Europe Green Cement Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Fly Ash, Slag, Recycled Aggregate, Others), Application ( Residential, Non-Residential, Infrastructure) And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Green Cement Market Size

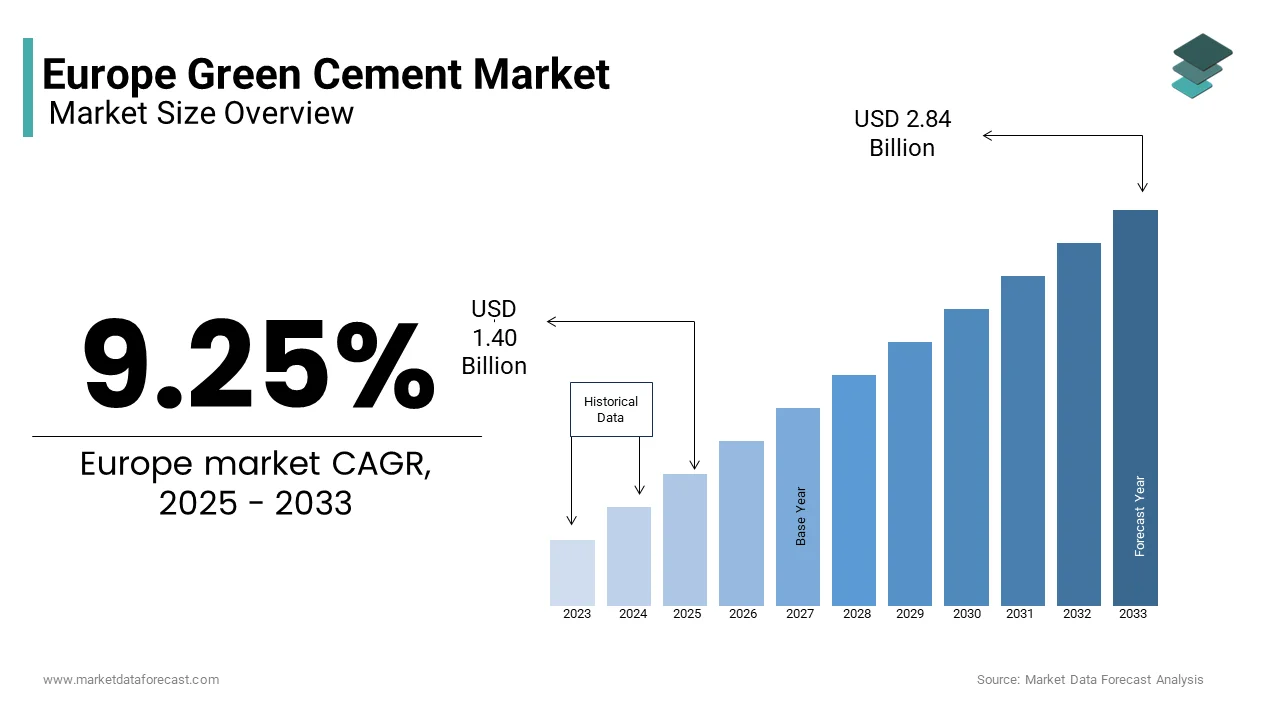

The Europe green cement market size was valued at USD 1.28 billion in 2024 and is anticipated to reach USD 1.40 billion in 2025 from USD 2.84 billion by 2033, growing at a CAGR of 9.25% during the forecast period from 2025 to 2033.

The urgent need to mitigate carbon emissions and promote sustainable building practices is leading the way for green cement worldwide. Green cement is also referred to as eco-friendly or low-carbon cement and is manufactured using alternative raw materials, industrial by-products, and energy-efficient processes that significantly reduce its carbon footprint compared to traditional Portland cement. According to the European Environment Agency, the production of conventional cement accounts for approximately 8% of global CO2 emissions, which is making it one of the largest contributors to greenhouse gas emissions in the construction sector. In response, the European Union has introduced stringent environmental regulations under the European Green Deal, aiming for a 55% reduction in carbon emissions by 2030 and climate neutrality by 2050.

The rising investments in sustainable infrastructure projects and increasing consumer awareness about environmentally responsible construction materials are fuelling the demand for green cement in Europe. Countries like Germany, France, and the United Kingdom are leading adopters, with government incentives such as tax breaks and subsidies further accelerating demand. The International Energy Agency highlights that the use of supplementary cementitious materials (SCMs), such as fly ash and slag, has gained traction, reducing clinker content by up to 40%. Additionally, innovations in carbon capture and storage (CCS) technologies are enabling manufacturers to produce net-zero cement. As urbanization continues and the demand for resilient, low-impact buildings rises, the green cement market is poised to play a pivotal role in shaping Europe’s sustainable future.

