Europe Hydrogen Market Size, Share, Trends, & Growth Forecast Report By Production (Grey Hydrogen, Blue Hydrogen, Green Hydrogen, Brown/Black Hydrogen, Pink/Purple Hydrogen and Turquoise Hydrogen), Form, Application, End User & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Hydrogen Market Size

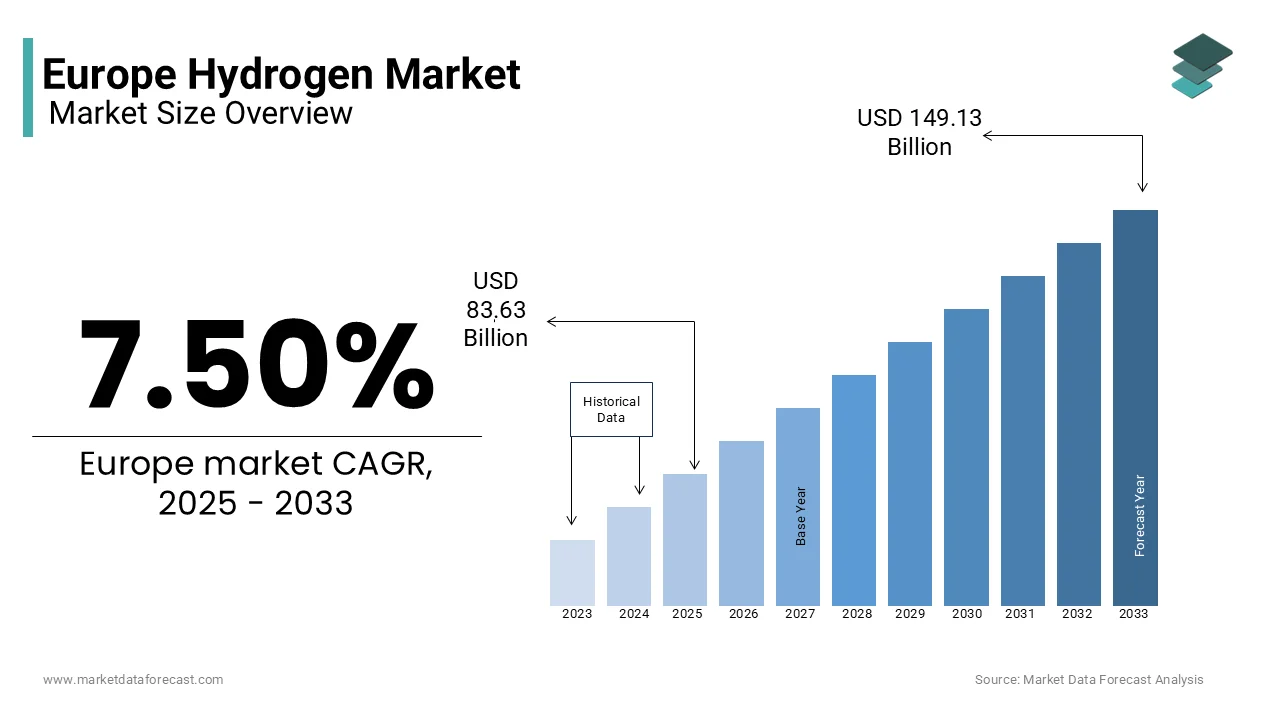

The Europe hydrogen market was valued at USD 77.80 billion in 2024. The European market is expected to reach USD 149.13 billion by 2033 from USD 83.63 billion in 2025, rising at a CAGR of 7.50% from 2025 to 2033.

Hydrogen, being a versatile and clean energy carrier, is gaining prominence as a key enabler for decarbonizing industries, transportation, and power generation. The European hydrogen market is expected to advance with projections indicating robust growth underpinned by supportive policies and technological advancements. According to Eurostat, hydrogen production currently accounts for nearly 2% of Europe’s total energy consumption, with over 70% derived from natural gas through steam methane reforming, while green hydrogen production remains in its nascent stages.

