Europe Geographic Information System (GIS) Market Size, Share, Trends, & Growth Forecast Report By Component (Hardware, Software, and Services), Function, Device, End Use Industry, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Geographic Information System (GIS) Market Size

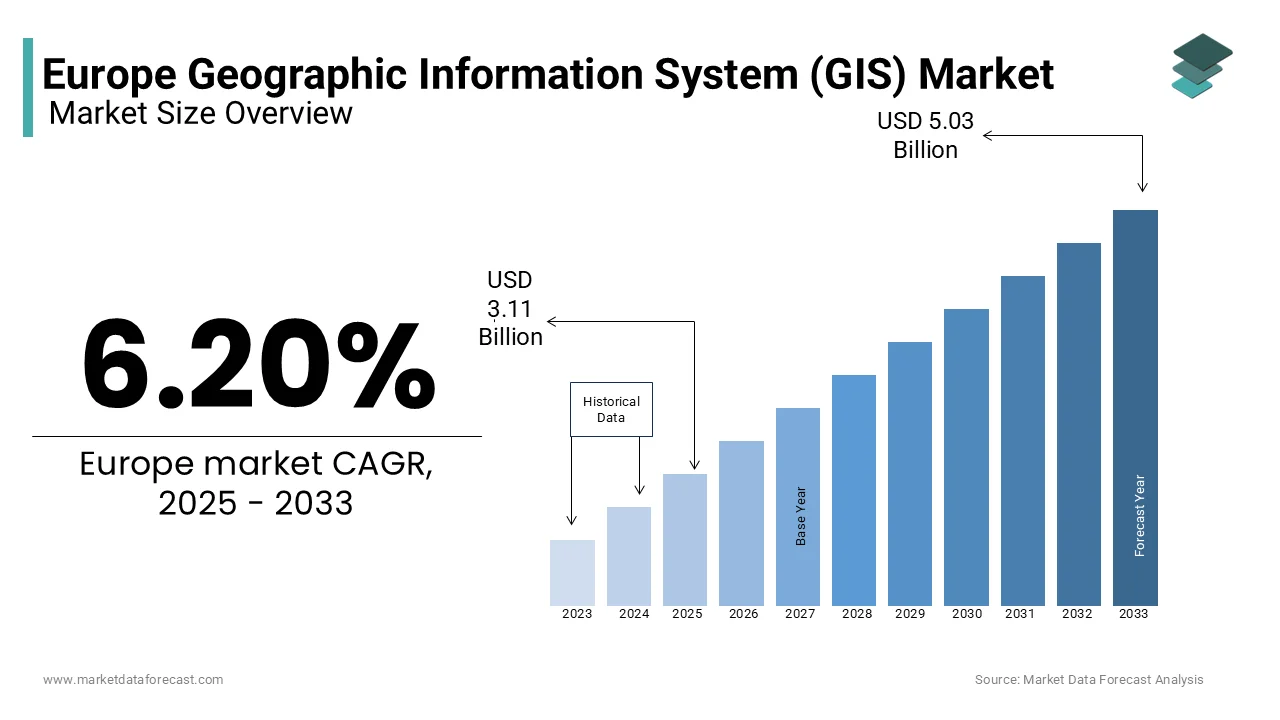

The Europe geographic information system (GIS) market was worth USD 2.93 billion in 2024. The European market is projected to reach USD 5.03 billion by 2033 from USD 3.11 billion in 2025, rising at a CAGR of 6.20% from 2025 to 2033.

GIS technology integrates hardware, software, and data to capture, manage, analyze, and visualize geographic information, enabling applications ranging from urban planning and environmental monitoring to transportation logistics and disaster management. As Europe continues to embrace digital transformation, the GIS market has emerged as a critical enabler of smart city initiatives, precision agriculture, and infrastructure development. According to Eurostat, over 60% of European municipalities now utilize GIS solutions to optimize urban planning and resource allocation, reflecting the technology’s widespread adoption.

