Europe Geopolymer Market Size, Share, Trends & Growth Forecast Report By Product Type (Cement, Concrete, and Precast Panel, Grout and Binder, Other Product Types (Composites, Foam, and Bricks)), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Geopolymer Market Size

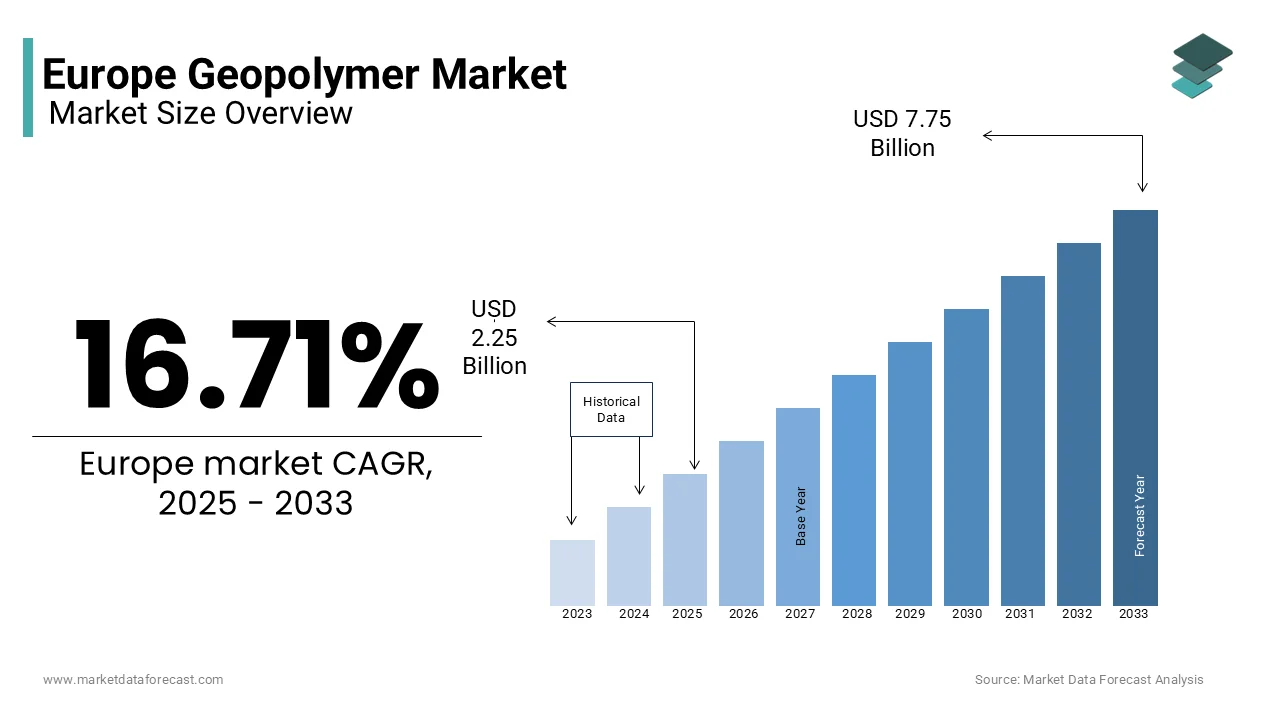

The Europe Geopolymer market size was valued at USD 1.93 billion in 2024. The European market is estimated to be worth USD 7.75 billion by 2033 from USD 2.25 billion in 2025, growing at a CAGR of 16.71% from 2025 to 2033.

Geopolymers are inorganic aluminosilicate materials that serve as eco-friendly alternatives to traditional cement and concrete. These materials are synthesized through the polymerization of natural minerals such as fly ash, slag, and clay, offering superior mechanical properties, thermal stability, and resistance to chemical degradation. In Europe, the geopolymer market is driven by increasing demand for sustainable construction materials, stringent environmental regulations, and advancements in green building technologies. According to the European Construction Industry Federation, over 40% of new construction projects in Europe prioritize low-carbon materials, amplifying the adoption of geopolymers. The European Commission's Green Deal initiative emphasizes reducing carbon emissions from the construction sector, further boosting demand for geopolymers.

MARKET DRIVERS

Stringent Environmental Regulations

Stringent environmental regulations governing the construction industry is driving the growth of the European geopolymer market. According to the European Environment Agency, the construction sector accounts for approximately 36% of Europe's total carbon emissions, prompting regulatory bodies to enforce stricter emission standards. The European Commission's Green Deal initiative mandates a 55% reduction in greenhouse gas emissions by 2030, driving demand for low-carbon alternatives like geopolymers. Additionally, the European Federation of Chemical Industries highlights that geopolymers reduce carbon footprints by up to 80% compared to traditional cement, underscoring their critical role in achieving sustainability goals.

