Europe Heat Pump Market Size, Share, Trends, & Growth Forecast Report Segmented By Product (Air Source, Ground Source, and Water Source), Application (Residential and Commercial), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Heat Pump Market Size

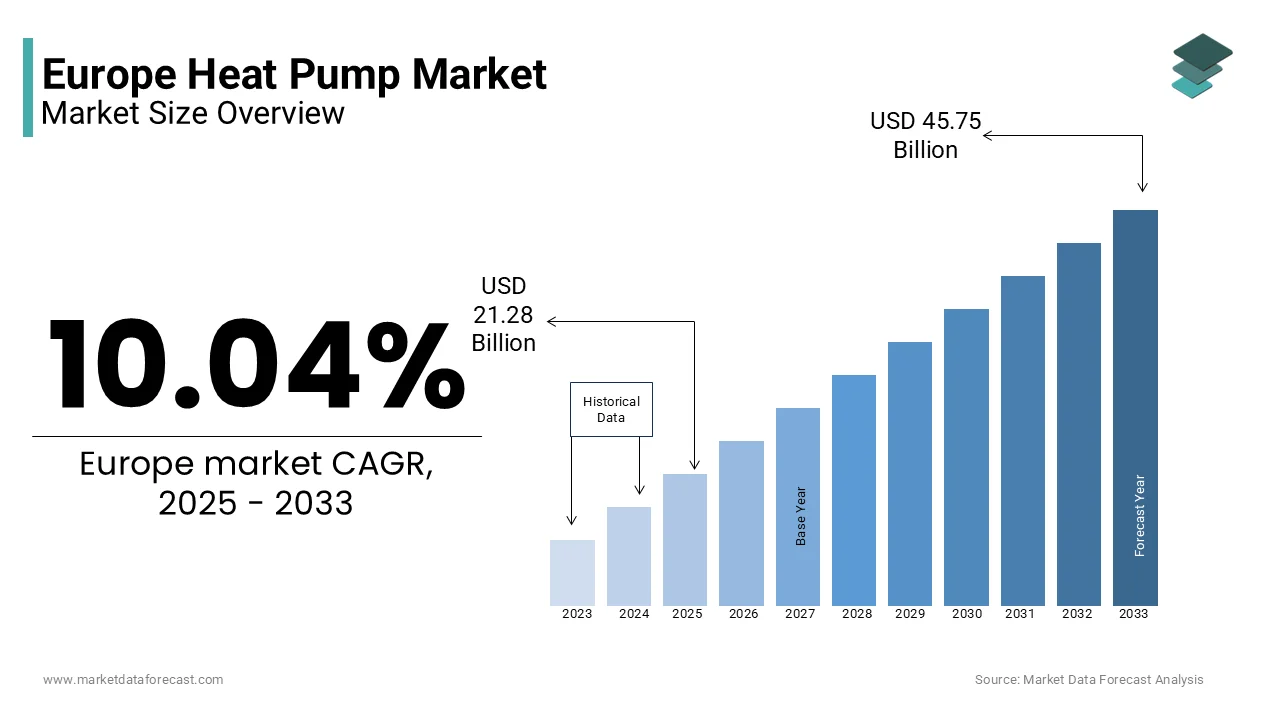

The Europe heat pump market was worth USD 19.34 billion in 2024. The European market is estimated to reach USD 45.75 billion by 2033 from USD 21.28 billion in 2025, growing at a CAGR of 10.04% during the foreseen period.

Heat pumps are used to transfer heat for space heating, cooling, and water heating applications. Heat pumps operate by extracting heat from renewable sources such as air, water, or ground, offering energy-efficient solutions that significantly reduce carbon emissions compared to traditional heating methods. The rising demand for eco-friendly heating systems and stringent regulatory measures under the European Green Deal that targets carbon neutrality by 2050 are some of the factors fuelling the demand for heat pumps in the European region. According to the European Heat Pump Association, heat pump sales in Europe reached a record high in 2022, with a 34% increase compared to the previous year, reflecting growing consumer and government interest in low-carbon technologies. The EU’s Energy Performance of Buildings Directive further supports this growth by mandating higher energy efficiency standards in new constructions and renovations. Technological advancements, including hybrid heat pumps and integration with renewable energy sources like solar panels, are further driving market adoption. Countries like Germany, France, and Sweden are leading the market, supported by government incentives and robust infrastructure development.

