Europe Human Resource (HR) Technology Market Size, Share, Trends, & Growth Forecast Report By Application (Talent Management, Payroll Management, Performance Management, Workforce Management, Recruitment, and Others), Type, End Use Industry, Company Size, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Human Resource (HR) Technology Market Size

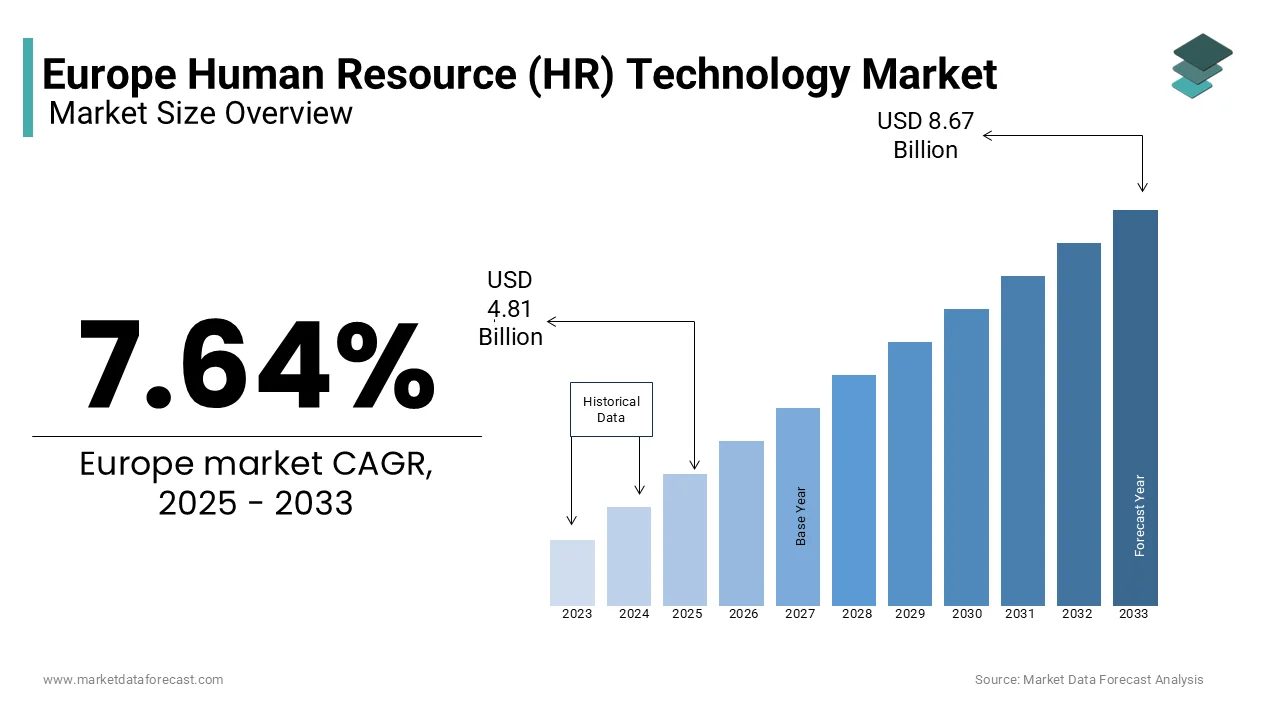

The Europe human resource (HR) technology market was worth USD 4.47 billion in 2024. The European market is expected to reach USD 8.67 billion by 2033 from USD 4.81 billion in 2025, rising at a CAGR of 7.64% from 2025 to 2033.

HR technology is often referred to as HR tech and involves a wide range of solutions including cloud-based systems, artificial intelligence (AI)-powered recruitment tools, payroll automation software, performance management platforms, and learning management systems. As organizations across Europe strive to adapt to the demands of a modern, hybrid work environment, the integration of advanced technologies into HR practices has become indispensable.

A key driver of this market is the growing emphasis on data-driven decision-making within HR departments. For instance, a report prepared by PwC identifies that over 70% of European companies are prioritizing analytics to improve talent acquisition and retention strategies. Furthermore, the proliferation of remote work models post-pandemic has accelerated the demand for collaborative HR tools and virtual onboarding solutions. Countries like Germany, France, and the United Kingdom lead the adoption curve, owing to their robust IT infrastructure and progressive labor policies. However, emerging markets in Eastern Europe are also witnessing significant traction, fueled by government incentives for technological innovation. This vibrant landscape underscores the pivotal role of HR technology in shaping the future of work across Europe.

