Europe Grease Market Size, Share, Trends & Growth Forecast Report By Thickener (Metallic Soap, Non-Soap, Inorganic), End-User Industry, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Grease Market Size

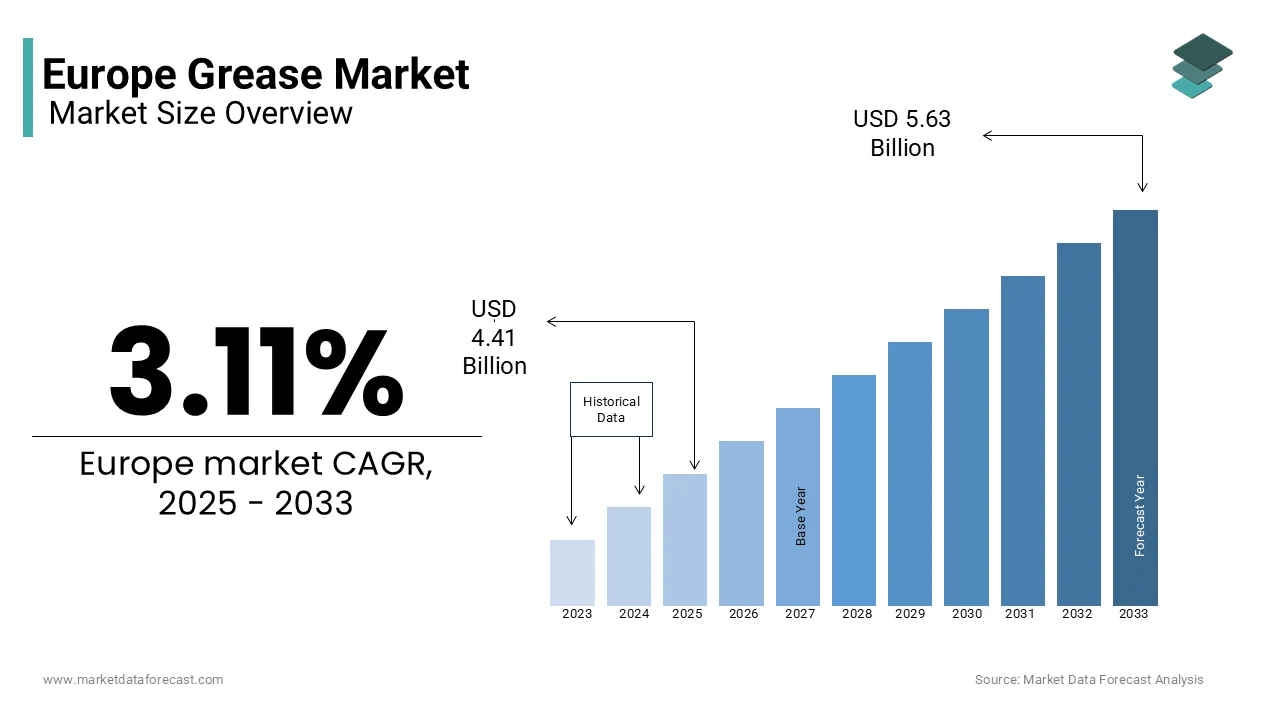

The Europe grease market size was valued at USD 4.28 billion in 2024. The European market is estimated to be worth USD 5.63 billion by 2033 from USD 4.41 billion in 2025, growing at a CAGR of 3.11% from 2025 to 2033.

The Europe grease market includes a diverse range of lubricating substances designed to reduce friction between surfaces in motion, thereby enhancing the efficiency and longevity of machinery and equipment. Also, grease is typically composed of a base oil, a thickener, and various additives that improve performance characteristics such as temperature stability, corrosion resistance, and load-bearing capacity. The market is driven by the increasing demand for high-performance lubricants across various industries, including automotive, manufacturing, and energy. This growth is attributed to the rising industrial activities and the need for efficient lubrication solutions to minimize wear and tear on machinery. Furthermore, the shift towards environmentally friendly products is influencing market dynamics, with manufacturers increasingly focusing on bio-based and biodegradable greases. The European Union's stringent regulations on environmental sustainability are also propelling innovation in grease formulations, thereby shaping the future landscape of the market.

