Europe Humic Acid Market Size, Share, Trends & Growth Forecast Report By Form (Dry, Liquid), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Humic Acid Market Size

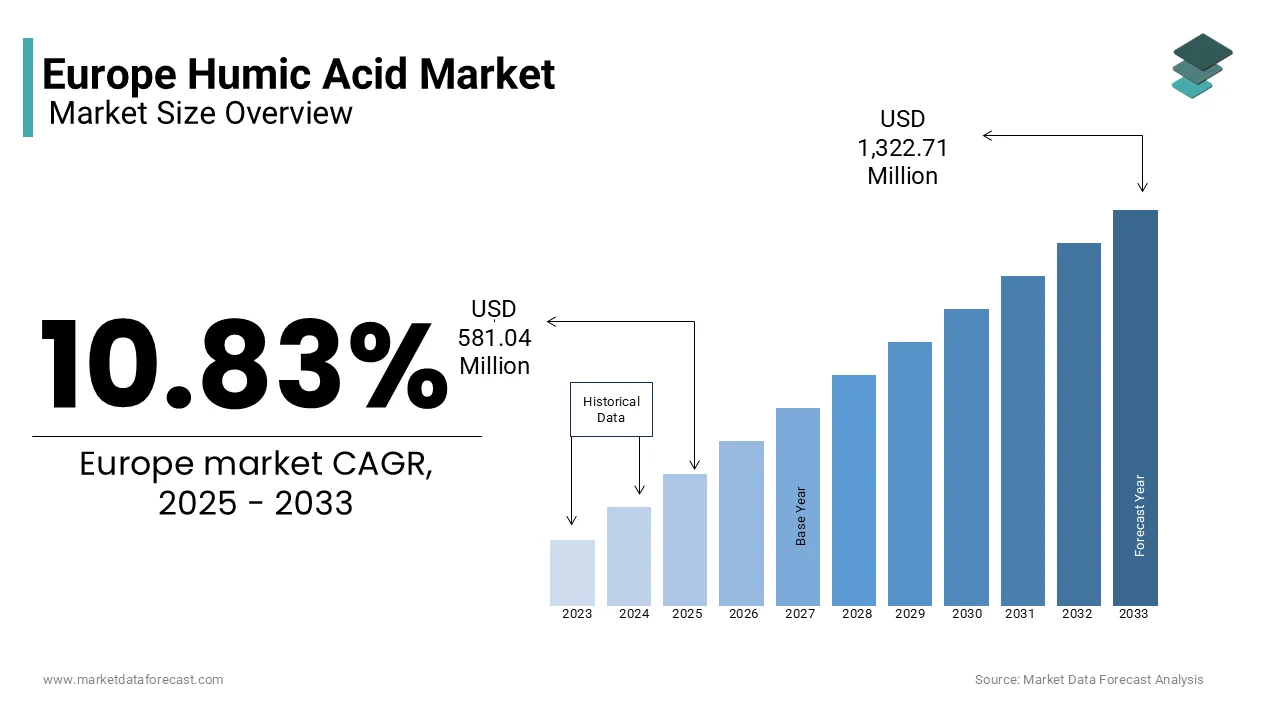

The Europe Humic Acid market size was valued at USD 524.46 million in 2024. The European market is estimated to be worth USD 1,322.71 million by 2033 from USD 581.04 million in 2025, growing at a CAGR of 10.83% from 2025 to 2033.

Humic acid is a naturally occurring organic compound derived from decomposed plant and animal matter and plays a pivotal role in enhancing soil fertility, nutrient absorption, and plant growth. In Europe, the humic acid market is driven by its extensive applications in agriculture, horticulture, ecological bioremediation, and dietary supplements. According to the European Chemical Industry Council, the demand for humic acid in Europe grew by 8% in 2022, supported by increasing awareness of sustainable farming practices and soil health management. The European Commission's Common Agricultural Policy (CAP) emphasizes eco-friendly agricultural inputs, further amplifying demand for humic acid as a natural soil conditioner.

MARKET DRIVERS

Increasing Demand for Organic Farming in Europe

The escalating demand for organic farming is primarily driving the growth of the European humic acid market. According to the European Union Organic Farming Federation, the area under organic farming in Europe increased by 15% in 2022, driven by consumer preference for chemical-free produce and government incentives for sustainable agriculture. Humic acid is extensively used as a natural soil conditioner to improve nutrient uptake, water retention, and microbial activity in organic farming systems. As per the European Investment Bank, more than 60% of organic farms in Europe utilize humic acid-based fertilizers, reflecting their widespread adoption. Additionally, as per the European Commission, investments in organic farming technologies have been growing considerably from the last few years, which is amplifying demand for humic acid. This trend positions humic acid as a critical enabler of sustainable and efficient agricultural practices.