The European Union’s Green Deal and Hydrogen Strategy have set ambitious targets by aiming for 40 gigawatts (GW) of renewable hydrogen electrolyzers by 2030, as outlined by the European Commission. This initiative has spurred investments exceeding €10 billion in hydrogen projects across the region. According to the International Energy Agency, Germany, France, and Spain are at the forefront of the hydrogen adoption which are collectively accounting for over 50% of Europe’s hydrogen capacity. Green hydrogen that is produced via electrolysis using renewable energy is expected to grow substantially in the coming years is supported by declining renewable energy costs and advancements in electrolyzer technology.

With applications spanning industrial processes, fuel cell vehicles, and energy storage, hydrogen is poised to play a transformative role in achieving net-zero emissions. However, challenges such as high production costs, infrastructure development, and scalability remain critical barriers. Despite these hurdles, the European hydrogen market is set to revolutionize the energy landscape, aligning economic growth with environmental sustainability.

This introduction provides a comprehensive overview of the current state of the European hydrogen market, supported by relevant statistics and facts.

MARKET DRIVERS

Ambitious Climate Goals and Policy Support

The region’s ambitious climate goals and robust policy frameworks aimed at achieving carbon neutrality is mainly influencing the growth of the European hydrogen market. The European Commission’s Green Deal and Hydrogen Strategy have set a target to install 40 gigawatts (GW) of renewable hydrogen electrolyzers by 2030, with investments exceeding €10 billion in hydrogen projects as of 2023. As per the Eurostat, hydrogen is expected to contribute up to 14% of Europe’s energy mix by 2050 which is significantly reducing reliance on fossil fuels. Additionally, the International Energy Agency notes that countries like Germany and France are leading this transition, allocating over €7 billion and €2 billion respectively for hydrogen development. These policies are driving demand for green hydrogen, particularly in hard-to-decarbonize sectors like steel and chemicals, ensuring sustained market growth while aligning with net-zero objectives.

Rising Demand for Clean Energy Solutions

The rising demand for clean energy solutions to decarbonize transportation, industry, and power generation also drives the market growth. The European Environment Agency reports that the transportation sector accounts for nearly 25% of Europe’s greenhouse gas emissions and is creating a critical need for alternatives like hydrogen fuel cells. Furthermore, according to the European Investment Bank, industrial sectors such as refining and ammonia production consume approximately 7 million tons of hydrogen annually, with green hydrogen adoption expected to reduce emissions by up to 30%. Renewable energy costs are declining. So, hydrogen's role in energy storage and grid stabilization is expanding, making it a vital component of Europe’s sustainable energy transition.

MARKET RESTRAINTS

High Production Costs of Green Hydrogen

The high production cost of green hydrogen is propelling the growth of the European hydrogen market. It remains a significant barrier to widespread adoption. According to the International Energy Agency, producing green hydrogen through electrolysis costs between €3.5 and €5.5 per kilogram and is significantly higher than gray hydrogen which costs approximately €1.5 per kilogram. Eurostat notes that the high costs are primarily due to expensive electrolyzer technology and the need for substantial renewable energy inputs. Although the European Commission aims to reduce costs to €1.8 per kilogram by 2030, current prices limit scalability and economic feasibility. Additionally, the European Investment Bank reports that only 5% of Europe’s hydrogen production is currently green which is showcasing the slow transition from fossil fuel-based methods. These financial challenges hinder rapid market expansion despite strong policy support.

Underdeveloped Infrastructure and Storage Challenges

The underdeveloped infrastructure for hydrogen transportation and storage poses logistical challenges which is slowing down the market growth rate. The European Environment Agency highlights that less than 20% of Europe’s existing natural gas pipelines are suitable for transporting hydrogen without modifications, requiring substantial investments in retrofitting or new pipeline construction. Furthermore, the International Renewable Energy Agency notes that large-scale hydrogen storage facilities are limited, with only a handful operational across the continent. This lack of infrastructure creates bottlenecks in supply chains, particularly for industrial hubs reliant on hydrogen. Eurostat reports that over €65 billion is needed to develop adequate hydrogen infrastructure by 2030, but current funding falls short of this target. These gaps in infrastructure and storage capacity impede the seamless integration of hydrogen into Europe’s energy systems, delaying its full-scale deployment.

