Europe Industrial Air Filtration Market Size, Share, Trends, & Growth Forecast Report By Product Type (Dust collectors, Mist collectors, HEPA filters, CCF, and Baghouse filters), Application, Distribution Channel, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Industrial Air Filtration Market Size

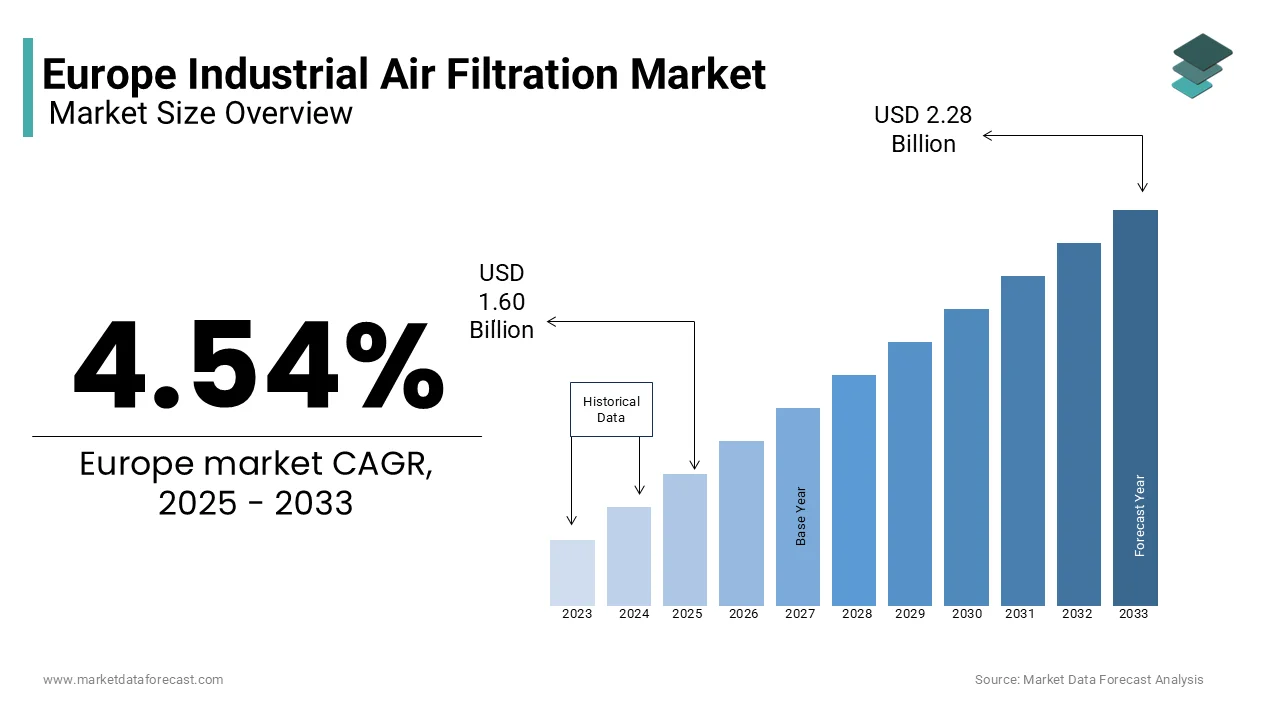

The Europe industrial air filtration market was worth USD 1.53 billion in 2024. The Europe market is expected to reach USD 2.28 billion by 2033 from USD 1.60 billion in 2025, rising at a CAGR of 4.54% from 2025 to 2033.

Industrial air filtration systems are integral to maintaining air quality, safeguarding worker health, and ensuring compliance with stringent environmental regulations. The market covers a diverse variety of technologies including HEPA filters, electrostatic precipitators, baghouse filters, and activated carbon filters each tailored to specific industrial applications such as manufacturing, pharmaceuticals, food processing, and power generation.

The European industrial air filtration market projections indicating steady growth driven by increasing awareness of occupational health hazards and tightening emission control norms. A study by Statista highlights that over 60% of industries in Western Europe have adopted advanced air filtration systems to comply with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations.

The demand for energy-efficient and sustainable filtration solutions has surged, particularly in Germany, France, and the UK, where industries are increasingly prioritizing green technologies. Additionally, the rising prevalence of respiratory diseases linked to industrial pollution has heightened the urgency for effective air filtration systems. Industries across Europe strive to balance productivity and environmental responsibility. Hence, the industrial air filtration market is set to play a pivotal role in shaping a cleaner and safer industrial future.

