Europe Herbal Tea Market Research Report - Segmented Based on Product, Flavour, Distribution Channel, Form, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis on Size, Share, Trends, COVID-19 Impact & Growth Forecast (2025 to 2033)

Europe Herbal Tea Market Size

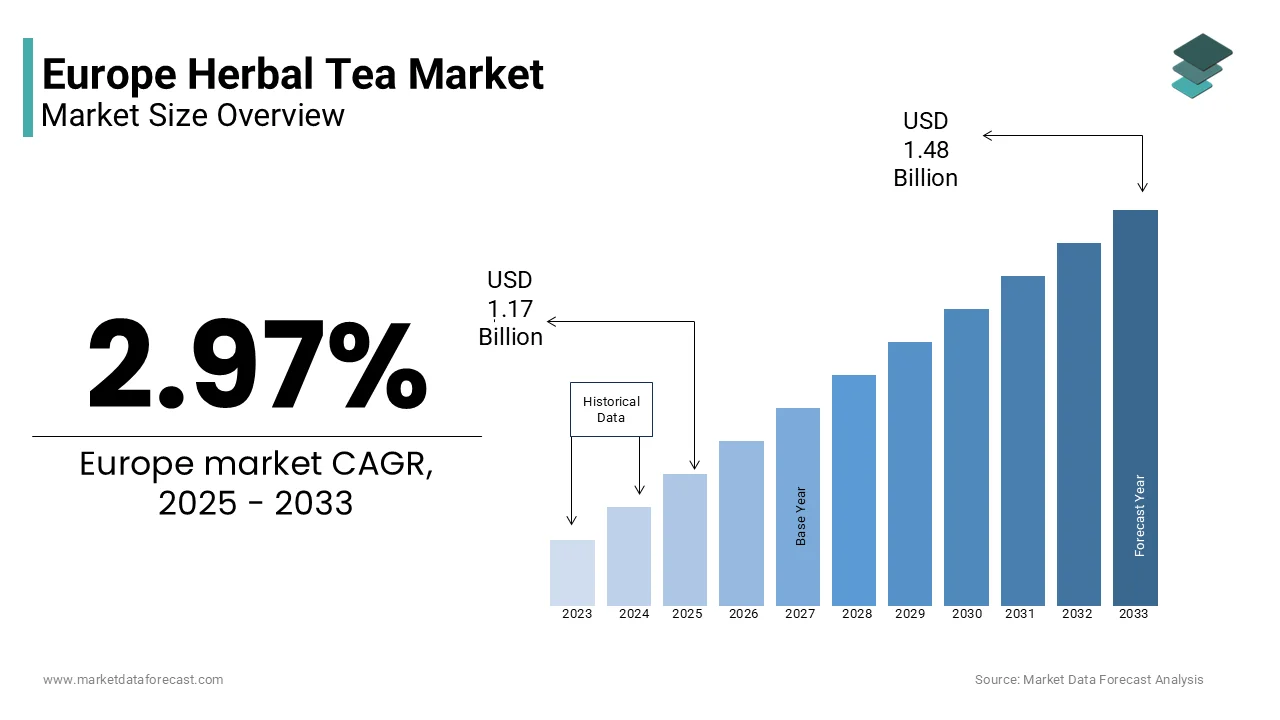

The Europe herbal tea market size was valued at USD 1.14 billion in 2024, and the market size is expected to reach USD 1.48 billion by 2033 from USD 1.17 billion in 2025. The market is growing at a CAGR of 2.97% during the forecast period.

Herbal tea is an infusion made from plants other than Camellia sinensis made by boiling or steeping herbs. Herbal teas are typically made with flower tisanes such as chamomile, lavender, hibiscus, and rose. Herbal teas can also be made with leaf tisanes such as mint, lemongrass, French verbena, and lemon balm. Root tisanes, fruit tisanes, and seed or spice tisanes are also used to blend herbal tea. Unlike coffee and true teas (both of which are available decaffeinated), most tisanes do not naturally contain caffeine.

MARKET DRIVERS

The growing consumer preference for safe, chemical-free, and healthy consumables is one of the major factors driving the market growth. Herbal tea farming is also based on ecological processes, biodiversity, and cycles tailored to local conditions, which keep the soil rich and fertile and promotes plant biodiversity. Furthermore, the growing demand for tea consumption in European countries drives the expansion of the European herbal tea market. The consumption of herbal tea among consumers has increased as there are numerous health benefits associated with the consumption of herbal tea. The increase in awareness among people relating to these health issues is driving the growth of the European herbal tea market.Other factors expected to drive Europe's herbal tea market growth during the forecast period include an increasing working population, rising demand for ready-to-use products, and expanding retail markets. In addition, herbal tea's growing popularity as a natural ingredient in personal care products is expected to fuel the demand of the Europe herbal tea market.

