European Hydrocarbon Refrigerants Market Size, Share, Trends & Growth Forecast Report, Segmented By Type, Application, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Hydrocarbon Refrigerants Market Size

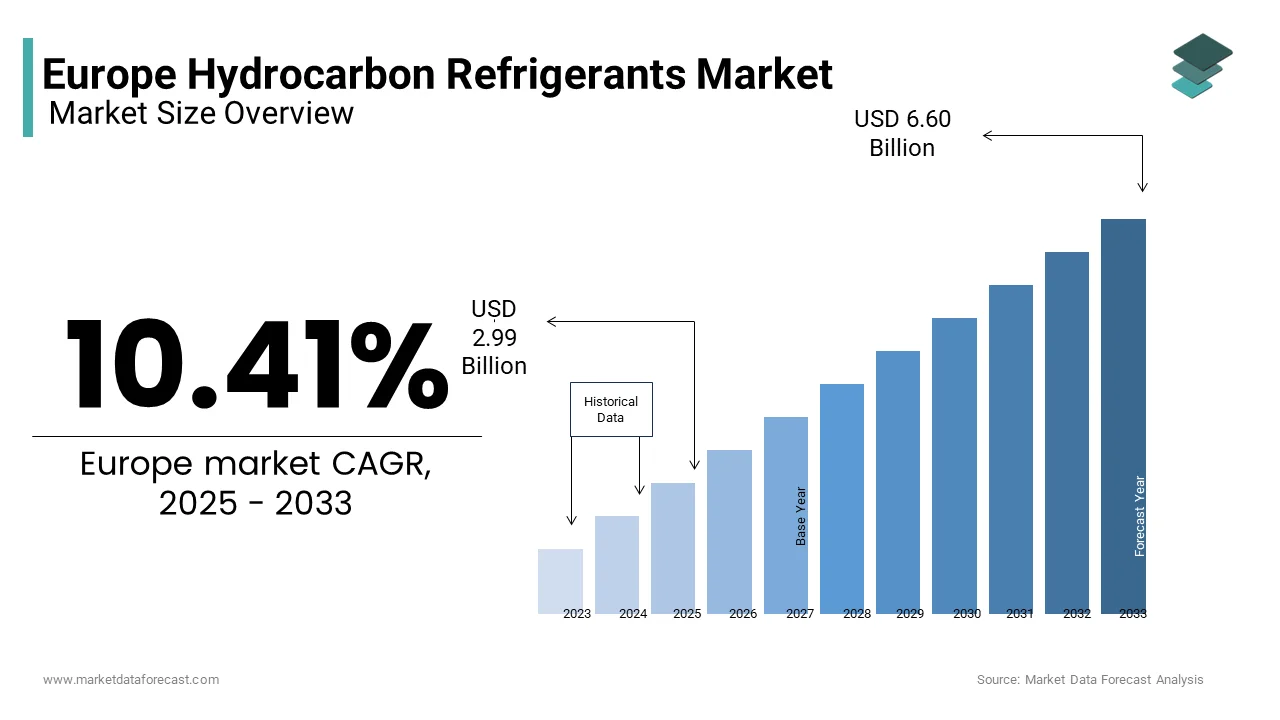

The European hydrocarbon refrigerants market size was valued at USD 2.15 billion in 2024 and is anticipated to reach USD 2.28 billion in 2025 from USD 3.70 billion by 2033, growing at a CAGR of 6.23% during the forecast period from 2025 to 2033.

The European hydrocarbon refrigerants market has witnessed steady growth with the stringent environmental regulations and a shift toward sustainable cooling solutions. As per the European Environment Agency, the region is committed to reducing greenhouse gas emissions by 55% by 2030, which has catalyzed the adoption of eco-friendly refrigerants. Hydrocarbons like propane and isobutane are gaining traction due to their low global warming potential (GWP) and ozone depletion potential (ODP).

MARKET DRIVERS

Environmental Regulations Promoting Low-GWP Solutions

Environmental policies have emerged as a significant catalyst for the European hydrocarbon refrigerants market. The European Union’s F-Gas Regulation mandates a phase-down of fluorinated gases by compelling industries to adopt alternatives with lower GWP. According to the European Commission, hydrocarbon refrigerants like propane and isobutane have seen a 15% annual increase in adoption since 2020. These refrigerants boast a GWP of less than 5 by making them an ideal choice for compliance. Additionally, the Kigali Amendment to the Montreal Protocol is ratified by all EU member states, has accelerated this transition. This regulatory push has created a robust demand in the commercial refrigeration sector, where sustainability is a priority.