MARKET DRIVERS

Stringent Environmental Regulations and Emission Control Norms

The stringent environmental regulations aimed at curbing industrial emissions is taking ahead the European industrial air filtration market. The European Environment Agency sheds light on industrial activities that account for nearly 40% of total particulate matter emissions in the EU and is prompting governments to enforce laws like the Industrial Emissions Directive (IED). This directive mandates industries to adopt Best Available Techniques (BAT) to minimize emissions, directly boosting the demand for advanced air filtration systems. Furthermore, the European Green Deal emphasizes achieving a 55% reduction in greenhouse gas emissions by 2030 which is compelling industries to invest in energy-efficient filtration technologies. According to Eurostat, over 70% of EU member states have already implemented national policies aligning with these goals. These regulatory frameworks not only ensure compliance but also drive innovation in filtration solutions and is making them indispensable for industries striving to meet environmental benchmarks.

Growing Awareness of Occupational Health and Safety

Rising awareness about occupational health hazards caused by poor air quality in industrial environments is another key driver propelling the European industrial air filtration market. According to the World Health Organization, air pollution contributes to approximately 600,000 premature deaths annually in Europe, with industrial pollutants being a significant contributor. Industries are increasingly adopting air filtration systems to mitigate risks associated with respiratory diseases, as drawn attention to this by the European Agency for Safety and Health at Work. Data from the UK Health and Safety Executive reveals that industries investing in advanced filtration systems have reported a 30% reduction in work-related respiratory illnesses. Companies prioritize employee well-being and adhere to ISO 45001 standards for workplace safety, hence, the demand for industrial air filtration solutions continues to grow, ensuring healthier and more productive industrial environments across Europe.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

High initial investment and ongoing maintenance costs associated with advanced filtration systems are significant challenges to the market participants in the European industrial air filtration market. As per the European Investment Bank, small and medium-sized enterprises (SMEs), which form a substantial portion of Europe’s industrial base, often struggle to allocate budgets for expensive filtration technologies. According to Eurostat, approximately 60% of SMEs cite financial constraints as a barrier to adopting cutting-edge environmental technologies. Additionally, the UK Department for Business, Energy & Industrial Strategy reports that maintenance costs for industrial air filtration systems can account for up to 25% of the total operational expenses annually. These financial burdens deter industries from upgrading their filtration systems, particularly in regions with weaker economic growth. As a result, cost remains a critical obstacle, limiting the widespread adoption of advanced air filtration solutions across Europe.

Low Awareness Level in Emerging Markets

Restricted awareness and technical knowledge about industrial air filtration systems in emerging markets within Europe. The European Environment Agency notes that industries in Eastern Europe and rural areas often lack access to information on modern filtration technologies and their long-term benefits. A study by the International Labour Organization reveals that only 40% of industries in these regions comply with recommended air quality standards due to insufficient awareness and training. Furthermore, the Czech Statistical Office reports that nearly 35% of industrial facilities in Central and Eastern Europe still rely on outdated filtration methods, leading to inefficiencies and higher emissions. This knowledge gap not only hampers market growth but also undermines efforts to achieve uniform environmental compliance across the continent which is creating disparities in air quality management practices.

MARKET OPPORTUNITIES

Growing Demand for Energy-Efficient Filtration Solutions

The increasing demand for energy-efficient industrial air filtration systems presents a significant opportunity for the European industrial air filtration market growth. According to the European Commission, industries consuming less energy can reduce operational costs by up to 20% which is driving the adoption of advanced filtration technologies that integrate energy-saving features. According to the International Energy Agency, energy-efficient systems are projected to account for over 45% of the total air filtration market by 2030 as industries strive to align with the EU’s Energy Efficiency Directive. Additionally, Germany’s Federal Environment Agency reports that industries adopting energy-efficient filtration systems have reduced their carbon footprint by an average of 30%. This shift not only supports sustainability goals but also enhances cost savings, making energy-efficient solutions a key growth avenue for manufacturers and suppliers in the European market.

Expansion of Pharmaceutical and Food Processing Industries

The rapid expansion of pharmaceutical and food processing industries in Europe offers another promising opportunity for the industrial air filtration market. The European Federation of Pharmaceutical Industries and Associations states that the pharmaceutical sector is expected to grow at a CAGR of 6.2% through 2025, necessitating advanced air filtration systems to maintain sterile environments. Similarly, the European Food Safety Authority emphasizes that stringent hygiene standards in food processing require high-performance filtration to prevent contamination. Data from France’s National Institute for Industrial Environment and Risks reveals that over 70% of food processing facilities have upgraded their air filtration systems in the past five years to comply with safety regulations. As these industries continue to expand, the demand for specialized filtration solutions will rise and is creating lucrative opportunities for innovation and market penetration across Europe.