MARKET DRIVERS

Workforce Analytics and Data-Driven Decision-Making

The growing emphasis on workforce analytics and data-driven decision-making is among the major drivers of the European human resource technology market. Organizations across Europe are increasingly adopting HR technologies to harness actionable insights into employee performance, engagement, and retention strategies. According to Eurostat, over 60% of large enterprises in the European Union have integrated data analytics tools into their HR functions, with predictive analytics emerging as a key focus area. The European Commission notes that companies utilizing HR analytics report a 15% to 20% improvement in talent retention rates. This trend is further fueled by the widespread availability of cloud-based HR platforms, which enable real-time data access and analysis. As businesses aim to remain competitive in a rapidly evolving labor market, the demand for sophisticated analytics tools continues to grow, making workforce analytics a cornerstone of HR tech adoption.

Remote Work Trends and Digital Transformation Initiatives

The rising adoption of remote work models and digital transformation initiatives is a significant driver for the market. The shift towards hybrid and remote work environments, accelerated by the COVID-19 pandemic, has created a pressing need for collaborative HR technologies. A report by the International Labour Organization reveals that approximately 40% of European workers now operate in hybrid or fully remote settings drive demand for virtual HR solutions such as video interviewing platforms and digital onboarding systems. Additionally, the European Investment Bank notes that investments in digital HR infrastructure surged by 25% in 2022 compared to pre-pandemic levels. Governments across Europe are also supporting this transition through funding programs like the EU’s Digital Europe Programme which allocates €7.5 billion to promote technological advancements. These factors collectively highlight how remote work trends and digitalization efforts are propelling the HR tech market forward.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

High implementation costs associated with advanced HR tech solutions which often deter small and medium-sized enterprises (SMEs) from adopting these tools is greatly affecting the progress of the European human resource technology market. According to a report by the European Investment Bank, over 45% of SMEs in Europe cite budget limitations as a significant barrier to digital transformation, including HR technologies. The initial investment required for cloud-based platforms, AI-driven tools, and data analytics systems can be prohibitive, especially for smaller organizations with limited financial resources. Additionally, Eurostat states that only 30% of SMEs in the EU have fully integrated digital HR solutions due to cost concerns. While larger corporations can absorb these expenses, SMEs often struggle to justify the upfront costs despite the long-term benefits. This financial barrier slows down the overall adoption rate of HR technologies across Europe.

Data Privacy Concerns and Regulatory Compliance Challenges

The rising concern over data privacy and the complexity of adhering to stringent regulatory frameworks such as the General Data Protection Regulation (GDPR). The European Data Protection Board reports that nearly 60% of organizations face challenges in ensuring compliance while implementing HR technologies that handle sensitive employee data. Non-compliance with GDPR can result in hefty fines with penalties reaching up to €20 million or 4% of global turnover as outlined by the European Commission. Furthermore, a survey conducted by the Organisation for Economic Co-operation and Development (OECD) reveals that 50% of European businesses consider data security risks a significant hurdle in adopting HR tech solutions. These concerns create hesitancy among organizations, particularly those lacking robust IT infrastructure, thereby limiting the widespread adoption of innovative HR technologies in the region.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Automation in HR Processes

Among the key opportunities in the European human resource technology market lies in the integration of artificial intelligence (AI) and automation to enhance HR processes. According to the European Commission, AI-driven HR solutions can reduce administrative workload by up to 40% allow organizations to focus on strategic initiatives such as talent development and employee engagement. According to Eurostat, over 50% of European enterprises are exploring or have already implemented AI tools for recruitment, payroll management and performance evaluation. These technologies not only improve operational efficiency but also enable predictive analytics for workforce planning. Furthermore, a report by the European Centre for the Development of Vocational Training (Cedefop) states that AI adoption in HR could create over 1 million new jobs in Europe by 2030, driven by the demand for skilled professionals to manage these systems. This presents a significant growth avenue for the HR tech market.

Expansion of HR Tech Solutions in Emerging European Markets

The expansion of HR technology solutions into emerging markets within Eastern and Southern Europe presents potential opportunity for the Europe humand resource technology market. The European Investment Bank notes that countries like Poland, Romania, and Greece are witnessing a 30% annual increase in digital HR tool adoption due to government incentives and growing awareness of technological benefits. Additionally, the European Association of Development Agencies reports that SMEs in these regions are increasingly investing in cloud-based HR platforms, with adoption rates rising by 25% in 2022. Governments are also playing a pivotal role by launching digitalization programs such as Poland’s "Digital Poland" initiative which allocates €1 billion to support technological advancements. As these markets continue to embrace HR tech, they offer untapped potential for vendors and service providers, fostering innovation and driving market growth across the continent.

MARKET CHALLENGES

Resistance to Change and Lack of Digital Skills Among HR Professionals

Resistance to change and the lack of digital skills among HR professionals which hinder the effective implementation of advanced HR technologies is a grave issue for the Europe human resource technology market. The European Centre for the Development of Vocational Training (Cedefop) reports that nearly 45% of HR employees in Europe lack the technical expertise required to operate modern HR tools such as AI-driven analytics platforms or cloud-based systems. This skills gap is particularly pronounced in smaller organizations, where training budgets are limited. Additionally, Eurostat notes that over 35% of European companies face internal resistance when introducing new HR technologies, often due to fear of job displacement or unfamiliarity with digital tools. Without adequate upskilling initiatives, this challenge could slow down the adoption of innovative HR solutions, limiting their potential impact on workforce management.

