Europe Golf Cart Market Research Report – Segmented By Product Type ( Electric Golf Carts, Solar-Powered Golf Carts ) Application ( Golf Courses, Commercial Services ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Golf Cart Market Size

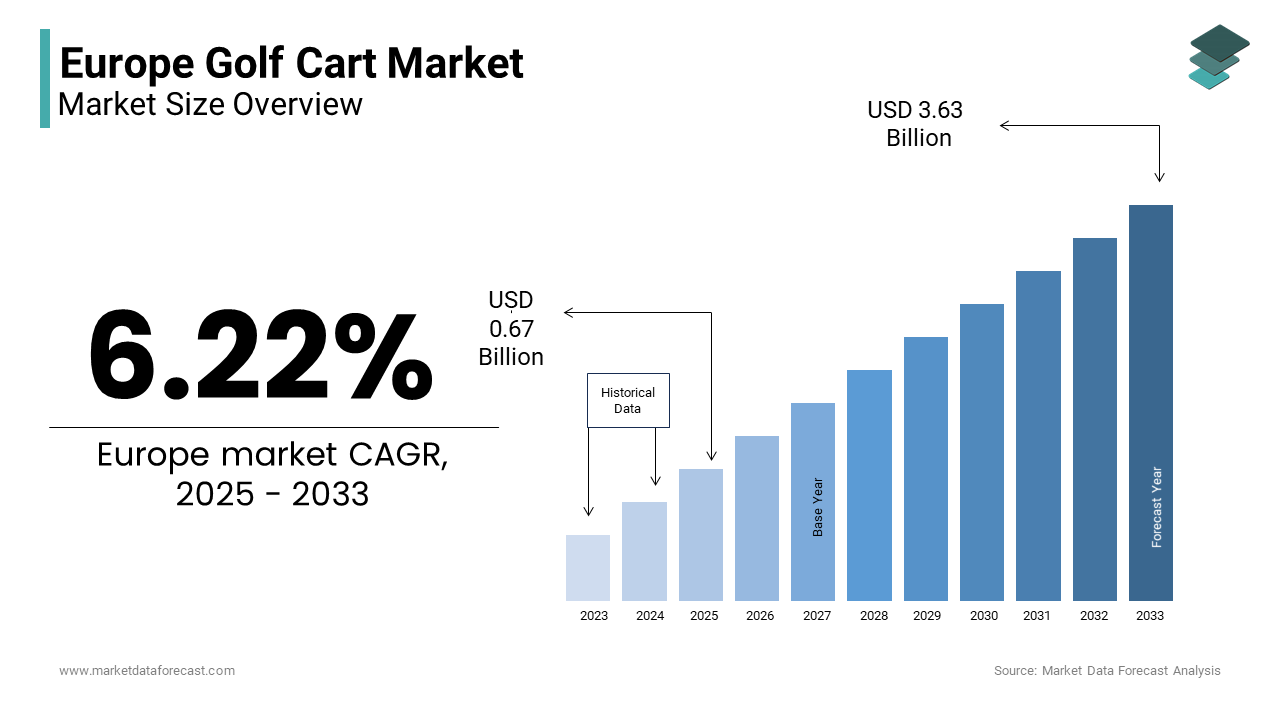

The Europe Golf Cart Market Size was valued at USD 0.63 billion in 2024. The Europe Golf Cart Market size is expected to have 6.22 % CAGR from 2025 to 2033 and be worth USD 3.63 billion by 2033 from USD 0.67 billion in 2025.

The European golf cart market has witnessed steady growth and is driven by the increasing popularity of golf as a recreational activity and the rising adoption of eco-friendly transportation solutions. Countries like the UK, Germany, and France are key contributors due to their well-established golf tourism industries and stringent environmental regulations promoting zero-emission vehicles. The European Union’s Green Deal initiative has further accelerated the adoption of sustainable mobility solutions, including golf carts, particularly in commercial and hospitality sectors. Additionally, the growing trend of integrating golf carts into personal and commercial services, such as resorts and gated communities, underscores the market's versatility and potential for expansion.

