Europe Hummus Market Size, Share, Trends & Growth Forecast Report By Product (Classic Hummus, Roasted Garlic Hummus, White Bean Hummus, Black Olive Hummus, Others), Packaging, Distribution Channel and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Hummus Market Size

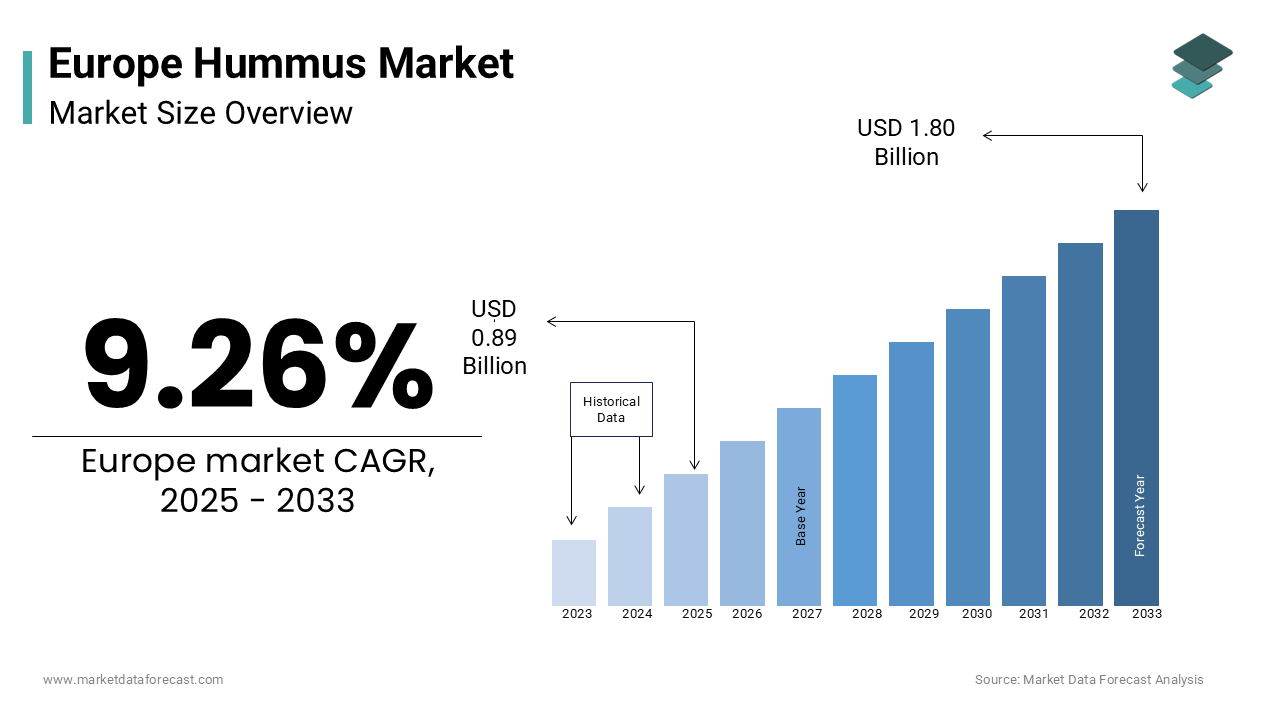

The europe hummus market was worth USD 0.81 billion in 2024. The europe market is estimated to grow at a CAGR of 9.26% from 2025 to 2033 and be valued at USD 1.80 billion by the end of 2033 from USD 0.89 billion in 2025.

Hummus is traditionally a Middle Eastern staple and has gained traction across European households due to its rich nutritional profile and versatility. The region's growing inclination toward plant-based diets has bolstered demand. Moreover, the UK is a major consumer of this, accounting for a notable portion of the regional market share. Rising health consciousness among millennials and Gen Z populations has further fueled adoption, particularly in urban centers like London, Berlin, and Paris. Additionally, the expansion of retail distribution channels, including online platforms, has made hummus more accessible. A study by the European Snacks Association shows that nearly 65% of European consumers now consider hummus a healthier alternative to traditional dips, reflecting its widespread acceptance.

MARKET DRIVERS

Rising Health Consciousness

Europeans are increasingly prioritizing health-conscious food choices, a trend that significantly propels the hummus market. Hummus, being rich in protein, fiber, and healthy fats, aligns well with the growing preference for nutrient-dense snacks. The product's low glycemic index and absence of artificial additives make it appealing to fitness enthusiasts and individuals managing dietary conditions like diabetes. Moreover, the rise of veganism, which grew in Europe between 2018 and 2022 as indicated by the Vegan Society UK, further amplifies demand. Hummus's adaptability as a spread, dip, or ingredient in salads and wraps enhances its appeal, fostering consistent growth in sales. This shift in consumer behavior showcases why health awareness remains a pivotal driver in the hummus market’s expansion.