MARKET CHALLENGES

Technological Integration Challenges in Legacy Systems

The difficulty in integrating advanced filtration technologies with legacy systems is among the prime issue the European industrial air filtration market faces. The European Commission for Industry and Innovation found that nearly 40% of industrial facilities in Europe still operate outdated equipment, making it technically complex and costly to upgrade to modern filtration solutions. In addition, according to the UK Department for Business, Energy & Industrial Strategy, retrofitting existing systems can increase implementation costs by up to 35% is deterring industries from adopting cutting-edge technologies. Additionally, a report by the French Ministry of Ecological Transition notes that over 60% of small-scale manufacturers lack the technical expertise required for seamless integration. This challenge not only slows down technological adoption but also creates inefficiencies, as older systems often fail to meet current emission standards, hindering overall market progress.

Supply Chain Disruptions and Raw Material Shortages

The impact of supply chain disruptions and raw material shortages on the production and delivery of air filtration systems also soberly affects the progress of the European industrial air filtration market. The European Central Bank reports that supply chain bottlenecks have increased manufacturing lead times by an average of 25% since 2020, affecting industries reliant on timely deliveries. Germany’s Federal Statistical Office stated that the cost of raw materials, such as specialized filter media, has surged by 15-20% due to global supply constraints. Furthermore, the European Manufacturers Association states that over 50% of filtration system manufacturers faced delays in fulfilling orders in 2022, impacting customer trust and market growth. These disruptions exacerbate operational challenges, particularly for industries requiring urgent upgrades to comply with environmental regulations and thereby limiting the market's ability to meet rising demand effectively.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.54% |

|

Segments Covered |

By Product Type, Application, Distribution Channel, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Abatement Technologies, Inc., Alfa Laval, AAF, Camfil Air Pollution Control (APC), Con-Air Industries, Daikin Industries Ltd., Electrocorp, FILCOM GmbH, Good Life, Inc., HealthWay Home Products, Inc., Honeywell International, Inc., MANN+HUMMEL, Philips Electronics N.V., Sentry Air Systems, Inc, and Sharp Corporation. |

SEGMENTAL ANALYSIS

By Product Type Insights

The Dust collectors segment dominated the European industrial air filtration market in 2024 and held a 25.2% share which is due to its critical role in industries like cement and metal processing, where dust emissions account for 30% of particulate pollution in the EU, according to the European Environment Agency. These systems ensure compliance with the Industrial Emissions Directive (IED) is driving their adoption. The EU aims for a 55% reduction in emissions by 2030. So, dust collectors are vital for achieving cleaner operations which is making them indispensable for emission-intensive sectors.

The HEPA filters segment is expected to exhibit a noteworthy CAGR of 10% over the forecast period and is fueled by demand in pharmaceuticals and healthcare, where sterile environments are essential. According to the World Health Organization, HEPA filters are crucial in preventing contamination in cleanrooms, a sector projected to grow by 12% annually. Their ability to capture 99.97% of particles makes them irreplaceable in sensitive applications, ensuring compliance with ISO standards and driving their expansion across Europe.

By Application Insights

The cement industry segment led the European Industrial air filtration market and captured a 20.6% market share in 2024. It leads due to its high dust emissions, which account for 20% of industrial particulate matter pollution in the EU, according to the European Environment Agency. Baghouse filters and dust collectors are critical in ensuring compliance with the Industrial Emissions Directive (IED). Germany’s Federal Environment Agency revealed that over 85% of cement plants use advanced filtration systems to meet emission standards. As the EU targets a 55% reduction in greenhouse gas emissions by 2030, the cement sector remains pivotal in driving demand for air filtration solutions, making it indispensable for sustainable industrial practices.

The pharmaceutical industry is the fastest-growing category with a CAGR of 6.2% throughout the forecast period. This quick rise is linked to the increasing need for sterile environments in drug manufacturing, where HEPA filters ensure compliance with ISO 14644-1 cleanroom standards. The World Health Organization emphasizes that contamination-free processes are vital for patient safety and product quality. With the European pharmaceutical market projected to grow significantly due to advancements in biotechnology and vaccine production, the demand for advanced air filtration systems is surging. This segment's focus on precision and hygiene underscores its importance in shaping the future of industrial air filtration in Europe.