MARKET DRIVERS

Growing Demand in the Automotive Sector

The increasing demand for high-performance lubricants in the automotive sector is a significant driver of the Europe grease market. The automotive industry which accounts for a substantial share of the grease consumption, is experiencing a paradigm shift towards advanced technologies, including electric vehicles (EVs) and hybrid models. According to the European Automobile Manufacturers Association, the production of electric vehicles in Europe is expected to reach 3 million units by 2025. This transition necessitates specialized greases that can withstand higher operating temperatures and provide superior lubrication under varying conditions. Additionally, the growing emphasis on vehicle efficiency and performance is prompting manufacturers to invest in high-quality lubricants that enhance fuel economy and reduce emissions. The automotive sector's robust growth, coupled with the increasing complexity of vehicle designs, underscores the critical role of advanced greases in ensuring optimal performance and reliability.

Resurgence of the Industrial Sector

The industrial sector's resurgence, particularly in manufacturing and heavy machinery, is another pivotal driver of the Europe grease market. The European manufacturing sector has shown resilience and growth, with the European Commission reporting a 5% increase in industrial production in 2021 compared to the previous year. This growth is accompanied by a rising need for effective lubrication solutions to enhance operational efficiency and reduce maintenance costs. Greases play a crucial role in minimizing friction and wear in machinery, thereby extending equipment life and reducing downtime. Furthermore, the increasing adoption of automation and advanced manufacturing technologies necessitates the use of specialized greases that can perform under extreme conditions. The demand for high-performance lubricants in sectors such as aerospace, construction, and energy is expected to propel the grease market forward. The industries continue to invest in modernization and efficiency improvements, and the grease market is poised for substantial growth which is driven by the need for reliable lubrication solutions.

MARKET RESTRAINTS

Volatility of Raw Material Prices

The volatility of raw material prices poses a significant restraint on the Europe grease market. The primary components of grease including base oils and thickeners, are derived from petroleum and other natural resources which are subject to price fluctuations due to geopolitical tensions, supply chain disruptions, and changes in global demand. For instance, the price of crude oil has experienced considerable volatility, with a reported increase of over 50% in 2021 alone that is impacting the cost structure of grease production. This unpredictability can lead to increased production costs for manufacturers, which may be passed on to consumers, potentially dampening demand. Additionally, the rising focus on sustainability and the transition towards bio-based lubricants may further complicate the supply chain, as sourcing sustainable raw materials can be challenging and costly.

Regulatory Challenges

Regulatory challenges also represent a significant restraint on the Europe grease market. The European Union has implemented stringent regulations regarding the environmental impact of lubricants, including the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, which mandates comprehensive testing and registration of chemical substances. Compliance with these regulations can be resource-intensive and costly for manufacturers, particularly smaller companies with limited capabilities. Furthermore, the increasing demand for environmentally friendly and biodegradable greases necessitates ongoing research and development efforts to formulate compliant products. The complexity of navigating regulatory frameworks across different European countries can also pose challenges for market participants, potentially leading to delays in product launches and increased operational costs. As the regulatory landscape continues to evolve, companies must remain agile and proactive in adapting to these changes to sustain their market presence.

MARKET OPPORTUNITIES

Sustainability and Eco-Friendly Products

The growing trend towards sustainability and eco-friendly products presents a significant opportunity for the Europe grease market. As consumers and industries increasingly prioritize environmental responsibility, there is a rising demand for biodegradable and bio-based greases. This shift is prompting manufacturers to innovate and develop sustainable grease formulations that meet both performance and environmental standards. Companies that invest in research and development to create eco-friendly products can gain a competitive edge in the market, appealing to environmentally conscious consumers and businesses. Additionally, the European Union's commitment to reducing greenhouse gas emissions and promoting sustainable practices is likely to drive further demand for green lubricants.

