Europe Gold Nanoparticle Market Size, Share, Trends & Growth Forecast Report, Segmented By End-User, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Gold Nanoparticle Market Size

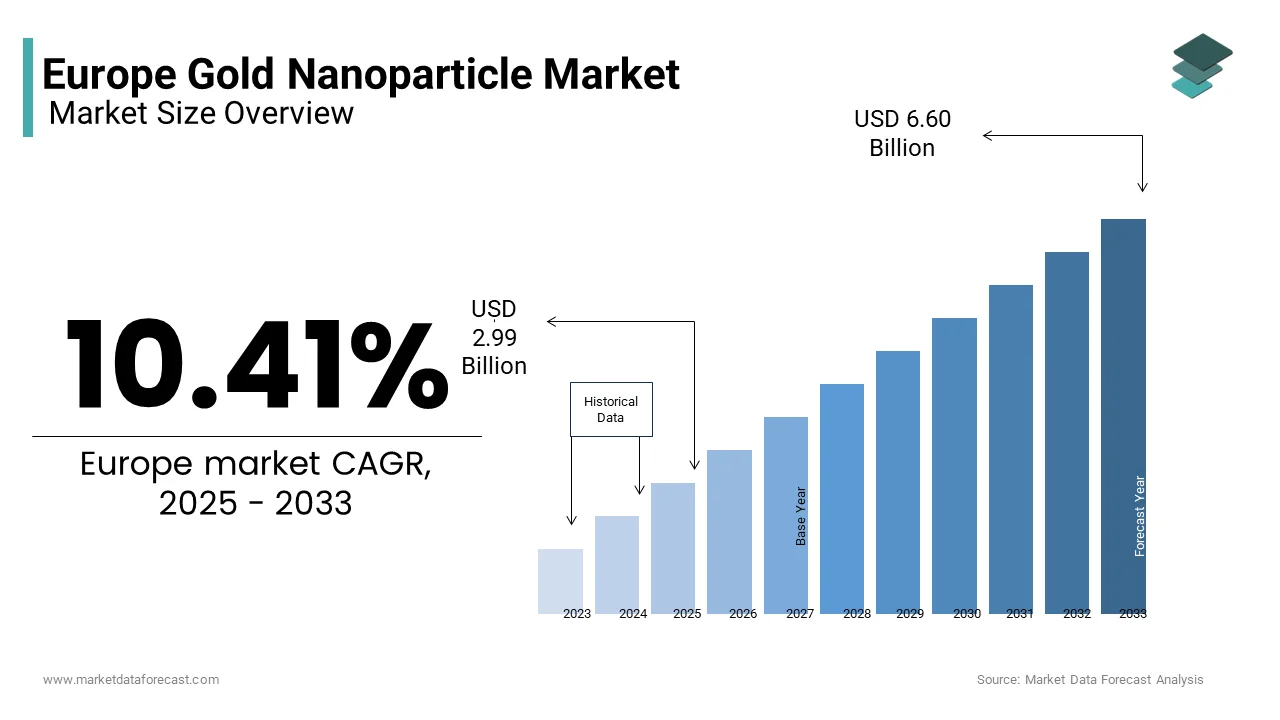

The Europe gold nanoparticle market was valued at USD 2.1 billion in 2024 and is anticipated to reach USD 2.99 billion in 2025 from USD 6.60 billion by 2033, growing at a CAGR of 10.41% during the forecast period from 2025 to 2033.

The Europe gold nanoparticle market is a thriving sector which is driven by its applications across industries such as healthcare, electronics, and catalysis. Also, the demand is fueled by advancements in nanotechnology, with Germany contributing over 25% of the regional market share. A report by the European Commission shows that investments in research and development for nanomaterials have surged significantly in recent years. Regulatory frameworks supporting sustainable manufacturing practices further enhance market stability. The medical sector's adoption of gold nanoparticles for diagnostics and therapeutics has grown by 18% year-on-year, as per a study by the European Nanomedicine Association.