MARKET DRIVERS

Decarbonization Goals and Regulatory Support In Europe

The European heat pump market is significantly driven by the EU’s decarbonization goals and supportive regulatory frameworks. Under the European Green Deal, the EU aims to achieve net-zero carbon emissions by 2050, with a focus on reducing dependency on fossil fuels for heating and cooling. The European Commission reported that heating accounts for nearly 50% of the EU’s total energy consumption, making heat pumps a critical solution for lowering emissions. Additionally, the Energy Performance of Buildings Directive mandates the installation of high-efficiency heating systems in new buildings and renovations. Incentive programs like Germany’s BEG (Federal Funding for Efficient Buildings) provide substantial subsidies for heat pump installations, accelerating adoption across residential and commercial sectors.

Rising Energy Costs and Demand for Energy Efficiency

The surge in energy prices across Europe has intensified demand for energy-efficient heating solutions, positioning heat pumps as an attractive alternative. The International Energy Agency reported a 17% increase in natural gas prices in Europe during 2022, prompting consumers and businesses to seek cost-effective solutions for heating and cooling. Heat pumps, which offer energy savings of up to 60% compared to conventional boilers, have emerged as a preferred choice. Their ability to operate efficiently in a variety of climates, particularly with advancements in cold-climate models, has further boosted their appeal. Countries like France and Sweden are experiencing rapid adoption due to rising energy costs and the long-term savings offered by heat pump systems.

MARKET RESTRAINTS

High Initial Installation Costs

The high upfront costs associated with heat pump installation act as a significant restraint on the European market. Although heat pumps offer long-term energy savings, their initial investment can range from €6,000 to €15,000 for air-source systems and up to €25,000 for ground-source systems, as reported by the European Commission in 2022. These costs include equipment, installation, and any necessary upgrades to existing heating infrastructure. This financial barrier is particularly challenging for middle- and low-income households, even with government subsidies in place. The cost disparity between heat pumps and traditional heating systems, such as gas boilers, limits widespread adoption, especially in regions with limited access to incentive programs.

Limited Awareness and Technical Expertise

A lack of consumer awareness and technical expertise in installing and maintaining heat pumps poses a challenge to market growth. Many consumers remain unfamiliar with the benefits and operation of heat pump systems, which hampers adoption in less urbanized areas. According to the European Heat Pump Association, 30% of surveyed homeowners in 2022 cited a lack of knowledge as a barrier to choosing heat pumps. Additionally, the limited availability of trained technicians capable of installing and servicing heat pumps creates bottlenecks in deployment. This skill gap is particularly pronounced in emerging markets within Eastern Europe, where the infrastructure to support heat pump adoption remains underdeveloped, further restricting market expansion.

MARKET OPPORTUNITIES

Integration with Renewable Energy Systems

The increasing integration of heat pumps with renewable energy systems presents a significant opportunity for the European market. Heat pumps combined with solar panels, wind turbines, and geothermal systems enhance energy efficiency and reduce reliance on fossil fuels. According to the European Commission, renewable energy accounted for 22% of the EU's total energy consumption in 2022, and this share is expected to rise under the European Green Deal. Hybrid systems, such as solar-assisted heat pumps, enable homeowners to achieve near-zero energy consumption for heating and cooling. Germany and Sweden are leading in renewable-integrated heat pump installations, supported by government incentives for energy-efficient homes. Manufacturers focusing on hybrid solutions can capitalize on this trend by offering products tailored to these advanced setups.

Expansion of District Heating Networks

The expansion of district heating networks across Europe offers substantial growth potential for the heat pump market. District heating systems, which accounted for 12% of residential heating in the EU in 2022, as reported by Eurostat, increasingly incorporate large-scale heat pumps for sustainable energy distribution. These networks are being modernized to integrate renewable sources, such as waste heat recovery and geothermal energy, further driving demand for industrial-scale heat pumps. Countries like Denmark and Finland are pioneers in this sector, with government-backed initiatives promoting low-carbon district heating. As more European cities transition to sustainable heating solutions, heat pump manufacturers can target this segment with scalable, energy-efficient products designed for large-scale applications.