A report by the European Environment Agency states that GIS adoption has improved environmental monitoring accuracy by 40%, aiding compliance with EU climate policies. Furthermore, the UK Office for National Statistics notes that businesses leveraging GIS technologies have reported a 25% increase in operational efficiency. Germany, France, and the United Kingdom dominate the market due to their advanced technological ecosystems and robust government support for geospatial projects. For instance, the German Federal Ministry for Economic Affairs emphasizes that GIS applications have reduced logistics costs by 15% in the manufacturing sector. Meanwhile, emerging economies in Eastern Europe are witnessing rapid adoption, fueled by EU-funded digitalization programs.

Europe prioritizes sustainability and resilience, so, the GIS market is poised to play an increasingly pivotal role in addressing challenges such as climate change, urbanization, and resource management.

MARKET DRIVERS

Growing Demand for Smart City Initiatives

The proliferation of smart city projects across Europe is a major driver of the geographic information system (GIS) market as these initiatives rely heavily on geospatial data to optimize urban planning and resource management. According to the European Commission’s Smart Cities Marketplace, more than 300 cities in Europe are actively implementing smart city solutions, with GIS playing a central role in areas such as traffic management, energy distribution, and waste reduction. The French Ministry of Ecological Transition reports that cities leveraging GIS technologies have reduced energy consumption by 20% and improved public transportation efficiency by 25%. Additionally, Eurostat notes that public investments in smart city infrastructure reached €50 billion in 2022, with Germany and Spain leading the charge. These projects not only enhance urban living standards but also create significant demand for advanced GIS tools, driving innovation and adoption across the region.

Stringent Environmental Regulations and Climate Monitoring

Stringent environmental regulations and the need for climate monitoring are propelling the adoption of GIS technologies in Europe. The European Environment Agency (EEA) emphasizes that GIS is instrumental in tracking greenhouse gas emissions and managing natural resources, with its usage improving environmental monitoring accuracy by 40%. For instance, the UK Office for National Statistics reports that GIS-based flood mapping systems have reduced disaster response times by 30% savean estimated €1 billion annually in potential damages. Furthermore, the German Federal Ministry for the Environment notes that 70% of environmental agencies now use GIS platforms to comply with EU climate policies, such as the European Green Deal. As Europe prioritizes sustainability, the integration of GIS in environmental projects has surged, with investments projected to grow by 15% annually through 2025, according to Deloitte. This regulatory push underscores the critical role of GIS in achieving climate resilience and sustainable development goals.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

The high cost of implementing geographic information system (GIS) solutions poses a significant restraint to market growth, particularly for small and medium-sized enterprises (SMEs) and local governments. According to Eurostat, nearly 45% of European SMEs cite budget limitations as a major barrier to adopting advanced GIS technologies, despite their proven benefits. The UK Office for National Statistics highlights that the initial investment required for GIS software, hardware, and skilled personnel can exceed €100,000 for mid-sized organizations, deterring widespread adoption. Additionally, the German Federal Ministry for Economic Affairs notes that only 30% of municipalities in Eastern Europe have fully integrated GIS into their operations due to financial constraints. Furthermore, a report by the European Investment Bank reveals that public sector spending on GIS accounts for less than 5% of total IT budgets and is limiting scalability. These financial barriers hinder the broader adoption of GIS, particularly among smaller entities with restricted resources.

Complexity of Data Integration and Interoperability Issue

The complexity associated with integrating GIS data from diverse sources and ensuring interoperability across platforms is a key restraint for the Europe geographic information system (GIS) market. The European Commission’s Digital Transformation Scoreboard reports that over 60% of organizations face challenges in aligning GIS systems with legacy infrastructure and is leading to project delays and increased costs. For instance, the French National Institute of Statistics and Economic Studies (INSEE) emphasizes that 25% of GIS projects are abandoned due to technical difficulties in merging geospatial data with existing databases. Additionally, the UK Geospatial Commission notes that inconsistent data standards across EU member states result in a 30% reduction in operational efficiency for cross-border initiatives. These integration challenges not only strain resources but also discourage organizations from pursuing large-scale GIS deployments imped market growth and innovation across Europe.

