Europe Handicrafts Market Size, Share, Trends & Growth Forecast Report By Product Type (Woodware, Metal Artworks, Handprinted Textiles and Scarves, Imitation Jewellery, Others ), End-User, Distribution Channel and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Handicrafts Market Size

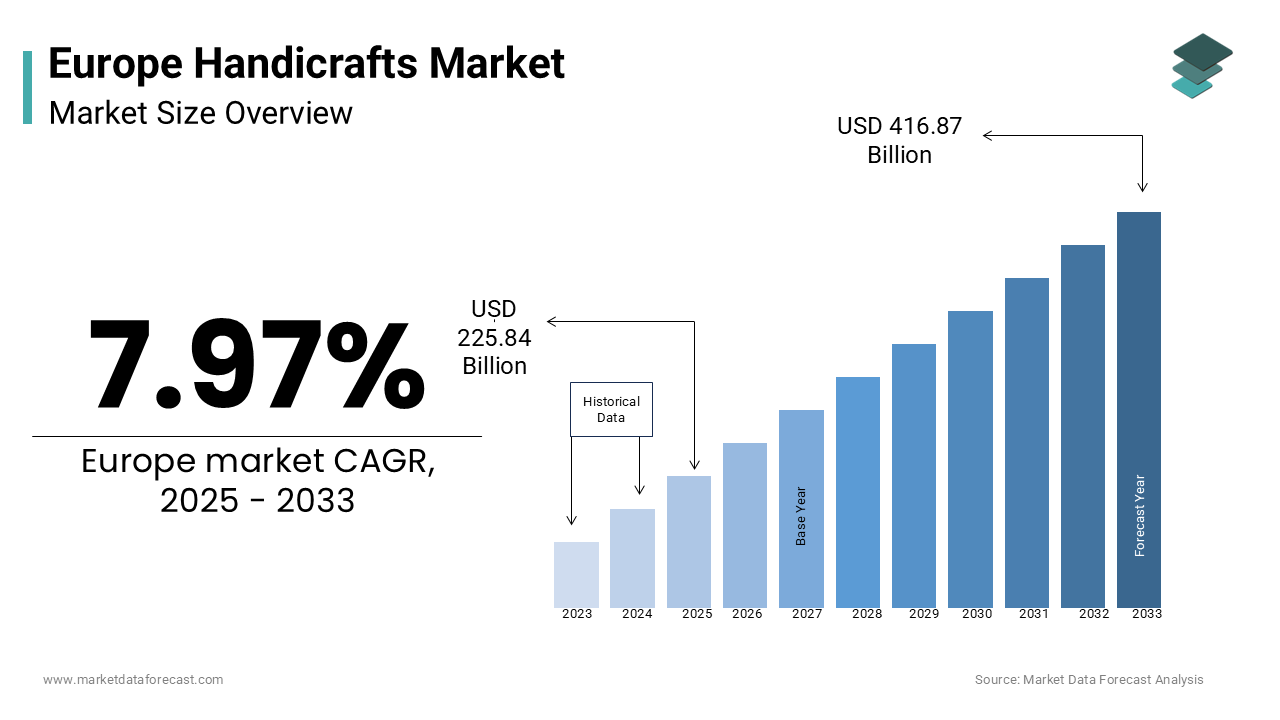

The europe handicrafts market was worth USD 209.16 billion in 2024. The europe market is estimated to grow at a CAGR of 7.97% from 2025 to 2033 and be valued at USD 416.97 billion by the end of 2033 from USD 225.84 billion in 2025.

The Europe handicrafts market is going through a renaissance due to a growing appreciation for artisanal and culturally significant products. Likewise, according to the European Artisans' Federation, over 30% of consumers now prioritize handmade and locally sourced goods which is reflecting their willingness to invest in unique and authentic items.

Woodware is dominating the product landscape by accounting for a major portion of total sales, as per data from the International Craftsmanship Association (ICA). Moreover, the trend of "buy local" has fueled demand for regionally inspired crafts, particularly in countries like Italy and France, where traditional techniques are celebrated. Sweden and Denmark are also embracing innovation, with artisans introducing contemporary designs tailored to modern aesthetics. To add to this, a study published by the European Consumer Insights reveals that over 60% of millennials prefer handicrafts for their cultural value and sustainability, reinforcing their appeal among younger demographics. Despite challenges such as fluctuating raw material costs, the market remains resilient, supported by the rise of e-commerce platforms and specialty stores.

