Europe Home Appliances Market Size, Share, Trends & Growth Forecast Report By Type (Major Appliances (Refrigeration Equipment, Cooking Appliances, Washing & Drying Equipment, Heating & Cooling Appliances), Small Appliances, Smart Home Appliances), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Home Appliances Market Size

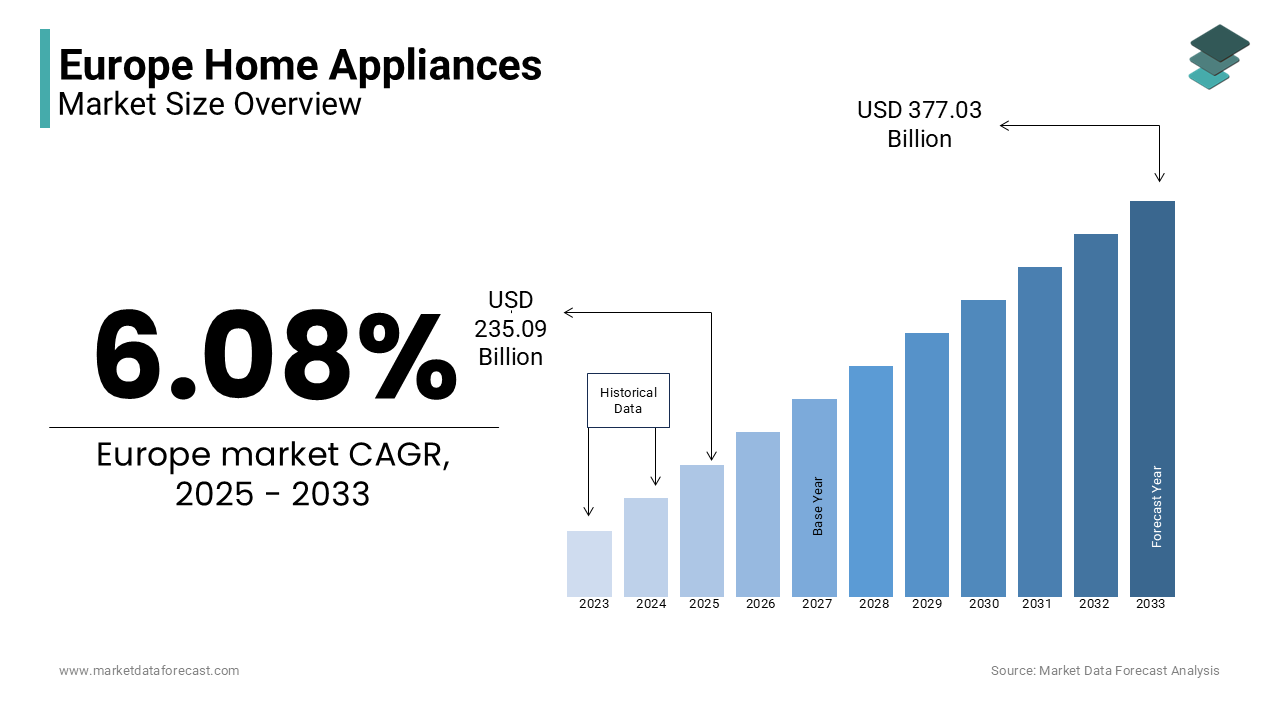

The home appliances market size in Europe was valued at USD 221.60 billion in 2024. The European market is estimated to be worth USD 377.03 billion by 2033 from USD 235.09 billion in 2025, growing at a CAGR of 6.08% from 2025 to 2033.

Home appliances include a wide range of devices designed to facilitate everyday household tasks such as cooking, cleaning, and food preservation. The home appliances sector is broadly categorized into major appliances, including refrigerators, washing machines, and ovens, and small appliances like vacuum cleaners, coffee machines, and microwaves.

The demand for home appliances in Europe has been consistently growing due to the evolving consumer preferences, technological advancements, and increasing demand for energy-efficient and smart appliances. Leading home appliance manufacturers in Europe focus on product innovation, sustainability, and digital integration to enhance convenience and efficiency. The adoption of smart technologies, such as IoT-enabled devices and AI-powered functionalities, is transforming consumer experiences, making home appliances more user-friendly and energy-efficient. Additionally, regulatory policies emphasizing energy conservation and sustainability have influenced product development, encouraging manufacturers to invest in eco-friendly solutions. Urbanization, rising disposable incomes, and the growing trend of connected homes contribute to the steady expansion of the market in Europe.