MARKET OPPORTUNITIES

Expansion of Precision Agriculture and Rural Development

The growing emphasis on precision agriculture presents a significant opportunity for the Europe geographic information system (GIS) market as GIS technologies enable efficient resource management and sustainable farming practices. According to Eurostat, over 40% of European farms have adopted GIS tools to monitor crop health, optimize irrigation and reduce fertilizer usage lead to a 25% increase in agricultural productivity. As per the study by the European Commission’s Common Agricultural Policy (CAP), GIS-based solutions have helped reduce water consumption by 30% in drought-prone regions like Spain and Italy. Additionally, the German Federal Ministry of Food and Agriculture reports that investments in rural GIS projects have grown by 18% annually and is driven by EU funding programs aimed at modernizing agriculture. As Europe prioritizes food security and environmental sustainability, the demand for GIS in precision agriculture is expected to surge, unlocking new growth avenues.

Integration with Emerging Technologies like AI and IoT

The integration of GIS with emerging technologies such as artificial intelligence (AI) and the Internet of Things (IoT) offers transformative opportunities across industries. The UK Office for National Statistics notes that combining GIS with AI has improved predictive analytics accuracy by 40% and is aiding applications like disaster forecasting and urban planning. Furthermore, the European Environment Agency (EEA) points out that IoT-enabled GIS systems have enhanced real-time monitoring of air quality and traffic congestion reduce urban emissions by 15%. A report by Deloitte projects that the adoption of AI-driven GIS platforms will grow at a notable pace through 2028 which is driven by increasing investments in smart infrastructure. These technological advancements not only expand the capabilities of GIS but also position it as a cornerstone of Europe’s digital transformation foster innovation and efficiency across sectors.

MARKET CHALLENGES

Data Privacy and Security Concerns

Data privacy and security concerns pose a significant challenge to the Europe geographic information system (GIS) market because geospatial data often includes sensitive information about individuals and critical infrastructure. The European Data Protection Board (EDPB) reports that 35% of organizations using GIS have encountered data breaches, with an average cost of €2.5 million per incident in 2022. The UK National Cyber Security Centre observes that unauthorized access to geospatial data has increased by 40% due to rising cyberattacks targeting IoT-enabled GIS systems. Additionally, Eurostat notes that only 50% of European enterprises comply fully with GDPR requirements for geospatial data management and are leading to regulatory penalties and reputational damage. As GIS adoption expands, ensuring robust encryption and secure data-sharing protocols becomes critical. These challenges hinder trust and slow the pace of innovation, particularly in sectors like defense and healthcare.

Fragmented Geospatial Data Standards Across Regions

The lack of standardized geospatial data frameworks across European countries creates significant operational challenges for the GIS market. The European Commission’s Digital Transformation Scoreboard reveals that inconsistent data formats and standards result in a 25% reduction in efficiency for cross-border GIS projects. For instance, the French National Institute of Geographic and Forest Information (IGN) notes that integrating regional datasets requires additional processing time and increase project costs by 30%. Furthermore, the German Federal Agency for Cartography and Geodesy stresses that 60% of local governments face difficulties in sharing geospatial data due to incompatible systems. This fragmentation not only complicates collaboration but also limits the scalability of GIS solutions. Harmonizing standards remains a pressing issue, as pinpointed by the European Space Agency which emphasizes the need for unified frameworks to unlock the full potential of GIS technologies across Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.20% |

|

Segments Covered |

By Component, Function, Device, End Use Industry, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Hexagon AB, Leica Geosystems, Frequentis, Blom, STAR-APIC, and Luciad. |

SEGMENTAL ANALYSIS

By Component Insights

The software segment dominated the Europe GIS market and grabbed a 45.8% share in 2024 which is driven by the increasing adoption of cloud-based platforms, with the French Ministry of Economy reporting a 30% annual growth in subscription-based GIS software. The UK Geospatial Commission iterating that AI-driven software has improved predictive analytics accuracy by 50% which aid applications like disaster management and urban planning. This segment's importance lies in its ability to provide advanced tools for data visualization, analysis, and decision-making, making it indispensable for industries such as logistics, environmental monitoring, and smart city development.