Rising Demand for Energy-Efficient Cooling Systems

Energy efficiency is another critical driver propelling the market forward. As per the International Energy Agency, cooling systems account for approximately 10% of global electricity consumption is prompting industries to seek energy-saving solutions. Hydrocarbon refrigerants offer superior thermodynamic properties by enhancing system efficiency by up to 20%. As per a study by the European Partnership for Energy and the Environment, hydrocarbon-based systems consume 12% less energy compared to traditional HFC systems. Moreover, the growing trend of smart buildings and IoT-enabled HVAC systems in Europe has further amplified demand.

MARKET RESTRAINTS

Flammability Concerns Limiting Adoption

A significant barrier to the widespread adoption of hydrocarbon refrigerants is their flammability, which raises safety concerns. Propane and isobutane, the most commonly used hydrocarbons, are classified as flammable substances under international safety standards. These safety requirements often result in higher operational costs, deterring small-scale users from transitioning. Furthermore, a report by the European Safety Federation have shown that only 40% of HVAC technicians in Europe are certified to handle flammable refrigerants is creating a skills gap. This limitation is particularly evident in residential air conditioning systems, where safety remains a top priority, thereby restricting market expansion.

High Initial Costs Hindering Market Penetration

Another major restraint is the high initial cost associated with hydrocarbon-based systems. As per a study by the European Heat Pump Association, retrofitting existing systems to accommodate hydrocarbon refrigerants can increase costs by up to 30%. This expense includes not only the refrigerants themselves but also the necessary modifications to ensure compliance with safety standards. Additionally, data from the European Investment Bank indicates that small and medium enterprises (SMEs) in the region face financial constraints is limiting their ability to invest in sustainable technologies. The upfront investment remains a deterrent for many businesses while long-term savings on energy bills are a strong incentive. This financial barrier is especially pronounced in Eastern Europe, where economic disparities hinder the adoption of advanced cooling solutions.

MARKET OPPORTUNITIES

Growing Demand for Natural Refrigerants in Commercial Applications

The commercial refrigeration sector presents a lucrative opportunity for hydrocarbon refrigerants, driven by the increasing focus on natural refrigerants. According to the European Cold Chain Federation, the demand for natural refrigerants in supermarkets and cold storage facilities has grown by 25% annually since 2019. Hydrocarbons like propane and isobutane are gaining popularity due to their compatibility with plug-and-play systems and minimal environmental impact. A survey by the European Retail Round Table reveals that over 65% of retailers plan to transition to natural refrigerants by 2025 is creating a substantial market for hydrocarbons. Furthermore, advancements in technology have reduced the flammability risks associated with these refrigerants by making them more appealing to end-users. This trend is expected to drive significant growth in the commercial segment, particularly in countries like Germany and France.

Expansion into Emerging Markets within Europe

Emerging markets in Eastern Europe offer untapped potential for the hydrocarbon refrigerants market. According to the European Bank for Reconstruction and Development, countries like Poland and Romania are witnessing a surge in industrial and commercial infrastructure development, necessitating efficient cooling solutions. Data from the Central Statistical Office of Poland indicates that investments in HVAC systems have increased by 18% annually over the past three years. Hydrocarbon refrigerants, with their low environmental impact and cost-effectiveness, are well-positioned to capitalize on this growth. Additionally, government initiatives promoting sustainable practices in these regions provide further impetus. For instance, Romania’s National Recovery and Resilience Plan allocates €2 billion for green technologies, including energy-efficient cooling systems. This creates a fertile ground for market expansion and innovation.

MARKET CHALLENGES

Stringent Safety Standards Increasing Compliance Costs

One of the primary challenges facing the hydrocarbon refrigerants market is the stringent safety standards imposed due to their flammable nature. According to the European Committee for Standardization, compliance with EN 378 standards requires extensive testing and certification, adding to operational expenses. Data from the European Industrial Gases Association reveals that the cost of ensuring compliance can increase project budgets by up to 25%. This is particularly challenging for small-scale manufacturers and installers who lack the resources to meet these rigorous requirements. Moreover, a report by the European Safety Federation has revealed that the non-compliance incidents have risen by 12% in the past two years with the need for stricter enforcement. These factors create a complex environment is hindering the seamless adoption of hydrocarbon refrigerants across various applications.

