Europe Heavy-duty Trucks Market Size, Share, Trends & Growth Forecast Report By Type, Fuel Type and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Heavy-duty Trucks Market Size

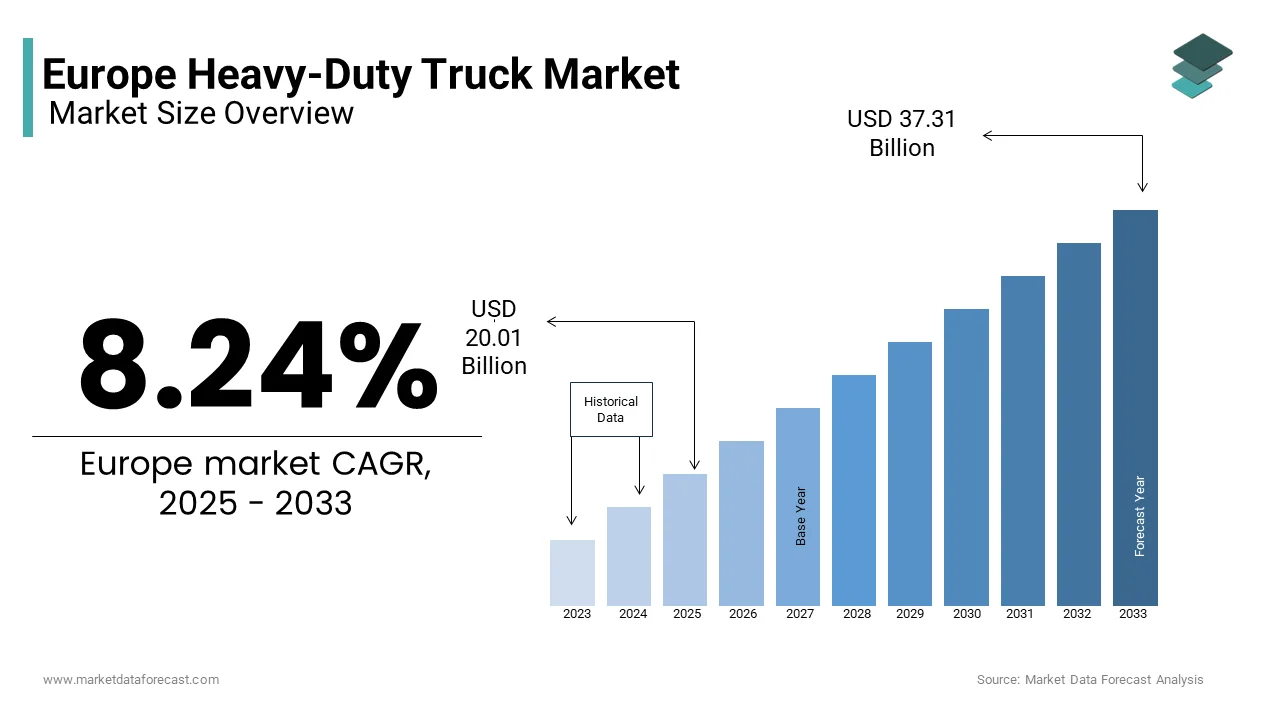

The Europe heavy-duty trucks market size was valued at USD 18.49 billion in 2024 and is anticipated to reach USD 20.01 billion in 2025 from USD 37.71 billion by 2033, growing at a CAGR of 8.24% during the forecast period from 2025 to 2033.

Heavy-duty trucks are typically classified as vehicles with a gross vehicle weight exceeding 16 metric tons, indispensable for long-haul freight operations, and intra-regional supply chain connectivity. These vehicles account for nearly 70% of inland freight movement, underscoring their critical role in sustaining economic activity.

In recent years, the market has been shaped by stringent emissions regulations, technological advancements, and shifting consumer demands. The European Green Deal, which mandates a 55% reduction in CO2 emissions from heavy-duty vehicles by 2030, has accelerated the adoption of alternative fuel technologies such as battery-electric and hydrogen-powered trucks. According to Transport & Environment, sales of zero-emission heavy-duty trucks accounted for 2.3% of total truck registrations in 2022, a figure projected to rise notably as manufacturers ramp up production.