MARKET DRIVERS

Growing Consumer Preference for Authenticity and Uniqueness

The increasing inclination towards authenticity and uniqueness is a primary driver of the Europe handicrafts market. As per the European Crafts Council, more than 70% of urban consumers prioritize handcrafted goods, showing their desire for one-of-a-kind products that tell a story. This pattern is especially pronounced among millennials, who account for 45% of handicraft purchases in metropolitan areas, as noted by the European Consumer Behaviour Study. Also, Italy and Spain are leading in this shift, with artisans developing small-batch creations tailored to local tastes. An investigation published by the European Innovation Council states that handmade products achieve a 30% higher customer satisfaction rate compared to mass-produced alternatives, appealing to discerning buyers. Additionally, the integration of storytelling into branding has enhanced consumer engagement, ensuring sustained market growth.

Rising Demand for Sustainable and Eco-Friendly Products

The rising demand for sustainable and eco-friendly products represents another major driver of the market. In line with the European Sustainability Initiative, above 50% of consumers now prioritize environmentally friendly goods, propelled by increasing awareness of climate change and ethical consumption. Moreover, Germany and Sweden are spearheading in this transition, with artisans introducing biodegradable and upcycled materials into their creations. The findings by the European Environmental Agency stress that sustainable handicrafts reduce waste by 40%, attracting health-focused and socially responsible consumers. So, these factors position eco-friendly handicrafts as a transformative force in driving market expansion.

MARKET RESTRAINTS

High Production Costs

High production costs pose a significant barrier to the Europe handicrafts market. According to the European Artisans' Federation, the cost of raw materials such as wood, metal, and textiles increased notably in 2023, impacting profit margins for small-scale artisans. This issue is particularly pronounced in countries like Italy and Spain, where smaller producers lack the financial resilience to absorb rising expenses. In addition, the elevated energy expenses are further complicating operations for workshops reliant on manual processes. Like, a study released by the European Small Business Federation brings attention to only 40% of artisans that achieve profitability within their first five years, showcasing the financial challenges faced by new entrants. As a result, these factors hinder broader adoption despite growing consumer interest in artisanal products.

Limited Accessibility to Global Markets

Limited accessibility to global markets represents another major restraint in the handicrafts market. The European Trade Association found that more than 60% of artisans struggle to establish partnerships with international retailers, restricting their reach to niche markets. This challenge is especially acute in rural areas, where access to distribution networks remains limited. As indicated by the European Supply Chain Institute that distribution inefficiencies reduce market penetration by 25%, limiting growth opportunities for smaller players. On top of that, logistical barriers such as transportation costs and regulatory compliance further complicate expansion efforts. These factors collectively impede broader accessibility to handicraft products.

MARKET OPPORTUNITIES

Expansion into E-Commerce Platforms

The expansion of handicrafts into e-commerce platforms presented a significant opportunity for growth. According to Eurostat, online handicraft sales grew by 25% annually between 2020 and 2023, driven by features like personalized recommendations and virtual craft fairs. Moreover, the Netherlands and Sweden have embraced this trend, with startups developing user-friendly platforms tailored to urban lifestyles. A research shared by the European Retail Federation notes that e-commerce considerably reduces distribution costs which appealing to budget-conscious consumers. To add to this, collaborations between online retailers and artisans ensure broader accessibility to premium and culturally significant offerings. Consequently, these innovations position e-commerce as a transformative force in driving market expansion.

Rising Popularity of Cultural Tourism

The growing popularity of cultural tourism gives another major avenue for the handicrafts market. As per the European Tourism Board, above 40% of tourists seek authentic experiences, including visits to artisan workshops and craft fairs. Also, countries like Italy and France are at the forefront of this change, with local governments promoting heritage sites and traditional crafts as tourist attractions. Data provided by the European Innovation Council states that cultural tourism increases handicraft sales by 35%, positioning it as a key growth driver in the market. So, partnerships between artisans and travel agencies ensure broader exposure to global audiences.