Competition from Alternative Refrigerant Technologies

The market faces stiff competition from alternative refrigerant technologies, such as hydrofluoroolefins (HFOs), which are gaining traction due to their non-flammable properties. Additionally, a study by the European Partnership for Energy and the Environment indicates that HFO-based systems are preferred in applications where safety is paramount, such as residential air conditioning. This competitive pressure is further exacerbated by the rapid technological advancements in HFO production, which have reduced costs by 15% annually.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.23% |

|

Segments Covered |

By Type, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Arkema (France), Dongyue Group Limited (China), Honeywell International Inc. (US), The Chemours Company (US), Linde plc (Ireland), The Sinochem Hong Kong (Group) Company Limited (China), Daikin Industries, Ltd. (Japan), Orbia Advance Corporation, S.A.B. de C.V. (US), AGC Inc. (Japan), and A-Gas International Limited (UK). |

SEGMENTAL ANALYSIS

By Type Insights

The propane segment was the largest and held 40.3% of the European hydrocarbon refrigerants market share in 2024. Its prevalence is attributed to its excellent thermodynamic properties and low GWP of 3. According to the European Partnership for Energy and the Environment, propane-based systems are widely used in commercial refrigeration, where they deliver energy savings of up to 15%. According to the European Retail Round Table, over 60% of new supermarket installations in 2022 utilized propane refrigerants. The growing emphasis on sustainability and energy efficiency further solidifies propane's dominance. Furthermore, advancements in leak detection and safety technologies have mitigated flammability concerns is making propane a preferred choice for large-scale applications.

The isobutane segment is likely to register a CAGR of 18.3% during the forecast period. This growth is driven by its increasing adoption in household refrigerators and small-scale cooling systems. According to the European Heat Pump Association, isobutane systems are 20% more energy-efficient than traditional HFC-based systems by making them ideal for residential applications. According to the European Consumer Organisation reveals that the demand for energy-efficient home appliances has surged by 22% annually since 2020 by boosting isobutane's market penetration. Additionally, government incentives promoting sustainable living, such as tax rebates for green appliances, have further fueled adoption.

By Application Insights

The refrigeration systems segment led the European hydrocarbon refrigerants market by holding a 50.4% of share in 2024. This dominance is fueled by the growing demand for energy-efficient and sustainable cooling solutions in the food and beverage industry. The shift toward natural refrigerants is further supported by stringent environmental regulations, which mandate the phase-out of high-GWP alternatives.

The air conditioning systems segment is lucratively to grow with a CAGR of 20.4% in the next coming years. This growth is driven by the rising demand for energy-efficient cooling solutions in residential and commercial buildings. According to the European Building Automation and Controls Association, the adoption of hydrocarbon-based air conditioning systems has increased by 25% annually since 2020. Data from the European Partnership for Energy and the Environment reveals that these systems consume 15% less energy than traditional HFC-based systems by making them highly attractive to environmentally conscious consumers. Additionally, government initiatives promoting green building practices, such as LEED certifications that have further accelerated adoption.

COUNTRY ANALYSIS

Germany was the top performer in the European hydrocarbon refrigerants market with a 28.7% of share in 2024. The country's growth is attributed with its robust industrial base, stringent environmental policies, and proactive adoption of sustainable technologies. According to Eurostat, Germany invested €5 billion in green cooling technologies in 2022, driven by its commitment to achieving net-zero emissions by 2045. The presence of key manufacturers like BASF and Linde, along with government incentives such as tax rebates for energy-efficient systems is likely to propel the growth of the market in this country.

Spain is anticipated to register a CAGR of 22.6% during the forecast period. This growth is fueled by increasing investments in hospitality and tourism infrastructure, where energy-efficient cooling solutions are critical. Government initiatives promoting renewable energy adoption, including subsidies for green HVAC systems are accelerating the growth of the market.

KEY MARKET PLAYERS

Arkema (France), Dongyue Group Limited (China), Honeywell International Inc. (US), The Chemours Company (US), Linde plc (Ireland), The Sinochem Hong Kong (Group) Company Limited (China), Daikin Industries, Ltd. (Japan), Orbia Advance Corporation, S.A.B. de C.V. (US), AGC Inc. (Japan), and A-Gas International Limited (UK). are the market players that are dominating the Europe hydrocarbon refrigerants market.