Geographically, Germany, France, and Italy dominate the market, collectively contributing over 50% of total sales due to their robust industrial sectors and extensive road networks. Furthermore, the rise of e-commerce has spurred demand for efficient logistics solutions. Despite challenges such as supply chain disruptions and rising fuel costs, the heavy-duty truck market remains resilient and is driven by innovation and sustainability-focused policies that align with Europe’s broader climate objectives.

MARKET DRIVERS

Rising E-Commerce Demand and Freight Volumes

The surge in e-commerce has become a pivotal driver for the European heavy-duty truck market, with freight volumes escalating to meet consumer expectations for rapid deliveries. According to Eurostat, e-commerce sales in Europe grew by 13% in 2022 is necessitating robust logistics networks reliant on heavy-duty trucks. The European Commission emphasizes that road transport accounts for 75% of all inland freight movement, emphasizing the sector's indispensability. This growth is fueled by the expansion of distribution centers and last-mile delivery hubs. As urbanization and online shopping continue to rise, the demand for efficient, reliable heavy-duty trucks is expected to grow further, reinforcing their critical role in sustaining Europe’s supply chains.

Advancements in Fuel Efficiency and Alternative Fuels

Technological advancements in fuel efficiency and alternative fuels are reshaping the European heavy-duty truck market, driven by both regulatory mandates and cost-saving opportunities. The European Environment Agency states that fuel costs account for approximately 30% of total operational expenses for fleet operators, incentivizing investments in fuel-efficient vehicles. Additionally, the International Energy Agency (IEA) notes that hybrid and alternative fuel trucks could reduce fuel consumption by up to 25% compared to conventional diesel models. Governments across Europe are promoting cleaner technologies through subsidies; for instance, Germany’s Federal Ministry for Economic Affairs offers grants covering up to 80% of the additional cost for low-emission trucks. With the EU aiming for carbon neutrality by 2050, manufacturers are prioritizing innovation in hydrogen and electric trucks, ensuring compliance while addressing environmental concerns.

MARKET RESTRAINTS

Supply Chain Disruptions and Component Shortages

The European heavy-duty truck market faces grave challenges due to ongoing supply chain disruptions and semiconductor shortages, which have hampered production capabilities. The European Automobile Manufacturers’ Association (ACEA) reported a 12% decline in commercial vehicle production in 2022, largely attributed to these bottlenecks. Semiconductor shortages, in particular, have delayed the manufacturing of advanced systems like telematics and emission control technologies, which are critical for compliance with Euro VI standards. Furthermore, the International Transport Forum revealed that port congestion and shipping delays caused a 20% increase in logistics costs for manufacturers in 2022. These disruptions have not only inflated operational expenses but also prolonged delivery times for new trucks, impacting fleet operators reliant on timely vehicle replacements to meet growing freight demands.

High Initial Costs and Economic Uncertainty

The high initial cost of heavy-duty trucks, particularly those equipped with alternative fuel technologies, poses a serious restraint for fleet operators. According to the European Investment Bank, the average price of an electric or hydrogen-powered truck is 50-70% higher than its diesel counterpart, making adoption financially challenging for small and medium-sized enterprises. Additionally, economic uncertainty fueled by inflation and rising interest rates has tightened financing options for fleet upgrades. Eurostat notes that inflation in the Eurozone reached 8.4% in 2022, increasing operational pressures on logistics companies. With the European Central Bank projecting slower GDP growth of 0.7% for 2023, businesses are hesitant to invest in expensive, long-term assets, further constraining market expansion despite the push for sustainable transport solutions.