Growing Adoption in Ecological Bioremediation

The growing adoption of humic acid in ecological bioremediation is further fuelling the growth of the European humic acid market. According to the European Environment Agency, over 40% of contaminated sites in Europe are treated using natural remediation methods, including humic acid, due to their ability to detoxify soils and water bodies. Humic acid is extensively used to neutralize heavy metals, reduce soil salinity, and enhance microbial activity in polluted environments. The European Commission's Green Deal initiative emphasizes the restoration of degraded ecosystems, further boosting demand for humic acid in bioremediation projects.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

Fluctuating raw material prices, particularly for lignite and leonardite, is a significant restraint for the European humic acid market. According to the European Mining Association, the cost of lignite and leonardite surged by over 25% in 2022 due to supply chain disruptions and geopolitical tensions. The European Federation of Chemical Industries notes that over 60% of manufacturers reported reduced profitability in 2022 due to rising production expenses. Additionally, the European Investment Bank reports that investments in capacity expansions have slowed, as companies struggle to absorb increased costs. These financial pressures not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios, thereby impacting overall expansion.

Limited Awareness Among Small-Scale Farmers

Limited awareness among small-scale farmers regarding the benefits of humic acid is further restraining the growth of the European humic acid market. According to the European Federation of Agricultural Cooperatives, less than 40% of small and medium-sized farms in Europe utilize humic acid-based fertilizers, creating a significant knowledge gap. According to the European Commission, over 50% of small-scale farmers struggle to adopt advanced soil conditioners due to insufficient training and education. Furthermore, the European Investment Bank reports that investments in workforce training programs for sustainable farming technologies remain insufficient. This lack of awareness not only slows the adoption of humic acid but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive awareness initiatives.

MARKET OPPORTUNITIES

Advancements in Sustainable Agriculture Practices

Advancements in sustainable agriculture practices is a lucrative opportunity for the European humic acid market. According to the European Commission's Green Deal initiative, over 30% of European farms are transitioning to eco-friendly inputs, driving demand for humic acid in soil conditioning and crop nutrition. Additionally, the European Technology Platform for Sustainable Chemistry highlights the increasing use of humic acid in precision farming techniques, further amplifying demand. This opportunity positions humic acid as a critical enabler of Europe's sustainability goals, aligning with the region's commitment to reducing chemical inputs in agriculture.

Expansion into Dietary Supplements

The growing focus on dietary supplements offers another promising opportunity for the European humic acid market. According to the European Food Safety Authority, the demand for humic acid-based dietary supplements grew by 12% in 2022, driven by increasing consumer awareness of gut health and immunity-boosting properties. Humic acid is extensively used in dietary supplements to enhance nutrient absorption and detoxify the body. Additionally, the European Commission's Circular Economy Action Plan supports the development of sustainable health solutions, amplifying the need for advanced ingredients like humic acid. This opportunity underscores the immense potential for market expansion in the health and wellness sector.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.83% |

|

Segments Covered |

By Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

The Andersons, Inc., Daymsa, Biolchim S.p.A., Humintech GmbH, Humic Growth Solutions, Inc., Nutri–Tech Solutions Pty. Ltd., Sikko Industries Ltd., Tagrow Co., Ltd., Grow More, Inc., WinField, Manidharma Biotech Private Limited, National Pesticides & Chemicals, Wilbur–Ellis Company LLC, and Jiloca Industrial, S.A, and others. |

SEGMENTAL ANALYSIS

By Form Insights

The dry humic acid segment accounted for 61.6% of the European market share in 2024. The leading position of dry segment in the European market is attributed to its ease of storage, transportation, and application in large-scale agricultural operations. According to the European Commission, over 70% of dry humic acid consumed in Europe is utilized in organic farming and soil conditioning, reflecting its widespread adoption. The versatility and reliability of dry humic acid ensure its sustained dominance in the market, particularly for applications requiring compliance with stringent performance standards.

The liquid segment is expected to expand at a CAGR of 10.4% over the forecast period owing to the increasing adoption in precision farming and foliar applications, where it provides superior nutrient delivery and absorption. Additionally, the European Commission's Green Deal initiative supports the development of sustainable farming solutions, amplifying the need for liquid humic acid. This trend positions liquid humic acid as a key driver of innovation in the European market.

