Europe Home Audio Equipment Market Size, Share, Trends, & Growth Forecast Report - Segmented By Technology ( Wired Home Audio Equipment, Wireless Home Audio Equipment ) Distribution Channel (Online Sales, Offline Sales) and Country (Germany, UK, France, Italy, Spain) – Industry Analysis from 2025 to 2033.

Europe Home Audio Equipment Market Size

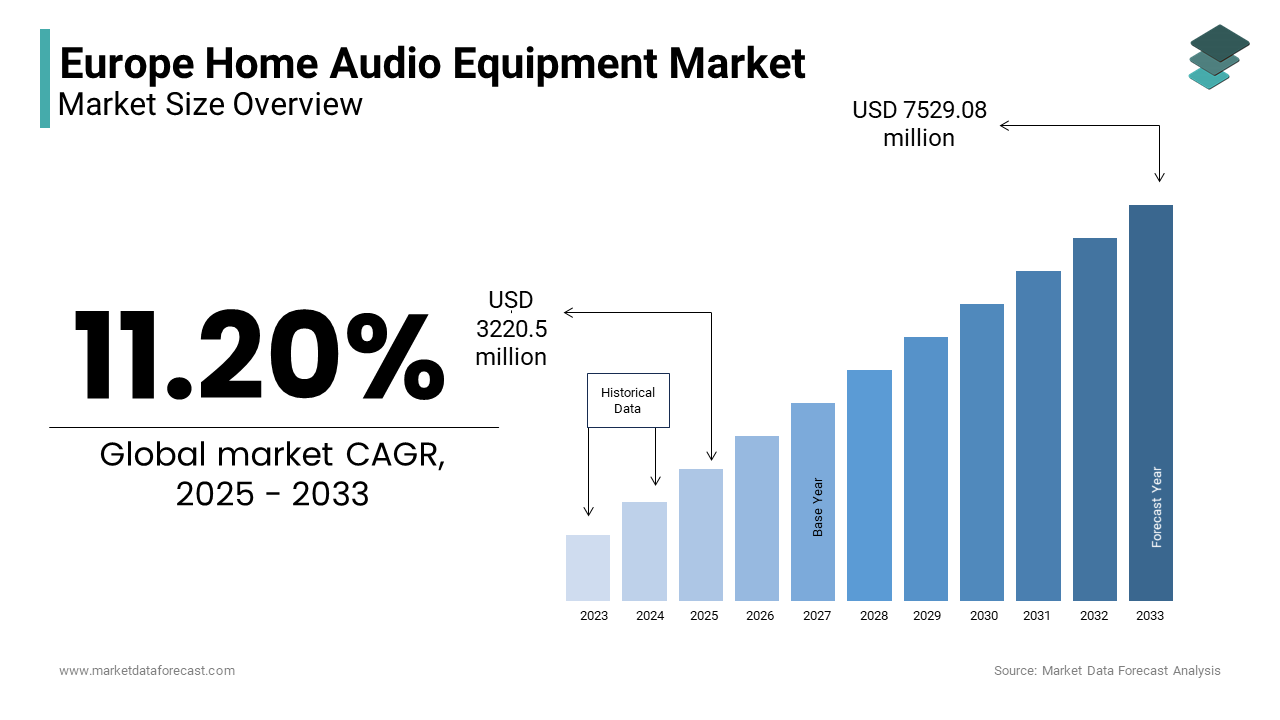

The europe home audio equipment market size was valued at USD 2896 million in 2024. The europe home audio equipment market size is expected to have 11.20% CAGR from 2025 to 2033 and be worth USD 7529.08 million by 2033 from USD 3220.35 million in 2025.

Home audio equipment includes a wide range of products such as soundbars, smart speakers, AV receivers, home theater systems, and wireless audio devices, designed to enhance entertainment, gaming, and virtual communication experiences. According to the European Consumer Electronics Association (ECEA), over 35 million units of home audio equipment sold across the region. As Europe’s aging population increasingly invests in home entertainment, coupled with the younger generation’s affinity for premium audio experiences, the home audio equipment market is poised for steady expansion in this region. With sustainability becoming a key focus, manufacturers are also innovating eco-friendly products, aligning with EU Green Deal objectives to reduce electronic waste and carbon footprints. As consumer preferences shift toward seamless integration, voice control, and multi-room audio capabilities, the Europe home audio equipment market continues to evolve.

