Europe General Data Protection Regulation (GDPR) Assessment Tools Market Size, Share, Trends, & Growth Forecast Report By Deployment (On-Premises and Cloud-Based), Service, Tool, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe General Data Protection Regulation (GDPR) Assessment Tools Market Size

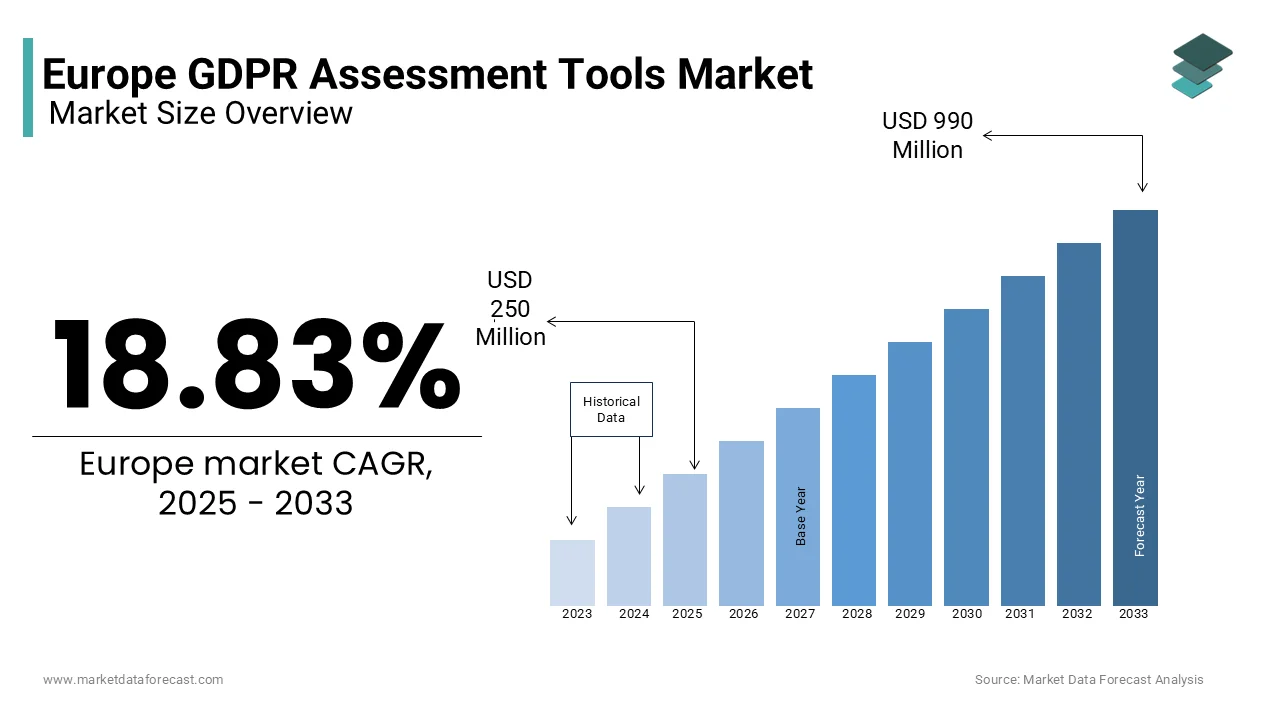

The Europe general data protection regulation (GDPR) assessment tools market was worth USD 210 million in 2024. The European market is estimated to reach USD 990 million by 2033 from USD 250 million in 2025, rising at a CAGR of 18.83% from 2025 to 2033.

GDPR is enforced by the European Union in 2018 and this mandates that businesses implement robust measures to safeguard personal data to ensure transparency in data processing and comply with accountability requirements. GDPR assessment tools are software solutions designed to help organizations evaluate their compliance levels, identify gaps, and implement corrective actions to meet regulatory obligations. These tools encompass functionalities such as data mapping, risk assessment, consent management, breach notification, and audit trail generation. According to a report by Statista, over 60% of European organizations have adopted GDPR assessment tools to streamline compliance efforts, reflecting the growing recognition of their importance in mitigating risks and avoiding hefty penalties.

The demand for GDPR assessment tools has surged as non-compliance fines reach staggering amounts, with the European Data Protection Board reporting fines exceeding €2 billion in 2022 alone. A study by PwC highlights that nearly 70% of European businesses consider GDPR compliance a top priority, yet 45% struggle with the complexity of implementation. This gap underscores the critical role of assessment tools in simplifying compliance workflows. Furthermore, the International Association of Privacy Professionals notes that the proliferation of remote work and cloud-based systems has amplified data security challenges, driving the adoption of advanced GDPR tools. As the regulatory landscape evolves and data privacy concerns intensify, the GDPR assessment tools market is poised for sustained growth, offering innovative solutions to address emerging compliance needs across industries.