Expansion of Retail Channels

The proliferation of diverse retail channels, especially e-commerce platforms, is another critical driver for the Europe hummus market. Hummus manufacturers have capitalized on this trend by partnering with major retailers like Amazon Fresh and Tesco Groceries to enhance accessibility. Convenience stores have also played a vital role, offering smaller, on-the-go packaging formats tailored to urban consumers. For instance, Aldi and Lidl have introduced private-label hummus variants priced competitively, catering to budget-conscious buyers. Furthermore, supermarkets and hypermarkets dominate distribution, holding a notable collective market share, as noted by the European Retail Forum. These establishments often feature dedicated sections for healthy snacks, prominently displaying hummus alongside other wellness products. Such strategic placement boosts visibility and purchase intent, strengthening retail expansion as a cornerstone of market growth.

MARKET RESTRAINTS

High Production Costs

One of the primary challenges hindering the Europe hummus market is the high production costs associated with sourcing key ingredients like chickpeas and tahini. This volatility impacts profit margins for manufacturers, particularly smaller players unable to absorb rising expenses. Additionally, tahini, a sesame seed paste integral to hummus, relies heavily on imports from regions like Turkey and Syria, where geopolitical tensions occasionally disrupt supplies. An investigation by the European Food Safety Authority notes that these cost pressures often translate into higher retail prices, deterring price-sensitive consumers. While premium brands can maintain demand through brand loyalty, mid-tier and budget offerings face challenges in sustaining market share amidst escalating input costs.

Limited Awareness in Certain Regions

Despite its popularity in Western Europe, hummus still struggles with limited awareness in parts of Eastern Europe, acting as a restraint to broader market penetration. Cultural preferences for traditional spreads and dips, such as ajvar or lutenitsa, overshadow the adoption of hummus in these regions. Furthermore, marketing efforts remain concentrated in affluent markets, leaving untapped potential in emerging economies. The lack of localized promotional campaigns and educational initiatives about hummus’s health benefits exacerbates the issue. Without targeted strategies to introduce hummus to new demographics, manufacturers risk stagnating growth in underdeveloped segments, limiting overall market expansion.

MARKET OPPORTUNITIES

Growing Demand for Organic and Non-GMO Products

The increasing consumer preference for organic and non-GMO food products presents a lucrative opportunity for the Europe hummus market. Consumers are willing to pay a premium for products labeled as organic, driven by concerns about chemical residues and environmental sustainability. For instance, a survey by the Soil Association revealed that over 70% of UK consumers actively seek organic certifications when purchasing dips and spreads. This trend has encouraged manufacturers to introduce organic hummus variants, which now account for a notable share of the total market in Western Europe. Furthermore, government initiatives promoting sustainable agriculture, such as the EU’s Farm to Fork Strategy, incentivize producers to adopt eco-friendly practices. By aligning with these trends, hummus brands can tap into a rapidly expanding niche while enhancing their brand image.

Innovation in Product Flavors and Formats

Innovation in flavors and packaging formats offers another promising avenue for growth in the Europe hummus market. As per data from the European Food Trends Report, a significant portion of consumers are eager to try new and exotic flavors, creating demand for unique hummus varieties. Manufacturers have responded by introducing innovative options like beetroot hummus, turmeric-infused hummus, and dessert-inspired flavors such as chocolate hummus. These unconventional offerings appeal to adventurous eaters and cater to diverse culinary preferences. Additionally, the rise of single-serve and portable packaging formats has made hummus more convenient for on-the-go consumption. By continuously innovating and adapting to evolving consumer tastes, companies can differentiate themselves in a competitive market while capturing untapped customer segments.

MARKET CHALLENGES

Intense Competition from Substitute Products

The Europe hummus market faces stiff competition from alternative dips and spreads, posing a significant challenge to its growth trajectory. These substitutes often target similar health-conscious consumers, leading to market fragmentation. Moreover, price wars initiated by private-label brands further intensify competition. For instance, major supermarket chains like Carrefour and Tesco offer cheaper alternatives to branded hummus, attracting budget-conscious buyers. While hummus remains a favorite among urban professionals, the availability of competitive options forces manufacturers to invest heavily in marketing and product differentiation. Failure to address this challenge may result in stagnation or loss of market share.

