Europe Industrial Gases Market Size, Share, Trends & Growth Forecast Report By Type (Oxygen, Nitrogen, Carbon Dioxide, Hydrogen, Acetylene, Inert Gases, and Other Types), End-Use Industry and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Industrial Gases Market Size

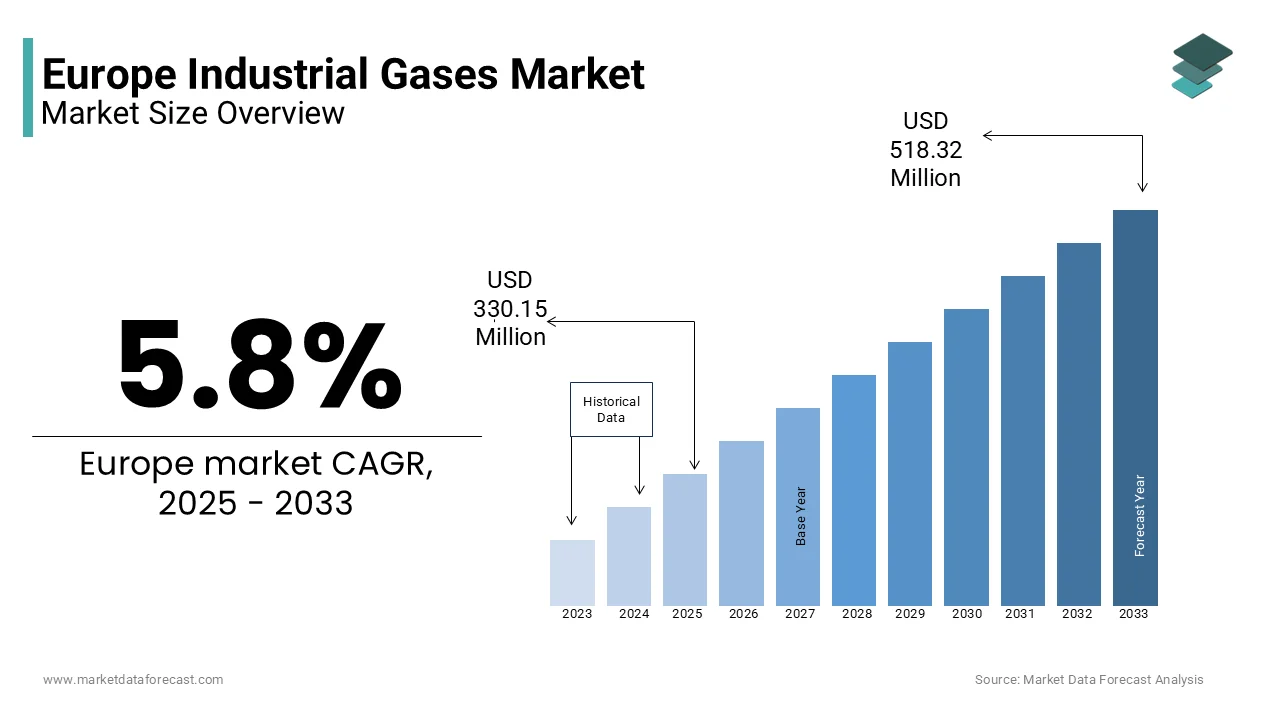

The Industrial gases market size in Europe was valued at USD 312.05 million in 2024. The European market is estimated to be worth USD 518.32 million by 2033 from USD 330.15 million in 2025, growing at a CAGR of 5.8% from 2025 to 2033.

Industrial gases such as oxygen, nitrogen, carbon dioxide, hydrogen, and specialty gases play an important role in the manufacturing, healthcare and energy sectors in the European region and. These gases are indispensable across diverse applications, including metal fabrication, chemical production, food processing, medical oxygen supply, and environmental management. The demand for industrial gases in Europe is expected to continue fuel during the forecast period owing to the industrialization, urbanization, and the transition toward sustainable energy solutions.

