Europe Gas Turbine Market Size, Share, Trends, & Growth Forecast Report Segmented By Technology (Open Cycle and Combined Cycle), Capacity, End-Use, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Gas Turbine Market Size

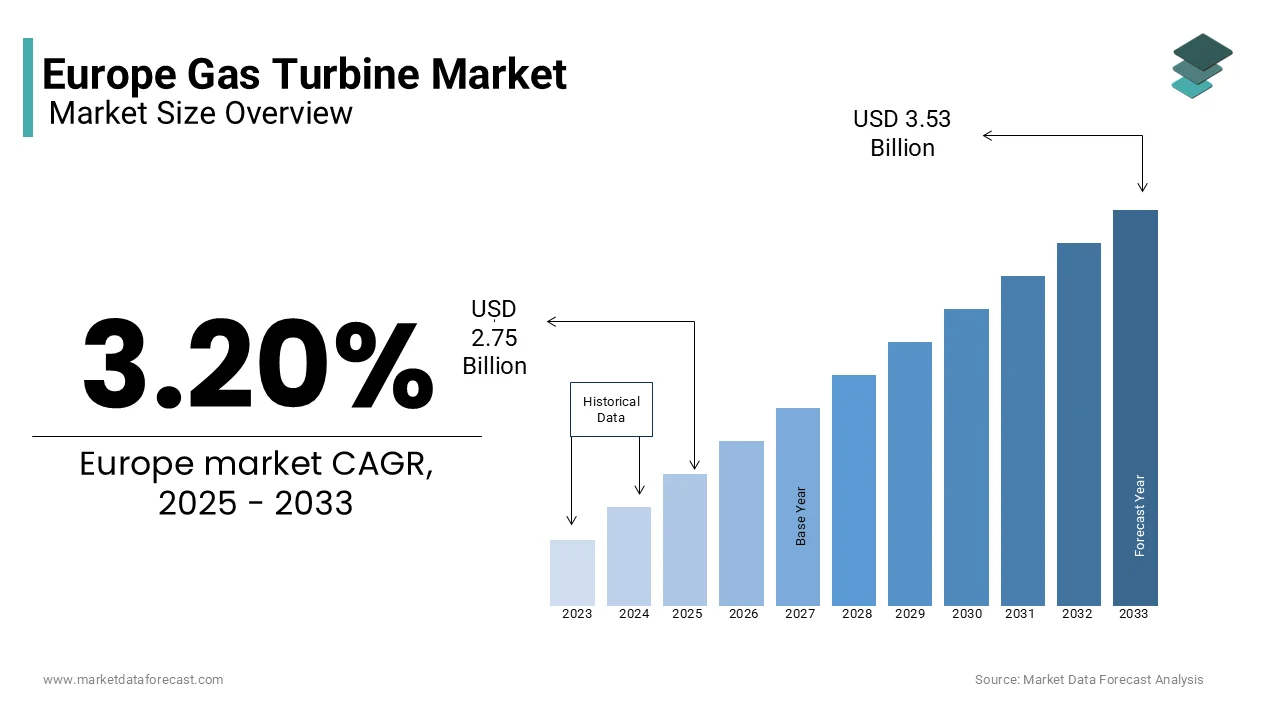

The Europe gas turbine market, valued at USD 2.66 billion in 2024, is projected to grow to USD 3.53 billion by 2033, increasing from USD 2.75 billion in 2025 at a CAGR of 3.20% between 2025 and 2033.

Gas turbines are primarily used for power generation, mechanical drive applications, and propulsion systems in various industries. Gas turbines operate by converting energy from combusted natural gas or other fuels into mechanical energy, which is subsequently utilized for electricity generation or other mechanical operations.

MARKET DRIVERS

Transition to Cleaner Energy Sources

The transition toward cleaner energy solutions is one of the major factors propelling the demand for gas turbines in Europe. Gas turbines are a preferred technology for reducing greenhouse gas emissions compared to coal-based power plants, aligning with the European Union’s climate targets under the European Green Deal. The International Energy Agency reported that natural gas accounted for approximately 25% of the EU's electricity generation in 2022, underscoring the importance of gas turbines in the region's energy mix.

