Europe Gas-Fired Boiler Market Size, Share, Trends, & Growth Forecast Report By Capacity (≤ 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, > 100 - 250 MMBtu/hr, and > 250 MMBtu/hr), Technology, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Gas-Fired Boiler Market Size

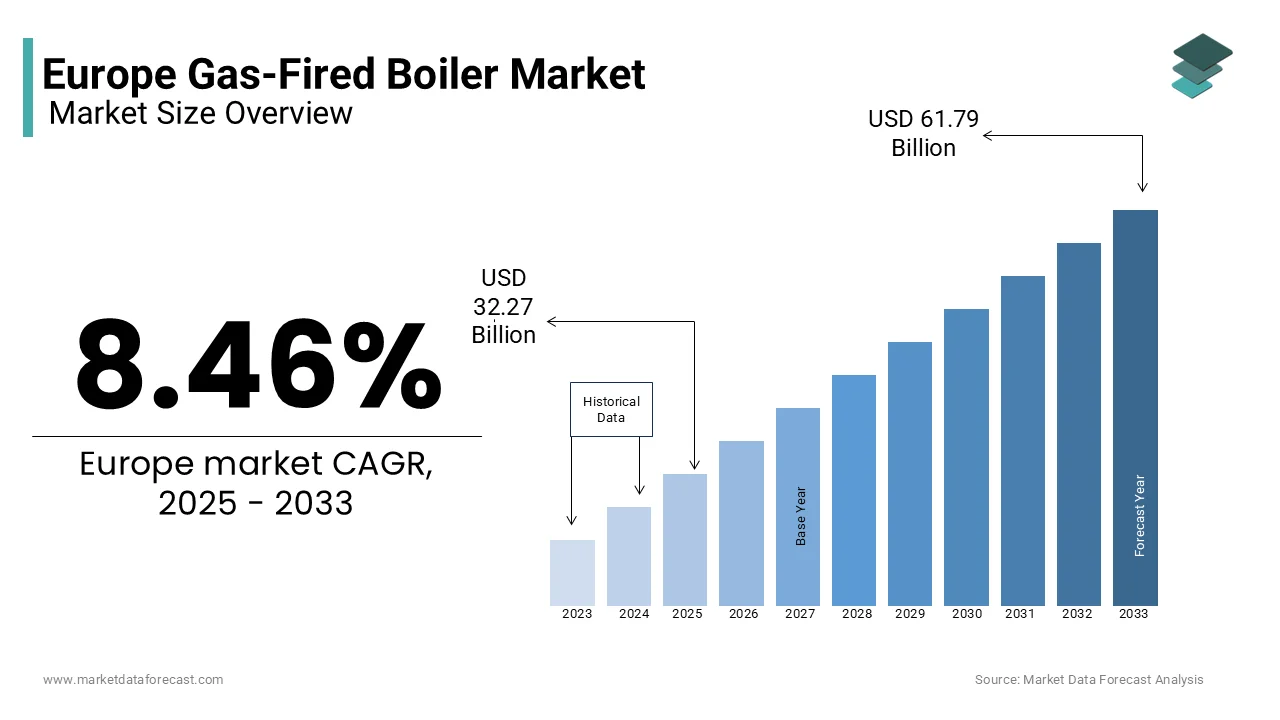

The Europe gas-fired boiler market was valued at USD 29.75 billion in 2024. The European market is projected to reach USD 61.79 billion by 2033 from USD 32.27 billion in 2025, growing at a CAGR of 8.46% from 2025 to 2033.

Gas-fired boilers are appliances that utilize natural gas or liquefied petroleum gas (LPG) to generate heat for space heating and hot water production. Europe continues its transition toward sustainable energy systems, so gas-fired boilers remain a critical component of the heating sector, particularly in countries with well-established natural gas networks. According to a report by the European Heat Pump Association (EHPA), gas-fired boilers accounted for approximately 45% of the total heating systems installed in Europe in 2022, underscoring their widespread adoption. Moreover, according to the International Energy Agency (IEA), natural gas remains the second-largest energy source in Europe, contributing to over 20% of the continent’s energy mix. This reliance on gas is further bolstered by the European Union’s commitment to phasing out coal-fired systems, driving demand for cleaner alternatives like gas-fired boilers. Germany, the United Kingdom, and Italy are leading markets in the European market.

Despite challenges such as fluctuating gas prices and regulatory pressures to adopt renewable heating technologies, the gas-fired boiler market remains resilient. Technological advancements, including condensing boilers and hybrid systems, have improved efficiency and reduced emissions, ensuring compliance with stringent EU environmental standards. The European Commission’s Green Deal initiative emphasizes the need for low-carbon heating solutions and are positioning gas-fired boilers as a transitional technology while renewable alternatives mature.