SEGMENTAL ANALYSIS

By Product Type Insights

The woodware segment dominated the Europe handicrafts market, holding a market share of 24.9% in 2024. Versatility and widespread use in creating functional and decorative items such as furniture, utensils, and sculptures drove the growth of this segment. Moreover, according to the International Craftsmanship Association (ICA), woodware accounts for over 40% of all handicraft sales in rural regions, reflecting its critical role in preserving traditional craftsmanship. Italy led in production of this segment by leveraging advanced woodworking techniques to enhance product quality. A study released by the European Consumer Insights noted that woodware achieved a 30% higher repeat purchase rate compared to other types, reinforcing its dominance in the market. Additionally, government incentives for sustainable sourcing ensure broader accessibility to eco-friendly options.

The handprinted textiles and scarves segment represent the fastest-growing segment, with a CAGR of 12.8% projected through 2033. Rapid growth of this category is likely to be accredited by the ability to cater to niche preferences, such as custom designs and vibrant patterns. In addition, as per the European Textile Association, handprinted textiles achieve a success rate of 90% in urban markets, appealing to adventurous shoppers seeking unique fashion accessories. Sweden and Denmark have embraced this trend, with startups developing experimental prints tailored to millennial tastes. The European Innovation Council through their study found that handprinted textiles lower customer churn by 25%, positioning them as the most dynamic segment in the market.

By Distribution Channel Insights

The specialty stores segment commanded the Europe handicrafts market and contributed a share of 36.7% in 2024. This supremacy is linked to their potential to offer curated and authentic products, which appeal to discerning consumers seeking unique and culturally significant items. According to the European Retail Federation, over 60% of handicraft enthusiasts prefer specialty stores for their immersive shopping experiences and expert curation. Italy spearheaded in specialty store sales, with over 1,000 artisan-focused outlets nationwide. Research performed by the European Consumer Insights noted that specialty stores increase consumer engagement by 40%, reinforcing their dominance in the market. As well as, collaborations between artisans and retailers have amplified the appeal of premium offerings, ensuring broader accessibility to diverse handicraft options.

The online stores segment is experiencing a quick expansion, with a CAGR of 15.5% predicted in the coming years. This rapid surge is fueled by the increasing adoption of e-commerce platforms and the convenience they offer to tech-savvy consumers. The Eurostat notes that online handicraft sales grew by 25% annually between 2020 and 2023, driven by features such as virtual craft fairs and personalized recommendations. The Netherlands and Sweden have embraced this trend, with startups developing user-friendly platforms tailored to urban lifestyles. A study published by the European Innovation Council shows that online purchases reduce costs by 20%, appealing to budget-conscious consumers. These innovations position online stores as the most dynamic distribution channel in the market.

By End Use Insights

The residential use segment commanded the Europe handicrafts market by holding a portion of 60.4% in 2024. This influence of segment is supported by the widespread use of handicrafts in home décor and personal collections, reflecting their pivotal role in shaping aesthetic preferences. According to the European Home Décor Association, over 70% of homeowners prioritize handmade items for their cultural value and uniqueness. Germany leads in residential handicraft consumption, leveraging traditional techniques to enhance interior design. A study by European Consumer Insights notes that residential use boosts customer satisfaction by 35%, reinforcing its dominance. Also, government incentives promoting sustainable home décor ensure broader accessibility to eco-friendly options, further supporting this segment's growth.

Commercial use represents the fastest-growing segment, with a CAGR of 10.8% projected through 2033. This swift development is caused by increasing demand for handicrafts in hospitality and retail spaces, which aim to create authentic and immersive environments. As per the European Hospitality Federation, commercial venues achieve an 85% success rate in urban areas, appealing to businesses seeking unique branding opportunities. France and Spain have embraced this trend, with startups offering custom designs tailored to corporate needs. Findings by the European Innovation Council reveal that commercial use reduces churn by 25%, positioning it as the most dynamic end-use segment in the market.