Regulatory Compliance and Labeling Requirements

Navigating stringent regulatory frameworks and labeling requirements is another hurdle for the Europe hummus market. The European Food Safety Authority mandates detailed ingredient disclosures and nutritional information, which can be costly and time-consuming for manufacturers. For example, allergen labeling regulations require clear identification of sesame seeds in tahini, a key hummus ingredient, complicating compliance for smaller players. Furthermore, the EU’s Green Deal initiative imposes stricter environmental standards, compelling companies to adopt sustainable packaging solutions. A report by the European Commission states that around 60% of food manufacturers struggle with transitioning to eco-friendly materials due to high costs. Non-compliance risks penalties and reputational damage, while meeting these requirements often necessitates significant investment. Balancing regulatory adherence with profitability remains a persistent challenge for the industry.

SEGMENTAL ANALYSIS

By Product Insights

The classic hummus segment was the dominant category of the Europe hummus market by holding a market share of 45.4% in 2024. This is due to the widespread popularity of its versatility and familiarity, making it a staple in households and restaurants alike. Also, the dominance is fueled by consistent demand from both casual consumers and professional chefs, who appreciate its neutral flavor profile and adaptability in various cuisines. Additionally, classic hummus benefits from strong brand loyalty, with established players like Sabra and Tribe maintaining a robust presence. The segment's standing is further reinforced by its affordability compared to niche flavors, appealing to a broad demographic. With such entrenched consumer trust and widespread availability, classic hummus remains the cornerstone of the market.

Roasted garlic hummus is the fastest-growing segment, with a projected CAGR of 9.2% from 2025 to 2033. This growth is attributed to its bold flavor profile, which appeals to adventurous eaters seeking variety. The segment's expansion is also driven by rising demand for gourmet and artisanal food products, particularly in affluent markets like Germany and France. Besides, social media platforms like Instagram have amplified its visibility, with influencers showcasing creative recipes featuring roasted garlic hummus. The premium positioning of the segment allows manufacturers to command higher prices, further fueling its rapid ascent in the market.

By Packaging Insights

The top performing segment was tubs and cups of the Europe hummus market by capturing 55.8% of the share in 2024. Also, the preeminence is rooted in their practicality and cost-effectiveness, making them ideal for bulk and retail sales. Supermarkets and hypermarkets favor this format due to its stackability and ease of display, contributing to its widespread adoption. Furthermore, advancements in recyclable plastic materials have enhanced their appeal, aligning with the growing emphasis on sustainability. The segment’s position is further reinforced by its compatibility with automated filling processes, reducing production costs. These factors collectively ensure its continued prominence in the market.

The Jars and bottles segment is the quickest growing packaging segment, with a CAGR of 8.5%. This rise is propelled by the rising demand for premium and visually appealing packaging, especially among health-conscious consumers. Glass jars, in particular, are perceived as more sustainable and aesthetically pleasing, driving their adoption in upscale retail channels. A report by the European Packaging Institute shows that jars and bottles account for a larger share of hummus packaging, with significant traction in urban areas. Additionally, their ability to preserve flavor and texture better than plastic alternatives enhances their appeal. The segment’s rapid expansion is further supported by innovations in lightweight glass designs, which reduce transportation costs. These trends position jars and bottles as a key growth driver in the hummus market.

By Distribution Channel Insights

Supermarkets and hypermarkets commanded the Europe hummus market by having a market share of 47.2% in 2024. The prominence of this segment is because of its extensive reach and ability to cater to diverse consumer demographics. These retail giants offer a wide variety of hummus products, ranging from private-label options to premium branded variants, ensuring accessibility for all income groups. Moreover, strategic placement in high-traffic aisles and promotional campaigns during peak shopping seasons further boost sales. Eurostat, via its study notes that supermarkets and hypermarkets account for a notable portion of total hummus purchases in urban areas, where convenience is a priority. The segment’s place is reinforced by partnerships with manufacturers, enabling exclusive product launches and discounts. With their robust supply chains and established customer bases, supermarkets and hypermarkets remain the backbone of the hummus distribution network.

Online retailers are the swiftest emerging distribution channel, with a CAGR of 10.7% from 2025 to 2033. This surge is fueled by the rapid expansion of e-commerce platforms like Amazon Fresh, Ocado, and Picnic, which offer seamless shopping experiences. The COVID-19 pandemic accelerated this trend, with online grocery sales increasing in Europe during 2020-2021, as reported by the European Consumer Organization. Hummus brands have capitalized on this shift by optimizing their digital presence and offering subscription-based delivery models. Furthermore, the rise of mobile apps and personalized recommendations enhances customer engagement, driving repeat purchases. A survey by the European E-commerce Association reveals that a significant portion of hummus buyers prefer online shopping due to competitive pricing and home delivery convenience. As digital adoption continues to rise, online retailers are poised to lead future growth in the hummus market.