MARKET DRIVERS

Transition from Coal to Cleaner Energy Sources

The transition from coal to cleaner energy sources is a notable propellent for growth in the European gas-fired boiler market. The European Commission reports that coal consumption in Europe has declined by over 30% since 2015, creating a significant demand for low-carbon heating alternatives like gas-fired boilers. Natural gas emits approximately 50% less carbon dioxide compared to coal, making it a preferred transitional fuel. According to Eurostat, natural gas accounted for 22% of Europe’s primary energy consumption in 2022, with gas-fired boilers being a key component in residential and industrial heating systems. As per the International Energy Agency (IEA), over 40% of new heating installations in Europe are gas-based, driven by government incentives to phase out coal-fired systems. This transition not only reduces greenhouse gas emissions but also ensures compliance with EU environmental regulations, further propelling the adoption of gas-fired boilers.

Advancements in Boiler Technology and Efficiency

Another key driver is the continuous advancement in gas-fired boiler technology, which has significantly improved efficiency and reduced operational costs. The European Heat Pump Association (EHPA) notes that modern condensing boilers achieve efficiency levels of up to 98%, compared to traditional non-condensing models that operate at around 70-80%. These advancements have made gas-fired boilers more appealing to consumers seeking cost-effective and energy-efficient solutions. The European Environment Agency reports that households equipped with high-efficiency gas boilers consume 20-30% less energy than those using older models, leading to substantial savings on heating bills. Additionally, hybrid systems that integrate gas boilers with renewable technologies like solar thermal panels are gaining traction, supported by EU funding programs. For instance, the European Investment Bank allocated €5 billion in 2022 for energy-efficient heating projects, further boosting demand for advanced gas-fired boilers across the region.

MARKET RESTRAINTS

Stringent Environmental Regulations

A major restraint in the Europe gas-fired boiler market is stringent environmental regulations aimed at reducing carbon emissions. The European Environment Agency stated that the EU's commitment to achieving net-zero greenhouse gas emissions by 2050 has led to policies discouraging fossil fuel-based heating systems. For instance, under the European Green Deal, member states are required to phase out inefficient gas boilers and replace them with renewable alternatives like heat pumps. According to Eurostat, residential energy consumption accounts for about 25% of total EU energy use, making this sector a prime target for emission cuts. These regulatory pressures increase compliance costs for manufacturers and limit consumer adoption due to higher upfront expenses associated with eco-friendly models.

Volatility of Natural Gas Prices

A further obstacle is the variability in natural gas prices which affects operational costs and makes it harder for consumers to afford services. The International Energy Agency reports that Europe faced an unprecedented surge in natural gas prices during 2021-2022, with prices reaching over €180 per megawatt-hour compared to around €20 before the crisis. This instability stems from geopolitical tensions, such as those involving Russia-Ukraine conflicts, affecting supply chains. High gas prices make gas-fired boilers less attractive economically, pushing consumers toward alternative technologies despite their initial cost barriers. Additionally, government subsidies often favour renewables, further tilting the balance away from traditional gas solutions according to data published by the European Commission Directorate-General for Energy.

MARKET OPPORTUNITIES

Growing Demand for Energy-Efficient Heating Solutions

The increasing interest in energy-efficient heating solutions gives a significant opportunity for the gas-fired boiler market in Europe. The European Commission Directorate-General for Energy states that over 70% of EU households still rely on outdated heating systems, creating a vast potential for upgrades to modern condensing gas boilers, which are up to 98% efficient. Eurostat reports that residential heating accounts for nearly 60% of total household energy consumption, driving interest in technologies that reduce energy waste. Governments across Europe are offering incentives, such as Germany’s Federal Office for Economic Affairs and Export Control (BAFA) subsidies, which provide up to €450 per unit for high-efficiency boilers. These initiatives encourage homeowners to replace older systems with energy-saving models, boosting market growth while aligning with sustainability goals.

Expansion of District Heating Networks

The growing acceptance of district heating networks across Europe creates a key opportunity for integrating gas-fired boilers. According to the International Energy Agency, district heating currently supplies around 12% of Europe’s total heat demand, with countries like Denmark and Sweden leading the way. Gas-fired boilers serve as reliable backup systems during peak loads or maintenance periods are ensuring uninterrupted heating supply. The European Heat Pump Association notes that hybrid systems combining gas boilers with renewable energy sources can enhance efficiency and flexibility. Additionally, the European Investment Bank has allocated €1 billion annually to support sustainable heating infrastructure projects. This trend makes a favourable environment for gas boiler manufacturers to innovate and cater to the evolving needs of district heating systems.

MARKET CHALLENGES

High Initial Costs and Economic Constraints

The expensive upfront investment required for advanced systems is a key impediment to widespread adoption in the European gas-fired boiler market. The European Commission Directorate-General for Energy revealed that modern condensing gas boilers, while highly efficient, can cost between €2,000 and €5,000, excluding installation fees. For many households, this upfront expense is prohibitive, especially in regions with lower disposable incomes. Eurostat reports that over 30 million people in the EU face energy poverty making it difficult for them to invest in energy-efficient technologies. Additionally, the European Environment Agency notes that financial incentives often favor renewable alternatives like heat pumps, leaving gas boilers at a competitive disadvantage. This economic barrier slows market growth, as consumers prioritize affordability over long-term energy savings.