Adoption of Advanced Technologies

The increasing adoption of advanced technologies in various industries also offers significant opportunities for the Europe grease market. The rise of automation, robotics, and Industry 4.0 is transforming manufacturing processes, leading to a greater need for specialized lubricants that can perform under demanding conditions. For instance, the integration of smart technologies in machinery requires greases that can withstand higher temperatures and provide superior lubrication to ensure optimal performance. The global market for industrial automation is projected to reach €200 billion by 2025, with Europe being a key player in this growth. This trend is driving demand for high-performance greases that can enhance the efficiency and reliability of automated systems. Furthermore, the ongoing development of electric vehicles and renewable energy technologies necessitates innovative lubrication solutions tailored to meet the unique requirements of these applications.

MARKET CHALLENGES

Competition from Alternative Solutions

The increasing competition from alternative lubrication solutions poses a significant challenge to the Europe grease market. For instance, solid lubricants can provide effective lubrication in extreme conditions where traditional greases may fail. This shift towards alternative solutions can lead to a decline in grease consumption, particularly in sectors where performance requirements are evolving. Additionally, the emergence of new technologies, such as nanotechnology and advanced coatings, is further intensifying competition in the lubrication market. Manufacturers must continuously innovate and differentiate their products to maintain market share and address the changing needs of consumers. The challenge of adapting to these competitive pressures while ensuring product quality and performance can strain resources and impact profitability.

Economic Fluctuations and Uncertainties

The impact of economic fluctuations and uncertainties also presents a challenge for the Europe grease market. Economic downturns can lead to reduced industrial activity and lower demand for lubricants, as companies may cut back on maintenance and operational expenditures. The COVID-19 pandemic exemplified this challenge, with many industries experiencing significant disruptions and declines in production. As per the European Commission, the EU economy contracted by 6.3% in 202 and is leading to decreased demand for lubricants across various sectors. While the market has shown signs of recovery, ongoing uncertainties related to geopolitical tensions, inflation, and supply chain disruptions can hinder growth prospects. Manufacturers must remain vigilant and adaptable to navigate these economic challenges, ensuring they can respond effectively to fluctuations in demand and maintain operational resilience in an unpredictable market environment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.11% |

|

Segments Covered |

By Thickener, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

FUCHS, Royal Dutch Shell, Lukoil, Lubrita, and Axel Christiernsson International AB, which together account for about 67% of the market share. Other notable companies in this sector are ExxonMobil Corporation, CONDAT Group, JXTG Nippon Oil & Energy Europe Limited (ENEOS), Brugarolas SA, and others. |