Fragmented Market and Regional Disparities in Technology Adoption

Another serious challenge is the fragmented nature of the European HR technology market, compounded by regional disparities in technology adoption. The European Investment Bank notes that while Western European countries like Germany and France lead in HR tech adoption, Eastern European nations lag behind, with adoption rates being 30-40% lower. This disparity is attributed to differences in economic development, IT infrastructure, and government support for digitalization. Furthermore, a report by the European Commission stresses that only 20% of organizations in less-developed regions have access to high-speed internet which is critical for cloud-based HR systems. These regional imbalances create challenges for HR tech vendors aiming to scale their solutions across Europe. Addressing these gaps requires targeted investments and policies to ensure equitable access to HR technologies, fostering a more unified and inclusive market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.64% |

|

Segments Covered |

By Application, Type, End Use Industry, Company Size, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

SAP SE, Workday, Inc., Oracle Corporation, IBM Corporation, ADP, LLC, Ceridian HCM Holding Inc., Cornerstone OnDemand, Inc., UKG Inc. (Ultimate Kronos Group), Infor, and PageUp. |

SEGMENTAL ANALYSIS

By Application Insights

The Talent management segment is the market leader by a substantial margin and accounted for 28.5% of the total market in 2024. Its dominance is due to the growing emphasis on employee retention and upskilling, with Cedefop reporting a 40% rise in demand for learning management systems since 2020. This segment is important as it addresses Europe’s widening skills gap, with 45% of employers struggling to find qualified workers, according to the European Commission. By taking advantage of AI-driven tools, organizations achieve a 25% improvement in retention rates stressing its importance in fostering workforce agility.

The recruitment segment is accelerating at an unprecedented pace and is forecasted to have a CAGR of 14.7% throughout the forecast period because of the surge in remote hiring practices, with Eurostat noting a 40% increase in video interviewing tool adoption since 2021. Also, the International Labour Organization reports that 40% of European companies now use AI-powered platforms to reduce time-to-hire by 35%. As talent acquisition becomes more competitive, these technologies streamline processes, enhance candidate quality, and address labor shortages, making recruitment pivotal for organizational success.

By Type Insights

The in-house segment led the European HR technology market by possessing a 60.3% market share in 2024. Its dominance is propelled by large enterprises prioritizing data security and customization and especially for sensitive functions like payroll and compliance. The European Investment Bank notes that in-house systems allow organizations to maintain full control over their HR processes ensure alignment with GDPR and other regulatory frameworks. These solutions are critical for companies with complex IT infrastructures allow seamless integration and tailored workflows. Despite higher upfront costs, in-house systems reduce long-term dependency on external vendors are making them indispensable for strategic HR management in Europe’s competitive business landscape.

The outsourced HR technology segment emerged as the swiftest growing with a CAGR of 12.3% in the future, according to the European Investment Bank. This growth is fueled by SMEs seeking cost-effective and scalable solutions, with Eurostat reporting that 45% of SMEs outsource at least one HR function. Outsourcing reduces administrative burdens, cutting costs by up to 30%, while providing access to advanced cloud-based tools without heavy investments. The International Labour Organization notes that 40% of European companies rely on outsourced solutions for remote workforce management, such as virtual onboarding. Its flexibility and ability to enhance operational efficiency make outsourcing vital for businesses adapting to dynamic labor markets and digital transformation trends.

By End Use Industry Insights

The Information Technology (IT) sector dominated the European HR technology market by holding a 25.2% share in 2024 because of the sector’s dynamic workforce and reliance on innovation, with 70% of IT firms adopting advanced HR tools for performance management and skill development. The European Investment Bank stresses that these technologies boost employee engagement by 25% enhance productivity. IT companies leverage AI-driven platforms to streamline recruitment, reduce turnover, and foster continuous learning. As digital transformation accelerates, HR tech becomes critical for attracting top talent and maintaining competitiveness, making the IT sector a key driver of HR technology adoption in Europe.

The health care sector segment stands as the fastest-growing category, with a CAGR of 13.8% during the forecast period. This rapid expansion is influenced by workforce shortages and the need for compliance management, with Eurostat reporting a 40% reduction in time-to-hire through AI-powered recruitment tools. Moreover, the International Labour Organization notes that 45% of health care organizations use HR tech for talent management and employee wellness. As the sector addresses challenges like staff burnout and regulatory adherence, HR technologies are vital for ensuring operational efficiency and improving patient care outcomes strengthen their importance in this rapidly evolving industry.