Market Opportunities

Adoption of Autonomous and Connected Truck Technologies

The integration of autonomous and connected technologies presents a transformative opportunity for the European heavy-duty truck market. The European Commission stresses that connected trucks could reduce fuel consumption by up to 10% through optimized driving patterns and platooning where vehicles travel in close formation to minimize air resistance. The European Automobile Manufacturers’ Association (ACEA) estimates that by 2030 and nearly 30% of new heavy-duty trucks could feature Level 4 autonomy, enabling considerable labour cost savings and improved safety. As regulatory frameworks evolve and technology becomes more accessible, this innovation will unlock new efficiencies and reshape logistics operations across the continent.

Expansion of Hydrogen Fuel Infrastructure

Hydrogen fuel cell technology offers a promising opportunity for decarbonizing the European heavy-duty truck market, particularly for long-haul transport where battery-electric solutions face limitations. The European Clean Hydrogen Alliance projects that hydrogen-powered trucks could account for 10-15% of new truck sales by 2030 supported by investments exceeding €430 billion in hydrogen infrastructure by 2050. Germany’s Federal Ministry for Economic Affairs has already committed €9 billion to expand hydrogen refueling stations is aiming for 400 operational sites by 2030. Additionally, the International Energy Agency (IEA) notes that hydrogen trucks have a range of up to 1,000 kilometers, making them ideal for cross-border freight. With the EU targeting carbon neutrality by 2050 and scaling hydrogen infrastructure will not only meet regulatory demands but also position Europe as a global leader in sustainable transport solutions.

MARKET CHALLENGES

Regulatory Compliance and Transition Costs

The European heavy-duty truck market faces crucial challenges in meeting stringent regulatory requirements, particularly the Euro VII emissions standards set to take effect by 2025. The European Environment Agency states that compliance with these regulations will require manufacturers to invest heavily in advanced emission control technologies, potentially increasing vehicle costs by 15-20%. Fleet operators are also burdened by the need to retrofit existing vehicles or replace them entirely to avoid penalties. Additionally, as per the International Council on Clean Transportation, non-compliance could result in fines exceeding €37,000 per vehicle under the EU’s CO2 monitoring framework. These financial pressures are compounded by uncertainty around the long-term viability of certain technologies, creating hesitancy among stakeholders. As regulations evolve, balancing compliance with affordability remains a critical challenge.

Infrastructure Gaps for Alternative Fuel Vehicles

The lack of adequate infrastructure for alternative fuel vehicles, particularly electric and hydrogen-powered trucks, poses a major challenge to market growth. The European Automobile Manufacturers’ Association (ACEA) reports that only 2% of Europe’s truck fleet is currently equipped for alternative fuels due to insufficient charging and refueling stations. For instance, Germany, despite being a leader in clean energy, has fewer than 100 hydrogen refueling stations as of 2023, far below the 400 required for widespread adoption. Furthermore, Eurostat notes that only 35% of major highways have fast-charging facilities capable of supporting electric heavy-duty trucks. This infrastructure deficit limits the operational range and feasibility of alternative fuel vehicles, hindering their adoption. Addressing these gaps requires substantial investment and coordination between governments and private sectors to meet the EU’s ambitious sustainability goals.

SEGMENTAL ANALYSIS

By Type

The over 16-tonne segment commanded the European heavy-duty truck market by capturing a 60.3% market share in 2024 because of its critical role in long-haul freight, carrying over 75% of inland cargo across Europe, as stated by the European Commission. This segment is pivotal for cross-border logistics, supporting industries like manufacturing and retail. The demand is further driven by the rise in e-commerce. Its importance lies in its ability to handle heavy loads efficiently, making it indispensable for sustaining Europe’s supply chain infrastructure and economic activity.

The 3.5 to 16-tonne segment is estimated to register the fastest CAGR of 7.8% during the forecast period due to the urbanization and the e-commerce boom which have increased demand for last-mile delivery solutions. This segment’s importance lies in its adaptability for urban distribution and construction and is addressing the challenges of narrow city streets and reducing carbon footprints. As cities expand and online shopping rises, this segment will play a crucial role in modernizing urban freight systems.

