Europe Orphan Drugs Market Size, Share, Trends & Growth Forecast Report By Type (Biological, Non-biological), Therapeutic and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

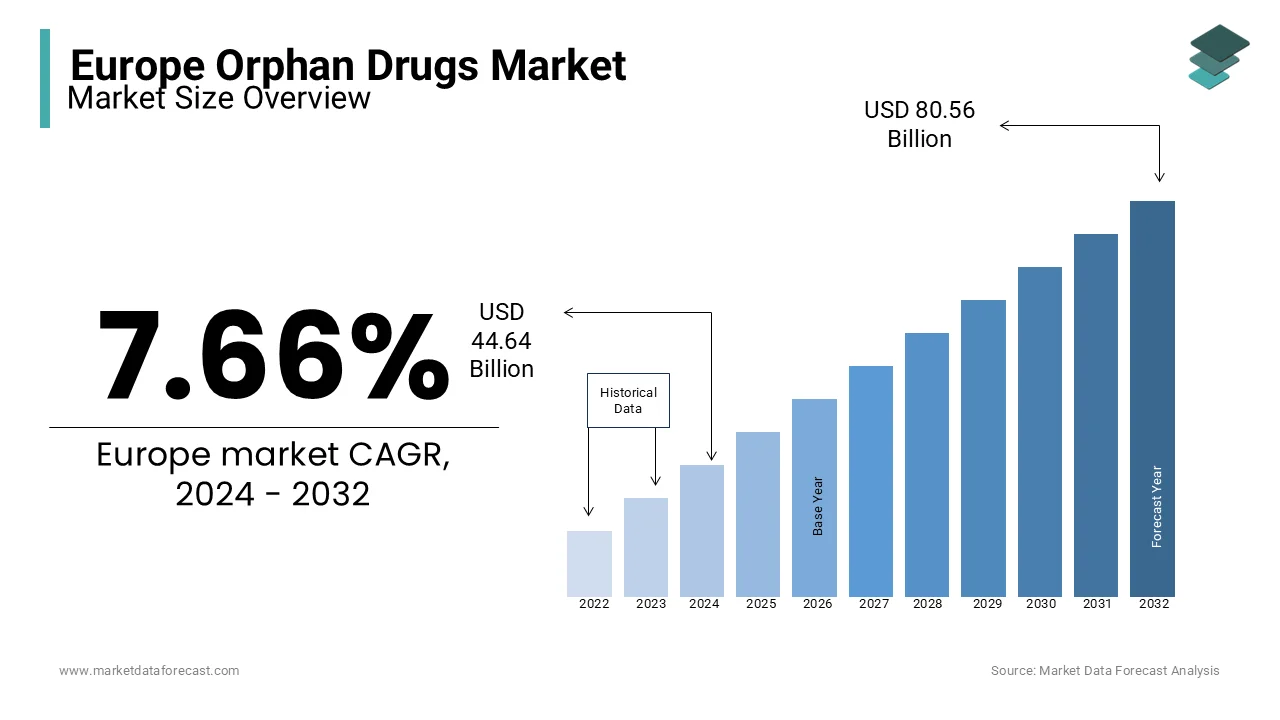

Europe Orphan Drugs Market Size

The orphan drugs market size in Europe was valued at USD 44.64 billion in 2024. Europe is forecasted to be worth USD 86.74 billion by 2033 from USD 48.06 billion in 2025, growing at a CAGR of 7.66% from 2025 to 2033.

Benchmarks for the designation of orphan disease differ from country to country; in Europe, if the disease is prevalent in fewer than 10000 people, it’s termed a rare disease. The growth of the European orphan Drugs Market is powered by factors such as prolonged market exclusivity and government enticements for orphan medicine. In Europe, ten years of marketing exclusivity from approval is granted to orphan drug-developing companies.

MARKET DRIVERS

The focus on developing orphan drugs is becoming more day by day, whereby both private and public organizations are much more useful than non-orphan drugs to cure rare diseases. It is the key driving factor for the European orphan drugs market to grow. The rise in the incidences of chronic and infectious diseases is fuelling the growth rate of the market. FDA (Food and Drug Administration) is making reasonable efforts to increase the commercialization of orphan drugs, accelerating the demand for the European Orphan Drugs Market. Government support is also another primary reason for the market to grow eventually, as they invest considerable amounts in improving the quality of drugs. The rise in healthcare expenditure, especially in urban areas, is fuelling the demand for Orphan Drugs in European countries. The rising demand to produce quality drugs with the latest technologies in pharmaceutical companies, rising capita income in developed and developing countries, and increasing awareness over the availability of different treatment procedures are to open growth opportunities to the market.

MARKET RESTRAINTS

Fluctuations in the availability of raw materials, rising prices of the drugs, and lack of complete knowledge in manufacturing the drugs with the latest formula are majorly inhibiting the demand of the European orphan drugs market. Strict rules and regulations by the government in approving new drugs and the rise in complications due to uncertainty in the development of novel orphan drugs further impede the regional market growth.

REGIONAL ANALYSIS

UK, Italy, France, and Spain are currently the largest shareholders in the European orphan drugs market. Only 5 % of people in Europe are affected by this, out of 10000. Currently, 986 products are designated in Europe, and the regulatory body approves more than 67 orphan drugs. In Europe, orphan designation takes six months for documentation with authority reference & condition to complete the process.

The growing number of rare diseases, health issues, and investment in drug production drive the European market of orphan drugs. Europe has its own regulatory body for orphan drugs, i.e., the European Medicines Agency for orphan designation medicinal products. It will open opportunities for orphan drug manufacturing and pharmaceutical companies.

Germany and the UK are the largest consumers of orphan drugs in the European region. On-going research & development activities are potentially making the market grow in the UK. Government authorities are increasing the investments in pharmaceutical companies by leveling the market demand. The launch of online pharmacy is additionally boosting the growth rate of the European market.

KEY MARKET PLAYERS

Companies playing a prominent role in the Europe orphan drugs market include Novartis, GlaxoSmithKline, Roche, Alexion, Sanofi, Bristol Myers Squibb, Pfizer, Vertex, Celgene, and Merck.

MARKET SEGMENTATION

This research report on the European orphan drugs market is segmented and sub-segmented into the following categories.

By Type

- Biological

- Non-biological

By Therapeutic

- Hematology

- Neurology

- Oncology

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]