MARKET DRIVERS

Stringent Environmental Regulations and Carbon Neutrality Goals in Europe

The implementation of stringent environmental regulations is a major driver of the Europe green cement market. According to the European Environment Agency, the construction sector is under increasing pressure to comply with the European Green Deal, which mandates a 55% reduction in carbon emissions by 2030 and climate neutrality by 2050. Traditional cement production contributes approximately 8% of global CO2 emissions, prompting governments to incentivize low-carbon alternatives. Eurostat reports that countries like Germany and France have introduced carbon pricing mechanisms, with costs exceeding EUR 100 per ton of CO2 emitted in 2023, pushing manufacturers to adopt green cement solutions. Additionally, the International Energy Agency notes that subsidies for sustainable construction materials have increased by 15% annually since 2020, further encouraging adoption. These regulatory frameworks are pivotal in driving demand for eco-friendly cement and fostering innovation in the industry.

Rising Investments in Sustainable Infrastructure Projects

Rising investments in sustainable infrastructure projects are significantly propelling the Europe green cement market. The European Investment Bank reports that over EUR 350 billion was allocated to green infrastructure initiatives in 2022, including energy-efficient buildings and renewable energy installations. These projects prioritize the use of low-carbon materials, such as green cement, which reduces embodied carbon in structures by up to 40%, according to the International Labour Organization. Furthermore, Statista highlights that urbanization in Europe is expected to grow by 0.5% annually, creating a surge in demand for eco-conscious construction materials. Public-private partnerships, such as the EU’s Renovation Wave Strategy, aim to retrofit 35 million buildings by 2030, further boosting the adoption of sustainable cement. This alignment with sustainability goals underscores the critical role of green cement in meeting both environmental and developmental objectives across the region.

MARKET RESTRAINTS

High Production Costs and Limited Economies of Scale

One of the primary restraints of the Europe green cement market is the high production cost associated with eco-friendly alternatives. The European Commission reports that green cement production can be up to 30% more expensive than traditional Portland cement due to the use of advanced technologies and alternative raw materials like fly ash and slag. Eurostat highlights that small and medium-sized enterprises (SMEs), which constitute over 90% of the construction material suppliers, face significant financial barriers in scaling sustainable production. Additionally, the International Labour Organization notes that the limited availability of industrial by-products, such as blast furnace slag, restricts large-scale adoption. With profit margins already under pressure, manufacturers struggle to absorb these additional costs, making green cement less competitive in price-sensitive markets. This economic challenge hinders widespread adoption despite its environmental benefits.

Lack of Awareness and Resistance to Change

Another major restraint is the lack of awareness and resistance to change among stakeholders in the construction industry. The European Environment Agency states that only 40% of construction firms in Europe are fully aware of the benefits of green cement, leading to slow adoption rates. Traditional builders and contractors often perceive eco-friendly materials as untested or less durable, despite evidence from Statista showing that green cement meets or exceeds performance standards in 95% of applications. Furthermore, the International Energy Agency highlights that entrenched practices and reluctance to invest in training for new materials create additional barriers. Misconceptions about higher upfront costs also deter consumers, particularly in regions with weaker regulatory enforcement. This resistance to innovation slows the transition to sustainable building practices, limiting the growth potential of the green cement market in Europe.

MARKET OPPORTUNITIES

Government Incentives and Funding for Sustainable Construction

Government incentives and funding for sustainable construction present a significant opportunity for the Europe green cement market. The European Investment Bank has allocated over EUR 1 trillion to green projects under the European Green Deal, with a focus on low-carbon materials like green cement. Eurostat reports that subsidies and tax breaks for eco-friendly building materials have increased by 20% annually since 2021, making green cement more financially viable for manufacturers and consumers. Additionally, the International Labour Organization highlights that public procurement policies now prioritize sustainable materials, with green cement accounting for 15% of cement used in government-funded projects in 2022. These initiatives not only reduce production costs but also encourage innovation and scalability. As governments intensify their commitment to carbon neutrality, the demand for green cement is expected to grow exponentially, creating a lucrative market for manufacturers.

Growing Demand for Energy-Efficient Buildings and Renovations

The growing demand for energy-efficient buildings and renovations offers another major opportunity for the Europe green cement market. The European Commission states that the EU’s Renovation Wave Strategy aims to retrofit 35 million buildings by 2030, emphasizing the use of sustainable materials to reduce embodied carbon. Statista reports that the renovation market in Europe grew by 8% in 2022, with green cement being a preferred choice for modernizing aging infrastructure. Furthermore, the International Energy Agency notes that energy-efficient buildings can reduce operational carbon emissions by up to 60%, driving architects and developers to adopt low-carbon solutions. Urbanization trends, coupled with consumer awareness about sustainability, are further propelling this demand. With nearly 75% of Europe’s building stock requiring energy upgrades, green cement is well-positioned to play a pivotal role in transforming the region’s construction landscape while aligning with environmental goals.