Modernization of existing power plants and the adoption of combined-cycle power plants, which enhance efficiency by utilizing both gas and steam turbines, are key growth drivers. Leading players like Siemens Energy, General Electric, and Mitsubishi Power dominate the market by introducing advanced turbine models with high efficiency and low emissions. These developments, coupled with increasing investments in renewable energy projects, highlight the pivotal role of gas turbines in Europe’s transition to a sustainable energy future.

Increasing Demand for Energy Efficiency

The rising demand for energy-efficient power generation solutions is another major driver of the gas turbine market. Combined-cycle gas turbine (CCGT) systems, which utilize both gas and steam turbines, achieve efficiency levels exceeding 60%, compared to conventional coal plants at around 35%. According to the International Energy Agency, the European Union witnessed a 15% increase in CCGT installations from 2020 to 2022, driven by their ability to maximize energy output while minimizing fuel consumption. This trend aligns with the EU’s Energy Efficiency Directive, which mandates improved energy utilization across industries, further bolstering the adoption of advanced gas turbine technologies.

MARKET RESTRAINTS

High Capital Costs and Maintenance Requirements

The high capital investment and maintenance costs associated with gas turbines are significant restraints on the European market. Advanced gas turbines, particularly those used in combined-cycle power plants, require substantial upfront costs for installation and ongoing operational expenditures. According to the International Energy Agency, the cost of a new gas turbine-based combined-cycle power plant ranges from €900 to €1,200 per kilowatt of capacity. Additionally, maintenance costs are elevated due to the need for skilled technicians and regular servicing to ensure efficiency and reliability. This financial burden can deter investments, especially in smaller utilities and regions with limited budgets, slowing market growth despite the technology’s efficiency advantages.

Fluctuating Natural Gas Prices and Supply Concerns

The volatility of natural gas prices and concerns over supply security act as key challenges for the gas turbine market in Europe. The European Union's reliance on imported natural gas, which accounted for 83% of consumption in 2022 according to Eurostat, makes the market vulnerable to price fluctuations and geopolitical disruptions. For instance, the Russia-Ukraine conflict in 2022 caused a 30% surge in European natural gas prices, significantly impacting operational costs for gas turbine-based power plants. This instability can reduce the competitiveness of gas turbines compared to renewable energy sources, which have lower operational costs and are not subject to fuel price volatility, hindering further adoption in the market.

MARKET OPPORTUNITIES

Integration of Hydrogen as a Fuel

The increasing focus on hydrogen as a clean energy source presents a significant opportunity for the European gas turbine market. Hydrogen can be blended with natural gas or used independently in advanced turbines to reduce carbon emissions. The European Commission reported in 2023 that hydrogen could meet up to 13% of the EU's energy demand by 2050, aligning with its Green Deal targets. Major turbine manufacturers, such as Siemens Energy and General Electric, are developing turbines capable of operating on high hydrogen blends, with some models reaching 100% hydrogen compatibility. As investments in hydrogen infrastructure, including production and storage facilities, grow under initiatives like the EU Hydrogen Strategy, the market for hydrogen-ready gas turbines is set to expand.

Modernization of Aging Power Infrastructure

The modernization of Europe’s aging power infrastructure offers a key growth opportunity for the gas turbine market. Over 40% of the EU’s thermal power plants are more than 30 years old, according to the International Energy Agency. Replacing outdated coal-based systems with advanced gas turbine technology is a priority for achieving energy efficiency and emissions reductions. Combined-cycle gas turbines, with efficiency rates exceeding 60%, are particularly favored for these upgrades. Furthermore, the European Investment Bank allocated €15 billion in 2022 to modernize energy infrastructure, supporting projects focused on cleaner and more efficient energy production. These modernization efforts position gas turbines as a critical component in transitioning to a more sustainable energy network.

MARKET CHALLENGES

Competition from Renewable Energy Sources

The growing penetration of renewable energy sources such as wind and solar power poses a significant challenge to the European gas turbine market. Renewables are increasingly preferred due to their lower operational costs and alignment with the European Union’s goal of achieving 40% renewable energy in its overall energy mix by 2030, as reported by the European Commission. In 2022, wind and solar power accounted for over 22% of Europe’s electricity generation, while natural gas-fired power declined in relative share. As renewable energy installations continue to expand, gas turbines face reduced demand, particularly in regions prioritizing zero-carbon solutions. This trend pressures turbine manufacturers to adapt by integrating technologies like hydrogen and enhancing flexibility to remain competitive.