Growing Demand for Sustainable Construction Materials

The growing demand for sustainable construction materials is propelling the European geopolymer market growth. According to the European Construction Products Regulation, over 70% of new buildings in Europe are required to meet energy efficiency standards, amplifying the need for eco-friendly materials. Geopolymers are extensively used in green building projects due to their durability, thermal stability, and resistance to chemical degradation. Additionally, the European Technology Platform for Sustainable Chemistry emphasizes the increasing use of geopolymers in retrofitting and renovation projects, amplifying their importance in the construction sector.

MARKET RESTRAINTS

High Production Costs

High production costs associated with geopolymers is a major restraint for the European market. According to the European Federation of Chemical Industries, the cost of producing geopolymers is approximately 30-40% higher than traditional cement, limiting their affordability for small and medium-sized enterprises (SMEs). The European Construction Industry Federation notes that over 60% of contractors cite affordability as a primary barrier to adopting geopolymers, particularly in low-budget infrastructure projects. Additionally, fluctuations in raw material prices, particularly fly ash and slag, exacerbate this issue. According to the European Plastics Converters Association, the cost of these materials surged by 25% in 2022 due to supply chain disruptions, impacting profit margins. These financial barriers not only hinder market growth but also constrain investments in scaling production capacities and expanding product portfolios.

Limited Awareness Among End Users

Limited awareness among end users regarding the benefits of geopolymers is further hampering the growth of the European geopolymer market growth. According to the European Federation of Civil Engineering Contractors, less than 40% of small and medium-sized enterprises (SMEs) in Europe utilize geopolymers in their construction projects, creating a significant knowledge gap. The European Commission highlights that over 50% of SMEs struggle to adopt advanced materials due to insufficient training and education. This lack of awareness not only slows the adoption of geopolymers but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive awareness initiatives.

MARKET OPPORTUNITIES

Advancements in Green Building Technologies

Advancements in green building technologies is a lucrative opportunity for the European geopolymer market. According to the European Commission's Green Deal initiative, over 30% of European construction projects are transitioning to eco-friendly materials, driving demand for geopolymers in building and infrastructure applications. The European Investment Bank reports that investments in sustainable construction technologies exceeded €100 billion in 2022, creating a favorable environment for geopolymer adoption. Additionally, the European Technology Platform for Sustainable Chemistry highlights the increasing use of geopolymers in retrofitting and renovation projects, further amplifying demand. This opportunity positions geopolymers as a critical enabler of Europe's sustainability goals, aligning with the region's commitment to reducing carbon footprints.

Expansion into Emerging Applications

The growing focus on emerging applications such as nuclear waste immobilization and fireproofing is another promising opportunity for the European geopolymer market. According to the European Nuclear Safety Regulators Group, the demand for geopolymers in nuclear waste containment grew by 12% in 2022, driven by their superior chemical resistance and thermal stability. Similarly, the European Fire Safety Association reports a 15% annual increase in their use in fireproofing applications, where they provide enhanced safety and durability. Additionally, the European Commission's Circular Economy Action Plan supports the development of sustainable safety solutions, amplifying the need for advanced materials like geopolymers. This opportunity underscores the immense potential for market expansion in these high-growth sectors.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions is a significant challenge to the European geopolymer market, exacerbated by logistical bottlenecks and geopolitical tensions. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022, affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as fly ash and slag, which account for nearly 70% of geopolymer production expenses. The European Federation of Chemical Industries reports that imports of certain raw materials declined by 40% in 2022, leading to shortages and price spikes. These disruptions not only elevate operational costs but also hinder production schedules, impacting market stability. According to Eurostat, over 30% of manufacturers experienced production halts in 2022 due to supply chain challenges, underscoring the severity of this issue.

Regulatory Scrutiny and Compliance Costs

Regulatory scrutiny and compliance costs surrounding the use of alternative materials is also challenging the growth of the European geopolymer market. According to the European Chemicals Agency, geopolymers must comply with strict environmental and safety regulations under the REACH Directive, which mandates rigorous testing and documentation to ensure compliance. The European Commission reports that over 40% of geopolymer projects face delays due to these stringent requirements, impacting time-to-market. Additionally, the European Federation of Civil Engineering Contractors highlights that compliance costs for geopolymer manufacturers have risen by 20% over the past three years, limiting affordability for SMEs. These regulatory hurdles not only hinder market growth but also deter new entrants, constraining overall expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.71% |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