MARKET RESTRAINTS

In the forecast period, the high cost of the product and labor exploitation on plantations will most likely act as restraints for the growth of the Europe herbal tea market. The ease of access to product substitutes, combined with a lack of awareness in developing economies, will somewhat limit the market growth. Furthermore, factors such as the prevalence of allergic reactions and various other health consequences are associated with consuming herbal teas. Furthermore, potentially toxic chemicals, such as flavor enhancers, dyes, and adhesives, during the growth or manufacturing of herbs causes harmful health complications.

SEGMENTAL ANALYSIS

By Product Types Insights

Based on the product types, the Europe Herbal tea market is segmented by black tea and green tea. Green tea is trending in the market, and most customers prefer it. Furthermore, the increase in the health benefits of consuming green tea contributes to adopting green tea, which further leads to the growth of the particular product and market.

By Flavor Insights

On the basis of flavor, the European herbal tea market is segmented by Ginger, Cardamom, Lemongrass, Peppermint, and Others. In this segment, ginger and cardamom flavors are the most commonly used in herbal tea, and this flavor provides health benefits to the herbal tea consumer.

By Form Insights

The Europe Herbal tea market is divided into three categories: liquid, powder, and premix. The powder and premix are expected to grow in the coming year during the forecast period.

By Distribution Channel Insights

Based on the distribution channel, the Europe Herbal Tea Market is segmented by online supermarkets, hypermarkets, specialty stores, cafes, and restaurants. The cafe and restaurant hold the largest market share in iced tea, where most people prefer to consume iced tea in the cafe. However, the supermarket channel also holds a strong position in the market as a number of people directly purchase the products and prepare them in-house.

REGIONAL ANALYSIS

The UK is the largest tea consumer and holds the market's largest shares during the forecast period. According to secondary source data, following the UK, Germany is expected to be the largest herbal tea market consumer due to lifestyle changes. Germany consumed 41,081 metric tonnes of herbal and fruit infusions (67.8% by volume) and 19,523 metric tonnes of black and green tea (32.2%), an increase of 1,400 metric tonnes over the previous year. India is Germany's most important tea trading partner, sending over 7 million kilos in 2023, followed by China and Sri Lanka.

KEY MARKET PLAYERS

Unilever, Associated British Foods plc.., Nestle S.A., Tanla Food Limited and Trade ltd, Harney & Sons Fine Teas, Martin Bauer group, Barry's Tea, Hain Celestial, Tata Consumer Products, Tielka are some of the notable companies in the Europe Herbal Tea market.

RECENT DEVELOPMENTS IN THE MARKET

- Nestle launched "Nesquik Go Vegetal," a plant-based tea drink, in Europe in 2023. The drink is intended for vegan consumers, according to the company. This strategy will also allow the company's product portfolio to grow.

- Tata Consumer Products is expanding its wellness portfolio in the packaged beverages category to meet consumer demands. Tata Tea Tulsi Green and Tata Tea Gold Care are two new products. In addition, Tetley Green Tea has been reformulated with added Vitamin C. These new products are made with beneficial ingredients that are known to boost the body's immunity and overall wellness.

MARKET SEGMENTATION

This research report on the Europe Herbal Tea market has been segmented and sub-segmented into the following categories.

By Product Types

- Black Tea

- Green Tea

- Yellow Tea

By Flavor

- Ginger

- Lemongrass

- Peppermint

- Others

By Form

- Liquid

- Powder

- Premix

By Distribution Channel

- Online

- Supermarkets

- Hypermarkets

- Specialty Stores

- Restaurants

By Country

- Germany,

- Bulgaria,

- France,

- U.K.,

- Italy,

- Spain,

- Turkey,

- Belgium,

- Netherlands,

- Switzerland,

- Sweden,

- Finland

Frequently Asked Questions

1. What are the key opportunities in the Europe Herbal Tea Market?

The market is benefiting from rising consumer preference for caffeine-free and wellness-oriented beverages, increased demand for functional teas with health benefits like stress relief and digestion, and the growing popularity of organic and sustainable tea blends.

2. What are the major challenges facing the Europe Herbal Tea Market?

Challenges include limited consumer awareness in certain regions, stiff competition from conventional teas and other health drinks, and fluctuating availability and cost of high-quality herbal ingredients due to seasonal and supply chain issues.

3. Who are the major players in the Europe Herbal Tea Market?

Key players include Twinings, Celestial Seasonings, Yogi Tea, Pukka Herbs, and Teekanne, known for their diverse product offerings, herbal formulations, and strong presence in both retail and e-commerce channels.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]