MARKET DRIVERS

Growing Popularity of Golf Tourism

The surge in golf tourism is a significant driver of the European golf cart market, with over 6 million golf tourists visiting Europe annually, as reported by the European Golf Association. This influx of visitors has led to increased investments in golf course infrastructure, where golf carts are indispensable. Courses like St. Andrews in Scotland and Le Golf National in France have expanded their fleets to accommodate growing demand. Moreover, premium golf resorts are adopting high-end electric carts equipped with GPS and entertainment systems enhancing the overall golfing experience. As per a study by the International Tourism Partnership, golf tourism contributes over €10 billion annually to the European economy. This economic impact incentivizes stakeholders to invest in advanced golf cart technologies, further fueling market growth.

Adoption of Eco-Friendly Mobility Solutions

Europe’s stringent environmental regulations have propelled the adoption of eco-friendly golf carts, particularly electric and solar-powered models. The European Environment Agency reports that a considerable proportion of urban areas now prioritize zero-emission vehicles for public and private use. Golf courses, hotels, and gated communities are transitioning to electric carts to comply with these regulations and reduce carbon footprints. For example, Club de Golf Alcanada in Spain replaced its entire fleet with solar-powered carts, achieving a 30% reduction in energy costs. Besides, government incentives, such as tax rebates for electric vehicle purchases, encourage businesses to adopt sustainable solutions. These factors collectively drive the demand for environmentally conscious mobility options within the golf cart market.

MARKET RESTRAINTS

High Initial Costs of Advanced Models

A significant restraint hindering the broader adoption of golf carts in Europe is the high initial investment required for advanced models, particularly electric and solar-powered variants. This financial barrier is particularly challenging for small golf courses and local businesses operating on tight budgets. For instance, a survey conducted by the European Small Business Alliance revealed that nearly 60% of SMEs cite upfront costs as a major obstacle to adopting modern golf carts. The need for additional investments in charging infrastructure and maintenance further compounds the financial burden, limiting market penetration.

Limited Awareness and Infrastructure Support

Another critical restraint is the limited awareness and infrastructure support for alternative-powered golf carts, such as solar models. Despite advancements in technology, many users remain unfamiliar with the benefits of solar-powered carts, as noted by the European Solar Energy Society. Moreover, the lack of widespread charging stations and repair facilities for electric carts hampers their adoption. For example, rural golf courses often face challenges in maintaining electric fleets due to inadequate infrastructure. This limitation stifles the technology’s potential, particularly in regions where access to renewable energy solutions is underdeveloped, creating barriers to market expansion.

MARKET OPPORTUNITIES

Expansion into Non-Golf Applications

The European golf cart market presents significant opportunities beyond traditional golf courses, particularly in sectors like hospitality, logistics, and urban mobility. According to the European Hospitality Association, hotels and resorts contribute notably to golf cart sales outside golf courses. These establishments utilize carts for guest transportation, luggage handling, and food delivery, enhancing operational efficiency. For instance, luxury resorts in the French Riviera have integrated customized golf carts into their services, improving guest satisfaction. Additionally, the rise of smart city initiatives has created demand for compact, eco-friendly vehicles like golf carts for last-mile delivery and security patrols. This diversification into non-golf applications broadens the market’s scope and ensures sustained growth.

Technological Advancements in Electric Models

Technological innovations in electric golf carts present another lucrative opportunity, driven by the growing emphasis on sustainability and connectivity. According to the European Technology Platform on Smart Systems Integration, a considerable share of new electric carts sold in 2023 featured smart technologies. These advancements not only enhance user experience but also open doors to data-driven services like predictive maintenance and fleet management. For example, German golf courses have adopted IoT-integrated carts to optimize route planning, reducing operational costs by 15%. This focus on innovation positions the market for exponential growth in the coming years.