MARKET DRIVERS

Rising Demand for Energy-Efficient Appliances in Europe

The growing emphasis on sustainability and cost savings is driving the demand for energy-efficient home appliances across Europe. Consumers are increasingly opting for products that reduce electricity consumption, contributing to lower household energy bills and environmental conservation. Government policies such as the European Union’s Ecodesign Directive and Energy Labelling Regulation have set high efficiency standards, encouraging manufacturers to develop energy-saving appliances. According to the European Commission, energy efficiency measures have helped households across EU member states cut down power consumption significantly. Refrigerators, washing machines, and dishwashers with advanced energy-saving technologies are gaining popularity, supporting the market’s growth. The shift toward eco-friendly appliances aligns with Europe’s broader climate goals, further accelerating adoption among environmentally conscious consumers.

Urbanization and Increasing Disposable Incomes

The ongoing urbanization trend and rising consumer purchasing power are key drivers of the European home appliance market. As more people migrate to cities, the demand for modern and space-efficient home appliances continues to grow. Urban households seek appliances that enhance convenience, automation, and energy efficiency. The European Commission highlights that urban populations across Europe are steadily increasing, influencing consumer spending on home appliances. Higher disposable incomes also enable consumers to invest in premium products with advanced features, such as smart connectivity and automation. This trend is particularly evident in the expanding market for high-end kitchen appliances and laundry solutions, where consumers prioritize innovation, durability, and design.

MARKET RESTRAINTS

High Repair Costs and Limited Affordability

One of the major challenges in the European home appliance market is the high cost of repairing household appliances. Consumers often find it more expensive to repair a product than to replace it, primarily due to expensive spare parts and labor charges. In the case of large appliances such as washing machines and refrigerators, repair costs can be significant, discouraging consumers from opting for maintenance. This trend contributes to increased electronic waste, counteracting sustainability efforts and making affordability a growing concern. Many consumers demand policies that support repairability, such as extended warranties and affordable spare parts, but the financial burden of repairs continues to be a deterrent to long-term appliance usage.

Planned Obsolescence and Shorter Product Lifespan

The limited lifespan of household appliances poses a significant restraint on market growth. Many home appliances are designed to function efficiently for a set period, after which performance declines or repairs become uneconomical. As a result, consumers are forced to replace products more frequently, leading to increased spending and higher electronic waste generation. Washing machines, vacuum cleaners, and kitchen appliances often have shorter lifespans than expected, reducing consumer trust in product durability. The demand for long-lasting, repairable, and modular appliances is growing, but manufacturers continue to face pressure to balance innovation with product longevity, impacting market dynamics.

MARKET OPPORTUNITIES

Expansion of Smart Home Technologies

The increasing adoption of smart technologies presents a major opportunity in the European home appliance market. Consumers are seeking advanced appliances with connectivity features that offer automation, remote control, and energy management capabilities. Smart home integration allows users to optimize energy consumption, enhancing efficiency and convenience. The European Commission actively supports digitalization and the Internet of Things (IoT) to drive innovation across industries. As digital infrastructure strengthens, demand for smart refrigerators, washing machines, and kitchen appliances continues to rise. Manufacturers investing in AI-driven features, voice control, and predictive maintenance solutions are well-positioned to capitalize on this growing market segment. The shift toward connected living is reshaping consumer expectations, creating a lucrative space for technologically advanced home appliances.

Growth of Circular Economy and Sustainable Products

The push for sustainability and circular economy practices is a key opportunity for home appliance manufacturers in Europe. Consumers are increasingly looking for durable, repairable, and energy-efficient appliances that align with environmental goals. The European Environment Agency encourages businesses to focus on extending product lifespans and enhancing recyclability to minimize waste. Manufacturers can leverage this trend by offering modular designs, repair services, and refurbishment programs that cater to eco-conscious buyers. Initiatives such as product-as-a-service models, where consumers rent appliances instead of purchasing them, are gaining traction. Emphasizing sustainability not only meets regulatory requirements but also strengthens brand reputation and long-term customer loyalty in an environmentally driven market landscape.

MARKET CHALLENGES

Declining Repair Sector and Increasing Product Replacement

One of the key challenges in the European home appliance market is the decline of the repair sector, as consumers increasingly replace appliances instead of repairing them. High repair costs and limited availability of spare parts discourage repairability, leading to a shorter product lifecycle. This trend negatively impacts sustainability efforts, as more appliances are discarded rather than maintained. The diminishing repair industry also affects employment opportunities in the sector, reducing consumer access to affordable repair services. Encouraging policies that support cost-effective repairs and extended warranties could help address this issue. However, unless manufacturers and policymakers take steps to promote repair-friendly designs, the market will continue to struggle with excessive product turnover and electronic waste generation.