MARKET DRIVERS

Rising Adoption of Smart Home Technologies

The growing adoption of smart home technologies is a major driver of the Europe home audio equipment market. The European Consumer Electronics Association (ECEA) reports that over 30% of households in Western Europe have integrated smart devices into their homes, with smart speakers and connected sound systems being among the most popular additions. The German Electrical and Electronic Manufacturers' Association highlights that smart speakers alone witnessed a 25% annual growth rate between 2020 and 2022, driven by advancements in voice assistants like Alexa and Google Assistant. Additionally, the UK Office for National Statistics notes that the proliferation of IoT-enabled devices has created a seamless ecosystem for wireless audio solutions, with over 40% of consumers prioritizing compatibility with other smart home products. As Europe’s smart home market is projected to reach €46 billion by 2025, according to the French Ministry for Digital Affairs, the demand for advanced home audio equipment is expected to surge, fueled by convenience and enhanced user experiences.

Increasing Popularity of Streaming Services

The increasing popularity of streaming services is another key driver propelling the Europe home audio equipment market. The UK Office for National Statistics highlights that over 70% of Europeans now subscribe to platforms like Netflix, Spotify, and Disney+, creating a heightened demand for high-quality audio systems to complement these services. The European Audiovisual Observatory notes that streaming accounted for 80% of total music consumption in 2022, driving investments in premium soundbars and home theater systems. The French Ministry for Digital Affairs emphasizes that wireless audio devices, such as Bluetooth-enabled speakers, have gained traction due to their ease of use and compatibility with streaming apps. Furthermore, the Italian Association of Consumer Electronics reports that over 50% of urban households have upgraded their audio setups to enhance their entertainment experiences. As streaming continues to dominate media consumption, the demand for immersive and high-fidelity audio solutions is set to grow, further boosting market expansion.

MARKET RESTRAINTS

High Costs of Premium Audio Equipment

The high costs associated with premium home audio equipment pose a significant restraint to market growth in Europe. The European Consumer Electronics Association (ECEA) highlights that advanced systems, such as Dolby Atmos-enabled soundbars and high-end home theater setups, can cost between €1,000 to €5,000, making them inaccessible for many consumers. The German Electrical and Electronic Manufacturers' Association notes that over 60% of households prioritize budget-friendly options, particularly in Eastern and Southern Europe, where disposable incomes are lower. Additionally, the UK Office for National Statistics reports that economic uncertainties, such as inflation and rising energy costs, have led to reduced discretionary spending on luxury electronics. Although mid-range products are gaining traction, their limited features often fail to meet the expectations of audiophiles. This financial barrier restricts widespread adoption, particularly among younger consumers and smaller households, hindering the market's ability to achieve its full potential.

Complexity in Installation and Integration

The complexity of installation and integration of advanced home audio systems presents another major challenge for the Europe home audio equipment market. The French Ministry for Digital Affairs emphasizes that over 40% of consumers face difficulties setting up multi-room audio systems or integrating devices with existing smart home ecosystems. The Italian Association of Consumer Electronics notes that professional installation services, which can cost an additional €200 to €500, deter many buyers from investing in complex systems. Furthermore, the German Electrical and Electronic Manufacturers' Association highlights that compatibility issues between brands and technologies often lead to frustration, with 30% of users reporting dissatisfaction due to connectivity problems. As seamless integration becomes a priority for tech-savvy consumers, these challenges create hesitancy in adopting sophisticated audio solutions, limiting market expansion despite advancements in technology.