By Company Size Insights

The segment of organizations with over 5,000 employees is the market's most prominent player in the European HR technology market and accounted for a 45.1% share in 2024. These large enterprises prioritize advanced HR solutions to manage complex workforces and ensure compliance with stringent regulations like GDPR. As per the European Investment Bank, 80% of these firms use AI-driven tools for workforce analytics achieve a 25% improvement in operational efficiency. Their lead is due to substantial budgets and the need for scalable systems that integrate payroll, talent management, and compliance. HR technologies are critical for aligning strategic goals with workforce planning, making this segment pivotal in driving innovation and adoption across the market.

The segment of small businesses with fewer than 1,000 employees is the growth engine of this market, with a CAGR of 14.2% in the coming years. This development is linked to affordable cloud-based HR solutions as it give SMEs to reduce administrative costs by 30%, as reported by Eurostat. The rise of remote work has further accelerated adoption, with the International Labour Organization noting a 40% increase in digital tool usage among small firms. These technologies allow SMEs to compete effectively by streamlining payroll, recruitment, and compliance. As small businesses increasingly embrace digital transformation, HR tech becomes vital for enhancing efficiency and fostering sustainable growth in this dynamic segment.

REGIONAL ANALYSIS

Germany dominates the market landscape in Europe and captured a 22.7% share in 2024 owing to the country’s robust IT infrastructure and strong emphasis on digital transformation across industries. The German Federal Ministry for Economic Affairs draws attention on the fact that over 70% of large enterprises in Germany have adopted advanced HR tech solutions and particularly for workforce analytics and compliance management. Additionally, Germany’s manufacturing-heavy economy benefits from HR tools that optimize labor-intensive processes reduce costs by 20%, according to Eurostat. The government’s Industry 4.0 initiative further accelerates adoption, fostering innovation in HR technologies. This strategic focus on efficiency and digitalization solidifies Germany’s position as a frontrunner in the European HR tech landscape.

The United Kingdom is a top performer in the European HR technology market and is estimated to grow at a CAGR of 12.3% in the coming years. Its high concentration of tech-savvy SMEs and large corporations leveraging cloud-based HR platforms is primarily driving the growth of this market. The British Chamber of Commerce observes that 65% of UK businesses use HR tech for talent management and remote workforce solutions and is propelled by the rise of hybrid work models. Furthermore, the UK’s flexible labor laws and strong regulatory frameworks encourage innovation in HR compliance tools. With London being a global tech hub, the UK benefits from cutting-edge advancements making it a pivotal player in shaping the future of HR technologies across Europe.

France is a notable player in the European HR technology market. The country’s grip in this market is fueled by its proactive approach to digitalization which is backed by initiatives like France’s Digital Transition Plan by allocating €5 billion to technological advancements. Eurostat notes that over 60% of French companies have adopted AI-driven recruitment tools reduce time-to-hire by 35%. France’s diverse economy, spanning sectors like healthcare and IT, drives demand for versatile HR solutions. Additionally, stringent GDPR compliance requirements have accelerated the adoption of secure HR platforms. These factors, combined with a strong focus on employee welfare, position France as a key innovator in the European HR tech market.

KEY MARKET PLAYERS

The major players in the Europe human resource (HR) technology market include SAP SE, Workday, Inc., Oracle Corporation, IBM Corporation, ADP, LLC, Ceridian HCM Holding Inc., Cornerstone OnDemand, Inc., UKG Inc. (Ultimate Kronos Group), Infor, and PageUp.

MARKET SEGMENTATION

This research report on the Europe human resource (HR) technology market is segmented and sub-segmented into the following categories.

By Application

- Talent Management

- Payroll Management

- Performance Management

- Workforce Management

- Recruitment

- Others

By Type

- Inhouse

- Outsourced

By End Use Industry

- TTH (Travel, Transportation, Hospitality)

- Public Sector

- Health Care

- Information Technology

- BFSI (Banking, Financial services, and Insurance)

- Others

By Company Size

- Less than 1k Employees

- 1k -5k Employees

- Greater than 5k Employees

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of HR technology in Europe?

The market is driven by the rising adoption of AI-powered HR solutions, cloud-based HR platforms, remote workforce management tools, and regulatory compliance requirements.

What are the most popular HR technology solutions in Europe?

The most widely used solutions include payroll automation, applicant tracking systems, employee engagement platforms, workforce analytics, and cloud-based HR management software.

How is artificial intelligence (AI) impacting HR technology in Europe?

AI is transforming HR technology by automating recruitment processes, enhancing employee engagement through chatbots, providing predictive analytics, and improving decision-making in talent management.

What are the future trends shaping the HR technology market in Europe?

Key trends include the rise of AI-powered recruitment, blockchain for secure employee records, increased focus on employee experience platforms, and the integration of HR tools with business intelligence systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]