Environmental Challenges Due to Shorter Product Lifespan

The environmental impact of home appliances remains a major concern in Europe, as product lifespans continue to decrease. Many household appliances, including washing machines and refrigerators, do not last as long as consumers expect, leading to higher waste levels. Shorter appliance lifespans contribute to increased raw material consumption, carbon emissions, and landfill waste. Consumers are becoming more conscious of sustainability, demanding durable and energy-efficient appliances. However, many products are still designed with limited repairability, leading to frequent replacements. To overcome this challenge, manufacturers must invest in long-lasting, modular designs that align with circular economy principles. Stricter regulations on durability and repairability could also drive industry-wide change, reducing the environmental footprint of home appliances.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.08% |

|

Segments Covered |

By Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Arcelik AS6, Robert Bosch GmbH6, Electrolux AB6, Haier, De'Longhi S.p.A, Gorenje Group, LG Electronics, Samsung Electronics Co. Ltd, Whirlpool Corporation, Liebherr Group, Panasonic Corporation, and others. |

SEGMENTAL ANALYSIS

By Type Insights

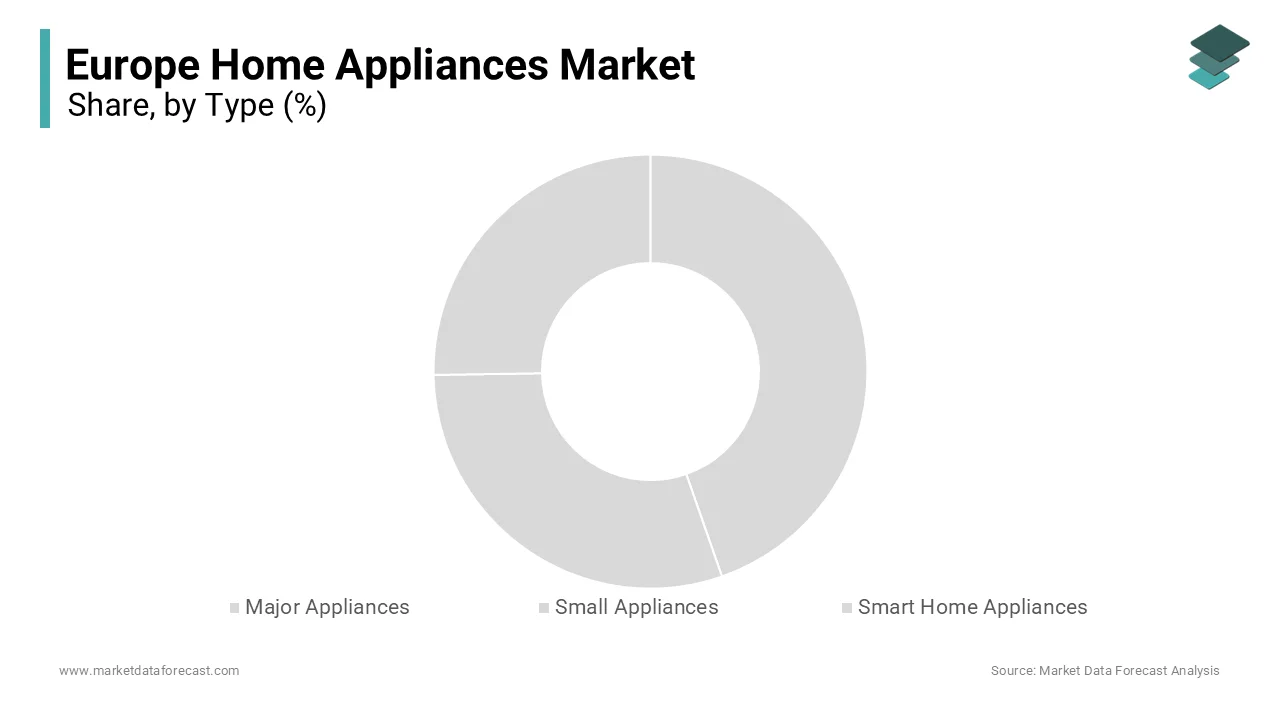

The major appliances segment dominated the European home appliances market by accounting for 56.5% of European market share in 2024. The major appliances category includes essential products such as refrigerators, washing machines, cooking appliances, and heating & cooling systems, which are crucial for everyday domestic use. The demand remains steady due to population growth, urbanization, and rising disposable incomes. Additionally, government initiatives promoting energy-efficient appliances, such as ENERGY STAR certification in the U.S., have further accelerated adoption. The importance of major appliances lies in their necessity for modern living, contributing significantly to the global economy and technological advancements in home automation.