MARKET DRIVERS

Increasing Regulatory Scrutiny and Hefty Non-Compliance Penalties

The growing regulatory scrutiny under GDPR is one of the major factors boosting the adoption of GDPR assessment tools in Europe. The European Data Protection Board reports that fines for non-compliance exceeded €2 billion in 2022, with high-profile penalties against multinational corporations underscoring the financial risks of non-adherence. According to PwC, nearly 70% of European organizations have faced at least one GDPR-related audit or inquiry since its implementation. This heightened enforcement has compelled businesses to invest in assessment tools to mitigate risks and ensure compliance. A study by the International Association of Privacy Professionals highlights that over 65% of companies now prioritize GDPR readiness, with assessment tools enabling them to conduct regular audits and identify vulnerabilities. As regulatory bodies intensify their focus on data privacy, these tools have become indispensable for organizations striving to avoid legal repercussions and reputational damage.

Rising Cybersecurity Threats and Data Breach Incidents

The surge in cybersecurity threats and data breaches across Europe is further fuelling the demand for GDPR assessment tools. Europol’s 2023 Internet Organised Crime Threat Assessment reveals that cyberattacks targeting personal data increased by 40% in the past two years, with phishing and ransomware being the most prevalent threats. The European Union Agency for Cybersecurity (ENISA) reports that nearly 60% of organizations experienced at least one data breach in 2022, highlighting the urgent need for robust data protection measures. GDPR mandates timely breach notifications and stringent safeguards, driving businesses to adopt assessment tools that enhance their security posture. A survey by Deloitte indicates that 75% of European firms have integrated GDPR tools to strengthen incident response protocols. As data breaches continue to escalate, these tools play a critical role in ensuring compliance while safeguarding sensitive information from malicious actors.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

High cost of implementation that poses challenges for small and medium-sized enterprises (SMEs) is a major factor hindering the growth of the Europe GDPR assessment tools market. According to the European Commission, over 50% of SMEs struggle with the financial burden of adopting advanced compliance technologies, as these tools often require substantial upfront investments in software licenses, training, and infrastructure. A study by Eurostat reveals that only 40% of SMEs in Europe have fully integrated GDPR assessment tools due to budget limitations. Additionally, McKinsey reports that the total cost of ownership for GDPR compliance solutions can exceed €100,000 annually for mid-sized firms, deterring widespread adoption. While larger organizations can absorb these costs, smaller players face difficulties in justifying the expenditure, limiting market growth. This financial barrier underscores the need for more affordable and scalable solutions tailored to SMEs.

Complexity of Integration with Legacy Systems

The complexity involved in integrating GDPR assessment tools with existing legacy systems that are prevalent across many European industries is another major restraint to the European market. The International Data Corporation (IDC) notes that over 60% of European organizations still rely on outdated IT infrastructures, making seamless integration a significant challenge. A report by the European Central Bank highlights that nearly 45% of businesses encounter technical difficulties when deploying GDPR tools, leading to delays and increased costs. Furthermore, PwC emphasizes that legacy systems often lack compatibility with modern APIs, hindering data mapping and real-time monitoring functionalities. This integration complexity not only slows down compliance efforts but also increases reliance on external consultants, further escalating expenses. As organizations grapple with these technical barriers, the pace of adoption for GDPR assessment tools remains constrained, particularly among traditional industries resistant to digital transformation.

MARKET OPPORTUNITIES

Expansion of AI-Driven GDPR Assessment Solutions

The integration of artificial intelligence (AI) to enhance compliance processes is a notable opportunity to the European market. The European Data Protection Supervisor highlights that AI-driven tools can reduce compliance workload by up to 40%, enabling organizations to automate data mapping, risk assessments, and breach notifications. According to a report by McKinsey, over 65% of European businesses are exploring AI-based solutions to address the growing complexity of GDPR requirements. Furthermore, the International Association of Privacy Professionals notes that AI-powered tools can improve accuracy in identifying non-compliance risks by 35%, minimizing human error. As data privacy concerns intensify, the demand for intelligent, predictive analytics is expected to grow. By leveraging AI, GDPR assessment tools can offer real-time insights and scalability, catering to diverse organizational needs while fostering innovation in the compliance technology landscape.