MARKET DRIVERS

Rising Demand in Medical & Dentistry Applications

The medical and dentistry sector is a significant driver for the Europe gold nanoparticle market. Gold nanoparticles are extensively used in cancer therapy, drug delivery systems, and diagnostic imaging due to their biocompatibility and unique optical properties. The use of gold nanoparticles in photothermal therapy increased significant since 2021. Additionally, the rising prevalence of chronic diseases in Europe, with chronic diseases are the leading cause of mortality and morbidity, drives the need for advanced therapeutic solutions. This growing reliance on precision medicine propels the demand for gold nanoparticles, ensuring steady growth in the region.

Technological Advancements in Electronics

The electronics industry is another major driver, with gold nanoparticles being integral to conductive inks, sensors, and flexible displays. Gold nanoparticles enhance conductivity and durability, making them indispensable in miniaturized electronic components. Furthermore, the shift toward wearable technology and IoT devices has increased the adoption of these nanoparticles considerably in recent years. With Europe being a hub for innovation in electronics, this trend underscores the pivotal role of technological advancements in driving the market forward.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints for the Europe gold nanoparticle market is the high cost of production, which limits accessibility for smaller enterprises. This cost barrier is exacerbated by the volatility of gold prices, which fluctuated greatly. Small-scale manufacturers face challenges in scaling production without substantial financial backing. Additionally, the energy-intensive synthesis processes required for nanoparticles contribute to elevated operational costs. As a result, the affordability of gold nanoparticles remains a critical concern for widespread adoption.

Stringent Regulatory Frameworks

Stringent regulatory requirements pose another significant restraint, particularly in the medical and food industries. According to the European Medicines Agency, nanoparticles must undergo rigorous safety assessments, which can take up to five years and costly per product. These regulations aim to ensure biocompatibility and minimize environmental risks but often delay product launches. A study by the European Environment Agency highlights that compliance costs account for 20% of total expenses for nanoparticle-based products. Moreover, varying standards across EU member states create additional hurdles for cross-border trade. Such complexities discourage new entrants and slow down innovation.

MARKET OPPORTUNITIES

Expansion in Catalysis Applications

The catalysis sector presents a lucrative opportunity for the Europe gold nanoparticle market. Gold nanoparticles exhibit exceptional catalytic activity, particularly in carbon monoxide oxidation and hydrogenation reactions. The push for sustainable industrial processes has significantly increased their adoption in the last few years. A report by the European Technology Platform for Sustainable Chemistry highlights that over 60% of chemical manufacturers are exploring nanoparticle-based catalysts to reduce energy consumption. Furthermore, the European Green Deal emphasizes reducing carbon emissions, creating a favorable environment for innovations in green chemistry.

Growth in Environmental Applications

Environmental remediation is another promising avenue, driven by the increasing focus on sustainability. Gold nanoparticles are effective in water purification, removing heavy metals and organic pollutants. Additionally, the EU’s Horizon Europe program allocates €10 billion for green technologies, fostering innovation in this domain. As environmental regulations tighten, the demand for gold nanoparticles in pollution control and resource recovery is set to surge, unlocking new opportunities for market players.

MARKET CHALLENGES

Limited Awareness Among End-Users

A significant challenge facing the Europe gold nanoparticle market is the limited awareness among end-users, particularly in non-traditional sectors like agriculture and textiles. There is lesser percentage of potential users who are familiar with the benefits of gold nanoparticles. This lack of awareness restricts market expansion beyond established industries like healthcare and electronics. Besides, misconceptions about the safety and environmental impact of nanoparticles persist, further deterring adoption. A report by the European Consumers Organization highlights that over 40% of businesses hesitate to invest in nanotechnology due to perceived risks.