MARKET CHALLENGES

Regulatory Hurdles Across Regions

A pressing challenge facing the European golf cart market is the inconsistency in regulatory frameworks governing low-speed vehicles. While some countries, like Germany, have clear guidelines for electric carts, others lack standardized regulations, creating uncertainty for manufacturers and operators. According to the European Automobile Manufacturers’ Association, this inconsistency has resulted in a fragmented market, where compliance costs vary significantly across regions. For instance, Italian municipalities impose additional fees for operating electric carts in urban areas, discouraging businesses from adopting them. These regulatory hurdles hinder market harmonization and limit cross-border expansion opportunities.

Seasonal Demand Variability

Further challenge is the seasonal nature of golf cart demand, which fluctuates based on weather conditions and tourism patterns. Northern European countries, such as Sweden and Norway, experience reduced usage during winter months, impacting sales and rental revenues. A study by the European Leisure Industry Association highlights that a significant portion of golf cart rentals occur between April and October. This variability forces manufacturers and service providers to adopt flexible business models, such as off-season discounts or alternative applications. However, addressing this issue requires innovative strategies to maintain consistent revenue streams throughout the year.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.22 % |

|

Segments Covered |

By Product Type,Application and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

Yamaha Golf-Car Company (Georgia, U.S.),Textron Inc. (Rhode Island, U.S.),Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd. |

SEGMENT ANALYSIS

By Product Type Inisghts

The electric golf carts dominated the European market, accounting for 65.2% of total sales in 2024. This performance is driven by their eco-friendly nature and alignment with stringent EU emissions regulations. For instance, the UK’s Net Zero Strategy mandates the adoption of zero-emission vehicles in recreational and commercial sectors, boosting electric cart adoption. Additionally, advancements in battery technology, such as lithium-ion systems, have extended operational ranges by up to 50%, enhancing user convenience. Golf courses like Wentworth in England have transitioned entirely to electric fleets, achieving a 30% reduction in operational costs. These factors, coupled with government incentives like tax rebates, stregthen the dominance of electric golf carts.

The solar-powered golf carts segment is the fastest-growing segment, with a projected CAGR of 18.1% from 2025 to 2033. This growth is fueled by increasing awareness of renewable energy solutions and declining solar panel costs. For example, Club de Golf Alcanada in Spain has adopted solar carts, reducing energy expenses by 40%. The integration of lightweight, high-efficiency solar panels has improved performance, making these carts viable for diverse applications. Moreover, partnerships between manufacturers and solar technology providers, such as SunPower, have accelerated innovation. As sustainability becomes a priority, solar-powered carts are poised to gain significant traction.

By Application Inisghts

The golf courses segment represented the largest application by contributing over 56.7% to the European golf cart market in 2024. This control over the market is caused by the indispensable role of golf carts in enhancing player experience and operational efficiency. Prestigious courses like St. Andrews in Scotland utilize advanced electric carts equipped with GPS and entertainment systems, attracting premium clientele. Furthermore, the growing number of golf tourists drives demand for reliable and modern fleets. Investments in sustainable practices, such as transitioning to electric carts, align with environmental goals, reinforcing this segment’s leadership.

The commercial services including resorts, hotels, and gated communities are the rapidly expanding application segment, with a CAGR of 20%. This progress is propelled by the versatility of golf carts in enhancing guest experiences and operational efficiency. For instance, luxury resorts in the French Riviera use customized carts for luggage transport and food delivery, improving satisfaction scores. Additionally, smart city initiatives have expanded their use for last-mile logistics and security patrols. The adaptability of golf carts to diverse commercial needs ensures sustained expansion in this segment.

COUNTRY LEVEL ANALYSIS

Germany commanded the European golf cart market by contributing 25.8% to regional sales in 2024. This is emphasized by its robust golf tourism industry and stringent environmental policies promoting zero-emission vehicles. For instance, Bavarian golf courses have adopted electric carts on a large scale, supported by government subsidies. Germany’s strong manufacturing base and technological expertise further enhance its market position, ensuring continued dominance.

