Europe Hydroponics Market Size, Share, Trends, & Growth Forecast Report Segmented By Equipment, Type, Crop Type, Input Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest Of Europe), Industry Analysis From (2025 to 2033)

Europe Hydroponics Market Size

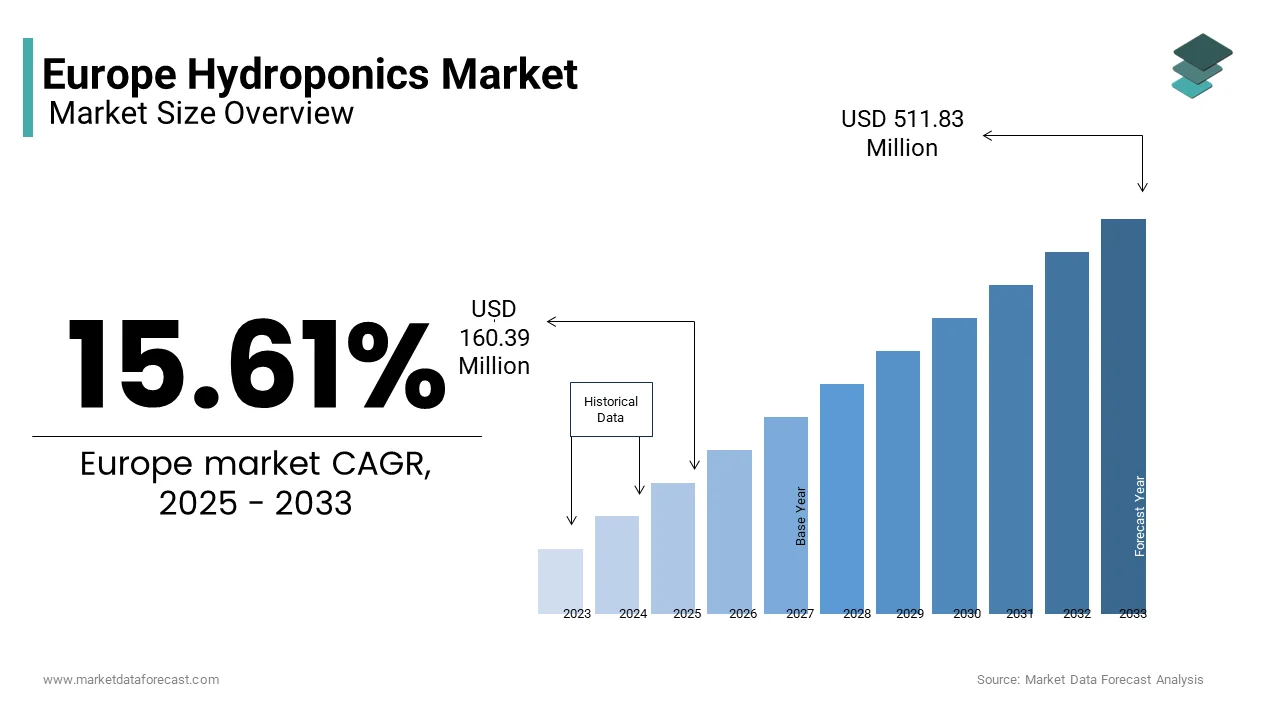

The Europe hydroponics market was valued at USD 138.73 million in 2024 and it is anticipated to reach USD 160.39 million in 2025 from USD 511.83 million by 2033, Europe is expected to grow at a compound annual growth rate (CAGR) of 15.61% growing at a CAGR of during the forecast period from 2025 to 2033.

The main factors propelling the hydroponics sector in Europe forward are the growing acceptance of controlled environment agriculture and the developments in hydroponic system technology. Agriculture makes up half of the land in the European Union, showing its important role in providing employment, economy, and environment. Over the next 20 years, the Food and Agriculture Organization predicts a fifty percent rise in global food output, with intensification contributing to eighty percent of this development. In addition to this, there were multiple reasons for the rise of controlled environment agriculture, like Climate change, water shortages (Europe's southern part), energy crises, environmental pollution, and food problems. Therefore, the need for a smart, controlled environment agricultural system will boost the market share of Europe's hydroponic market.

The increased acceptance of hydroponics as a profitable farming method is providing future opportunities for the hydroponic companies in the region. Over seven hundred global hydroponics companies operate, with around 200 start-ups currently in the market. Furthermore, recent advances in agricultural technology are moving the European hydroponic market forward. Using cutting-edge technology, next-generation vertical farms are a growing trend that reliably supplies an abundance of high-quality crops for a whole year.