Top Players In The Market

Honeywell International Inc.

Honeywell is a leading player in the European hydrocarbon refrigerants market, contributing significantly to global innovation. Its Solstice® line of low-GWP refrigerants is likely to promote the growth opportunities in the next coming years. The company’s focus on R&D has enabled it to develop cutting-edge solutions that comply with stringent environmental regulations.

Chemours Company

Chemours is another major contributor in the European hydrocarbon refrigerants market. The company’s Opteon™ series of refrigerants are widely adopted in commercial and industrial applications. Chemours’ commitment to sustainability aligns with Europe’s green initiatives is reinforcing its market presence.

Daikin Industries Ltd.

Daikin’s hydrocarbon-based systems are renowned for their energy efficiency and reliability. Daikin’s strategic investments in Europe have promoted its position as a key player in the market.

Top Strategies Used By Key Players

Key players in the European hydrocarbon refrigerants market leverage diverse strategies to maintain their competitive edge. Product innovation remains a cornerstone, with companies like Honeywell and Chemours investing heavily in R&D to develop low-GWP refrigerants tailored to specific applications. Strategic partnerships are another focus area; for example, Daikin collaborates with local distributors to expand its reach in underserved markets. Mergers and acquisitions also play a pivotal role by enabling firms to consolidate their positions and access cutting-edge technologies. Additionally, companies emphasize compliance with EU regulations by ensuring their products meet stringent environmental standards.

COMPETITION OVERVIEW

The European hydrocarbon refrigerants market is highly competitive, characterized by the presence of global giants and regional players striving to capture market share. Smaller players, such as Arkema and Linde, focus on niche segments by offering specialized solutions for industrial applications. The competitive landscape is shaped by stringent environmental regulations, which drive innovation and product differentiation. Companies are increasingly investing in sustainable technologies to align with EU climate goals by fostering a dynamic environment. Price competition remains moderate, as customers prioritize performance and compliance over cost. This evolving ecosystem ensures continuous advancements in hydrocarbon refrigerant technologies.

RECENT HAPPENINGS IN THIS MARKET

- In April 2023, Honeywell launched Solstice® N71, a next-generation hydrocarbon refrigerant designed for commercial refrigeration systems by enhancing energy efficiency by 15%.

- In June 2023, Chemours partnered with Carrier Global Corporation to integrate Opteon™ refrigerants into Carrier’s HVAC systems by expanding its market reach across Europe.

- In August 2023, Daikin unveiled a new line of air conditioning units powered by propane-based refrigerants by targeting residential and small-scale commercial applications.

- In October 2023, Arkema invested €100 million in a state-of-the-art production facility in France to scale up the manufacturing of Forane®, its flagship hydrocarbon refrigerant.

- In December 2023, BASF acquired GreenTech Refrigerants, a startup specializing in bio-based refrigerants to bolster its portfolio of sustainable cooling solutions.

MARKET SEGMENTATION

This research report on the Europe hydrocarbon refrigerants market is segmented and sub-segmented into the following categories.

By Type

- HFC & Blends

- HFO

- Isobutane

- Propane

- Ammonia

- Corban Dioxide

By Application

- Refrigeration System

- Air Conditioning System

- Chillers

- MNC

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are hydrocarbon refrigerants and why are they used in Europe?

Hydrocarbon refrigerants, like propane (R-290) and isobutane (R-600a), are natural, eco-friendly alternatives to synthetic refrigerants. They're widely used in Europe due to their low global warming potential (GWP) and compliance with EU F-Gas regulations.

What industries are driving the demand for hydrocarbon refrigerants in Europe?

Key sectors include commercial refrigeration (like supermarkets and cold storage), domestic appliances, and automotive air conditioning, all seeking greener, energy-efficient solutions

How do EU regulations impact the hydrocarbon refrigerants market?

EU F-Gas regulations and the Kigali Amendment to the Montreal Protocol are phasing down high-GWP refrigerants, boosting demand for hydrocarbons as sustainable replacements.

What are the safety concerns associated with hydrocarbon refrigerants?

Hydrocarbon refrigerants are flammable, so safety standards and proper equipment handling are critical. Advances in technology and system design have minimized these risks.

Who are the major players in the European hydrocarbon refrigerants market?

Key companies include A-Gas, Linde Group, ExxonMobil, and Harp International, focusing on production, supply, and R&D for eco-friendly refrigerant solutions.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]