Spain exhibits the highest growth rate, with a CAGR of 22% . This development is fueled by the country’s thriving golf tourism sector and favorable climate conditions. Resorts in regions like Costa del Sol have integrated solar-powered carts, aligning with sustainability goals. Other countries like Italy and France are expected to follow, driven by similar tourism and environmental priorities.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe Golf Cart Market are Yamaha Golf-Car Company (Georgia, U.S.),Textron Inc. (Rhode Island, U.S.),Suzhou Eagle Electric Vehicle Manufacturing Co. Ltd. (Suzhou, China),CLUB CAR (Georgia, U.S.),Cruise Car, Inc. (Florida, U.S.),Garia, Inc. (Texas, U.S.),JH Global Services, Inc. (South Carolina, U.S.),SHOWA DENKO K.K. (Tokyo, Japan),Columbia Vehicle Group Inc. (Wisconsin, U.S.)

The European golf cart market is highly competitive, characterized by intense rivalry among established players and emerging startups. Innovations in electric and solar-powered models drive differentiation. Collaborations with industry bodies and government agencies further intensify competition, ensuring rapid technological advancements. The focus on sustainability and customization positions leaders like Club Car, Yamaha, and E-Z-GO at the forefront of this dynamic landscape.

Top Players in the Market

Club Car

Club Car holds a prominent position in the European market, renowned for its innovative electric and gasoline-powered models. The company excels in delivering durable, high-performance carts tailored to golf courses, resorts, and urban mobility solutions. Its focus on integrating IoT-enabled technologies, such as GPS and diagnostics, enhances user experience and operational efficiency. Collaborations with European golf associations further strengthen its leadership position.

Yamaha

Yamaha is a key innovator in the European golf cart landscape, offering advanced electric and hybrid models. The company’s strength lies in its extensive R&D capabilities and commitment to sustainability. Yamaha’s carts are widely adopted in hospitality and commercial sectors due to their reliability and versatility. Strategic partnerships with solar technology providers ensure it remains at the forefront of innovation.

E-Z-GO

E-Z-GO commands a significant presence in Europe, leveraging its expertise in compact, eco-friendly vehicles. The company’s offerings cater to diverse applications, from golf courses to gated communities. Its emphasis on customer-centric design and affordability has earned it a loyal customer base. By expanding its product portfolio and entering new verticals, E-Z-GO continues to drive market growth.

Top strategies used by the key market participants

Key strategies include product innovation, strategic partnerships, and geographic expansion. For instance, Club Car partnered with European golf associations to develop customized solutions for premium courses. Yamaha focused on integrating renewable energy technologies, such as solar panels, into its carts. E-Z-GO expanded its footprint in emerging markets through collaborations with local distributors. These initiatives enhance market presence and foster innovation.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Club Car launched its Connect Series, featuring IoT-enabled carts for enhanced user experience.

- In May 2023, Yamaha introduced solar-integrated carts, targeting eco-conscious golf courses in Spain.

- In July 2023, E-Z-GO expanded its distribution network in Eastern Europe to tap into emerging markets.

- In September 2023, Club Car partnered with the European Golf Tourism Association to promote electric carts.

- In November 2023, Yamaha acquired a solar technology startup to enhance its renewable energy offerings.

MARKET SEGMENTATION

This research report on the europe golf cart market has been segmented and sub-segmented into the following categories.

By Product Type

- Electric Golf Carts

- Solar-Powered Golf Carts

By Application

- Golf Courses

- Commercial Services

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

Which countries in Europe are leading in golf cart adoption?

Germany, France, the UK, Spain, and Italy are among the leading countries in golf cart adoption due to strong golf tourism and growing interest in sustainable transport solutions.

What are the major drivers of growth in the Europe golf cart market?

Key drivers include the expansion of golf tourism, increasing urbanization, adoption of eco-friendly transportation options, and the use of golf carts in commercial and industrial sectors.

What types of golf carts are popular in the European market?

Electric golf carts are gaining popularity due to environmental regulations and a push for zero-emission vehicles. Gasoline and solar-powered carts also have a presence but are less dominant.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]