CEMEX, S.A.B. de C.V., Critica Infrastructure, MITSUI & CO., LTD., PCI Augsburg GmbH, and SLB (Schlumberger Limited), and others |

SEGMENTAL ANALYSIS

By Product Type Insights

The concrete segment dominated the market by commanding 46.4% of the European market share in 2024. The dominating position of concrete segment in the European market is attributed to its extensive use in building and infrastructure projects, where it provides superior durability, thermal stability, and resistance to chemical degradation. According to the European Commission, over 60% of geopolymer-based concrete is utilized in sustainable construction projects, reflecting its widespread adoption. The versatility and reliability of geopolymer concrete ensure its sustained dominance in the market, particularly for applications requiring compliance with stringent performance standards. .

The precast panels segment is predicted to witness a CAGR of 12.2% over the forecast period owing to their increasing adoption in modular construction and prefabricated building systems, where they provide superior load-bearing capacities and durability. Additionally, the European Commission's Green Deal initiative supports the development of sustainable construction solutions, amplifying the need for precast panels made from geopolymers. This trend positions precast panels as a key driver of innovation in the European market.

By Application Insights

The building segment accounted for 50.9% of the European market share in 2024. The leading position of building segment in the European market is attributed to extensive use of geopolymers in residential, commercial, and industrial construction projects, where they provide superior durability, thermal stability, and resistance to chemical degradation. The European Commission reports that over 60% of geopolymer-based materials consumed in Europe are utilized in building applications, reflecting their widespread adoption.

The road and pavement segment is anticipated to register a prominent CAGR of 10.4% over the forecast period owing to the increasing demand for durable and eco-friendly materials in road construction and maintenance projects. Geopolymers are extensively used in road and pavement applications due to their superior load-bearing capacities and resistance to wear and tear. Additionally, the European Commission's Green Deal initiative supports the development of sustainable infrastructure solutions, amplifying the need for geopolymer-based road and pavement materials. This trend positions road and pavement as a key driver of innovation in the European market.

REGIONAL ANALYSIS

Germany held 22.9% of the European geopolymer market share in 2024. The prominence of Germany in the European market is attributed to the country's robust infrastructure development programs and strong emphasis on sustainable construction practices. The German Federal Ministry for Economic Affairs and Climate Action reports that over 60% of road and railway projects in Germany incorporate geopolymers, reflecting the region's leadership in adopting advanced materials. Additionally, Germany's strategic investments in green infrastructure create a favorable environment for market growth, aligning with the European Green Deal initiative.

France played a prominent role in the European geopolymer market in 2024 and is expected to register a prominent CAGR over the forecast period. The strong presence of France in road construction and coastal protection projects drives geopolymer adoption. According to the French Ministry of Ecology, the growing use of geopolymers in sustainable infrastructure projects, while the French Environment Agency reports a 15% annual increase in their use in coastal erosion control. Furthermore, France's focus on eco-friendly solutions boosts the use of advanced geopolymer technologies, underscoring the segment's importance.

The UK is predicted to account for a substantial share of the European market over the forecast period. The thriving infrastructure sector, coupled with its robust railway and road construction projects, drives geopolymer demand in the UK. The UK government's commitment to sustainable construction supports the use of high-performance geopolymers, ensuring steady market growth. Additionally, the UK's investment in advanced manufacturing technologies amplifies its leadership in producing

KEY MARKET PLAYERS

The major key players in Europe Geopolymer market are CEMEX, S.A.B. de C.V., Critica Infrastructure, MITSUI & CO., LTD., PCI Augsburg GmbH, and SLB (Schlumberger Limited), and others.

MARKET SEGMENTATION

This research report on the Europe Geopolymer market is segmented and sub-segmented into the following categories.

By Product Type

- Cement, Concrete, and Precast Panel

- Grout and Binder

- Other Product Types (Composites, Foam, and Bricks)

By Application

- Building

- Road and Pavement

- Runway

- Pipe and Concrete Repair

- Bridge

- Tunnel Lining

- Railroad Sleeper

- Coating

- Fireproofing

- Nuclear and Other Toxic Waste Immobilization

- Specific Mold Products

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth rate of the European geopolymer market from 2025 to 2033?

The European geopolymer market is projected to grow at a CAGR of 16.71% from 2025 to 2033.

2. What are some of the major applications of geopolymers in Europe?

Major applications include building construction, infrastructure projects, and industrial uses, with geopolymers serving as alternatives to traditional cement due to their eco-friendly and high-performance properties

3. Which countries are leading the European geopolymer market?

Germany is currently the largest market in Europe, followed by other countries like the United Kingdom and Italy, where construction activities are driving demand for geopolymers

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com