MARKET OPPORTUNITIES

Growing Demand for Wireless and Portable Audio Solutions

The rising demand for wireless and portable audio solutions presents a significant opportunity for the Europe home audio equipment market. The European Consumer Electronics Association (ECEA) reports that wireless audio devices, including Bluetooth speakers and portable sound systems, account for over 45% of total sales in 2022, driven by their convenience and versatility. The UK Office for National Statistics highlights that over 60% of urban consumers prefer wireless setups due to their ease of integration with smartphones and tablets. Additionally, the French Ministry for Digital Affairs notes that advancements in battery technology and connectivity, such as Bluetooth 5.0, have improved user experiences, boosting adoption rates by 20% annually. With the growing trend of remote work and outdoor entertainment, portable audio devices are becoming indispensable. As manufacturers focus on compact, energy-efficient designs, this segment is poised to drive innovation and revenue growth in the market.

Expansion into Smart Home Ecosystems

The integration of home audio equipment into smart home ecosystems offers another major growth opportunity. The German Electrical and Electronic Manufacturers' Association highlights that over 30% of European households now use smart home systems, with voice-controlled audio devices like smart speakers serving as central hubs. The Italian Association of Consumer Electronics reports that multi-room audio systems, which allow seamless streaming across rooms, are projected to grow at a CAGR of 15% (2023-2028). Furthermore, the European Audiovisual Observatory emphasizes that partnerships between audio brands and smart home platforms, such as Amazon Alexa and Google Home, have increased consumer interest, with 70% of smart home users investing in compatible audio devices. As Europe’s smart home market is expected to reach €46 billion by 2025, according to the French Ministry for Digital Affairs, the demand for interconnected audio solutions will surge, positioning the market for sustained expansion.

MARKET CHALLENGES

Intense Competition from Low-Cost Imports

Intense competition from low-cost imports poses a significant challenge to the Europe home audio equipment market. The European Commission reports that over 40% of audio devices sold in Europe are imported from countries like China and India, where manufacturing costs are significantly lower. The German Electrical and Electronic Manufacturers' Association highlights that these imports often undercut local manufacturers, with prices up to 30% cheaper than European-made products. While cost-effective, many of these devices compromise on quality and durability, creating pricing pressure on premium brands. Additionally, the UK Office for National Statistics notes that small and medium-sized enterprises (SMEs) in Europe struggle to compete, with some reporting revenue declines of up to 15% annually. This influx of low-cost alternatives not only erodes profit margins but also undermines investments in innovation, hindering the growth of high-quality, locally produced home audio equipment.

Rapid Technological Obsolescence

Rapid technological obsolescence is another major challenge impacting the Europe home audio equipment market. The French Ministry for Digital Affairs emphasizes that the average lifecycle of audio devices has decreased to just 2-3 years, driven by continuous advancements in connectivity, sound quality, and smart features. The Italian Association of Consumer Electronics notes that over 50% of consumers delay upgrading their systems due to concerns about compatibility with future technologies. Furthermore, the European Consumer Electronics Association (ECEA) highlights that manufacturers face mounting pressure to innovate quickly, often at the expense of profitability. With the rise of new standards like Wi-Fi 6 and Dolby Atmos, older models become outdated faster, leading to increased electronic waste and sustainability concerns. This rapid pace of change creates uncertainty for both consumers and manufacturers, limiting long-term investments in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.20% |

|

Segments Covered |

By Technology,Distribution Channel and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Harman International Industries, Inc.,Intex Technologies,JVCKENWOOD Corporation,Nimble Holdings Company Limited |

SEGMENTAL ANALYSIS

By Technology Insights

The wireless segment dominated the market by holding 61.8% of the European market share in 2024 and is estimated to be the fastest growing segment by showcasing a CAGR of 13.31% over the forecast period. The growth of the wireless segment is driven by the growing adoption of smart home technologies and the convenience of wireless connectivity. The UK Office for National Statistics highlights that over 70% of urban households prefer wireless solutions like soundbars and smart speakers due to their ease of integration with IoT devices. Additionally, advancements in Bluetooth 5.0 and Wi-Fi 6 have enhanced user experiences, making wireless systems indispensable for modern entertainment. Their compatibility with streaming services and portability ensures they remain central to consumer preferences.