The healthcare sector has emerged as a significant consumer of industrial gases, particularly medical oxygen, with demand surging by 12% annually since 2020, as reported by the World Health Organization (WHO). Additionally, the growing emphasis on decarbonization has propelled hydrogen adoption, with the European Commission identifying it as a key enabler of the EU Green Deal. The European Environment Agency notes that carbon dioxide usage in food and beverage industries has grown by 8% annually, driven by rising consumption of carbonated drinks and packaged foods.

MARKET DRIVERS

Growing Demand for Hydrogen in Decarbonization Efforts

The increasing demand for hydrogen as a clean energy carrier is a major driver of the European industrial gases market. The European Commission’s EU Green Deal has set ambitious targets to achieve carbon neutrality by 2050, with hydrogen expected to play a pivotal role in decarbonizing industries such as steel, refining, and transportation. According to Eurostat, investments in green hydrogen production have surged by 30% annually since 2020, supported by government subsidies and private sector initiatives. The European Environment Agency highlights that hydrogen demand in industrial applications is projected to grow by 10% annually, reaching 8 million tons by 2030. This shift is driven by policies promoting renewable energy integration and reducing reliance on fossil fuels. As Europe accelerates its transition to sustainable energy solutions, hydrogen’s versatility and eco-friendly properties continue to drive the industrial gases market.

Rising Healthcare Sector Dependence on Medical Gases

The healthcare sector’s growing reliance on medical gases, particularly oxygen, is another key driver propelling the European industrial gases market. The World Health Organization (WHO) reports that medical oxygen demand surged by 12% annually between 2020 and 2023, fueled by aging populations and increased prevalence of respiratory diseases. Additionally, the COVID-19 pandemic underscored the critical role of oxygen in emergency care, prompting governments to expand healthcare infrastructure. The UK Office for National Statistics notes that over €5 million was allocated to enhance medical gas supply chains across Europe in 2022. Furthermore, advancements in cryogenic technologies have improved the efficiency of oxygen production and distribution. With Europe prioritizing universal healthcare access and medical innovation, the demand for industrial gases in healthcare applications is set to rise significantly, reinforcing their importance in the market.

MARKET RESTRAINTS

High Energy Costs in Gas Production

The production of industrial gases is highly energy-intensive, making the European market vulnerable to rising energy costs, which pose a significant restraint. According to Eurostat, energy expenses account for approximately 40% of the total production costs in the industrial gases sector, with natural gas being a critical input for processes like air separation. The European Commission reports that energy prices surged by 60% in 2022 due to geopolitical tensions and supply chain disruptions, severely impacting manufacturers. Additionally, the EU Emissions Trading System (ETS) imposes carbon pricing, further increasing operational costs. These financial pressures are particularly challenging for small- and medium-sized enterprises, limiting their ability to invest in innovation or expand capacity. As Europe grapples with an ongoing energy crisis, the industrial gases market faces significant hurdles in maintaining profitability while meeting growing demand.

Stringent Environmental Regulations

Stringent environmental regulations, while promoting sustainability, present another major challenge to the European industrial gases market. The European Environment Agency highlights that compliance with emission reduction targets under the EU Green Deal requires significant investments in low-carbon technologies, raising operational costs by up to 25% for manufacturers. For instance, the production of gases like carbon dioxide and nitrogen involves high energy consumption and emissions, attracting scrutiny under the Industrial Emissions Directive (IED). Non-compliance can result in penalties or operational shutdowns, creating additional financial burdens. Furthermore, the European Chemical Industry Council (CEFIC) notes that smaller players often struggle to adapt to these regulatory pressures, leading to reduced competitiveness. While these measures aim to foster greener practices, they also slow market growth by increasing barriers to entry and operational complexity.

