Europe Heat Meters Market Size, Share, Trends, & Growth Forecast Report By Product (Ultrasonic, Vortex, and Others), Technology, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Heat Meters Market Size

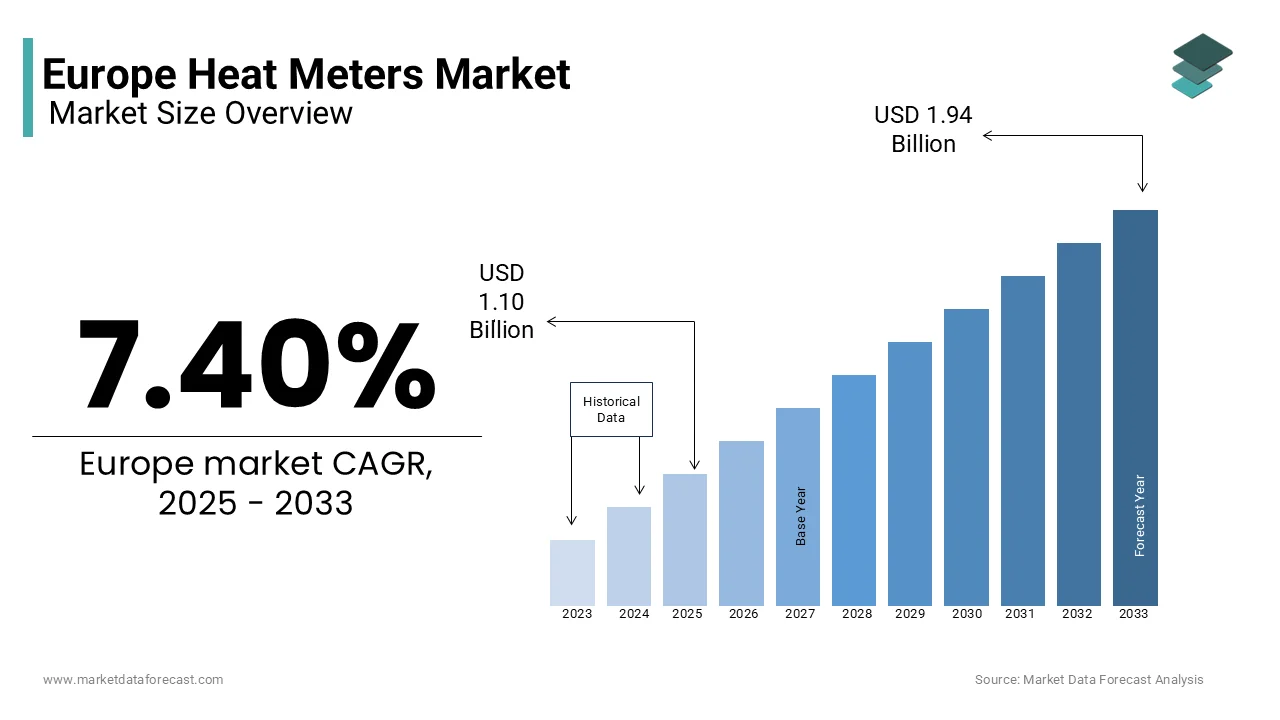

The Europe heat meters market was valued at USD 1.02 billion in 2024. The European market is estimated to reach USD 1.94 billion by 2033 from USD 1.10 billion in 2025, rising at a CAGR of 7.40% from 2025 to 2033.

Heat meters are sophisticated devices designed to quantify the amount of heat energy transferred through heating systems, enabling accurate billing and efficient energy usage. These meters operate on principles such as ultrasonic, mechanical, or static measurement technologies with ultrasonic meters gaining prominence due to their precision and low maintenance requirements. The European Union’s stringent regulatory framework including the Energy Efficiency Directive (EED) and the European Green Deal has mandated the installation of heat meters in district heating systems and multi-apartment buildings which is further propelling market growth.

According to Eurostat, over 60% of European households rely on centralized heating systems, creating a substantial demand for heat meters to ensure transparency and fairness in energy billing. The European Heat Metering Association reports that the market is projected to grow notably and is driven by increasing urbanization and the adoption of smart metering solutions. Germany, France, and Sweden lead the market which is accounting for nearly 45% of total installations, owing to their advanced district heating infrastructure and strong policy support. Furthermore, the International Energy Agency stated that Europe’s commitment to reducing carbon emissions by 55% by 2030 under the EU Climate Law has intensified investments in energy-efficient technologies, including heat meters. Energy conservation becomes a top priority, so the heat meters market is set to expand by offering innovative solutions for sustainable energy management across the continent.

