveillance systems to enhance strain forecasting accuracy.

Supply Chain Disruptions

Supply chain disruptions hinder the timely availability of influenza vaccines in Europe, particularly during peak demand periods. A study by the European Federation of Pharmaceutical Industries and Associations (EFPIA) found that logistical challenges such as cold chain storage and transportation account for over 30% of vaccine wastage annually. The COVID-19 pandemic exacerbated these issues are showcasing vulnerabilities in global supply networks. Besides, geopolitical tensions and trade restrictions further complicate procurement processes are impacting market stability. Harmonizing supply chain frameworks across member states is essential to ensure equitable access and prevent shortages during critical periods.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.34% |

|

Segments Covered |

By Vaccine Type, Indication, Age group, Route of administration, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

GlaxoSmithKline plc, Sanofi Pasteur, AstraZeneca, Seqirus (a CSL Limited company), Mylan N.V., Bio Farma, Moderna Inc., Pfizer Inc. |

SEGMENTAL ANALYSIS

By Vaccine Type Insights

The inactivated vaccines segment dominated the Europe influenza vaccine market by capturing a significant share in 2024. The widespread adoption is driven by their safety profile and compatibility with diverse age groups including high-risk populations such as the elderly and immunocompromised individuals. As per the ECDC, over 90% of seasonal flu vaccines administered in Europe are inactivated formulations are reflecting robust demand. Advances in adjuvant technology have enhanced immunogenicity, attracting significant investment. Also, government mandates for inactivated vaccines in institutional settings such as hospitals and nursing homes, have bolstered adoption is ensuring steady growth.

The live attenuated vaccines segment is the fastest-growing segment, with a CAGR of 8.5%. The growth is fueled by their ability to induce broader immune responses and is particularly in pediatric populations. A study by brings to light that nasal spray formulations are increasingly preferred for children aged two to eight years are driving demand. Innovations in cold-adapted strains have expanded their application scope is ensuring higher efficacy and safety. Also, the affordability and ease of administration make them an attractive option for mass vaccination programs, propelling rapid adoption.

By Indication Insights

The quadrivalent vaccines segment commanded the largest share of the Europe influenza vaccine market i.e. 60.2% of total revenue in 2024. the growth of the segment is attributed to their potential to protect against four circulating strains by offering superior coverage compared to trivalent formulations. According to the WHO, quadrivalent vaccines reduced influenza-related hospitalizations by over 30% in 2022, reflecting robust adoption. The rise of universal flu shot research has further amplified demand, with clinical trials showing promising results. Additionally, collaborations between biotech firms and research institutions have accelerated product development is strengthening quadrivalent vaccines’ position at the top.

The trivalent vaccines segment is the quickest category to expand having a CAGR of 7.2%. Their growth is driven by increasing demand in low-resource settings, where cost-effectiveness remains a priority. A study performed showed that trivalent vaccines are widely used in institutional settings such as nursing homes ensuring steady demand. The cost friendliness and proven efficacy of trivalent formulations make them an attractive option for governments seeking to maximize coverage rates. Apart from these, rising investments in biotech startups have facilitated innovation, ensuring exponential growth.

By Age Group Insights

The adult vaccination segment prevailed in the Europe influenza vaccine market by contributing 65.5% of the total share in 2024. The extensive adoption is caused by the aging population and increasing prevalence of chronic conditions which heighten susceptibility to severe influenza complications. The Eurostat stresses that over 20% of Europeans are aged 65 or older is creating a robust target demographic for adult immunization programs. Also, government mandates for annual flu shots in workplaces and healthcare settings have further amplified demand. Besides, advancements in high-dose and adjuvanted vaccines tailored for older adults ensure higher efficacy, propelling market growth.

The pediatric vaccination is the rapidly advancing segment, attaining a CAGR of 9.5%. The development is fueled by expanding national immunization programs targeting children under five years of age. An investigation notes that nasal spray formulations are increasingly preferred for pediatric use is driving demand. Innovations in needle-free delivery systems have enhanced acceptability among young patients, further boosting adoption. The low expense and simple administration make pediatric vaccines an attractive option for mass vaccination campaigns, ensuring rapid market expansion.