MARKET OPPORTUNITIES

Decarbonization of Hard-to-Abate Sectors

Decarbonization of hard-to-abate sectors such as steel, chemicals, and refining is giving substantial development opportunities for the European hydrogen market. As per the European Environment Agency, these industries account for nearly 20% of Europe’s total carbon emissions and is creating a critical need for clean energy alternatives. Hydrogen, particularly green hydrogen, is projected to reduce emissions in the steel industry by up to 35%, according to the International Energy Agency. Furthermore, the European Investment Bank notes that over €20 billion has been earmarked for hydrogen projects targeting industrial decarbonization by 2030. Germany’s H2Giga program aims to scale electrolyzer production. Therefore hydrogen adoption is set to accelerate. Industries face increasing regulatory pressure to meet net-zero targets, so hydrogen offers a viable way to achieve sustainable operations. This drives demand and fosters innovation in this segment.

Growth of Hydrogen Fuel Cell Vehicles

The growing adoption of hydrogen fuel cell vehicles (FCVs), particularly in public transportation and heavy-duty logistics serves major opportunity for the expansion of the market. The European Commission reports that hydrogen-powered buses and trucks are expected to grow remarkably in the future which is driven by investments exceeding €5 billion in hydrogen refueling infrastructure. Eurostat stated that cities like Paris and Berlin have already deployed over 300 hydrogen buses, with plans to expand fleets significantly. Additionally, the International Renewable Energy Agency notes that hydrogen FCVs can reduce lifecycle emissions by up to 40% compared to conventional diesel vehicles. With rising urbanization and stricter emissions standards under the European Green Deal, hydrogen FCVs are gaining traction as a sustainable mobility solution. This trend presents lucrative opportunities for scaling hydrogen production and distribution networks across Europe.

MARKET CHALLENGES

Limited Public Awareness and Acceptance

The limited public awareness and acceptance of hydrogen technologies hinders widespread adoption in the European hydrogen market. The European Environment Agency reported that less than 30% of Europeans are familiar with hydrogen’s role in energy transition that is creating skepticism about its safety and benefits. Misconceptions about hydrogen's flammability and storage risks further exacerbate resistance, particularly among local communities near proposed projects. Additionally, the International Energy Agency notes that public opposition has delayed several high-profile hydrogen initiatives, such as pipeline expansions in Germany and France. Eurostat reports that only 15% of surveyed stakeholders fully support large-scale hydrogen investments which is demostrating the need for educational campaigns. Without addressing these knowledge gaps, securing social license for hydrogen infrastructure development remains a significant barrier to market growth.

Dependence on Imported Technologies and Materials

Europe’s dependence on imported technologies and materials for hydrogen production and infrastructure threatens supply chain resilience which is a key challenge for the market players. The European Commission reports that over 70% of electrolyzers used in Europe are manufactured outside the region, primarily in Asia, increasing costs and lead times. Furthermore, the International Renewable Energy Agency stated that critical materials like platinum and iridium, essential for electrolyzer efficiency, are sourced from geopolitically sensitive regions, posing risks of price volatility and supply disruptions. Eurostat notes that only 20% of Europe’s hydrogen-related patents are commercially scaled within the region, reflecting a lack of domestic innovation capacity. This reliance on imports undermines Europe’s strategic autonomy in scaling hydrogen technologies, making it imperative to invest in localized manufacturing and research to strengthen the market’s long-term viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.50% |

|

Segments Covered |

By Production, Form, Application, End User and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Linde plc (Ireland), Air Products and Chemicals, Inc. (US), Air Liquide (France), Worthington Industries (US), Cryolor (France), Hexagon Purus (Norway), and NPROXX (Netherlands). |

SEGMENTAL ANALYSIS

By Production Insights

The gray hydrogen segment dominated the European market by holding a 70% share in 2024 owing to its cost-effectiveness, with production costs averaging €1.5 per kilogram via steam methane reforming (SMR). According to the International Energy Agency, gray hydrogen is widely used in refining and ammonia production, consuming over 7 million tons annually. However, its reliance on fossil fuels results in significant carbon emissions, contributing to nearly 830 million tons of CO2 yearly. Despite its prevalence, gray hydrogen remains unsustainable for long-term climate goals, which points out the urgent need for cleaner alternatives like blue and green hydrogen to meet Europe’s decarbonization targets.