By Distribution Channel Insights

The Direct sales segment accounted for 60.1% of the European industrial air filtration market in 2024 owing to its ability to provide customized solutions and technical expertise to large industries like cement and power generation, which require compliance with stringent EU regulations such as the Industrial Emissions Directive (IED). Germany’s Federal Ministry for Economic Affairs and Climate Action notes that direct sales ensure seamless integration of advanced systems like baghouse filters and dust collectors, which are critical for emission control. Over 85% of large-scale industries prefer direct procurement for reliability and after-sales support so this channel remains vital for delivering high-performance filtration solutions tailored to industrial needs.

The Indirect sales segment is flourishing and is likely to experience the fastest CAGR of 7.5%. This growth is influenced by the rising demand from small and medium-sized enterprises (SMEs), which represent over 90% of businesses in Europe, as per the UK Department for Business, Energy & Industrial Strategy. Distributors play a key role in making cost-effective solutions like HEPA filters and mist collectors accessible to SMEs and emerging markets in Eastern Europe. France’s National Institute for Industrial Environment and Risks reported that indirect sales are essential for regions with limited awareness of advanced technologies. As industries seek affordable and scalable filtration options, this channel’s ability to bridge accessibility gaps ensures its rapid expansion across Europe.

REGIONAL ANALYSIS

Germany commanded the European industrial air filtration market with a 28% share. The German Federal Environment Agency stated that the it’s development in this market is propelled by its established manufacturing sector, stringent environmental regulations under the Industrial Emissions Directive (IED), and high demand for advanced filtration systems like dust collectors and baghouse filters. Germany’s engineering expertise and focus on emission reductions have positioned it as a hub for innovation in air filtration technologies. With industries such as cement, metal processing, and automotive driving adoption, Germany remains at the forefront of this market. The country’s proactive approach to sustainability and compliance with EU Green Deal targets further solidifies its dominance in the regional landscape.

The United Kingdom is advancing at a significant pace and is predicted to register a CAGR of 5.9%. According to the UK Health and Safety Executive, the UK’s growth is fueled by its expanding pharmaceutical and food processing industries, which require advanced HEPA filters and mist collectors to maintain hygiene and safety standards. The UK’s commitment to reducing workplace hazards and ensuring compliance with ISO cleanroom standards has increased the adoption of air filtration systems. Additionally, the government’s push for cleaner industrial practices underlines the growing importance of filtration solutions. The pharmaceutical sector continues to expand, so, the UK remains a key contributor to the European industrial air filtration market.

France positioned itself at a crucial level in the European industrial air filtration market. France’s National Institute for Industrial Environment and Risks notes that the country’s leadership stems from its focus on reducing industrial emissions and promoting green technologies. Industries such as chemical manufacturing and power generation are adopting carbon canister filters and energy-efficient systems to align with national sustainability goals. France’s emphasis on regulatory compliance and worker safety has further accelerated the demand for advanced air filtration technologies. With strong government support for R&D and innovation, France continues to play a pivotal role in shaping the future of the European industrial air filtration market.

KEY MARKET PLAYERS

The major players in the Europe industrial air filtration market include Abatement Technologies, Inc., Alfa Laval, AAF, Camfil Air Pollution Control (APC), Con-Air Industries, Daikin Industries Ltd., Electrocorp, FILCOM GmbH, Good Life, Inc., HealthWay Home Products, Inc., Honeywell International, Inc., MANN+HUMMEL, Philips Electronics N.V., Sentry Air Systems, Inc, and Sharp Corporation.

MARKET SEGMENTATION

This research report on the Europe industrial air filtration market is segmented and sub-segmented into the following categories.

By Product Type

- Dust collectors

- Mist collectors

- HEPA filters

- CCF

- Baghouse filters

By Application

- Cement

- Food

- Cereal

- Spices

- Feed and raw grain agriculture

- Eggshell and dust

- Sugar dust

- Flour

- Corn starches

- Others

- Metal

- Grinding

- Sandblasting

- Welding fumes

- Fine powders

- Others

- Power

- Pharmaceuticals

- Other

By Distribution Channel

- Direct Sales

- Indirect Sales

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe Industrial Air Filtration Market?

The key drivers include stringent environmental regulations, increasing industrialization, rising awareness about worker safety, and advancements in filtration technologies.

Which industries are the primary consumers of industrial air filtration systems in Europe?

Major industries include manufacturing, food & beverage, pharmaceuticals, chemicals, power generation, and automotive.

What technological advancements are shaping the industrial air filtration market in Europe?

Innovations such as nanofiber filtration, IoT-enabled smart filters, energy-efficient systems, and self-cleaning filters are transforming the industry.

What is the future outlook for the Europe Industrial Air Filtration Market?

The market is expected to grow steadily, driven by stricter environmental policies, increasing industrial activities, and the adoption of advanced filtration technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]