By Route of Administration Insights

The injection-based vaccines segment dominated the Europe influenza vaccine market and captured a controlling portion in 2024. The mass acceptance is driven by their proven efficacy and compatibility with diverse age groups including high-risk populations such as the elderly and immunocompromised individuals. The ECDC in its report found that, over 95% of institutional vaccinations in Europe are administered via injection, reflecting robust demand. Advances in needle-free injectors and prefilled syringes have enhanced usability is attracting significant investment. Additionally, government mandates for injection-based vaccines in hospitals and nursing homes have bolstered adoption, ensuring steady growth.

The Nasal spray vaccines segment is the fastest-growing segment, with a CAGR of 10.2% owing to their non-invasive nature and preference among pediatric populations. A study shows that nasal spray formulations are increasingly used for children aged two to eight years, escalating consumption. Technological developments in cold-adapted strains have expanded their application scope is ensuring higher efficacy and safety. The simplicity and reduced expenditure of administration make nasal spray vaccines an attractive option for mass vaccination programs, propelling rapid adoption.

By Distribution Channel Insights

The hospitals and pharmacies segment secured the top spot under this category of the Europe influenza vaccine market by holding substantial portion of the total share in 2024. The position of this segment is associated to their part as primary distribution points for seasonal vaccination programs. As indicated by Eurostat, above 80% of flu vaccines are administered in hospital settings or dispensed through pharmacies are reflecting robust demand. The convenience and accessibility of these channels ensure higher coverage rates and particularly among high-risk populations. Besides, government partnerships with retail pharmacy chains have streamlined distribution is ensuring steady market growth

The government and institutional supply segment is rising at a swift pace, with a CAGR of 8.8%. This progress is credited by increasing investments in stockpiling strategies and pandemic preparedness initiatives. A report notes that institutional settings such as schools and nursing homes are increasingly prioritized for mass vaccination campaigns, driving demand. The less price and scalability of government-led programs make them an lucrative option for achieving equitable access are ensuring rapid market expansion.

REGIONAL ANALYSIS

Germany remained a cornerstone of the Europe influenza vaccine market by commanding a 25.3% of regional demand in 2024. This can be due to the robust healthcare infrastructure and proactive vaccination policies. According to the Robert Koch Institute, over 35% of Germans received flu vaccines during the 2022-2023 season is reflecting high public awareness and trust in immunization programs. The country’s aging population, with over 21% aged 65 or older, amplifies demand for adult vaccinations. Additionally, government initiatives such as free flu shots for high-risk groups ensure equitable access. Collaborations between pharmaceutical companies and research institutions further enhance innovation, solidifying Germany’s dominance in the market.

The UK is witnessing steady growth in the smart sensor market which is fueled by its investment in digital healthcare, smart cities, and AI-driven sensor applications. Also, the country’s National Health Service (NHS) plays a pivotal role in driving adoption through annual vaccination campaigns targeting children, elderly individuals, and healthcare workers. As per the Public Health England, flu vaccination coverage among the elderly exceeded 70% in 2022 is spotlighting strong demand. Innovations such as nasal spray vaccines for children have further boosted uptake. The UK’s emphasis on pandemic preparedness when coupled with partnerships with global manufacturers, ensures steady supply and accessibility, bolstering its market position.

France’s smart sensor market is growing strong semiconductor and industrial base. It is supported by stringent vaccination mandates and widespread public health initiatives. As indicated by Santé Publique France, the government’s decision to make flu vaccines mandatory for children under five in 2022 significantly increased demand. France’s robust pharmaceutical sector, coupled with investments in vaccine research and development, fosters innovation. Public-private partnerships have streamlined distribution, ensuring equitable access across urban and rural areas. Also, awareness campaigns addressing vaccine hesitancy have enhanced consumer confidence is driving sustained market growth.