MARKET DRIVERS

Stringent Regulatory Frameworks for Energy Efficiency

Strict regulatory framework aimed at enhancing energy efficiency and reducing carbon emission is mainly driving the growth of the Europe heat meters market. The European Union’s Energy Efficiency Directive (EED) mandates the installation of heat meters in multi-apartment buildings and district heating systems to ensure accurate energy consumption monitoring. Eurostat reports that over 60% of European households are connected to centralized heating systems, making compliance with these regulations critical. Additionally, the European Green Deal emphasizes achieving a 55% reduction in greenhouse gas emissions by 2030 which is further accelerating the adoption of heat meters. According to the International Energy Agency, smart metering solutions, including heat meters, have reduced energy consumption by up to 15% in pilot projects across Europe. These policies not only drive market growth but also promote sustainable energy practices.

Growing Adoption of Smart Metering Technologies

Another key propellent is the increasing adoption of smart metering technologies which integrate heat meters with IoT-enabled systems for real-time energy monitoring. The European Commission reported that smart meters are expected to cover 80% of European households by 2030, creating a robust ecosystem for advanced heat metering solutions. Germany alone has installed over 12 million smart meters as of 2022, with heat meters being a key component in district heating networks. The European Heat Metering Association notes that smart heat meters improve billing transparency and enable consumers to optimize energy usage, reducing costs by up to 20%. Furthermore, the rise of urbanization, with over 75% of Europeans living in cities, as reported by Eurostat, boosts demand for efficient energy management systems. This technological shift underscores the importance of heat meters in modernizing energy infrastructure.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

Requirement of high initial investment often deters widespread adoption and particularly among small-scale building owners constitutes as the primary issue for the Europe heat meters market. The European Investment Bank found that the cost of advanced heat metering systems including ultrasonic and smart-enabled models can range from €200 to €500 per unit depends on complexity. For many Eastern European countries, where energy infrastructure is less developed, these costs pose a substantial barrier. Eurostat reports that over 30% of households in these regions still rely on outdated heating systems limits the feasibility of retrofitting with modern heat meters. Additionally, the International Energy Agency notes that maintenance and calibration expenses further strain budgets and particularly for mechanical meters prone to wear and tear. These financial barriers slow market growth as stakeholders prioritize short-term affordability over long-term efficiency gains.

Limited Awareness and Technical Expertise

The limited awareness and technical expertise surrounding the benefits and operation of heat meters, especially in rural and underdeveloped regions are a key restraint for the Europe heat meters market. The European Agency for Safety and Health at Work emphasizes that inadequate training leads to improper installation and usage and is reducing system effectiveness. A survey by Eurostat revealed that nearly 40% of end-users in Southern Europe lack sufficient knowledge about heat meter functionalities and their role in energy conservation. Furthermore, the European Heat Metering Association points out that fragmented regulations across member states create confusion regarding compliance requirements and is hindering uniform adoption. This knowledge gap not only affects consumer confidence but also limits the potential for energy savings, as highlighted by pilot projects showing up to 25% efficiency losses due to incorrect usage or neglect.

MARKET OPPORTUNITIES

Expansion of District Heating Networks

Rapid expansion of district heating networks provides major opportunities for the Europe heat meters market. It is becoming a cornerstone of sustainable urban energy systems. The European Commission reports that district heating currently supplies 12% of Europe’s total heating demand, with plans to increase this share to 25% by 2030 under the EU Green Deal. Germany and Sweden lead this transition with over 70% of their urban populations connected to district heating systems, as per Eurostat. Heat meters are essential for accurate billing and energy monitoring in these networks which is driving demand for advanced ultrasonic and IoT-enabled models. The International Energy Agency reported that integrating smart heat meters into district heating systems can reduce energy losses by up to 30%. This infrastructure shift presents a lucrative opportunity for manufacturers to innovate and cater to the growing need for precise energy measurement solutions.