SEGMENTAL ANALYSIS

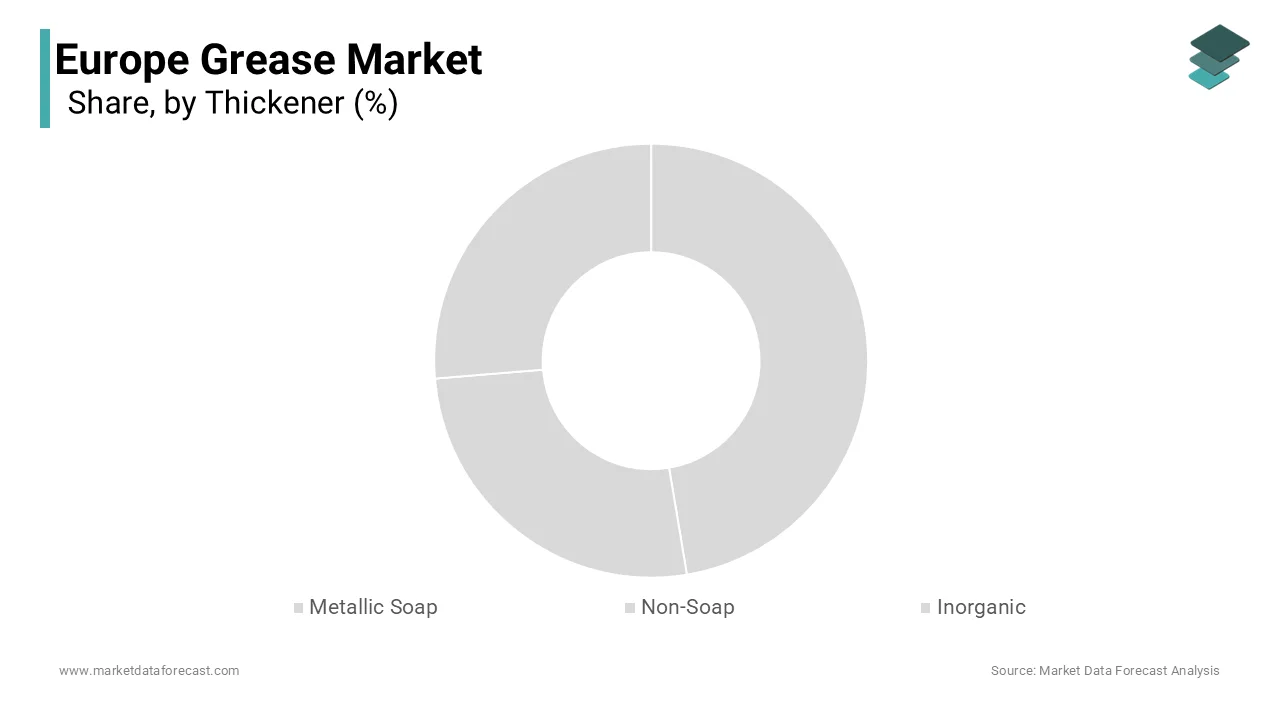

By Thickener Insights

Metal Soaps and Other Thickeners

The segment of metal soaps and other thickeners represented the largest share of the Europe grease market and accounted for 60.5% of the total market share in 2024. This position in the market can be attributed to the widespread use of metal soap thickeners, such as lithium and calcium soaps which are favored for their excellent performance characteristics, including high-temperature stability and water resistance. Moreover, the versatility of metal soap thickeners makes them suitable for a wide range of applications across various industries including automotive, manufacturing, and construction.

According to industry estimates, the demand for metal soap thickeners is projected to surge greatly which is propelled by the increasing need for reliable lubrication solutions in industrial applications. The segment is demonstrated by its ability to provide effective lubrication under challenging conditions, thereby enhancing the performance and longevity of machinery. The industries continue to prioritize efficiency and reliability and ultimately, the metal soap thickener segment is likely to maintain its leading position in the grease market.

Non-Soap Thickeners

The fastest-growing segment within the Europe grease market is the non-soap thickeners which is projected to experience a CAGR of 6.2% from 2025 to 2033. This development can be linked to the increasing demand for specialized lubricants that can perform under extreme conditions, such as high temperatures and heavy loads. Non-soap thickeners including polyurea and clay-based thickeners offer unique properties that make them suitable for specific applications, particularly in the automotive and aerospace sectors. The rising trend towards electric vehicles and advanced manufacturing technologies is further driving the demand for non-soap thickeners, as these applications require lubricants that can withstand higher operating temperatures and provide superior performance. The importance of this segment lies in its ability to meet the evolving needs of industries seeking innovative lubrication solutions.

By End-User Industry Insights

Automotive and Other Transportation

The automotive and other transportation segment stands as the top contributor to the Europe grease market and commanded 45.4% of the total market share in 2024. This trajectory in recent years is greatly caused by the extensive use of greases in various automotive applications, including bearings, chassis, and engine components. The European automotive industry is one of the largest in the world with over 15 million vehicles produced annually, according to the European Automobile Manufacturers Association. The increasing focus on vehicle performance, fuel efficiency, and the transition towards electric vehicles is further propelling the demand for high-quality lubricants. The auto makers strive to meet stringent performance standards and enhance the longevity of automotive components the automotive segment is expected to maintain its leading position in the grease market. The critical role of greases in ensuring optimal performance and reliability in vehicles underscores the importance of this segment in driving market growth. Since the automotive industry continues to innovate and adapt to changing consumer preferences, the demand for advanced lubrication solutions will remain strong, further strengthening the automotive sector's dominance in the European grease market.