However, the smart home appliances segment is growing rapidly and is estimated to showcase a CAGR of 9.12% over the forecast period owing to the increasing adoption of Internet of Things (IoT) technology, allowing remote monitoring and automation via smartphone apps. Consumers prioritize energy efficiency, convenience, and security, leading to higher demand for smart refrigerators, washing machines, and automated kitchen appliances. Governments worldwide, including the U.S. Department of Energy, encourage smart energy solutions, fostering market growth. Additionally, the expansion of 5G networks enhances connectivity, making smart home integration more seamless and attractive to modern consumers.

By Distribution Channel Insights

The specialty stores segment held the leading share of the European home appliances market in 2024. The preference of specialty stores is majorly attributed to consumers' desire to physically assess products and receive immediate assistance. The tactile experience and personalized service offered by brick-and-mortar stores play a crucial role in purchasing decisions. Additionally, immediate product availability and the opportunity to negotiate prices or obtain bundled deals enhance the appeal of offline shopping. These factors collectively contribute to the sustained prominence of offline stores in the home appliances market.

The online/e-commerce segment is experiencing significant growth in the European home appliances market and is anticipated to pose a CAGR of 6.1% over the forecast period. The growing internet penetration, technological advancements, and evolving consumer shopping behaviors are primarily boosting the expansion of the online segment in the European market. Online platforms offer convenience, a wide range of products, competitive pricing, and the ability to compare options easily. Retailers are enhancing digital experiences with virtual product demonstrations, augmented reality visualization tools, and improved delivery services. The flexibility of online shopping, coupled with comprehensive product information and customer reviews, has made e-commerce an increasingly popular choice for consumers purchasing home appliances

REGIONAL ANALYSIS

Germany is the market leader for home appliances in the European region. The leading position of Germany is primarily credited to its strong manufacturing sector and emphasis on energy-efficient and high-tech appliances. The presence of major brands like Bosch and Miele enhances its leadership. Consumers prioritize durability, sustainability, and smart home integration, driving continuous innovation.

France holds a significant market position in Europe. France is experiencing a rising demand for premium kitchen appliances. The cultural emphasis of France on cooking and home aesthetics is contributing to the French home appliances market growth. The demand for multi-functional ovens, coffee machines, and connected appliances is rising, aligning with changing lifestyles. Increased urbanization and disposable incomes further drive the market.

The UK is also a key player in the European market and is experiencing strong demand for eco-friendly and energy-efficient appliances. Government policies promoting low-energy consumption products and increasing awareness of carbon footprints influence consumer choices. Online retail expansion also accelerates market growth.

KEY MARKET PLAYERS

The major key players in Europe home appliances market are Arcelik AS6, Robert Bosch GmbH6, Electrolux AB6, Haier, De'Longhi S.p.A, Gorenje Group, LG Electronics, Samsung Electronics Co. Ltd, Whirlpool Corporation, Liebherr Group, Panasonic Corporation, and others.

MARKET SEGMENTATION

This research report on the Europe home appliances market is segmented and sub-segmented into the following categories.

By Type

- Major Appliances

- Refrigeration Equipment

- Cooking Appliances

- Washing & Drying Equipment

- Heating & Cooling Appliances

- Others

- Small Appliances

- Coffeemakers

- Food Processors

- Humidifiers

- Microwave Ovens

- Others

- Smart Home Appliances

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online/E-commerce

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the Europe home appliances market?

The market is driven by increasing urbanization, rising disposable income, advancements in smart home technologies, and growing consumer preference for energy-efficient appliances.

2. How is the demand for smart home appliances shaping the market in Europe?

The adoption of IoT and AI-driven appliances is on the rise, with consumers preferring connected devices that offer convenience, remote control, and energy efficiency.

3. Which product segment holds the largest market share in the Europe home appliances market?

Major household appliances like refrigerators, washing machines, and ovens account for a significant share, driven by high replacement rates and technological advancements.

4. What role does sustainability play in the Europe home appliances market?

With strict EU regulations on energy consumption and environmental impact, manufacturers are focusing on eco-friendly designs, recyclable materials, and energy-efficient appliances.

5. How is the competitive landscape evolving in the Europe home appliances market?

Leading players are investing in R&D, strategic partnerships, and smart technology integration to stay competitive, while emerging brands focus on affordability and innovation.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]