Supply Chain Disruptions

Supply chain vulnerabilities pose another challenge, exacerbated by geopolitical tensions and economic uncertainties. The reliance on imported gold, particularly from South Africa and Australia, makes the market susceptible to price fluctuations and logistical delays. Furthermore, the complexity of nanoparticle synthesis adds layers of dependency on specialized equipment and skilled labour. Such supply chain challenges hinder consistent production and timely delivery and is impacting customer trust and market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.41% |

|

Segments Covered |

By End-User and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Cytodiagnostics Inc., Goldsol Inc, BBI Solutions, NanoHybrids Inc., Nanopartz Inc., Nanosphere Inc., Nanostellar Inc., Solaris Nanosciences Corporation, Tanaka Holdings Co. Ltd., The Metalor Group, Sigma Aldrich. |

SEGMENTAL ANALYSIS

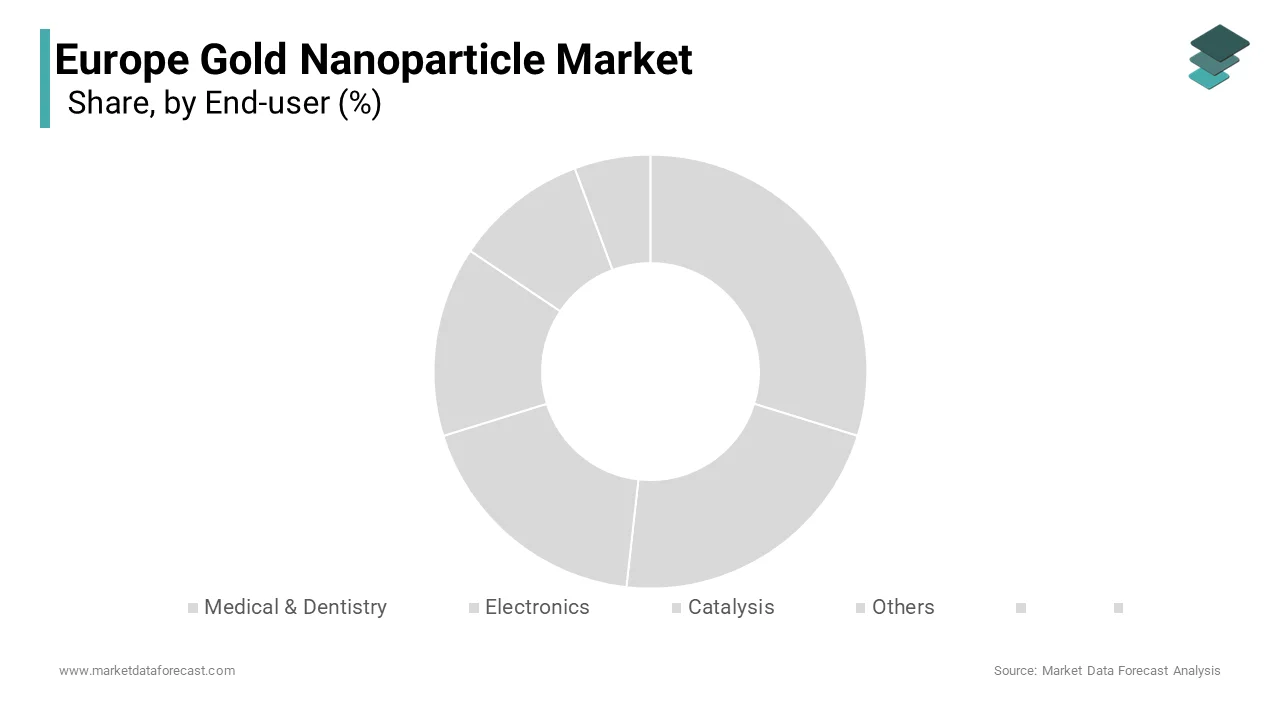

By End-User Insights

The medical and dentistry segment dominated the Europe gold nanoparticle market by holding a 45% share in 2024. This dominance of the segment is credited to the nanoparticles' role in cancer therapeutics, where their usage has increased notably in recent years. Also, the precision offered by gold nanoparticles in targeted drug delivery systems has revolutionized oncology. Additionally, advancements in dental implants and prosthetics drive demand, as these nanoparticles enhance biocompatibility and durability.

The electronics segment is the fastest-growing, with a CAGR of 14.2%. This growth is fueled by the rising adoption of gold nanoparticles in flexible displays and wearable devices. Innovations in IoT and 5G technologies further amplify the need for efficient conductive materials. Additionally, the European Green Deal promotes sustainable electronics, encouraging the use of eco-friendly nanoparticles. With Europe significantly investing annually in semiconductor research, the electronics segment is set to maintain its rapid growth trajectory.