Growing Demand for Cloud-Based GDPR Tools

The growing adoption of cloud-based GDPR assessment tools due to the shift toward remote work and digital transformation is another significant opportunity in the European market. Eurostat reports that over 70% of European organizations now use cloud services, creating a fertile ground for cloud-native compliance solutions. A study by the European Commission highlights that cloud-based GDPR tools have grown by 50% since 2020, offering cost-effective and scalable alternatives to traditional on-premise systems. Deloitte emphasizes that these tools enable real-time collaboration and data access, reducing compliance costs by 25%. Additionally, the European Union Agency for Cybersecurity (ENISA) notes that cloud solutions with built-in encryption and access controls align well with GDPR’s security mandates. As businesses seek flexible and secure ways to manage data privacy, cloud-based GDPR tools are poised to dominate, addressing both operational efficiency and regulatory adherence.

MARKET CHALLENGES

Fragmented Regulatory Interpretations Across Member States

Fragmented interpretation and enforcement of GDPR regulations across member states is a major challenge to the European market. According to the European Data Protection Board, inconsistencies in national implementation have created confusion for organizations operating across borders, with 40% of businesses reporting difficulties in aligning their compliance strategies. According to Eurostat, over 60% of companies face challenges due to varying data protection authorities' guidelines, leading to increased complexity in tool customization. A study by PwC notes that this fragmentation results in a 25% higher cost for multinational firms to ensure compliance across jurisdictions. As GDPR assessment tools must cater to diverse regulatory nuances, developers struggle to create universally applicable solutions. This lack of harmonization not only complicates tool design but also slows down adoption rates, hindering market growth.

Limited Awareness Among Smaller Organizations

Limited awareness and understanding of GDPR requirements among smaller organizations, particularly SMEs is also challenging the growth of the European GDPR assessment tools market. The European Commission reports that nearly 50% of SMEs in Europe lack adequate knowledge about GDPR obligations, leading to underinvestment in assessment tools. A survey by the International Association of Privacy Professionals reveals that only 35% of SMEs conduct regular GDPR audits, often relying on manual processes instead of automated tools. Furthermore, McKinsey highlights that 60% of smaller firms view GDPR compliance as overly complex, deterring them from adopting advanced solutions. This knowledge gap exacerbates non-compliance risks, as smaller entities are less equipped to handle audits or breaches. Without targeted education and affordable tools tailored to SMEs, the market struggles to achieve widespread penetration, leaving a significant segment underserved and vulnerable to regulatory penalties.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

18.83% |

|

Segments Covered |

By Deployment, Service, Tool, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Commvault Systems Inc., Softcat Plc, Mimecast Services limited, IBM Corporation, Microsoft Corporation, and Others. |

SEGMENTAL ANALYSIS

By Deployment Insights

The cloud-based segment held the leading share of 60.7% in the European market in 2024 owing to the growing preference for scalable and cost-effective solutions, particularly among SMEs. Eurostat reports that over 70% of European businesses now use cloud services, with Deloitte highlighting that cloud-based tools reduce compliance costs by 30%. Enhanced security features, such as encryption, have addressed data protection concerns, driving adoption. The segment’s importance lies in its ability to provide real-time insights and adaptability, making it indispensable for organizations navigating complex GDPR requirements.

By Service Insights

The consulting segment had the leading share of 35.9% of the European market in 2024. The dominating position of consulting segment in the European market is driven by the complexity of GDPR regulations, with the European Data Protection Supervisor reporting that over 60% of businesses rely on external consultants for guidance. Consulting services help organizations interpret regulatory requirements, identify compliance gaps, and implement tailored solutions. Eurostat highlights that companies leveraging consulting services reduce non-compliance risks by 40%.

The training segment is anticipated to progress at a notable CAGR of 18.5% over the forecast period owing to the increasing awareness of the role employee education plays in achieving compliance. Eurostat reports that organizations with structured GDPR training programs reduce non-compliance incidents by 30%. Deloitte notes that such programs improve compliance rates by 25%, making them indispensable for risk mitigation. As regulatory scrutiny intensifies, businesses are prioritizing training to foster a culture of data privacy.

By Tool Insights

The data inventory and mapping automation tool segment held 26.2% of the European market share in 2024. The growth of the data inventory and mapping automation tool segment in the European market is driven by the growing complexity of data ecosystems, with over 65% of businesses relying on automation to manage data flows effectively. Deloitte reports that these tools reduce manual effort by 50%, improving accuracy and scalability while ensuring compliance with GDPR’s transparency requirements. Their importance lies in enabling organizations to track personal data across systems and third-party vendors, a foundational step for audits and regulatory inquiries. As data mapping becomes a regulatory priority, this segment remains indispensable for achieving accountability and operational efficiency.