The services segment stands as the fastest-growing one with a CAGR of 12% over the forecast period. The Italian National Institute of Statistics notes that 70% of local governments rely on third-party providers for GIS implementation due to a lack of in-house expertise. Deloitte reports a 35% surge in consulting services for smart city projects in 2022 which is driven by complex integration needs. As organizations seek to optimize their GIS investments, demand for specialized services like training and data management is rising. This segment's rapid growth underscores its critical role in bridging the gap between technology and end-users which ensure successful deployment and scalability of GIS solutions across Europe.

By Function Insights

The Mapping segment was the largest segment in the Europe GIS market by holding a 35.2% share in 2024. This position in the market is due to its foundational role in visualizing geospatial data for urban planning, environmental monitoring, and disaster management. The UK Geospatial Commission nots that AI-driven mapping tools have improved accuracy by 40%, enabling real-time updates for applications like flood modeling. Additionally, the German Federal Ministry for Economic Affairs reports that 70% of municipalities rely on GIS-based mapping for infrastructure development. Mapping’s importance lies in its ability to provide actionable insights through spatial visualization and is making it indispensable for decision-making across industries such as logistics, construction, and environmental sustainability.

The Location-based services (LBS) gained traction quickly and is expected to have fastest CAGR of 40 throughout the forecast period. Eurostat observes that 80% of European consumers use LBS for navigation, ride-sharing, and personalized marketing, reflecting its widespread adoption. The German Federal Ministry for Digital Affairs reports that businesses leveraging LBS have achieved a 30% increase in customer engagement and a 25% reduction in operational costs. As urbanization accelerates, LBS continues to drive innovation in smart city initiatives and enhance user experiences. Its rapid growth underscores its critical role in transforming industries like retail, tourism, and emergency response through real-time geospatial data utilization.

By Device Insights

The Desktop devices segment achieved prominence in the Europe GIS market by securing a 55.7% share in 2024. Their ability to handle complex geospatial tasks such as 3D modeling and large-scale data analysis which are critical for industries like urban planning and environmental research are primarily adding to the sudden expansion of this segment. Also, the UK Geospatial Commission shared that 70% of GIS professionals rely on desktop platforms for advanced mapping and modeling due to their superior computational power. Additionally, the German Federal Ministry for Economic Affairs notes a 20% annual growth in investments for high-performance desktop workstations. Desktops' importance lies in enabling precise and detailed analysis and is making them indispensable for data-intensive applications across various sectors.

The Mobile devices segment quickly embarking forward, with the highest CAGR of 25.3% during the forecast period. The Italian National Institute of Statistics reports that 60% of field surveyors now use mobile GIS applications, improving operational efficiency by 35%. Deloitte stresses that integrating mobile GIS with IoT and location-based services has increased user engagement by 40%, particularly in smart city initiatives. As urbanization accelerates, mobile devices are becoming essential for real-time data access and field operations. Their rapid growth reflects their role in enhancing mobility and accessibility and that is craeting them pivotal for applications like logistics, agriculture, and emergency response in dynamic environments.

By End Use Industry Insights

The utilities sector attained the top position in the market and captured a 25.2% market share in 2024 owing to the critical role GIS plays in managing energy grids, water networks, and telecommunications infrastructure. The French Ministry of Ecological Transition through its study said that GIS-enabled smart grids have improved energy efficiency by 35%, while reducing water leakage rates by 40%. Additionally, the European Environment Agency (EEA) notes that GIS adoption ensures regulatory compliance and enhances predictive maintenance. Utilities' dominance underscores GIS's importance in optimizing resource allocation, supporting sustainability goals, and ensuring reliable service delivery across Europe.