The green hydrogen segment is estimated to register the fastest CAGR of 18.4% from 2025 to 2033. Produced via electrolysis using renewable energy, it currently accounts for only 5% of production but is pivotal for achieving net-zero emissions. The International Renewable Energy Agency notes that declining renewable energy costs and advancements in electrolyzer technology are driving adoption, particularly in Germany and Spain. Eurostat revealed that over €10 billion has been allocated to green hydrogen projects under the EU Hydrogen Strategy, aiming for 40 GW of electrolyzer capacity by 2030. Green hydrogen is the cornerstone of Europe’s energy transition. It is revolutionizing industries and transportation and ensuring sustainability.

REGIONAL ANALYSIS

Germany led the European hydrogen market by holding a 25% share in 2024. This position in the regional market is due to its robust policy framework, including the National Hydrogen Strategy, which allocates over €9 billion for green hydrogen projects. The International Energy Agency reported that Germany is investing heavily in electrolyzer capacity and is aiming for 5 GW by 2030. Additionally, the country’s strong industrial base, particularly in sectors like steel and chemicals, drives demand for clean hydrogen. Eurostat notes that Germany accounts for nearly 40% of Europe’s hydrogen patents, underscoring its innovation leadership. With significant investments in infrastructure and research, Germany is spearheading Europe’s transition to a hydrogen-based economy.

France is a key player in the European hydrogen market. The country’s progress is fuelled by its commitment to renewable energy, with plans to invest €7.2 billion in hydrogen projects by 2030. The International Renewable Energy Agency revealed that France is focusing on green hydrogen production which is leveraging its abundant nuclear and renewable energy resources. Additionally, the European Commission notes that France is developing hydrogen hubs in regions like Normandy and Dunkirk, targeting industrial decarbonization. Eurostat reports that France aims to produce 6.5 GW of electrolyzer capacity by 2030. With strong government backing and strategic initiatives, France is positioning itself as a leader in sustainable hydrogen solutions.

Spain ranks among the top performers. This growth is influenced by Spain’s abundant renewable energy resources and particularly solar and wind, which make it an ideal location for green hydrogen production. The International Energy Agency notes that Spain has launched the "Hydrogen Roadmap," allocating €1.5 billion to develop 4 GW of electrolyzer capacity by 2030. Additionally, the European Investment Bank highlights that Spain is attracting significant foreign investments, particularly in regions like Andalusia and Castilla-La Mancha. Eurostat reports that Spain’s focus on exporting green hydrogen to other European countries further strengthens its position. Spain has favorable conditions for renewable energy and proactive policies. Therefore, Spain is emerging as a major hub for green hydrogen in Europe.

KEY MARKET PLAYERS

The major players in the Europe hydrogen market include Linde plc (Ireland), Air Products and Chemicals, Inc. (US), Air Liquide (France), Worthington Industries (US), Cryolor (France), Hexagon Purus (Norway), and NPROXX (Netherlands).

MARKET SEGMENTATION

This research report on the European hydrogen market is segmented and sub-segmented into the following categories.

By Production

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

- Brown/Black Hydrogen

- Pink/Purple Hydrogen

- Turquoise Hydrogen

By Form

- Compressed Hydrogen Gas (CHG)

- Liquid Hydrogen

- Ammonia (NH₃)

- Methanol

By Application

- Transportation

- Industrial Processes

- Power Generation

- Energy Storage

- Residential and Commercial Heating

By End User

- Oil and Gas

- Chemicals

- Metals and Mining

- Transportation

- Energy and Utilities

- Agriculture

- Electronics

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the hydrogen market in Europe?

The growth is primarily driven by government policies, carbon neutrality targets, and increasing investments in hydrogen infrastructure and production technologies.

Which industries in Europe are major consumers of hydrogen?

Key industries include transportation, chemicals, refining, and steel manufacturing, with increasing use in power generation and heavy-duty mobility.

What role does blue hydrogen play in Europe's hydrogen economy?

Blue hydrogen, produced from natural gas with carbon capture, acts as a transitional solution until green hydrogen production becomes more cost-competitive and scalable.

What are the key hydrogen production projects currently underway in Europe?

Projects like the NortH2 (Netherlands), AquaVentus (Germany), and the Iberian Green Hydrogen Corridor (Spain-Portugal) aim to scale up green hydrogen production and supply chains.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]