COUNTRY ANALYSIS

Germany held the largest market share of 30.3% in the Europe gold nanoparticle market in 2024. This position in the market is driven by its robust R&D ecosystem, with many nanotechnology-focused firms operating within the country. Also, Germany’s influence is further bolstered by its strong healthcare sector, which accounts for portion of the gold nanoparticle demand in the region. The German government allocates substantial funds annually to support nanotechnology research, fostering innovation in medical diagnostics, cancer treatment, and dentistry applications. Additionally, the country's emphasis on precision engineering and high-quality manufacturing processes ensures consistent demand for gold nanoparticles. The nation’s proactive regulatory framework and focus on sustainability further strengthen its position as a leader in the gold nanoparticle market.

France is the fastest-growing market, with a CAGR of 15.3%. This rapid expansion is caused by investments in green technologies and environmental applications, where gold nanoparticles are used for water purification and pollution control. The French government has committed €54 billion to fund eco-friendly innovations under the France 2030" investment plan which is driving adoption in this segment. Furthermore, the rise of nanomedicine applications has seen a quick annual increase in demand. France’s strategic focus on IoT and 5G technologies has also propelled the use of gold nanoparticles in flexible electronics and wearable devices. With initiatives like the French Tech Mission fostering startup ecosystems, the country is well-positioned to maintain its growth momentum.

Italy and Spain are projected to grow steadily which is driven by their focus on environmental remediation and catalysis applications. According to the Spanish Ministry of Science and Innovation, Spain’s wastewater treatment sector, valued at €3 billion in 2022, is adopting gold nanoparticles for advanced filtration systems. On the other hand, the UK stands out for its expertise in electronics, particularly in semiconductor design, leveraging its high investment in nanotechnology research. These regions are expected to witness steady growth, with increasing adoption across diverse industries.

KEY MARKET PLAYERS

Cytodiagnostics Inc., Goldsol Inc, BBI Solutions, NanoHybrids Inc., Nanopartz Inc., Nanosphere Inc., Nanostellar Inc., Solaris Nanosciences Corporation, Tanaka Holdings Co. Ltd., The Metalor Group, Sigma Aldrich. are the market players that are dominating the Europe gold nanoparticles market.

Top Players In The Market

Nanogold GmbH (Germany)

Nanogold GmbH is a leading player in the Europe gold nanoparticle market. The company specializes in producing high-purity gold nanoparticles for medical applications, particularly in cancer therapeutics and diagnostic imaging. Its strategic partnerships with academic institutions and hospitals have enabled it to develop cutting-edge solutions, such as targeted drug delivery systems. According to the European Federation of Pharmaceutical Industries and Associations, Nanogold GmbH’s products are used in over 100 clinical trials across Europe. The company’s focus on biocompatibility and regulatory compliance has strengthened its reputation as a trusted supplier.

Gold Nano Tech Ltd. (UK)

Gold Nano Tech Ltd. holds a significant share of the market and excels in electronics applications. The company has pioneered the development of conductive inks and flexible displays, leveraging its proprietary synthesis techniques to produce uniform nanoparticles. Also, the company’s expansion into emerging markets, such as India and China, has further strengthened its global presence. Gold Nano Tech Ltd. also invests heavily in R&D, allocating a notable portion to its revenue to explore new applications in IoT and 5G technologies.

Eco Gold Nanoparticles (France)

Eco Gold Nanoparticles leads the catalysis segment. The company focuses on sustainable manufacturing practices, aligning with the European Green Deal’s objectives. Moreover, the company’s commitment to environmental applications, such as water purification and pollution control, has earned it significant recognition. Eco Gold Nanoparticles has also partnered with major chemical manufacturers to develop cost-effective solutions, ensuring widespread adoption.