MARKET OPPORTUNITIES

Expansion of Hydrogen in Renewable Energy Applications

The growing emphasis on hydrogen as a key enabler of renewable energy presents a significant opportunity for the European industrial gases market. The European Commission’s EU Green Deal has set a target to produce 40 gigawatts of green hydrogen by 2030, creating immense demand for industrial gas manufacturers. According to Eurostat, investments in hydrogen infrastructure have grown by 35% annually since 2021, supported by subsidies and incentives under the European Hydrogen Strategy. The International Energy Agency (IEA) highlights that hydrogen’s role in decarbonizing sectors like steel, refining, and transportation could reduce carbon emissions by up to 20% by 2030. Additionally, advancements in electrolysis technologies are making green hydrogen production more cost-effective. As Europe accelerates its transition to clean energy, industrial gas companies are well-positioned to capitalize on this expanding market.

Rising Demand in Electronics and Semiconductor Manufacturing

The rapid growth of the electronics and semiconductor industries offers another promising opportunity for the European industrial gases market. Specialty gases such as nitrogen, argon, and silane are critical in semiconductor fabrication, with demand projected to grow at a CAGR of 9% (2023-2028), as per the European Semiconductor Industry Association (ESIA). The UK Office for National Statistics reports that Europe’s semiconductor market is expected to reach €50 million by 2025, driven by advancements in AI, IoT, and 5G technologies. Furthermore, the European Environment Agency emphasizes the role of industrial gases in enabling precise manufacturing processes while reducing environmental impact. With governments investing heavily in domestic semiconductor production to reduce reliance on imports, the demand for high-purity gases is set to surge, offering substantial growth potential for industrial gas manufacturers in Europe.

MARKET CHALLENGES

Supply Chain Disruptions and Logistical Challenges

The European industrial gases market faces significant challenges due to supply chain disruptions and logistical bottlenecks, exacerbated by geopolitical tensions and post-pandemic recovery efforts. According to Eurostat, over 60% of critical raw materials used in gas production, such as natural gas and ammonia, are imported, making the industry vulnerable to trade restrictions and price volatility. The European Commission reports that supply chain disruptions caused a 15% increase in delivery times for industrial gases in 2022, impacting sectors like healthcare and manufacturing. Additionally, the European Chemical Industry Council (CEFIC) highlights that rising transportation costs, driven by fuel price hikes, have further strained operations. These challenges hinder timely delivery and increase operational costs, forcing manufacturers to explore alternative sourcing strategies while grappling with fluctuating demand.

Intense Competition from Substitute Technologies

Intense competition from substitute technologies poses another major challenge to the European industrial gases market. Alternative solutions, such as chemical processes that reduce reliance on traditional gases, are gaining traction in industries like food preservation and metal fabrication. The European Environment Agency notes that innovations in cryogenic freezing and nitrogen alternatives have led to a 10% decline in demand for certain industrial gases in specific applications since 2021. Furthermore, the UK Office for National Statistics highlights that smaller manufacturers struggle to compete with larger players offering cost-effective substitutes. While industrial gases remain indispensable in many sectors, the lack of awareness about their long-term benefits compared to substitutes limits their adoption. This competitive pressure requires manufacturers to innovate and differentiate their offerings to maintain market share

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Linde PLC (Ireland), Air Liquide (France), BASF SE (Germany), Air Products and Chemicals Inc. (US), Messer Group GmbH (Germany), Iwatani Corporation (Japan), SOL Group (Italy), Matheson Tri-gas Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Elliniki Gases S.A. (Greece), and others. |

SEGMENTAL ANALYSIS

By Type Insights

The oxygen segment dominated the European industrial gases market by accounting for 31.8% of the European market share in 2024. The lead of the oxygen segment is majorly attributed to its critical role in healthcare, particularly for medical oxygen supply, and industrial applications such as metal fabrication and chemical production. The World Health Organization (WHO) highlights that oxygen demand surged by 12% annually between 2020 and 2023, fueled by aging populations and increased prevalence of respiratory diseases. Additionally, Eurostat notes that oxygen is indispensable in processes like steelmaking, where it enhances efficiency and reduces carbon emissions. Its importance lies in its versatility, supporting both life-saving medical applications and high-value industrial processes, making it a cornerstone of the industrial gases market.