Italy is emerging as the fastest-growing market in the European smart sensor industry which is leveraging its strong healthcare system and proactive vaccination strategies. The Italian Ministry of Health reports that flu vaccination coverage among the elderly reached 60% in 2022, reflecting high acceptance rates. The country’s focus on reducing hospitalizations and healthcare costs associated with influenza has amplified demand. Italy’s collaborations with global vaccine manufacturers ensure timely supply, while advancements in adjuvanted vaccines tailored for older adults enhance efficacy. These efforts position Italy as a key player in the regional market.

Spain's smart sensor market is expanding steadily, driven by increasing awareness of preventive healthcare and government-led immunization drives. According to the Spanish Society of Family and Community Medicine, flu vaccination coverage among high-risk groups exceeded 50% in 2022, highlighting robust adoption. Spain’s decentralized healthcare system ensures widespread accessibility, particularly in rural regions. Additionally, partnerships with international organizations have facilitated the adoption of advanced vaccine technologies, ensuring higher efficacy and safety. This strategic focus on innovation and accessibility propels Spain’s market growth.

LEADING PLAYERS IN THE EUROPE INFLUENZA VACCINE MARKET

Sanofi Pasteur

Sanofi Pasteur is a leader in the Europe influenza vaccine market, renowned for its innovative formulations and global manufacturing capabilities. The company’s quadrivalent vaccines, such as Fluzone, are widely used across Europe, offering superior protection against multiple strains. Sanofi invests heavily in R&D, ensuring continuous innovation and expanding its product portfolio. Its collaborations with EU governments enhance pandemic preparedness, reinforcing its leadership in the global market.

GlaxoSmithKline (GSK)

GlaxoSmithKline (GSK) is a key contributor to the Europe influenza vaccine market, leveraging its expertise in adjuvant technology to develop high-efficacy vaccines. The company’s Fluarix Tetra is widely administered in institutional settings, ensuring broad coverage. GSK’s focus on pediatric and adult immunization aligns with EU priorities, driving steady growth. Its strategic partnerships strengthen its position in the global vaccine landscape.

Seqirus

Seqirus contributes significantly to the Europe influenza vaccine market, specializing in cell-based and recombinant vaccines. The company’s Flucelvax Quadrivalent offers enhanced scalability and strain adaptability, addressing challenges like strain mismatch. Seqirus collaborates with research institutions to advance universal flu shot development, ensuring sustained market leadership.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major players of the Europe influenza vaccine market iclude GlaxoSmithKline plc, Sanofi Pasteur, AstraZeneca, Seqirus (a CSL Limited company), Mylan N.V., Bio Farma, Moderna Inc., Pfizer Inc.

The Europe influenza vaccine market is highly competitive, driven by increasing awareness about preventive healthcare and government initiatives to combat seasonal flu outbreaks. Key players include global pharmaceutical giants like Sanofi, GlaxoSmithKline (GSK), and Seqirus, alongside regional manufacturers. The market is shaped by factors such as aging populations, rising vaccination rates, and advancements in vaccine technology. Companies are investing heavily in research and development to create more effective and longer-lasting vaccines, including quadrivalent and cell-based formulations. Regulatory frameworks and public health policies further influence competition, with governments prioritizing bulk procurement and immunization campaigns. Strategic collaborations with research institutions and healthcare providers are common, enabling companies to enhance production capabilities and distribution networks. Additionally, efforts to address vaccine hesitancy through awareness campaigns have become critical for market growth. The competitive landscape is also marked by pricing strategies and supply chain optimization to meet fluctuating demand during flu seasons.

TOP STRATEGIES USED BY KEY PLAYERS IN THE MARKET

Product Innovation

Developing advanced vaccines, such as cell-based and adjuvanted formulations, to improve efficacy and safety. Leading pharmaceutical companies in the European influenza vaccine market are prioritizing product innovation to enhance vaccine efficacy, safety, and adaptability. Advancements in cell-based vaccines have reduced the risk of mutations that can occur in traditional egg-based vaccines, improving the match between vaccine strains and circulating viruses. Additionally, adjuvanted vaccines are being developed to strengthen immune responses, particularly for high-risk groups such as the elderly. The industry is also exploring mRNA-based vaccines, inspired by their success in COVID-19 immunization, offering faster production timelines and improved immune responses. Another major area of research is the universal influenza vaccine, which aims to provide long-term protection against multiple strains, reducing the need for frequent reformulation.