Top Strategies Used By Key Players

The key players in the Europe gold nanoparticle market employ a variety of strategies to strengthen their positions and drive growth. Strategic partnerships with academic and research institutions are a common approach, enabling companies to leverage cutting-edge innovations. For instance, Nanogold GmbH collaborates with universities to advance nanomedicine applications, while Gold Nano Tech Ltd. partners with semiconductor manufacturers to enhance product performance. Another prominent strategy is geographic expansion, with companies like Eco Gold Nanoparticles entering emerging markets to tap into new customer bases. Investments in R&D remain a cornerstone of competitive advantage, with firms allocating significant resources to explore novel applications and improve production efficiency. Additionally, mergers and acquisitions are frequently used to consolidate market share and diversify product portfolios. Sustainability initiatives, such as Eco Gold’s focus on green chemistry, are also critical in aligning with regulatory requirements and consumer preferences.

COMPETITION OVERVIEW

The Europe gold nanoparticle market is characterized by intense competition, driven by the presence of both established players and innovative startups. Companies strive to differentiate themselves through technological advancements, quality assurance, and regulatory compliance. The market’s fragmented nature, with numerous small and medium-sized enterprises, fosters a dynamic environment where innovation thrives. According to the European Nanotechnology Trade Alliance, over 500 firms are actively involved in the production and application of gold nanoparticles, creating a highly competitive landscape. Established players dominate through economies of scale and extensive distribution networks, while startups bring fresh ideas and niche applications to the table. Regulatory frameworks play a pivotal role in shaping competition, as stringent safety and environmental standards require significant investments in compliance. Additionally, collaborations with research institutions and participation in government-funded projects provide a competitive edge. The emphasis on sustainability and eco-friendly solutions further intensifies competition, as companies vie to meet the growing demand for green technologies.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, Nanogold GmbH partnered with the Technical University of Munich to develop advanced cancer therapies using gold nanoparticles. This collaboration aims to enhance the precision of targeted drug delivery systems and accelerate clinical trials.

- In June 2023, Gold Nano Tech Ltd. expanded its production facility in Lyon, France, to meet the rising demand for conductive inks and flexible displays. The expansion increased its annual production capacity by 25%.

- In January 2023, Eco Gold Nanoparticles launched a new line of eco-friendly catalysts designed to reduce carbon emissions in industrial processes. The product line aligns with the European Green Deal’s sustainability goals.

- In September 2022, Nano Med Inc. acquired a Swiss startup specializing in biosensors, enhancing its portfolio of diagnostic tools powered by gold nanoparticles. This acquisition strengthened its position in the medical segment.

- In March 2022, Swiss Nano Tech initiated a joint venture with a Swiss pharmaceutical firm to develop nanoparticle-based drug delivery systems. The partnership aims to commercialize innovative treatments for chronic diseases.

MARKET SEGMENTATION

This research report on the Europe gold nanoparticle market is segmented and sub-segmented into the following categories.

By End-User

- Medical & Dentistry

- Electronics

- Catalysis

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are gold nanoparticles and why are they important in Europe?

Gold nanoparticles are tiny gold particles measured in nanometers, valued for their unique chemical, optical, and electronic properties. In Europe, they are gaining traction due to their versatility in advanced fields like medicine, electronics, and environmental science.

What industries in Europe are driving demand for gold nanoparticles?

Key industries include healthcare, electronics, and chemical manufacturing. In healthcare, they’re used in imaging and drug delivery. In electronics, they're vital for conductive components and nanosensors. The chemical sector uses them as efficient catalysts in industrial reactions.

How is the regulatory environment affecting the gold nanoparticle market in Europe?

Strict EU regulations around safety, environmental impact, and nanomaterials classification influence how gold nanoparticles are developed and applied. These regulations encourage high-quality, research-backed use, which enhances long-term market reliability.

What are the key challenges facing gold nanoparticle market in Europe?

The primary challenges include high production costs, limited large-scale manufacturing, and complex handling of nanomaterials. Additionally, awareness and adoption in smaller industries are still emerging, slowing widespread integration.

What is the outlook for the gold nanoparticle market in Europe?

The market outlook is strong, driven by growth in nanomedicine, precision electronics, and sustainable technologies. As research and innovation continue to evolve, gold nanoparticles are expected to become integral to next-gen European industries.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]