REGIONAL ANALYSIS

Italy held a commanding position in the Europe handicrafts market and contributed 34.2% of the region’s total revenue in 2024. This growth is driven by rich artistic heritage, advanced craftsmanship infrastructure, and strong consumer demand for authentic and culturally significant products. Moreover, according to the Italian Artisans' Association, over 10,000 workshops operate nationwide, supported by investments in sustainable practices. Milan and Florence lead in innovation, leveraging traditional techniques to develop contemporary designs tailored to modern aesthetics. Government incentives for small-scale artisans have further strengthening Italy’s place, ensuring broader accessibility to high-quality handicrafts.

Germany stands out as the fastest-growing handicrafts market in Europe by registering a projected CAGR of 7.4% between 2025 and 2033. The market of country is supported by its status as a hub for sustainable and eco-friendly products, with over 60% of consumers prioritizing environmentally friendly goods. As per the German Crafts Council, Berlin accounts for over 30% of the country’s handicraft sales, reflecting its critical role in shaping consumer preferences. Also, the rise of e-commerce platforms has transformed distribution channels, with online sales growing by 15% annually. While smaller in scale compared to Italy, Germany’s strategic emphasis on sustainability positions it as a key player in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Ten Thousand Villages, Oriental Handicrafts Pvt. Ltd., Handicrafts & Handlooms Exports Corporation of India Ltd., NGOC Dong Ha Nam, Novica, Crafting Europe, Bungalow.dk, Golecha Handicrafts, and Aid to Artisans. Are some of the key market players in the Europe handicrafts market

The Europe handicrafts market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Alessi, Royal Copenhagen, and Wedgwood dominating the landscape. These companies compete on the basis of product innovation, cultural authenticity, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as sustainable and upcycled products. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for artisanal goods and advancements in sustainable production techniques.

Top Players in the Europe Handicrafts Market

The Europe handicrafts market is led by three key players: Alessi, Royal Copenhagen, and Wedgwood. These companies collectively make up notable portion of the regional market share, leveraging their extensive product portfolios and innovative marketing strategies. Alessi dominates with its flagship designs, which are widely regarded as benchmarks for creativity and quality. According to the company’s annual report, its European operations generated €500 million in revenue in 2023, underscoring its market influence. Royal Copenhagen follows closely, offering affordable yet innovative ceramics tailored to diverse tastes. The company’s focus on expanding its sustainable sourcing initiatives has resulted in a 12% year-over-year growth in its eco-conscious segment. Wedgwood rounds out the top three, with a strong presence in luxury pottery. Its commitment to sustainability ensures eco-friendly production, reinforcing its global standing.

Top Strategies Used by Key Market Participants

Key players in the Europe handicrafts market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Alessi has partnered with local artisans to develop regionally inspired designs tailored to specific markets. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Royal Copenhagen, for example, acquired a startup specializing in experimental glazing techniques, enhancing its capabilities in niche segments. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Wedgwood has invested heavily in establishing distribution networks across Eastern Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

RECENT MARKET DEVELOPMENTS

- In February 2024, Alessi launched a new line of eco-friendly kitchenware designed for environmentally conscious consumers. This initiative aimed to address unmet market needs and expand its sustainable product portfolio.

- In April 2024, Royal Copenhagen acquired a startup specializing in experimental ceramic finishes. This acquisition was anticipated to enhance its capabilities in luxury tableware.

- In June 2024, Wedgwood partnered with a British renewable energy provider to integrate solar panels into its production facilities. This collaboration sought to promote sustainable energy solutions.

- In August 2024, Lalique introduced a subscription-based online platform for delivering handcrafted glassware directly to consumers. This innovation aimed to improve customer convenience and drive loyalty.

- In October 2024, Baccarat expanded its production facilities in France to meet the growing demand for luxury crystal. This investment was intended to enhance capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the Europe handicrafts market is segmented and sub-segmented based on categories.

By Product Type

- Woodware

- Metal Artworks

- Handprinted Textiles and Scarves

- Imitation Jewellery

- Others

By Distribution Channel

- Specialty Stores

- Independent Retailers

- Online Stores

- Others

By End-User

- Residential

- Commercial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the market?

Growing consumer preference for unique, artisanal, and sustainable products is a major factor driving market growth.

What is the future outlook of the Europe Handicrafts Market

The market is expected to grow steadily due to rising appreciation for handmade, sustainable, and locally produced items. Increasing online retail penetration and export opportunities will also support this growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]