Europe Identity and Access Management (IAM) Market Size, Share, Trends, & Growth Forecast Report Segmented By Component (Audit, Compliance & Governance, Directory Service, Multifactor Authentication, Provisioning, Password Management, and Single Sign-On), Deployment, and End-use, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Identity and Access Management (IAM) Market Size

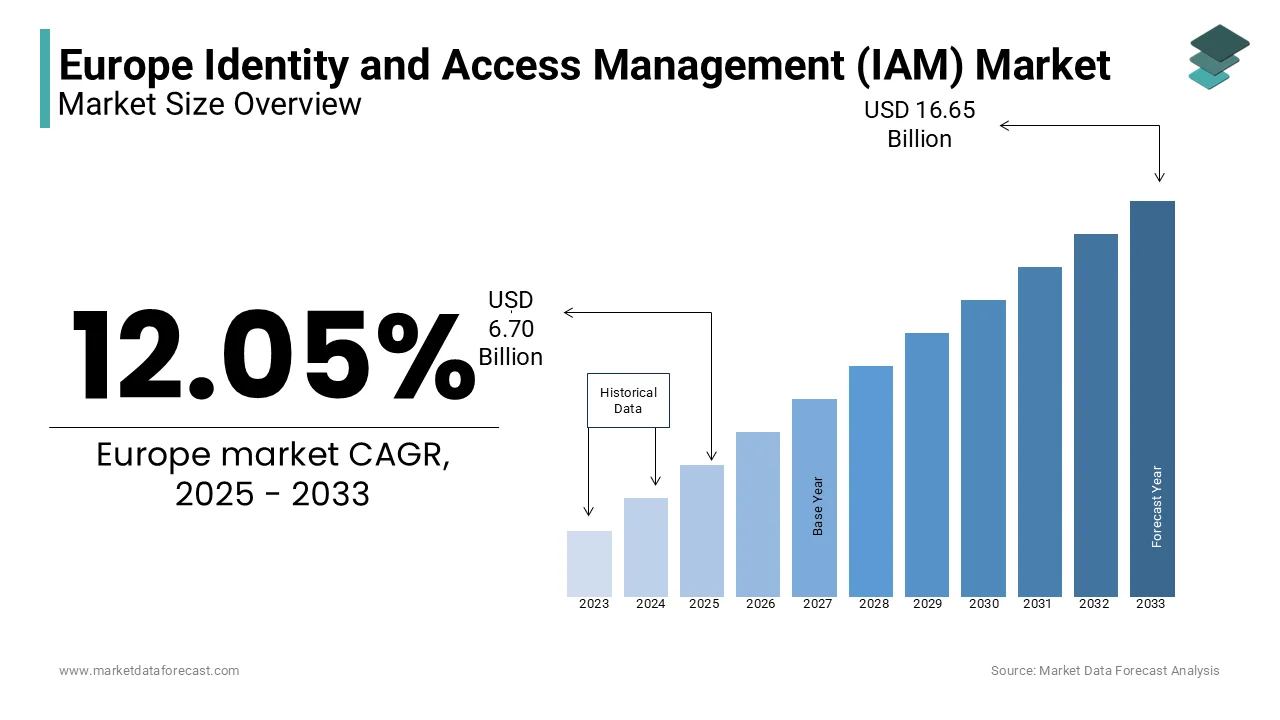

The Europe identity and access management (IAM) market was worth USD 5.98 billion in 2024. The European market is projected to reach USD 16.65 billion by 2033 from USD 6.70 billion in 2025, growing at a CAGR of 12.05% from 2025 to 2033.

Identity and Access Management (IAM) is a key component of the European cybersecurity landscape and focusses on ensuring secure and efficient access to digital resources. IAM includes technologies, policies and processes that manage user identities, authenticate access, and enforce authorization controls across systems and applications. It plays a major role in safeguarding sensitive data, mitigating cyber threats, and ensuring compliance with stringent regulatory frameworks such as the General Data Protection Regulation (GDPR).

The Europe IAM market has been experiencing robust growth over the last few years owing to the increasing adoption of cloud-based services, the rapid adoption of digital transformation initiatives, and the rising frequency of cyberattacks. According to the European Union Agency for Cybersecurity (ENISA), cyber incidents in Europe surged by 47% in 2022. This is indicating the urgent need for advanced IAM solutions. Additionally, according to the reports of the European Commission, 78% of enterprises in the EU have accelerated their digital transformation efforts, further fueling demand for IAM systems to manage complex IT environments securely.

MARKET DRIVERS

Increasing Adoption of Cloud-Based Solutions

The growing reliance on cloud-based solutions is a major driver of the Europe identity and access management market. According to Eurostat, in 2022, 41% of EU enterprises utilized cloud computing services, primarily for email systems and file storage. This shift to cloud infrastructure has heightened the need for robust IAM solutions to manage user identities and ensure secure access across platforms. The rise in remote work and digital transformation initiatives has further accelerated this trend, as organizations seek scalable and efficient IAM systems to support their cloud-based operations.