SEGMENTAL ANALYSIS

Europe Green Cement Market By Type

The fly ash segment was the leading segment in the European green cement market with 40.4% of the European market share in 2024. The ability of fly ash to reduce clinker content by up to 30%, which is significantly lowering CO2 emissions is one of the factors driving the growth of the segment in the European market. According to the reports of the Eurostat, fly ash-based green cement is cost-effective and enhances concrete durability, which is making it ideal for large infrastructure projects. Despite a 15% decline in availability due to reduced coal-fired power generation, its widespread adoption persists. The International Energy Agency highlights that fly ash improves resistance to chemical attacks and thermal cracking, ensuring long-term performance. Its importance lies in balancing sustainability with affordability, making it a cornerstone of low-carbon construction.

The recycled aggregate segment is predicted to witness the fastest growth and register a CAGR of 6.5% over the forecast period. Factors such as circular economy initiatives of Europe that aim to reduce raw material extraction by 50%, as stated by the European Investment Bank, is driving the growth of the recycled aggregate segment in the European market. Recycled aggregate is derived from construction waste, aligning with stricter waste management regulations. Eurostat notes that urban demolition projects have increased by 10% annually, boosting supply. While challenges like quality variability persist, its application in road bases and landscaping drives demand. The International Energy Agency emphasizes its role in reducing landfill waste, underscoring its environmental and economic significance in sustainable construction practices.

Europe Green Cement Market By Application

The residential segment dominated the market by capturing 40.8% of the European market share in 2024. The domination of the residential segment is majorly driven by the growing increasing investments in sustainable housing and renovations, with the European Commission reporting a 15% rise in home improvement spending post-pandemic. Green cement is favored for its ability to reduce embodied carbon while enhancing energy efficiency, aligning with EU directives like the Energy Performance of Buildings Directive. The International Labour Organization highlights that government incentives, such as subsidies for eco-friendly materials, have further accelerated adoption. This segment's importance lies in its alignment with consumer preferences for sustainable living spaces, making it a cornerstone of the green cement market.

The infrastructure segment is on the rise and is expected to expand at a CAGR of 7.2% over the forecast period. The growth of the infrastructure segment is expected to be fuelled by large-scale sustainable projects, including roads, bridges, and public utilities, supported by over EUR 350 billion in green infrastructure funding in 2022. The International Energy Agency notes that green cement reduces the carbon footprint of infrastructure by up to 50%, making it indispensable for climate-resilient construction. Fly ash and slag-based cements are particularly valued for their durability in harsh conditions. As governments intensify efforts under the EU Green Deal, this segment's role in achieving carbon neutrality underscores its rapid expansion and long-term significance.

REGIONAL ANALYSIS

Germany led the green cement market in Europe by accounting for 25.5% of the European market share in 2024. The growth of the German market is primarily driven by the stringent environmental regulations under the European Green Deal, with the Federal Ministry for the Environment reporting that Germany aims to reduce construction-related emissions by 40% by 2030. The country’s robust manufacturing base supports innovation in low-carbon materials like slag-based cement and carbon capture technologies. Additionally, the International Energy Agency highlights that Germany’s strong emphasis on sustainable infrastructure projects, including energy-efficient buildings, has fueled demand for green cement. Government incentives, such as subsidies for eco-friendly materials, further bolster adoption. Germany’s proactive approach to sustainability and its advanced industrial ecosystem solidify its position as a leader in the green cement market.

France is a prominent green cement market in Europe. The French Ministry of Ecology reports that the country’s commitment to achieving carbon neutrality by 2050 has spurred investments in green building materials. France’s focus on aesthetic and durable construction, particularly in urban areas like Paris, drives demand for innovative cement solutions. Eurostat highlights that renovation spending in France grew by 12% in 2022, supported by tax incentives for energy-efficient home upgrades. Furthermore, the International Labour Organization notes that France’s leadership in LEED-certified projects has increased the adoption of fly ash and recycled aggregate-based cements. These factors, combined with strong policy support, position France as a key player in advancing sustainable construction practices across Europe.

Italy is likely to a key role in the European green cement market during the forecast period. The expertise of Italy in producing high-quality cement using alternative materials like fly ash and slag, which align with EU sustainability goals is propelling the Italian green cement market. The European Environment Agency highlights that Italy’s circular economy initiatives have reduced raw material extraction by 30%, boosting the use of recycled aggregates. Additionally, the country’s focus on preserving historical structures while modernizing urban infrastructure has driven demand for durable, low-carbon cement. The International Energy Agency notes that Italy’s investments in renewable energy projects and green public procurement policies further amplify its role in promoting eco-friendly construction, making it a pivotal contributor to the regional market.

KEY MARKET PLAYERS

Hoffmann Green Cement Technologies, Ecocem, CEMEX, S.A.B. de C.V., HOLCIM, Heidelberg Materials. These are the market players that are dominating the Europe green cement market.

MARKET SEGMENTATION

This research report on the Europe green cement market is segmented and sub-segmented into the following categories.

By Type

- Fly Ash

- Slag

- Recycled Aggregate

- Others

By Application

- Residential

- Non-Residential

- Infrastructure

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com