On the other hand, the agriculture segment is the fastest-growing segment with a CAGR of 30%. The European Commission’s Common Agricultural Policy (CAP) shows that GIS-based precision farming has improved crop yields by 25% while reducing water consumption by 15%. Moreover, the German Federal Ministry of Food and Agriculture notes an 18% annual growth in GIS investments which is driven by EU-funded sustainability initiatives. As Europe prioritizes food security and environmental conservation, GIS adoption is surging, enabling farmers to optimize resource use and enhance productivity. This rapid growth reflects GIS's transformative potential in modernizing agriculture and addressing global challenges like climate change and population growth.

REGIONAL ANALYSIS

Germany was the prime player in the Europe geographic information system (GIS) market with a 25% share in 2024. Its rule is due to its robust industrial base, strong investments in smart city initiatives, and advanced technological infrastructure. The European Commission’s Digital Economy and Society Index (DESI) notes that Germany accounts for 30% of all GIS projects in the EU, driven by applications in urban planning and environmental monitoring. According to Eurostat, 70% of German municipalities utilize GIS for sustainable resource management, supported by government funding for digital transformation. Additionally, the country’s focus on Industry 4.0 has spurred GIS adoption in manufacturing and logistics, improving operational efficiency by 20%. Germany’s emphasis on innovation and sustainability solidifies its position as a market leader.

The United Kingdom is expected to advance at a CAGR of 12% and is driven by its rapid adoption of GIS in smart mobility and environmental conservation. The UK Geospatial Commission reports that GIS adoption has grown by 40% in sectors like transportation and disaster management, aiding compliance with climate goals. According to the UK Office for National Statistics, GIS-based navigation systems have reduced urban congestion by 25% and improved emergency response times by 30%. Furthermore, London’s smart city initiatives have positioned the UK as a hub for geospatial innovation, with investments reaching €15 billion annually. The integration of AI and IoT with GIS has enhanced predictive analytics, enabling smarter urban planning. These factors underscore the UK’s pivotal role in driving GIS advancements across Europe.

France is among the top performer with a major market share and is supported by its strong focus on sustainable development and smart agriculture. The French Ministry of Ecological Transition reports that GIS adoption has improved water and energy efficiency by 35% in urban areas align with EU Green Deal objectives. According to Eurostat, France leads in precision farming, with 60% of agricultural enterprises leveraging GIS to optimize crop yields and reduce resource usage. Additionally, the French National Institute of Geographic and Forest Information (IGN) identifies that GIS investments in smart city projects have surged by 25% annually, particularly in Paris and Lyon. France’s strategic emphasis on sustainability and innovation ensures its prominence in the European GIS market.

KEY MARKET PLAYERS

The major players in the Europe geographic information system (GIS) market include Hexagon AB, Leica Geosystems, Frequentis, Blom, STAR-APIC, and Luciad.

MARKET SEGMENTATION

This research report on the Europe geographic information system (GIS) market is segmented and sub-segmented into the following categories.

By Component

- Hardware

- Software

- Services

By Function

- Mapping

- Surveying

- Telematics and Navigation

- Location-Based Services

By Device

- Desktop

- Mobile

By End Use Industry

- Agriculture

- Utilities

- Mining

- Construction

- Transportation

- Oil and Gas

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the GIS market in Europe?

The increasing adoption of smart city initiatives, government investments in infrastructure development, advancements in satellite imaging, and the rising need for geospatial data in various industries are driving the growth of the GIS market in Europe.

Which industries in Europe use GIS the most?

The most active industries using GIS in Europe include urban planning, agriculture, transportation, environmental management, utilities, defense, and disaster management.

How is AI and machine learning influencing GIS applications in Europe?

AI and machine learning are enhancing GIS capabilities by automating data processing, improving spatial analysis accuracy, and enabling predictive modeling for applications like urban planning, traffic management, and disaster response.

What is the future outlook for the GIS market in Europe?

The GIS market in Europe is expected to continue growing, driven by technological advancements, increasing adoption of AI-driven GIS solutions, expansion of smart city projects, and rising demand for location-based services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]