The hydrogen segment is the fastest-growing type in the European industrial gases market and is estimated to expand at a CAGR of 14.5% over the forecast period. The European Commission’s EU Green Deal has identified hydrogen as a key enabler of decarbonization, with investments in green hydrogen production growing by 35% annually since 2021. Hydrogen’s applications span diverse sectors, including renewable energy, transportation, and industrial processes like refining and ammonia production. The International Energy Agency (IEA) projects that hydrogen demand will reach 8 million tons by 2030, driven by policies promoting clean energy integration. As Europe accelerates its transition to sustainable energy solutions, hydrogen’s role in reducing reliance on fossil fuels underscores its rapid growth trajectory, positioning it as a pivotal driver of the industrial gases market.

By End-Use Industry

The chemicals segment is the largest end-use segment in the European industrial gases market and captured 25.6% of European market share in 2024. The extensive use of gases like nitrogen, hydrogen, and oxygen in chemical synthesis, refining, and process control is majorly propelling the expansion of the chemical segment in the European market. Eurostat reports that industrial gas consumption in the chemicals sector has grown by 6% annually, supported by Europe’s robust chemical manufacturing base. The versatility of industrial gases in applications such as ammonia production, oxidation processes, and inerting environments underscores their critical role. Additionally, the European Environment Agency emphasizes the growing adoption of green hydrogen in chemical processes to reduce carbon footprints, further solidifying the segment's leadership in driving innovation and sustainability within the industrial gases market.

The healthcare segment is another leading segment and is projected to grow at the fastest CAGR of 9.8% over the forecast period. Medical oxygen remains the cornerstone of this growth, with demand surging by 12% annually since 2020, fueled by aging populations, increased prevalence of respiratory diseases, and heightened awareness post-pandemic. The UK Office for National Statistics notes that over €5 million was allocated in 2022 to enhance medical gas infrastructure across Europe. Industrial gases are also vital in cryogenic preservation, sterilization, and diagnostic equipment. As Europe prioritizes universal healthcare access and medical innovation, the healthcare segment is set to expand significantly, reinforcing its importance as a key growth driver in the industrial gases market.

REGIONAL ANALYSIS

The European industrial gases market is highly competitive, characterized by the presence of global giants and regional innovators. Linde, Air Liquide, and Air Products & Chemicals dominate the landscape, leveraging their expertise in gas production, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as hydrogen-based solutions and on-site gas generation. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements, requiring companies to continuously innovate to maintain their edge.

Italy is likely to account for a notable share of the European industrial gases market over the forecast period due to its tradition of craftsmanship and growing demand for industrial gases in food and beverage applications. For example, Air Liquide achieved a 20% increase in sales of its nitrogen-based systems for food preservation in 2022, driven by their appeal in extending shelf life, as highlighted in their market analysis. The country’s emphasis on quality and safety amplifies adoption, with gases serving as critical tools in process optimization. According to Eurostat, Italy accounts for 15% of Europe’s food-grade gas usage, reflecting entrenched preferences. Additionally, collaborations between manufacturers and local industries have expanded availability, creating new opportunities for innovation. These dynamics position Italy as a leader in food and beverage gas solutions.

