Europe Health Insurance Market Size, Share, Trends & Growth Forecast Report By Service Provider (Private Public, Standalone, Health Insurers), Coverage Type, Product Type, Insurance Plan Type, Demographics and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

Europe Health Insurance Market Size

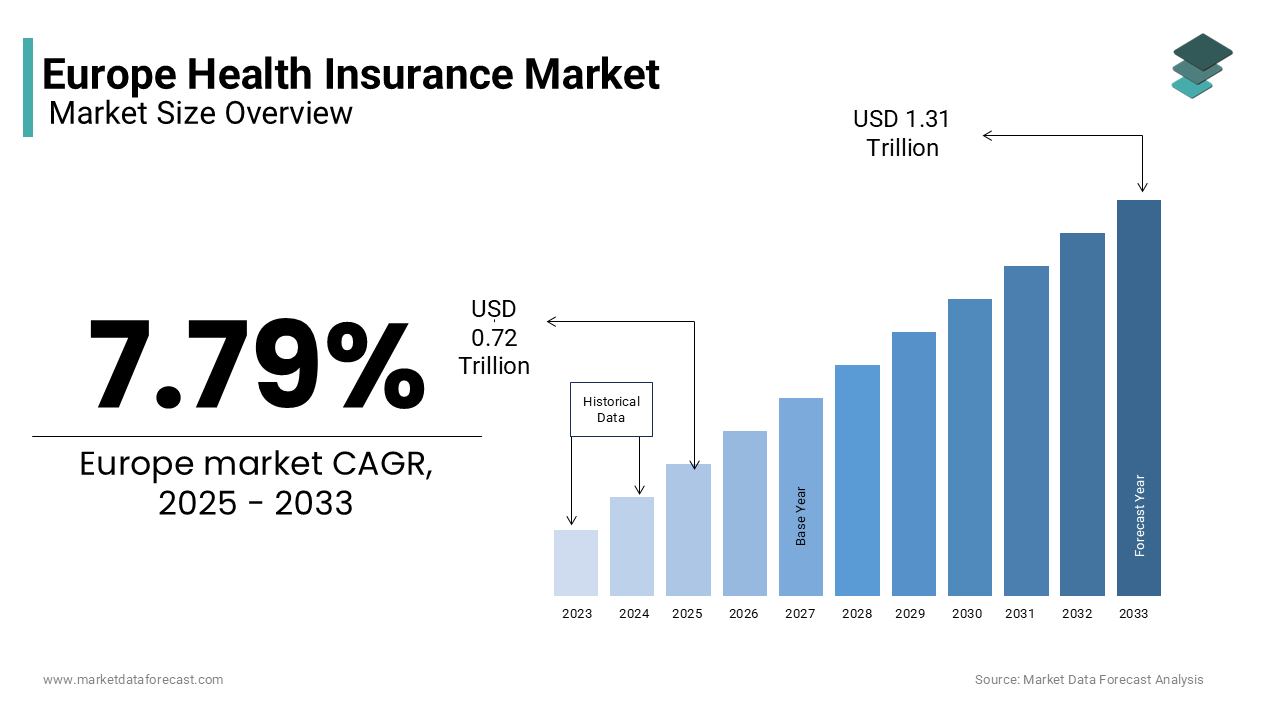

The size of the europe health insurance market was valued at USD 0.67 trillion in 2024. The global market size is further expected to be valued at USD 1.31 trillion by 2033 from USD 0.72 trillion in 2025, growing at a CAGR of 7.79% from 2025 to 2033.

The European health insurance market is an integral component of the region's healthcare system which provides financial coverage for medical expenses and ensuring access to essential healthcare services. This market includes public, private, and hybrid insurance schemes, designed to cater to diverse demographic and socioeconomic groups. Health insurance in Europe operates through various models, such as tax-funded universal healthcare systems (e.g., the UK) and social insurance schemes (e.g., Germany and France) and that is reflects the region's heterogeneous governance and funding structures.

As of recent reports by the European Commission, nearly all EU countries ensure some form of mandatory or government-subsidized health insurance, resulting in over 95% of the population being covered. This high penetration is driven by regulatory mandates and a strong focus on universal healthcare access. In Germany, for instance, statutory health insurance covers approximately 87% of the population, as emphasized by the European Observatory on Health Systems and Policies.

Key challenges, including an aging population and increasing healthcare costs, continue to shape the market dynamics. The market's adaptability to emerging technologies and its role in preventive healthcare initiatives further emphasize its critical importance in sustaining Europe's healthcare infrastructure.

MARKET DRIVERS

Aging Population and Increased Healthcare Needs

Europe is experiencing a marked demographic shift, with a significant rise in the aging population. According to the World Health Organization (WHO), by 2050, individuals aged 60 and older will account for approximately 34% of the total European population. This aging demographic brings an increased prevalence of chronic conditions such as cardiovascular diseases and diabetes, creating greater demand for healthcare services. Consequently, health insurance plays a critical role in ensuring accessibility to necessary treatments, enabling aging populations to manage their health needs effectively.

Public Health Initiatives and Policy Mandates

Governments across Europe have prioritized health insurance as a vital tool for achieving universal healthcare coverage. The European Commission reports that nearly all member states maintain mandatory or heavily subsidized health insurance schemes, ensuring that the population has access to essential healthcare services. These initiatives aim to reduce health disparities and promote equitable healthcare access. For instance, Germany’s social health insurance system covers approximately 90% of its population, as noted by the European Observatory on Health Systems and Policies. These structured systems drive public participation in health insurance programs which is reinforcing their role in supporting national healthcare goals.