Rising Incidence of Cyber Threats and Data Breaches

The surge in cyber threats and data breaches is another critical factor driving the Europe IAM market. The European Union Agency for Cybersecurity (ENISA) reported a 47% increase in ransomware attacks in 2022. This alarming rise in cyberattacks has pushed organizations to adopt advanced IAM solutions to safeguard sensitive data and comply with stringent regulations like GDPR. The need for enhanced security measures to mitigate risks and ensure regulatory compliance is significantly boosting the demand for IAM systems across Europe.

MARKET RESTRAINTS

High Implementation Costs

The high cost of implementing identity and access management solutions is a significant restraint in the European market. According to Eurostat, in 2021, only 34% of small and medium-sized enterprises (SMEs) in the EU adopted advanced digital technologies due to budget constraints. IAM systems often require substantial upfront investments in software, hardware, and skilled personnel, making them less accessible for smaller organizations. Additionally, ongoing maintenance and upgrade costs further strain budgets, limiting widespread adoption, particularly among SMEs that dominate the European business landscape.

Complexity of Regulatory Compliance

The complexity of adhering to stringent data protection regulations, such as GDPR, poses a challenge for IAM adoption. The European Data Protection Board reported that in 2022, over 1,000 cross-border GDPR cases were processed, highlighting the rigorous enforcement of compliance standards. Organizations must ensure their IAM systems align with these regulations, which often involves intricate customization and continuous monitoring. This complexity discourages some businesses, particularly smaller ones, from fully embracing IAM solutions, hindering market growth.

MARKET OPPORTUNITIES

Increasing Demand for Zero Trust Security Models

The growing adoption of zero trust security frameworks presents a significant opportunity for the Europe identity and access management market. According to the European Union Agency for Cybersecurity (ENISA), 76% of organizations in the EU are planning to implement zero trust architectures by 2025 to enhance cybersecurity. IAM solutions are critical to zero trust models, as they ensure strict user authentication and access control. This shift toward zero trust, driven by rising cyber threats and remote work, creates a substantial demand for advanced IAM systems that can support these security frameworks, offering significant growth potential for the market.

Expansion of Digital Transformation Initiatives

According to the Digital Economy and Society Index (DESI) 2022 report of the European Commission, 55% of EU enterprises have accelerated their digital transformation efforts. This expansion drives the need for robust IAM solutions to manage digital identities and secure access across evolving IT ecosystems. As businesses adopt technologies like IoT, AI, and cloud computing, the demand for scalable and integrated IAM systems increases. This trend provides a lucrative opportunity for IAM providers to offer innovative solutions that cater to the complex identity management needs of digitally transforming organizations.

MARKET CHALLENGES

Lack of Skilled Cybersecurity Professionals

A significant challenge for the Europe identity and access management market is the shortage of skilled cybersecurity professionals. According to the European Cybersecurity Organization (ECSO), there is a projected skills gap of 350,000 cybersecurity professionals in Europe by 2025. This shortage hampers the effective implementation and management of IAM systems, as organizations struggle to find experts capable of configuring, maintaining, and optimizing these solutions. The lack of skilled personnel not only delays deployment but also increases the risk of misconfigurations, which can lead to security vulnerabilities, further complicating the adoption of IAM technologies.

Integration with Legacy Systems

Integrating IAM solutions with existing legacy systems is a major challenge for European organizations. Eurostat reports that 60% of EU enterprises still rely on legacy IT infrastructure, which often lacks compatibility with modern IAM technologies. This integration complexity increases implementation time and costs, creating resistance to adopting advanced IAM systems. Additionally, legacy systems may not support the scalability and flexibility required for contemporary identity management, limiting the effectiveness of IAM solutions and posing a barrier to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.05% |

|

Segments Covered |

By Component, Deployment, End-use and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Amazon Web Services, Inc., Broadcom, One Identity LLC., ForgeRock, HID Global Corp., IBM, McAfee, LLC, Microsoft, Okta, OneLogin, Oracle, Ping Identity, SecureAuth, and Evidian are some of the major players in the europe identity and access management (IAM) market. |

SEGMENTAL ANALYSIS

By Component Insights

The multifactor authentication (MFA) segment dominated the market in Europe and held 30.8% of the European market share in 2024. The dominance of the MFA segment in the European is majorly attributed to the increasing number of cyberattacks in Europe. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks increased by 47% in 2022. This is driving the adoption of MFA to enhance security. MFA adds layers of protection by requiring multiple verification methods to reduce the risk of unauthorized access. Its importance is underscored by GDPR compliance requirements, as 58% of EU organizations cited data protection as a top priority in a Eurostat survey. MFA’s ability to mitigate breaches and ensure regulatory compliance makes it the leading segment.