By Application Insights

The agriculture segment led the humic acid market in Europe in 2024 by holding 51.5% of the European market share in 2024. The dominance of agriculture segment in the European market is driven by the extensive use of humic acid as a soil conditioner and fertilizer enhancer, improving nutrient uptake, water retention, and microbial activity in crops. According to the European Commission, over 60% of humic acid consumed in Europe is utilized in agricultural applications, reflecting its widespread adoption. The versatility and reliability of humic acid ensure its sustained dominance in the agricultural sector.

The dietary supplements segment is on the rise and is estimated to register a promising CAGR of 12.8% over the forecast period owing to the rising demand for humic acid-based dietary supplements, which enhance nutrient absorption and support gut health. Additionally, the European Commission's Circular Economy Action Plan supports the development of sustainable health solutions, amplifying the need for advanced ingredients like humic acid. This trend positions dietary supplements as a key driver of innovation in the European market.

REGIONAL ANALYSIS

Germany led the European humic acid market by holding 26.1% of the European market share in 2024. The prominence of Germany in the European market is attributed to the country's robust agriculture sector and strong emphasis on sustainable farming practices. The German Federal Ministry for Economic Affairs and Climate Action reports that over 60% of organic farms in Germany utilize humic acid-based fertilizers, reflecting the region's leadership in adopting advanced soil conditioners. Additionally, Germany's strategic investments in green agriculture create a favorable environment for market growth, aligning with the European Green Deal initiative.

France had a substantial share of the European humic acid market in 2024 and is estimated to progress at a prominent CAGR over the forecast period. The rising focus of France on organic farming and ecological bioremediation drives humic acid adoption. The French Environmental Protection Agency highlights the growing use of humic acid in soil restoration projects, while the French Agricultural Federation reports a 15% annual increase in its use in organic farming. Furthermore, France's focus on sustainability boosts the use of eco-friendly solutions, underscoring the segment's importance.

The UK is projected to hold a prominent share of the European humic acid market over the forecast period. The thriving agriculture sector and robust ecological restoration projects of the UK are driving the demand for humic acid in the UK. The commitment of the UK commitment to sustainable agriculture supports the use of high-performance humic acid, ensuring steady market growth. Additionally, the UK's investment in advanced farming technologies amplifies its leadership in producing eco-friendly humic acid solutions, aligning with global trends toward sustainability.

Italy accounts for a notable share of the European humic acid market. The extensive vineyards and orchards rely heavily on humic acid for enhancing soil fertility and crop yield. The sustainable agriculture amplifies demand for eco-friendly solutions is fuelling the Italian market growth. Furthermore, the Italian government's focus on environmental regulations aligns with the growing adoption of advanced humic acid, further supporting market growth.

Spain is predicted to witness a notable CAGR in the European humic acid market over the forecast period. The agriculture and ecological restoration projects of Spain are significant consumers of humic acid. Spain's emphasis on sustainable farming utilizes humic acid extensively in eco-friendly formulations. Additionally, the Spanish Ministry for Ecological Transition highlights the country's commitment to circular economy initiatives, driving demand for sustainable materials like liquid humic acid.

KEY MARKET PLAYERS

The major key players in Europe Humic Acid market are The Andersons, Inc., Daymsa, Biolchim S.p.A., Humintech GmbH, Humic Growth Solutions, Inc., Nutri–Tech Solutions Pty. Ltd., Sikko Industries Ltd., Tagrow Co., Ltd., Grow More, Inc., WinField, Manidharma Biotech Private Limited, National Pesticides & Chemicals, Wilbur–Ellis Company LLC, and Jiloca Industrial, S.A., and others.

MARKET SEGMENTATION

This research report on the Europe humic acid market is segmented and sub-segmented into the following categories.

By Form

- Dry

- Liquid

By Application

- Agriculture

- Horticulture

- Ecological Bioremediation

- Dietary Supplements

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the Europe Humic Acid market in 2024?

The Europe Humic Acid market size was valued at USD 524.46 million in 2024.

2. Which countries are leading the humic acid market in Europe?

Germany and France are among the leading markets in Europe for humic acids

3. Who are some key players in the European humic acid market?

Key players include Agricultural and Mining Development SA, Humic Growth Solutions Inc, Humintech GmbH, The Andersons Inc, and Grow More Inc

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]