Food and Beverage Industry

The swift moving ahead in the Europe grease market is the food and beverage industry and is predicted to achieve a CAGR of 7.6% during the forecast period. This progress is influenced by the increasing demand for food-grade lubricants that comply with stringent safety and regulatory standards. The food and beverage sector is experiencing significant expansion, driven by changing consumer preferences and the rising demand for processed and packaged foods. According to the European Food and Drink Industry Confederation, the food and beverage sector in Europe generated over €1 trillion in revenue in 2020 is showcasing its substantial economic impact. The need for lubricants that are safe for use in food processing and packaging applications is paramount, as any contamination can have serious health implications. Consequently, manufacturers are increasingly focusing on developing high-performance, food-grade greases that meet regulatory requirements, such as those set by the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). This part is pointed by its capability to ensure operational efficiency while adhering to safety standards, making it a critical area for growth in the grease market.

REGIONAL ANALYSIS

Germany stands out as the leading country in the European grease market and accounted for 26.2% of the total market share in 2024. The robust industrial base and advanced manufacturing capabilities of Germany contribute significantly to this dominance. The country is home to numerous automotive manufacturers and machinery producers, which are major consumers of grease products. According to the German Engineering Federation, the machinery and equipment sector alone generated over €200 billion in revenue in 2021, underscoring the critical role of lubrication in maintaining operational efficiency. Additionally, Germany's commitment to innovation and sustainability is driving the development of high-performance greases that meet the evolving needs of various industries.

France follows closely in the grease in Europe by holding 20.5% of the market share in 2024. The French automotive and aerospace industries are significant contributors to this demand, with the country being home to major manufacturers such as Renault and Airbus. The French automotive sector produced over 1.5 million vehicles in 2021, according to the French Automobile Manufacturers Association, showcasing the substantial need for high-quality lubricants. Furthermore, France's focus on sustainability and environmental regulations is driving the demand for eco-friendly greases is aligning with the broader European trend towards greener products. As industries in France continue to innovate and adapt to changing market dynamics, the grease market is poised for continued growth.

Italy has a strong manufacturing base in the Europe grease market. The Italian manufacturing sector, particularly in machinery and automotive, is a key driver of grease consumption. According to the Italian National Institute of Statistics, the manufacturing sector contributed over €200 billion to the national economy in 2021. The increasing focus on efficiency and performance in Italian industries is propelling the demand for advanced lubrication solutions. Additionally, Italy's strategic location within Europe facilitates trade and distribution, further enhancing its position in the grease market.

The United Kingdom is another significant contributor in the Europe grease market. The UK automotive and aerospace sectors are major consumers of grease products, with the automotive industry producing over 1.3 million vehicles in 2021, according to the Society of Motor Manufacturers and Traders. The emphasis on high-performance lubricants in these industries is driving demand for specialized grease formulations. Furthermore, the UK's commitment to sustainability and regulatory compliance is influencing the development of eco-friendly lubricants, aligning with broader market trends.

Spain is an emerging country in the European grease market by accounting for 10.5% of the market share in 2024. The Spanish automotive industry, which produced over 2 million vehicles in 2021, according to the Spanish Association of Automobile and Truck Manufacturers, is a significant driver of grease demand. Additionally, Spain's growing manufacturing sector and focus on innovation are contributing to the increasing consumption of lubricants. The emphasis on efficiency and performance in Spanish industries is expected to drive further growth in the grease market. As Spain continues to develop its industrial capabilities, the demand for high-quality lubricants is anticipated to rise, reinforcing its position in the European grease market.

KEY MARKET PLAYERS

The major key players in Europe Grease market are FUCHS, Royal Dutch Shell, Lukoil, Lubrita, and Axel Christiernsson International AB, which together account for about 67% of the market share. Other notable companies in this sector are ExxonMobil Corporation, CONDAT Group, JXTG Nippon Oil & Energy Europe Limited (ENEOS), Brugarolas SA, and others.

MARKET SEGMENTATION

This research report on the Europe grease market is segmented and sub-segmented into the following categories.

By Thickener

- Metallic Soap

- Non-Soap

- Inorganic

By End-User Industry

- Power Generation

- Automotive

- Heavy Equipment

- Food and Beverage

- Chemical Manufacturing

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]