Stringent Emissions Regulations and Compliance Costs

Stringent environmental regulations targeting emissions reductions challenge the European gas turbine market. The European Green Deal and the Industrial Emissions Directive set strict limits on nitrogen oxides (NOx) and carbon dioxide (CO₂) emissions, requiring gas turbine operators to invest in costly upgrades or adopt advanced low-emission technologies. According to the European Environment Agency, power sector emissions must be cut by 55% by 2030 compared to 1990 levels. Compliance costs for upgrading existing gas turbines or developing new models with lower emissions have increased by approximately 20% since 2020. These financial and technological hurdles can deter investments and complicate the adoption of gas turbines, particularly in smaller-scale projects.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.20% |

|

Segments Covered |

By Technology, Capacity, End-Use, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Ansaldo Energia, GE Aerospace, Kawasaki Heavy Industries Ltd, ManpowerGroup Inc, Mitsubishi Corp, Opera Ltd ADR, Siemens AG, and Caterpillar Inc. |

REGIONAL ANALYSIS

Germany held the dominating position in the European gas turbine market in 2024 due to its focus on transitioning from coal to cleaner energy sources and its strong industrial base. According to the German Federal Ministry for Economic Affairs and Climate Action, Germany allocated €40 billion in 2023 for modernizing its power sector, including combined-cycle gas turbine (CCGT) installations. These turbines are essential for stabilizing the grid as the country expands its renewable energy capacity. German manufacturers, such as Siemens Energy, are also at the forefront of developing advanced turbines compatible with hydrogen, reinforcing the country’s leadership in sustainable energy technologies.

The UK gas turbines market is one of the notable markets for gas turbines in Europe. The growth of the UK market is driven by significant investments in low-carbon energy and flexible power generation systems. The UK Department for Business, Energy & Industrial Strategy reported that natural gas accounted for 38% of electricity generation in 2022, underscoring the importance of gas turbines in the energy mix. The government’s push for hydrogen-ready infrastructure further bolsters this market segment, with initiatives like the £240 million Net Zero Hydrogen Fund supporting the integration of hydrogen in gas turbines. Companies like General Electric and Mitsubishi Power maintain strong presences in the UK, contributing to technological advancements and market growth.

France stands out in the European market due to its adoption of combined-cycle gas turbines (CCGT) to complement its nuclear-dominated energy grid. The French Ministry for the Ecological Transition highlighted that natural gas provided 16% of the country’s electricity in 2022, a significant share given France’s renewable and nuclear focus. Gas turbines are critical for peak-load management and grid stability. Additionally, modernization of aging infrastructure and the government’s hydrogen strategy have driven demand for advanced turbines, with major manufacturers like Alstom and General Electric playing key roles in supporting France’s energy goals.

KEY MARKET PLAYERS

The major players in the Europe gas turbine market include Ansaldo Energia, GE Aerospace, Kawasaki Heavy Industries Ltd, ManpowerGroup Inc, Mitsubishi Corp, Opera Ltd ADR, Siemens AG, and Caterpillar Inc.

MARKET SEGMENTATION

This research report on the European gas turbine market is segmented and sub-segmented into the following categories.

By Technology

- Open Cycle

- Combined Cycle

By Capacity

- Greater than equal to 200 MW

- >200 MW

By End-Use

- Power & Utility

- Industrial

By Application

- Oil & Gas

- Power Generation

- Marine

- Aerospace

- Process Plants

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the Europe gas turbine market?

The market is driven by increasing power demand, a shift towards cleaner energy sources, advancements in gas turbine technology, and government regulations supporting low-carbon power generation.

What types of gas turbines are most commonly used in Europe?

Heavy-duty gas turbines and aeroderivative gas turbines are the most common, with heavy-duty models being preferred for power plants and aeroderivative ones used for industrial and mobile applications.

What are the latest technological advancements in the Europe gas turbine market?

Advancements include higher efficiency models, hydrogen-ready turbines, digital monitoring systems, and lower-emission combustion technologies.

What is the future outlook for the gas turbine market in Europe?

The market is expected to evolve with a focus on efficiency, hydrogen integration, and hybrid power solutions, ensuring gas turbines remain relevant in the energy transition.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]