MARKET RESTRAINTS

Economic Inequalities and Accessibility Challenges

Economic disparities in Europe pose a significant restraint to equitable access to health insurance. According to the European Union’s Eurostat, approximately 21.7% of the EU population was at risk of poverty or social exclusion in 2021, limiting their ability to afford comprehensive health coverage. While public systems often provide baseline care, out-of-pocket expenses and private insurance costs remain prohibitive for low-income groups. This creates significant gaps in healthcare access and that is leading to untreated conditions and long-term public health implications.

Regulatory Variations Across Member States

The health insurance landscape in Europe is complicated by diverse regulatory frameworks across its member states. Each country operates under distinct rules, reflecting differences in governance, funding structures, and healthcare priorities. For example, the European Commission highlights variations in how healthcare is financed, ranging from tax-based systems like in the UK to social insurance models seen in Germany. Also, these disparities complicate cross-border healthcare coordination and create inefficiencies in achieving uniform healthcare goals.

MARKET OPPORTUNITIES

Digital Health Integration

The integration of digital health technologies gives a potential opportunity for the European health insurance market. Moreover, the European Commission emphasizes the importance of digital health in enhancing healthcare delivery and patient outcomes. The adoption of electronic health records, telemedicine, and mobile health applications can streamline healthcare services which further improve patient engagement, and reduce costs. For instance, telemedicine services have become increasingly prevalen by offering remote consultations and monitoring, that are particularly beneficial in rural or underserved areas. Health insurers can leverage these technologies to offer innovative products and services, improve risk assessment, and enhance customer satisfaction.

Preventive Healthcare Initiatives

There is a growing emphasis on preventive healthcare within Europe. It is aiming to reduce the incidence of chronic diseases and associated healthcare costs. The European Commission has launched various initiatives to promote healthy lifestyles and early disease detection. Health insurers have the opportunity to develop products that incentivize preventive measures, such as wellness programs, regular screenings, and vaccinations. By encouraging policyholders to engage in preventive care, insurers can improve population health outcomes and potentially reduce long-term expenditures. The European Commission's Health Promotion and Disease Prevention Knowledge Gateway provides evidence-based information to support the development of effective preventive strategies.

MARKET CHALLENGES

Fragmented Healthcare Systems Across Europe

Among the major challenges in the European health insurance landscape is the fragmentation of healthcare systems. The European Commission notes that healthcare structures vary widely across member states which are influenced by local policies, funding mechanisms, and cultural approaches to care. This diversity complicates efforts to standardize health insurance practices and create cross-border healthcare solutions. For instance, while some countries operate tax-funded healthcare systems (e.g., the UK), others rely on social insurance models (e.g., Germany and France). These disparities hinder collaboration, restrict seamless access for mobile EU citizens, and create administrative inefficiencies in integrating healthcare services.

Rising Healthcare Costs and Economic Pressures

Escalating healthcare costs across Europe pose a considerable challenge for the sustainability of health insurance systems. According to the Organisation for Economic Co-operation and Development (OECD), healthcare expenditure in the EU averages nearly 10% of GDP, with an upward trend driven by advanced treatments, aging populations, and the prevalence of chronic diseases. This financial burden impacts both public and private insurers by straining resources and increasing premiums for consumers. Additionally, economic pressures in lower-income member states further exacerbate these challenges, as governments struggle to allocate adequate funds for comprehensive health insurance coverage.

REGIONAL ANALYSIS

The Netherlands held the largest share of the European health insurance market by accounting for 39.1% of gross direct premiums written in 2024. This leading position is attributed to the country's mandatory private health insurance system, where insurers are required to offer a universal healthcare package at a fixed price, ensuring coverage for all residents. This system promotes competition among insurers while maintaining accessibility and quality of care.

Germany remains a key player in this European market. The nation's statutory health insurance system, the oldest in the world, mandates that employees contribute a portion of their income towards health coverage, with employers matching this contribution. This model ensures widespread coverage and financial stability within the healthcare system and is contributing to Germany's prominent position in the market.

France captured a notable share of the European health insurance market. The country's healthcare system is largely financed by the government through a national health insurance program, providing extensive coverage to its citizens.

KEY MARKET PLAYERS

Allianz SE, Zurich Insurance Group AG, AXA, Aviva Plc, and Prudential Plc are some of the key market players in the European health insurance market.

MARKET SEGMENTATION

This research report on the europe health insurance market has been segmented and sub-segmented based on following categories.

By Service Provider

- Private

- Public

- Standalone Health Insurers

By Coverage Type

- Life-Time Coverage

- Term Insurance

By Product Type

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

By Demographics

- Minor

- Adults

- Senior Citizen

By Insurance Plan Type

- Preferred Provider Organizations (PPOS)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOS))

- Indemnity Health Insurance

- Health Savings Account (HSA)

- Qualified Small Employer Health Reimbursement Arrangements (QSEHRAS)

- Others

By End-User

- Individuals

- Corporate/ Employer-Sponsored Group Plans

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the European health insurance market?

The market is driven by factors such as an aging population, rising healthcare costs, digitalization of health services, and increasing demand for private insurance coverage.

What challenges does the European health insurance market face?

Key challenges include rising healthcare costs, regulatory changes, economic instability, and balancing public and private healthcare systems.

What is the European health insurance market?

The European health insurance market consists of private and public health insurance providers that offer coverage for medical expenses, hospitalization, and other healthcare-related services across European countries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]