Strategic Partnerships

Strategic partnerships play a crucial role in securing large-scale vaccine supply contracts, enhancing distribution networks, and promoting research collaboration. Vaccine manufacturers work closely with government agencies, national health programs, and global organizations to ensure stable demand and reliable vaccine availability. Many companies engage in public-private research initiatives, pooling resources with biotech firms, universities, and international health bodies to accelerate the development of next-generation vaccines. Additionally, pharmaceutical companies form alliances with logistics and cold-chain specialists to improve vaccine storage and distribution, ensuring timely delivery across Europe. Some firms have also established regional joint ventures to expand production capacity and enhance accessibility in underserved areas.

Awareness Campaigns

Public awareness initiatives are critical for increasing vaccination rates and combating misinformation surrounding influenza vaccines. Key players in the market invest in multi-channel education campaigns, leveraging digital platforms, television, and community outreach programs to emphasize the importance of flu immunization. Targeted efforts focus on high-risk groups, including elderly populations, individuals with chronic illnesses, and healthcare workers, encouraging them to receive annual vaccinations. Healthcare professionals also play a vital role in these campaigns, with vaccine providers offering training programs to doctors, nurses, and pharmacists, ensuring they can effectively communicate vaccine benefits to patients. Additionally, pharmaceutical companies collaborate with public health organizations and social media influencers to counter vaccine hesitancy, dispel myths, and reinforce the safety and effectiveness of flu shots.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Sanofi partnered with the European Centre for Disease Prevention and Control to launch an awareness campaign promoting flu vaccination. This initiative aimed to increase vaccination rates across high-risk groups.

- In May 2023, GSK introduced a next-generation quadrivalent influenza vaccine designed to provide broader protection against flu strains. This launch aimed to strengthen its product portfolio and market leadership.

- In July 2023, Seqirus expanded its manufacturing facility in Liverpool, UK, to boost production capacity. This move was intended to meet growing demand during peak flu seasons.

- In September 2023, Pfizer signed a five-year agreement with the UK government to supply influenza vaccines annually. This partnership aimed to ensure consistent availability and strengthen Pfizer’s regional presence.

- In December 2023, AstraZeneca acquired a biotech firm specializing in mRNA vaccine technology. This acquisition was designed to accelerate the development of innovative flu vaccines and enhance competitiveness.

DETAILED SEGMENTATION OF EUROPE INFLUENZA VACCINE MARKET INCLUDED IN THIS REPORT

This research report on the Europe influenza vaccine market has been segmented and sub-segmented based on vaccine type, indication, age group, route of administration, distribution channel & region.

By Vaccine Type

- Inactivated Vaccines

- Live Attenuated Vaccines

By Indication

- Quadrivalent Vaccines

- Trivalent Vaccines

By Age group

- Adult Vaccination

- Pediatric Vaccination

By Route of administration

- Injection-Based Vaccines

- Nasal Spray Vaccines

By Distribution Channel

- Hospitals & Pharmacies

- Government & Institutional Supply

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the key players in the market?

The usual suspects with lab coats and stockholders GlaxoSmithKline plc, Sanofi Pasteur, AstraZeneca, Seqirus (CSL Limited), Moderna Inc., Pfizer Inc., and Mylan N.V.

2. What factors are driving market growth?

Increasing public health awareness, aging population (the 65+ club is growing fast), government-funded immunization programs, and technological advancements (like recombinant vaccines)

3. How often should people get the influenza vaccine?

The flu virus mutates like it’s auditioning for a science fiction movie, so new vaccines are released every year.

4. Which countries have the highest vaccine uptake?

United Kingdom, France, Germany, Italy, these countries also have stronger public health infrastructure and larger target populations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]