By Fuel Type

The Diesel-powered trucks dominated the European heavy-duty truck market by holding a substantial market share in 2024. Their prominence is due to superior torque, fuel efficiency, and an extensive refueling infrastructure, making them ideal for long-haul freight. The European Environment Agency said that diesel trucks transport over 70% of inland cargo, underscoring their critical role in logistics. Despite regulatory pressures to reduce emissions, diesel remains indispensable due to its reliability and load capacity. However, with Euro VII standards mandating a 55% CO2 reduction by 2030 as manufacturers are innovating cleaner diesel technologies which is ensuring its continued relevance in the near term.

The Electric-powered trucks segment is predicted to witness the highest CAGR of 18.5%. This progress is driven by the European Green Deal and subsidies promoting zero-emission vehicles, with electric trucks accounting for 2.3% of new sales in 2022. The International Energy Agency (IEA) states that electric trucks can cut operational costs by 25% compared to diesel trucks. Governments like Germany are investing in charging networks, aiming for 400 fast-charging stations by 2030. Their importance lies in reducing urban emissions, making them ideal for last-mile delivery and aligning with Europe’s net-zero goals, driving rapid adoption despite high upfront costs.

COUNTRY ANALYSIS

Germany

Germany led the European heavy-duty truck market with a 28.8% share in 2024. Its dominance stems from being home to global manufacturers like Daimler Trucks and MAN which drive innovation in fuel-efficient and alternative-fuel vehicles. Germany’s robust industrial base and extensive road network further bolster demand. The country’s commitment to sustainability, including subsidies for electric trucks and hydrogen infrastructure, positions it at the forefront of the green transition. These factors, combined with its central location in Europe make Germany a critical hub for both production and logistics.

France

France is at the forefront of adopting alternative fuel technologies and is predicted to register a CAGR of 4.9%. It is supported by initiatives from RTE France and the French Ministry of Transport. The country’s focus on modernizing its logistics infrastructure has spurred demand for heavy-duty trucks, particularly in urban distribution and construction. According to Eurostat, France’s e-commerce sector grew by 18% in 2022, driving the need for efficient last-mile delivery solutions. Additionally, France’s investments in hydrogen refueling stations, with plans for 100 stations by 2025, have accelerated the adoption of alternative-fuel trucks. Its strategic emphasis on reducing carbon emissions aligns with EU goals, making it a leader in sustainable freight transport.

United Kingdom

The UK holds a significant but evolving position in the European heavy-duty trucks market and is fuelled by rising freight volumes and e-commerce expansion. The UK Office of Gas and Electricity Markets reports that online shopping led to a 15% increase in freight demand in 2022 which is necessitating reliable heavy-duty trucks for logistics. The UK government’s push for net-zero emissions has also incentivized fleet operators to adopt cleaner vehicles, with grants covering up to 80% of costs for low-emission trucks. Furthermore, the country’s well-developed road networks and ports facilitate cross-border trade, enhancing its role in European supply chains. These factors underscore the UK’s leadership in balancing economic growth with environmental responsibility.

KEY MARKET PLAYERS

AB Volvo, Ashok Leyland Ltd., BYD Co. Ltd., Daimler Truck AG, Dongfeng Motor Group Co. Ltd., Eicher Motors Ltd., Ford Motor Co., General Motors Co., Hindustan Motors Ltd., Isuzu Motors Ltd., Iveco SpA, Mahindra and Mahindra Ltd., Oshkosh Corp., PACCAR Inc., Scania AB, Sinotruk Hong Kong Ltd., Tata Motors Ltd., Tesla Inc., Toyota Motor Corp., and Volkswagen AG. These are the market players that are dominating the Europe heavy-duty truck market.

MARKET SEGMENTATION

This research report on the Europe heavy-duty truck market is segmented and sub-segmented into the following categories.

By Type

- 3.5 to 16 tonnes

- Over 16 tonnes

By Fuel Type

- Diesel powered

- Gasoline powered

- Electric powered

- Solar powered

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]