The consent management tool segment is anticipated to register a CAGR of 20.7% over the forecast period owing to the increasing regulatory scrutiny on user consent, with Eurostat highlighting that organizations using these tools achieve a 40% higher compliance rate in managing user preferences. Consent management tools automate the collection, storage, and withdrawal of user consent, ensuring transparency and compliance with GDPR’s core principles. Their importance lies in addressing evolving consumer privacy expectations and mitigating risks associated with non-compliance. As businesses prioritize user trust and regulatory adherence, this segment is becoming critical for navigating the complexities of modern data protection frameworks.

REGIONAL ANALYSIS

The UK accounted for 25.9% in the European GDPR assessment tools market share in 2024. The domination of the UK in the European market is driven by stringent data protection enforcement, with the UK Information Commissioner’s Office imposing fines exceeding €100 million in 2022 alone. According to PwC, over 70% of UK businesses have adopted GDPR assessment tools to mitigate compliance risks, reflecting the country’s proactive approach to data privacy. The UK’s robust financial sector and high digital maturity further amplify demand, with Eurostat highlighting that 85% of UK enterprises use advanced IT solutions. Additionally, London’s status as a global tech hub fosters innovation, enabling the development of cutting-edge tools. The UK’s emphasis on regulatory adherence and technological advancement solidifies its position as a leader in this market.

Germany held the second biggest share of the European GDPR assessment tools market in 2024. The growth of Germany in the European market is attributed to its strong industrial base and high awareness of data protection, with the Federal Office for Information Security reporting that 65% of German organizations prioritize GDPR compliance. Statista highlights that Germany’s adoption of Industry 4.0 technologies has accelerated the integration of GDPR tools into manufacturing and logistics sectors. Furthermore, the Bundesbank notes that cloud-based GDPR solutions have grown by 50% since 2020, driven by the need for scalable compliance frameworks. Germany’s rigorous regulatory environment and focus on cybersecurity further reinforce its leadership, making it a key driver of innovation in the GDPR tools landscape.

France is also a leading player in the European GDPR assessment tools market. The strong emphasis of France on digital transformation and data privacy, with Deloitte reporting that 60% of French organizations have implemented GDPR tools to streamline compliance processes. France’s government initiatives, such as the French Tech ecosystem, have fostered innovation in privacy technologies, enabling startups like Capgemini to gain prominence. Additionally, CNIL highlights those breaches involving French entities increased by 30% in 2022, driving demand for robust assessment tools. France’s proactive regulatory framework and growing reliance on AI-driven solutions further enhance its position as a key contributor to the market’s growth.

KEY MARKET PLAYERS

The major players in the Europe general data protection regulation (GDPR) assessment tools market include Commvault Systems Inc., Softcat Plc, Mimecast Services limited, IBM Corporation, Microsoft Corporation, and Others.

MARKET SEGMENTATION

This research report on the Europe general data protection regulation (GDPR) assessment tools market is segmented and sub-segmented into the following categories.

By Deployment

- On-Premises

- Cloud-Based

By Service

- Consulting

- Training

- Implementation and Integration

- Support and Maintenance

By Tool

- Privacy Impact Assessment Tool

- Data Inventory and Mapping Automation Tool

- Readiness and Accountability Tool

- Incident and Breach Management Tool

- Subject Access Rights Portal Tool

- Website Scanning and Cookie Compliance Tool

- Vendor Risk Assessment Tool

- Consent Management Tool

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the primary drivers of growth in the GDPR assessment tools market?

The growing enforcement of GDPR regulations, rising concerns about data breaches, increasing penalties for non-compliance, and the need for automated compliance solutions are key factors driving market growth.

Which industries benefit the most from GDPR assessment tools?

Industries such as banking and finance, healthcare, IT and telecom, retail, and e-commerce benefit the most as they process and store large amounts of personal data.

What are the key trends shaping the GDPR assessment tools market?

Trends include the adoption of AI-driven compliance automation, cloud-based GDPR solutions, increased demand for privacy-by-design frameworks, and integration with cybersecurity solutions.

What is the future outlook for the GDPR assessment tools market in Europe?

The market is expected to grow as organizations continue to prioritize data protection, invest in advanced compliance technologies, and respond to evolving privacy regulations beyond GDPR, such as AI and digital services regulations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]