The single sign-on (SSO) is projected to grow at a CAGR of 18.5% over the forecast period. According to the Digital Economy and Society Index (DESI) 2022 report of the European Commission, 55% of EU enterprises are accelerating digital transformation, increasing the need for seamless access across platforms. SSO simplifies user authentication by allowing access to multiple applications with one login, improving productivity and user experience. With remote work rising, ENISA reports that 64% of organizations prioritize user-friendly security solutions, fueling SSO adoption. Its efficiency and alignment with modern work environments drive its rapid growth.

By Deployment Insights

Largest Segment: Cloud Deployment

The cloud deployment segment was the largest segment and accounted for 53.9% of the European market share in 2024. According to Eurostat, 41% of EU enterprises adopted cloud computing services in 2022, driven by the need for scalability, cost-efficiency, and remote accessibility. The European Union Agency for Cybersecurity (ENISA) highlights that 76% of organizations plan to implement zero trust architectures by 2025, further boosting cloud IAM adoption. Cloud solutions align with GDPR compliance, as 58% of EU organizations prioritize data protection, making them essential for secure and efficient identity management in a digitally transforming Europe.

The hybrid segment is on the rise and is estimated to exhibit the fastest CAGR of 20.3% over the forecast period. According to the reports of the Eurostat, 60% of EU enterprises still rely on legacy systems, creating demand for hybrid IAM solutions that integrate modern technologies with existing infrastructure. The European Commission’s Digital Economy and Society Index (DESI) 2022 report states that 55% of enterprises are accelerating digital transformation, further driving hybrid adoption. Hybrid models offer flexibility, enabling organizations to balance cloud scalability with on-premise security, making them critical for industries like finance and healthcare that require stringent data protection and compliance.

By End-use Insights

Largest Segment: Healthcare

The healthcare segment dominated the market by accounting for 26.8% of the European market share in 2023. This dominance is driven by increasing healthcare expenditures, aging populations, and advancements in medical technology. According to the U.S. Centers for Medicare & Medicaid Services, global healthcare spending reached $8.3 trillion in 2022, accounting for 10% of global GDP. The sector's importance lies in its critical role in improving life expectancy and addressing chronic diseases, with governments and private entities investing heavily in infrastructure and innovation.

The Telecom & IT segment is growing at a promising pace in the European market. This growth is fueled by the rapid adoption of 5G, cloud computing, and IoT technologies. The ITU reports that global internet penetration reached 67% in 2023 with mobile broadband subscriptions surpassing 6 billion. The sector's importance lies in enabling digital transformation across industries, driving economic growth, and improving connectivity. For instance, the World Bank highlights that a 10% increase in broadband penetration can boost GDP by 1.38%, underscoring its critical role in global development.

REGIONAL ANALYSIS

Germany led the IAM market in Europe by capturing 22.3% in 2024. The leading position of Germany is anticipated to continue throughout the forecast period in Europe owing to the robust cybersecurity regulations of Germany, high adoption of cloud-based solutions, and strong industrial digitization. The German government’s focus on data protection, aligned with GDPR compliance, has further accelerated IAM adoption.

The UK IAM market is predicted to grow at a prominent CAGR during the forecast period in the European region. The advanced IT infrastructure of the UK, increasing cyber threats, and stringent regulatory frameworks like the UK GDPR have propelled its IAM market growth. The country’s financial services sector, a major adopter of IAM solutions, contributes significantly to its leading position.

France held a substantial share of the European market in 2023. France’s emphasis on national cybersecurity strategies and digital transformation initiatives, particularly in public sector and healthcare, has fueled IAM adoption. The country’s focus on securing critical infrastructure and sensitive data ensures its strong market presence.

KEY MARKET PLAYERS

Amazon Web Services, Inc., Broadcom, One Identity LLC., ForgeRock, HID Global Corp., IBM, McAfee, LLC, Microsoft, Okta, OneLogin, Oracle, Ping Identity, SecureAuth, and Evidian are some of the major players in the europe identity and access management (IAM) market.

MARKET SEGMENTATION

This research report on the Europe identity and access management (IAM) market is segmented and sub-segmented into the following categories.

By Component

- Audit, Compliance & Governance

- Directory Service

- Multifactor Authentication

- Provisioning

- Password Management

- Single Sign-On

By Deployment

- Cloud

- Hybrid

- On-premise

By End-use

- BFSI

- Energy, Oil & Gas

- Telecom & IT

- Education

- Healthcare

- Public Sector & Utilities

- Manufacturing

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Identity and Access Management (IAM) market?

The growth is driven by increasing cybersecurity threats, strict data protection regulations like GDPR, and the rising adoption of cloud-based IAM solutions by businesses.

How is cloud adoption influencing the IAM market in Europe?

The shift to cloud-based applications is increasing the demand for cloud IAM solutions that offer scalability, remote access security, and integration with SaaS platforms.

What role do artificial intelligence and machine learning play in IAM?

AI and ML enhance IAM by enabling real-time threat detection, behavioral analytics, automated identity verification, and adaptive authentication.

What is the future outlook for the IAM market in Europe?

The market is expected to grow steadily as businesses increasingly prioritize cybersecurity, compliance, and digital transformation efforts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]