By Distribution Channel Insights

The offline segment held 57.4% of the European market share in 2024 owing to the trust and tactile experience offered by brick-and-mortar stores, where consumers can test sound quality and receive expert advice. The German Electrical and Electronic Manufacturers' Association highlights that offline channels are particularly crucial for premium products, with 70% of high-end purchases made in-store. Older demographics also favor physical stores due to familiarity and immediate product availability. Despite a gradual decline at an annual rate of 3-5%, offline sales remain vital for building brand credibility and catering to customers seeking personalized service.

The online segment is another major segment and is expected to progress at an exponential CAGR of 15.2% over the forecast period. Factors such as the convenience of e-commerce platforms like Amazon, offering competitive pricing, detailed reviews, and doorstep delivery is fuelling the growth of the online segment in the European market. The UK Office for National Statistics notes that over 45% of consumers now buy home audio equipment online, with younger buyers driving adoption. Additionally, the French Ministry for Digital Affairs highlights that online sales accounted for 35% of total revenue in 2022, benefiting from improved logistics and digital literacy. As Europe’s e-commerce market expands, online sales are pivotal in reaching tech-savvy urban consumers and boosting accessibility across rural areas.

REGIONAL ANALYSIS

Germany held the major share of 28.3%of the European market share in 2024. The domination of Germany in the European market is expected to continue throughout the forecast period owing to the high disposable incomes, a tech-savvy population, and robust smart home adoption, with over 40% of households integrating connected devices. The Federal Ministry for Economic Affairs highlights that Germany’s strong retail infrastructure and emphasis on premium audio systems further boost demand. Additionally, advancements in wireless technologies, such as Bluetooth 5.0 and Wi-Fi 6, align with consumer preferences for seamless integration and multi-room audio solutions, solidifying Germany’s position as a market leader.

The UK is another leading region for home audio equipment in the European market. The dominance in online sales and a thriving streaming culture in the UK are driving the UK home audio equipment market expansion. The UK Office for National Statistics notes that over 50% of audio equipment purchases are made online, supported by platforms like Amazon and Currys. The rise of smart speakers and voice assistants, such as Alexa, has fueled growth, with British consumers prioritizing convenience and connectivity. Furthermore, the UK’s urbanization and high penetration of streaming services like Spotify amplify demand for high-quality sound systems. The UK’s focus on digital transformation and innovative audio technologies ensures its continued prominence in the regional market, catering to both tech-savvy millennials and older demographics seeking modern entertainment solutions.

France is a prominent market for home audio equipment in Europe and is predicted to hold a substantial share of the European market over the forecast period due to its growing smart home ecosystem and government initiatives promoting digital transformation. The French Ministry for Digital Affairs emphasizes that over 30% of households now use IoT-enabled devices, driving demand for wireless audio solutions. France’s focus on sustainable electronics and energy-efficient products also boosts adoption, as manufacturers cater to eco-conscious consumers. The Italian Association of Consumer Electronics highlights that France’s investments in smart technologies, coupled with rising urbanization, have increased the popularity of wireless speakers and multi-room audio systems. With a strong emphasis on innovation and sustainability, France is well-positioned to remain a key contributor to the Europe home audio equipment market’s expansion.

KEY MARKET PLAYERS

Companies playing a prominent role in the Europe Home Audio Equipment Market include are Harman International Industries, Inc.,Intex Technologies,JVCKENWOOD Corporation,Nimble Holdings Company Limited,Cambridge Audio,Bose Corporation,Dolby Laboratories, Inc.XPERI INC.,LG Electronics,Nakamichi Corporation.

MARKET SEGMENTATION

This Europe Home Audio Equipment Market research report has been segmented and sub-segmented into the following categories.

By Technology

- Wired Home Audio Equipment

- Wireless Home Audio Equipment

By Distribution Channel

- Online Sales

- Offline Sales

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the Europe Home Audio Equipment Market?

Key drivers include technological advancements, increasing consumer demand for high-quality audio experiences, and the rising popularity of home entertainment systems.

What are the key challenges faced by the Europe Home Audio Equipment Market?

Challenges include high costs of high-end audio systems, space constraints in smaller living areas, and compatibility issues with other home devices.

What are the future trends expected in this market?

Future trends include the development of smart audio devices with voice assistant integration, personalized audio experiences, and the growth of online retail channels for audio equipment.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]