Rising Demand for Energy-Efficient Buildings

The increasing demand for energy-efficient buildings is presenting another key opportunity for the Europe heat meters market. It is driven by stringent EU regulations and consumer awareness. The European Environment Agency states that nearly 75% of Europe’s building stock is energy-inefficient, prompting large-scale renovations under initiatives like the Renovation Wave Strategy. By 2030, the EU aims to renovate 35 million buildings to improve energy performance, creating a surge in demand for heat meters to monitor thermal energy usage. Eurostat notes that smart heat meters installed during renovations have reduced energy consumption by an average of 15% in pilot projects across Europe. Additionally, the European Heat Metering Association emphasizes that advancements in IoT integration enable real-time data analytics which is empowering consumers to optimize energy use. This trend aligns with Europe’s net-zero goals and is positioning heat meters as a key enabler of sustainable building transformation.

MARKET CHALLENGES

Interoperability Issues in Diverse Heating Systems

The lack of interoperability between heat meters and diverse heating systems complicates installation and data integration is a significant challenge for the Europe heat meters market. The European Commission revealed that over 40% of heating systems in Europe are outdated or non-standardized, particularly in Eastern and Southern regions and is making it difficult to implement uniform metering solutions. Eurostat reports that mechanical heat meters, which account for nearly 35% of installations, often face compatibility issues with modern IoT-enabled infrastructure, limiting their functionality. Additionally, the European Heat Metering Association notes that fragmented regulations across member states result in inconsistent technical standards, further exacerbating interoperability challenges. This issue not only increases operational inefficiencies but also hinders the adoption of smart metering technologies, as showcased by a 2022 study showing a 20% drop in efficiency when incompatible systems are paired.

Cybersecurity Risks in Smart Heat Meters

The growing concern over cybersecurity risks associated with smart heat meters are increasingly integrated into IoT networks poses a great challenge for the European heat meters market The European Union Agency for Cybersecurity (ENISA) warns that smart meters are vulnerable to cyberattacks, with over 60% of connected devices lacking robust security protocols. A report by Eurostat reveals that incidents of unauthorized data access in smart energy systems have risen by 15% annually since 2020 and raises concerns about consumer privacy and system integrity. Furthermore, the International Energy Agency emphasizes that cybersecurity breaches can disrupt billing accuracy and energy monitoring which is undermining trust in these technologies. Europe accelerates its adoption of smart heat meters under initiatives like the EU Green Deal, so addressing these vulnerabilities becomes critical to ensuring widespread acceptance and safeguarding sensitive energy consumption data.

REPROT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.40% |

|

Segments Covered |

By Product, Technology, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Apator S.A., Axioma Metering, BMETERS Srl, Danfoss, Diehl Stiftung & Co. KG, FLEXIM, ista Energy Solutions Limited, Itron Inc., Kamstrup, Landis+Gyr, Micronics Ltd, Meters UK Ltd,Norstrom Metering, Premier Control Technologies Ltd, Secure Meters Ltd., Schneider Electric, Siemens, Sontex SA, Stockshed, Vital Energi, and ZENNER International GmbH & Co. KG. |