REGIONAL ANALYSIS

The United Kingdom spearheaded the Europe hummus market, accounting for 30.3% of the regional share in 2024. Dominance of this is driven by high health awareness, urbanization, and a strong affinity for Mediterranean cuisine. London, in particular, serves as a hub for hummus consumption, with cafes and restaurants frequently incorporating it into menus. Additionally, the UK’s robust retail infrastructure, including Tesco and Sainsbury’s, ensures widespread availability.

Germany is the fastest-growing market, with a CAGR of 8.2%. This progress is propelled by rising veganism, with over 2.6 million Germans identifying as vegans in 2022. Furthermore, government initiatives promoting plant-based diets have bolstered adoption. The country’s emphasis on sustainability aligns perfectly with hummus’s eco-friendly image, ensuring sustained momentum.

France, Italy, and Spain are gradually embracing hummus, albeit at a slower pace. France’s gourmet culture has led to niche adoption, while Italy’s culinary traditions pose resistance. Spain, however, shows promise due to its younger population’s openness to global cuisines. Collectively, these regions are expected to grow steadily, driven by urbanization and health trends.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Bakkavor Group, Sabra Dipping Company, Bonduelle S.A., Roquette Frères, Frosta AG, Zentis GmbH & Co. KG, Yarden Inc., Houmous Me, Tribe Mediterranean Foods, and Mezete (Kasih Food Production Co.) are some of the Key market players Europe hummus market.

The Europe hummus market is highly competitive, characterized by intense rivalry among established brands and emerging players. Innovation, branding, and distribution networks are key differentiators. While Sabra leads with its aggressive marketing, smaller companies focus on niche segments, fostering a dynamic yet fragmented landscape.

Top Players in the Europe Hummus Market

Sabra Dipping Co.

Sabra dominates the Europe hummus market, leveraging its strong brand equity and innovative product portfolio. Known for its classic and flavored variants, Sabra commands a substantial market share. Its commitment to quality and sustainability resonates with European consumers, contributing significantly to global revenue.

Tahini Bros

Tahini Bros specializes in organic and artisanal hummus, catering to health-conscious buyers. Holding a notable market share, the company emphasizes premium ingredients and eco-friendly packaging, aligning with Europe’s growing demand for sustainable options.

Oasis Foods

Oasis Foods focuses on affordability and accessibility, targeting mid-tier consumers. With a smaller yet eye-catching market share, it partners with major retailers to expand its footprint. Its localized marketing strategies enhance its appeal across diverse demographics.

Top Strategies Used by Key Market Participants

Major players employ strategies such as product diversification, sustainability initiatives, and digital marketing. For instance, Sabra invests in R&D to introduce exotic flavors, while Tahini Bros prioritizes organic certifications. Online engagement through social media campaigns and influencer partnerships also boosts visibility.

RECENT MARKET DEVELOPMENTS

- In March 2023, Sabra launched a limited-edition truffle hummus variant, targeting gourmet enthusiasts.

- In June 2023, Tahini Bros partnered with Whole Foods to expand its organic hummus range.

- In September 2023, Oasis Foods introduced recyclable packaging, enhancing its sustainability credentials.

- In November 2023, Tribe Foods collaborated with fitness influencers to promote protein-rich hummus.

- In January 2024, Pita Pit Europe integrated hummus into its menu, boosting brand visibility.

MARKET SEGMENTATION

This research report on the europe hummus market is segmented and sub-segmented based on categories.

By Product

- Classic Hummus

- Roasted Garlic Hummus

- White Bean Hummus

- Black Olive Hummus

- Others

By Packaging

- Tubs & Cups

- Jars & Bottles

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Grocery Stores

- Online Retailers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the major factors driving the growth of the hummus market in Europe?

Growth is driven by rising health consciousness and the popularity of plant-based diets. The Mediterranean diet trend also fuels demand.

What challenges are facing the hummus market in Europe?

Challenges include competition from other dips and short product shelf life. Price sensitivity in certain markets is also a concern.

What is the long-term outlook for the Europe hummus market?

The outlook is positive, with steady growth expected over the next 5–10 years. Health trends, innovation, and expanding retail presence will drive market success.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]