MARKET CHALLENGES

Grid Infrastructure Limitations

The limitations of existing grid infrastructure in Europe present a significant challenge to the widespread adoption of heat pumps. Heat pumps rely on electricity, and their increased usage can strain power grids, particularly during peak demand in winter. According to the European Network of Transmission System Operators for Electricity (ENTSO-E), electricity demand in the EU rose by 4% in 2022, driven by electrification in heating and transportation. Older grid systems in some regions struggle to accommodate this growth, leading to inefficiencies and potential outages. Upgrading grid infrastructure to support the electrification of heating systems is a complex and costly process, slowing the adoption of heat pumps, especially in rural and underdeveloped areas.

Performance Limitations in Extremely Cold Climates

Heat pump performance in extremely cold climates poses a technical challenge to market growth in certain regions of Europe. While advancements in cold-climate heat pumps have improved efficiency, their output can still decline significantly in sub-zero temperatures, requiring supplementary heating systems. According to the European Heat Pump Association, heat pump efficiency drops by 10-25% when temperatures fall below -10°C, which is a concern in countries like Sweden and Finland. This performance limitation increases operational costs and diminishes the appeal of heat pumps in colder regions. Addressing this challenge requires further innovation in low-temperature heat pump technology to ensure consistent performance in extreme weather conditions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.04% |

|

Segments Covered |

By Product, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Trane, Viessmann, Bosch Thermotechnology Ltd., Panasonic Corporation, STIEBEL ELTRON GmbH & Co. KG, Gree Electric Appliances, Inc., SAMSUNG, and NIBE Industrier AB. |

REGIONAL ANALYSIS

Germany held the largest share of the European heat pump market in 2024 due to its robust adoption of renewable energy and strong government incentives. The German Federal Ministry for Economic Affairs and Climate Action reported that over 170,000 heat pump installations were completed in 2022, a 50% increase from the previous year. This growth is driven by subsidies under programs like the Federal Funding for Efficient Buildings (BEG), which supports the transition to low-carbon heating systems. Germany’s emphasis on integrating heat pumps with solar and geothermal energy further solidifies its leadership, as it aligns with the country’s long-term decarbonization goals.

France is another major market for heat pumps in Europe. The strong focus of France on residential energy efficiency is driving the French heat pump market growth. The French Ministry for Ecological Transition reported that over 100,000 heat pumps were installed in 2022, driven by government schemes such as MaPrimeRénov’, which provides financial assistance for eco-friendly home upgrades. France’s adoption is bolstered by its efforts to phase out fossil fuel boilers, aligning with the EU's energy efficiency directives. Leading manufacturers, such as Daikin and Mitsubishi Electric, dominate the French market by offering advanced heat pump solutions tailored to both urban and rural consumers.

Sweden excels in the heat pump market in the European market. The cold climate of Sweden and well-established district heating networks are contributing to the heat pumps market growth in Sweden. The Swedish Energy Agency reported that heat pumps accounted for 40% of residential heating systems in 2022, highlighting widespread adoption. Government subsidies and low electricity prices make heat pumps a cost-effective and sustainable option. Sweden’s leadership in energy-efficient solutions and strong environmental policies further support its dominant position in the European heat pump market.

KEY MARKET PLAYERS

The major players in the Europe heat pump market include Trane, Viessmann, Bosch Thermotechnology Ltd., Panasonic Corporation, STIEBEL ELTRON GmbH & Co. KG, Gree Electric Appliances, Inc., SAMSUNG, and NIBE Industrier AB.

MARKET SEGMENTATION

This research report on the European heat pump market is segmented and sub-segmented into the following categories.

By Product

- Air Source

- Ground Source

- Water Source

By Application

- Residential

- Commercial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe heat pump market?

The growth is driven by government incentives, stricter energy efficiency regulations, and increasing awareness of sustainable heating solutions.

Which sectors are driving heat pump demand in Europe?

The residential sector is the biggest driver, followed by commercial buildings and industrial applications looking to reduce carbon emissions.

How is technological innovation shaping the European heat pump market?

Advances in refrigerants, hybrid heat pump systems, and smart grid integration are making heat pumps more efficient and attractive to consumers.

What is the outlook for the European heat pump market in the coming years?

The market is expected to continue growing steadily due to policy support, rising energy costs, and increasing consumer preference for sustainable heating solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com