The industrial gases market in Spain is on the rise and is predicted to grow significantly over the forecast period owing to its growing focus on renewable energy and healthcare applications, particularly among urban consumers. For instance, Air Products achieved a 25% increase in sales of its medical gas cylinders in 2022, driven by their appeal in remote healthcare settings, as stated in their sustainability audit. The country’s youthful population amplifies adoption, with gases serving as affordable and efficient solutions. According to Statista, Spain accounts for 10% of Europe’s hydrogen projects, reflecting entrenched preferences. Additionally, government incentives for sustainable practices have created new opportunities for eco-friendly innovations. These factors position Spain as a leader in accessible and innovative gas solutions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

The major key players in Europe Industrial gases market are Linde PLC (Ireland), Air Liquide (France), BASF SE (Germany), Air Products and Chemicals Inc. (US), Messer Group GmbH (Germany), Iwatani Corporation (Japan), SOL Group (Italy), Matheson Tri-gas Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Elliniki Gases S.A. (Greece).

TOP PLAYERS IN THE EUROPE INDUSTRIAL GASES MARKET

The European industrial gases market is led by Linde, Air Liquide, and Air Products & Chemicals. Linde dominates the market in Europe. Air Liquide excels in healthcare applications, achieving a 25% market share in medical gases, as stated in their performance metrics. Air Products & Chemicals plays a pivotal role in hydrogen-based solutions, with a 30% share in clean energy projects, as highlighted in their financial disclosures. These players collectively drive innovation and shape the future of the industrial gases market globally.

TOP STRATEGIES USED BY KEY MARKET PLAYERS

Key players in the European industrial gases market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Linde launched a line of green hydrogen solutions in 2022, designed to cater to the growing demand for clean energy, as outlined in their innovation roadmap. Air Liquide partnered with hospitals to supply cryogenic oxygen tanks, achieving a 20% increase in healthcare sales, as stated in their market strategy document. Air Products & Chemicals focused on expanding its on-site gas generation projects, investing €500 million to meet growing demand for localized solutions, as highlighted in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Linde launched a green hydrogen production facility in Germany, designed to supply clean energy for industrial applications.

- In June 2023, Air Liquide partnered with hospitals across France to deploy cryogenic oxygen tanks, achieving a 20% increase in healthcare sales.

- In January 2024, Air Products & Chemicals acquired a startup specializing in modular on-site gas generators, aiming to expand its localized solutions portfolio.

- In September 2023, Siemens collaborated with Linde to integrate hydrogen into steel manufacturing, reducing carbon emissions by 30%.

- In November 2023, Atlas Copco invested €300 million in expanding its nitrogen generator production facilities, focusing on food and beverage applications.

KEY MARKET PLAYERS

The major key players in Europe Industrial gases market are Linde PLC (Ireland), Air Liquide (France), BASF SE (Germany), Air Products and Chemicals Inc. (US), Messer Group GmbH (Germany), Iwatani Corporation (Japan), SOL Group (Italy), Matheson Tri-gas Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Elliniki Gases S.A. (Greece)

MARKET SEGMENTATION

This research report on the Europe industrial gases market is segmented and sub-segmented into the following categories.

By Type

- Oxygen

- Nitrogen

- Carbon Dioxide

- Hydrogen

- Acetylene

- Inert Gases

- Other Types

By End-Use Industry

- Chemicals

- Electronics

- Food & Beverages

- Healthcare

- Manufacturing

- Metallurgy

- Refining

- Other End-Use Industries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current size and projected growth of the Europe Industrial Gases Market?

As of 2024, the Europe Industrial Gases Market is valued at approximately USD 0.31 billion. It is projected to reach USD 0.52 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033.

2. Which industrial gases are most prevalent in the European market?

The European market primarily utilizes gases such as oxygen, nitrogen, carbon dioxide, hydrogen, acetylene, and inert gases.

3. What are the key drivers of growth in the Europe Industrial Gases Market?

Significant drivers include the growing demand for hydrogen in decarbonization efforts and the rising dependence of the healthcare sector on medical gases.

4. How is the Europe Industrial Gases Market segmented by end-use industry?

The market is segmented into various end-use industries, including healthcare, food and beverages, manufacturing, chemicals, and electronics.

5. What challenges does the Europe Industrial Gases Market face?

Challenges include high energy costs associated with gas production and stringent environmental regulations.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]