SEGMENTAL ANALYSIS

By Product Insights

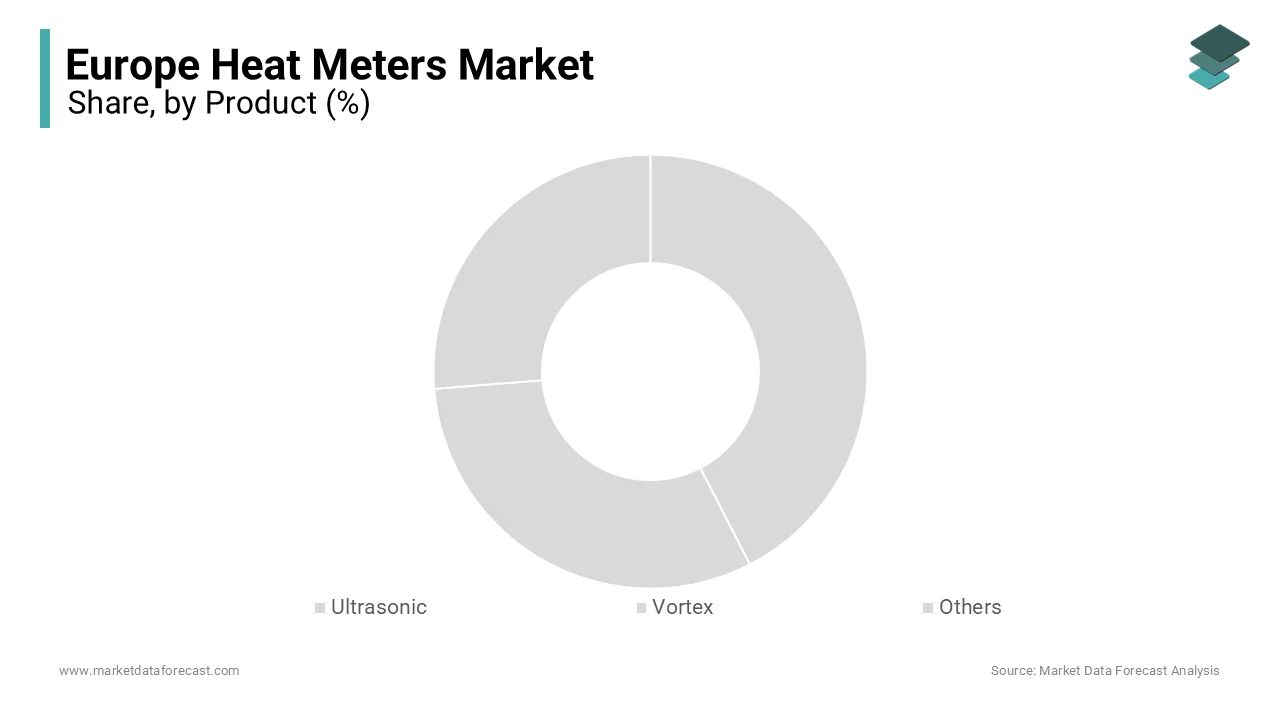

The Ultrasonic heat meters segment dominated the Europe heat meters market and held 55.1% share in 2024 due to their unmatched accuracy and reliability. These meters measure thermal energy with precision up to ±1%, reducing billing disputes in district heating systems. The European Heat Metering Association stated that their non-invasive design eliminates moving parts, cutting maintenance costs by 30% compared to mechanical meters. Ultrasonic meters are also integral to smart energy solutions, aligning with the EU Green Deal’s goals. Their compatibility with IoT enables real-time monitoring, driving adoption in Germany and Sweden where district heating networks are expanding. This position of this segment in the market showcases their critical role in enhancing energy efficiency and supporting Europe’s sustainability targets.

The vortex heat meters segment is expected to exhibit a noteworthy CAGR of 8.2% owing to their suitability for high-temperature and high-pressure industrial applications such as manufacturing and chemical processing. Eurostat reports a 20% annual rise in vortex meter adoption in these sectors, driven by their durability and minimal calibration needs. Unlike ultrasonic or mechanical meters, vortex meters excel in harsh environments, making them indispensable for modernizing industrial heating systems. Industries prioritize energy-efficient and robust solutions, so vortex meters are becoming vital for optimizing thermal energy usage, positioning them as a key driver of innovation in the heat meters market.

By Technology Insights

The Static heat meters segment dominated the Europe heat meters market and held a 70% share due to its superior accuracy, minimal maintenance, and compatibility with IoT-enabled systems, which reduce energy losses by up to 20%, according to Eurostat. Technologies like ultrasonic meters offer ±1% precision, surpassing mechanical alternatives. The European Commission reported their critical role in achieving the EU Green Deal’s energy efficiency targets with Germany and Sweden leading installations. Static meters enable real-time monitoring, enhancing billing transparency and optimizing energy usage. Their ability to integrate into smart district heating networks underscores their importance in modernizing infrastructure and supporting Europe’s sustainability goals.

The static heat meters segment is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 9.5%. This can be linked to the urbanization and the expansion of smart district heating systems and particularly in Western Europe. The European Heat Metering Association reports that static meters’ IoT integration reduces energy consumption by 15% in pilot projects. Unlike mechanical meters, they require no moving parts, cutting long-term costs by 30%. Europe accelerates its push for energy-efficient buildings under the Renovation Wave Strategy, so static meters are becoming indispensable. Their durability and alignment with net-zero emissions goals make them pivotal for transforming energy management and driving market innovation.