The high one-time cost of setting up hydroponics is one of the major factors limiting the growth rate of the European hydroponic market. There is a shift taking place in Europe in the vertical farming sector, and a number of firms are crowdfunding money for their requirements and technology. Also, because of the energy crisis, the major vertical farming companies are reducing their operations and employees in multiple countries. The high electricity consumption of Lights used to power plant growth caused consumer energy costs in the EU to rise by over 58% between December 2020 and July 2022.

Despite the court’s rule that qualifies the hydroponic products as organic, producers have to comply with a number of soil-building standards in order to receive their organic certification. Such double standards in the organic label are one of the prime challenges for the European hydroponic market. Moreover, one of the main issues that could prevent the market from expanding is a lack of practical understanding of the practice.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16% |

|

Segments Covered |

By Equipment, Type, Crop Type, Input Type, Aggregate Hydroponics Systems, Liquid Hydroponic Systems, Closed Systems and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

BASF SE, Biostadt India Limited, Valagro SpA, Novozymes A/S, Biolchim SpA, Isagro SpA, and Koppert B.V. |

SEGMENTAL ANALYSIS

By Equipment Insights

The HVAC segment held the biggest market share in Europe in 2022. With hydroponic HVAC systems, indoor farming is becoming more and more popular as a way to replicate the outdoors and keep a steady temperature.

By Type Insights

The liquid segment under this category will continue to expand at a higher CAGR during the forecast period of the European hydroponic market. The rise of deep-water culture to grow and maintain producers among the home and commercial growers is driving this segment.

By Crop Type Insights

The pepper and strawberry segment is predicted to flourish at a faster growth rate under this category during the forecast period. Strawberries and other berries are some of the most popular berries grown with the help of hydroponics.

By Input Type Insights

The Nutrient segment has largely occupied the market share in the region and is anticipated to register a prominent growth rate during the forecast period.

By Aggregate Hydroponics Systems Insights

The closed systems segment is leading with the maximum market share because it helps the plant with 80 percent less water and fertilizers.

By Liquid Hydroponic Systems Insights

The Nutrient Film Technique (NFT) segment is propelling the market with an elevated growth rate in Europe.

By Closed Systems Insights

The drip system segment is moving forward prominently under this category as it is the most popular hydroponic system adopted in Europe.

COUNTRY ANALYSIS

The UK hydroponics market is projected to continue to have the highest market share at a steady pace due to rising awareness and adoption of hydroponic systems.

The German hydroponics market is the dominant market in the region, following the UK's because of the introduction of state-of-the-art greenhouses. The increasing population has driven the rise of the indoor farming business in Germany.

The French hydroponics market is thriving at an exponential rate due to the deep penetration of hydroponic systems in the French agricultural sector.

The Italian hydroponics market is moving forward toward maturity due to the high growth of greenhouses all over the country.

The Spanish hydroponics market is propelling with increased emphasis on smart controlled environment agriculture.

KEY MARKET PLAYERS

Argus Control Systems, Koninklijke Philips NV, Greentech Agro LLC, Logiqs B.V., Lumigrow, Inc. and General Hydroponics, Inc. are some of the notable players in the European hydroponics market.

MARKET SEGMENTATION

This market research report on the European hydroponic market is segmented and sub-segmented into the following categories.

By Equipment

-

HVAC

-

LED Grow Light

-

Communication Technology

-

Irrigation Systems

-

Material Handling

-

Control Systems

By Type

-

Aggregate

-

Liquid

By Crop Type

-

Tomato

-

Lettuce & Leafy Vegetables

-

Cucumber

-

Pepper & Strawberry

By Input Type

-

Nutrients

-

Growth Medium

By Aggregate Hydroponics Systems

-

Closed Systems

-

Open Systems

By Liquid Hydroponic Systems

-

Nutrient Film Technique (NFT)

-

Floating Hydroponics and Aeroponics

By Closed Systems

-

The Water Culture System

-

The EBB and Flow System

-

Drip Systems

-

The Wick System

By Country

-

UK

-

France

-

Spain

-

Germany

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Switzerland

-

Netherlands

-

Turkey

-

Czech Republic

-

Rest of Europe

Frequently Asked Questions

What Is The Size Of Europe Hydroponics Market?

The size of the European hydroponics market at USD 160.39 million in 2025

What Is The Growth Of Europe Hydroponics Market?

As per our report analysis, the European hydroponics market is the largest regional market because of its advanced agricultural techniques and is expected to grow to USD 511.83 million by 2033.

What Are The Key Market Players Involved In Europe Hydroponics Market?

Major key Players dominating the market are Argus Control Systems, Koninklijke Philips NV, Greentech Agro LLC, Logiqs B.V., Lumigrow, Inc. and General Hydroponics, Inc. are playing a dominant role in the Europe hydroponics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]