By Application Insights

The residential sector was the largest segment in the Europe heat meters market and accounted for 50.2% share because of the widespread adoption of district heating systems, with over 60% of European households connected to centralized heating networks, according to the European Commission. Static heat meters and particularly ultrasonic models dominate due to their accuracy and compatibility with smart home systems. The Renovation Wave Strategy further boosts demand, aiming to upgrade 35 million buildings by 2030. Residential heat meters ensure billing transparency and reduce household energy costs and is playing a vital role in achieving EU sustainability goals. Their widespread use underscores their importance in promoting energy conservation and supporting Europe’s green transition.

However, the commercial segment is the fastest-growing application with a CAGR of 8.5%. This growth is fuelled by urbanization and stricter energy efficiency mandates under the EU Energy Performance of Buildings Directive. According to the Eurostat, smart heat meters installed in commercial spaces reduce energy consumption by up to 15% which is driving their adoption in offices, malls and institutions. IoT-enabled static meters enable real-time monitoring and is optimizing energy usage and cutting operational costs. As Europe expands its commercial infrastructure, the demand for advanced heat metering solutions is surging. This rapid growth of this segment shows its critical role in enhancing energy efficiency and supporting Europe’s net-zero emissions targets.

REGIONAL ANALYSIS

Germany was the largest heat meters market with a 25% share owing to the country’s advanced district heating infrastructure, which supplies thermal energy to over 14% of households, according to Eurostat. Germany’s commitment to the EU Green Deal and its national energy transition strategy, Energiewende, has accelerated investments in smart heat metering solutions. The European Heat Metering Association notes that ultrasonic heat meters are widely adopted in urban areas like Berlin and Munich and is enabling precise energy monitoring and reducing consumption by up to 20%. These initiatives underscore Germany’s pivotal role in driving innovation and sustainability in the heat meters market.

Sweden is a leader in sustainable energy practices and is predicted to register a CAGR of 8.2%. Over 60% of Swedish households rely on district heating systems, fostering demand for advanced heat meters. The country’s focus on achieving carbon neutrality by 2045 has spurred the adoption of IoT-enabled static meters which is enhancing energy efficiency. Sweden’s emphasis on integrating renewable energy sources into district heating networks aligns with its ambitious climate goals. According to Eurostat, Swedish cities like Stockholm have achieved significant reductions in energy losses through smart heat metering technologies. This proactive approach positions Sweden as a key innovator in promoting energy-efficient solutions across Europe.

Denmark is expected to grow steadily and is driven by Copenhagen’s world-class district heating network, as reported by the Danish Energy Agency. Over 60% of Danish households are connected to district heating systems, making heat meters indispensable for accurate billing and energy optimization. Denmark’s focus on renewable energy integration and smart city initiatives has accelerated the adoption of advanced heat metering technologies. The International Energy Agency stated that Denmark’s district heating systems achieve energy savings of up to 30% through the use of smart heat meters. By prioritizing sustainability and innovation, Denmark has established itself as a leader in transforming energy management practices, ensuring reduced energy wastage and supporting Europe’s green transition goals.

KEY MARKET PLAYERS

The major players in the Europe heat meters market include Apator S.A., Axioma Metering, BMETERS Srl, Danfoss, Diehl Stiftung & Co. KG, FLEXIM, ista Energy Solutions Limited, Itron Inc., Kamstrup, Landis+Gyr, Micronics Ltd, Meters UK Ltd,Norstrom Metering, Premier Control Technologies Ltd, Secure Meters Ltd., Schneider Electric, Siemens, Sontex SA, Stockshed, Vital Energi, and ZENNER International GmbH & Co. KG.

MARKET SEGMENTATION

This research report on the Europe heat meters market is segmented and sub-segmented into the following categories.

By Product

- Ultrasonic

- Vortex

- Others

By Technology

- Mechanical

- Static

By Application

- Residential

- Commercial

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the Europe heat meters market?

The Europe heat meters market is driven by increasing demand for energy efficiency, government regulations promoting district heating, and growing adoption of renewable energy sources for heating applications.

What are the main applications of heat meters in Europe?

Heat meters are primarily used in residential buildings, commercial establishments, and industrial facilities for measuring energy consumption in district heating and cooling systems.

How is smart metering technology influencing the heat meters market?

Smart metering technology is enabling real-time energy monitoring, remote reading capabilities, and improved efficiency in billing and consumption management.

What future trends are expected in the Europe heat meters market?

Future trends include the integration of IoT and AI in metering solutions, stricter energy efficiency mandates, and increasing adoption of heat meters in smart city projects.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]