Competition from Renewable Heating Technologies

An additional challenge is the heightened competition from renewable heating technologies due to robust decarbonization policies. The International Energy Agency states that heat pump installations in Europe surged by 35% in 2022 alone and is supported by subsidies such as Austria’s €6,000 grant per unit. These technologies are increasingly viewed as the future of sustainable heating overshadows gas-fired boilers. The European Heat Pump Association predicts that heat pumps could meet 40% of Europe’s heating demand by 2030, further eroding the gas boiler market share. Moreover, the European Investment Bank has committed €10 billion annually to renewable energy projects, prioritizing alternatives to fossil fuel-based systems. This policy-driven shift intensifies competition, forcing gas boiler manufacturers to innovate or risk obsolescence in a rapidly evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.46% |

|

Segments Covered |

By Capacity, Technology, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

A.O. Smith, Ariston Holding N.V., Babcock & Wilcox Enterprises, BAXI, Bosch Industriekessel, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Carrier, Daikin, FERROLI, Hurst Boiler & Welding, Ideal Heating, Miura America, Slant/Fin Corporation, The Fulton Companies, Vaillant Group, Viessmann, and WM Technologies. |

SEGMENTAL ANALYSIS

By Capacity Insights

The ≤ 10 MMBtu/hr segment led the market by capturing a 65% of the European market share in 2024 due to its widespread adoption in residential applications, where compact and cost-effective heating solutions are essential. The European Commission Directorate-General for Energy states that over 70% of EU households rely on boilers in this range due to their affordability, with prices averaging €2,500. These systems are critical for meeting household heating demands, which account for 60% of residential energy consumption. Their importance lies in providing efficient heating while aligning with EU efficiency standards, ensuring compliance with environmental goals.

The > 10 - 50 MMBtu/hr segment is anticipated to witness the fastest CAGR of 6.8% from 2025 to 2033. Factors such as the growing demand is driven by driven by increasing demand from medium-sized commercial facilities like schools and hospitals, where moderate heating loads are required. According to the European Investment Bank, investments in energy-efficient infrastructure have boosted this segment's adoption. Operational costs are 20% lower than larger-capacity systems, so these boilers offer scalability and cost-effectiveness. Their ability to integrate with renewable energy sources further enhances their appeal, making them vital for achieving EU decarbonization targets while supporting industrial and commercial heating needs.

By Technology Insights

The condensing technology segment led the market by occupying a 80.5% of the market share in 2024. Its superior efficiency, achieving up to 98% thermal efficiency compared to 70-80% for non-condensing systems has majorly contributed to the domination of the segment in the global market.. Eurostat reported that condensing boilers are now mandatory in new buildings under EU energy performance regulations, boosting their adoption. With subsidies like Germany’s €450 incentive per unit under BAFA, these systems reduce energy consumption and carbon emissions significantly. Their importance lies in aligning with the European Green Deal’s net-zero goals are making them critical for sustainable heating solutions across residential and commercial sectors.

By Application Insights

The residential segment was the largest segment and held 65.8% of the total market share in 2024. The growth of this segment is primarily due to the high demand for heating systems in over 220 million households across the EU, where residential energy consumption accounts for nearly 60% of total household energy use, according to the European Commission Directorate-General for Energy. Modern condensing boilers with efficiencies exceeding 90% are increasingly adopted due to government incentives like Germany’s BAFA subsidies, which provide up to €450 per unit. The segment's importance lies in its role in addressing energy poverty, as over 30 million Europeans struggle with heating costs, making affordable and efficient residential solutions critical.

The healthcare facilities segment within the commercial segment is predicted to witness the highest CAGR of 8.5% during the forecast period. The increasing need for reliable heating in hospitals and clinics and especially post-pandemic where precise temperature control is vital is mainly propelling the growth of this segment. A study by European Investment Bank revealed that energy-efficient gas-fired boilers reduce operational costs by up to 25% compared to older systems, making them ideal for healthcare infrastructure expansion. Their ability to ensure patient comfort and comply with environmental regulations further boosts adoption. Europe invests heavily in modernizing healthcare facilities, so this segment plays a pivotal role in delivering sustainable and dependable heating solutions.

REGIONAL ANALYSIS

Germany led the Europe gas-fired boiler market with a 25.8% share in 2024 and is driven by its robust energy efficiency policies and significant investments in sustainable heating solutions. The European Commission Directorate-General for Energy stated that Germany’s BAFA subsidies offeres up to €450 per unit for high-efficiency condensing boilers have accelerated adoption. Digital adoption rises so e-commerce bridges gaps in accessibility and affordability, reshaping the eyewear market by catering to evolving consumer preferences and driving innovation in retail strategies. Germany's development is enhanced by its dedication to lowering carbon emissions, a key component of the German Climate Action Plan 2050 This emphasis on sustainability and financial incentives has positioned Germany as a frontrunner in the regional market.

The UK currently has a robust market for gas-fired boilers and is expected to have a CAGR of 5.9%. It is supported by strict carbon emission regulations and the phase-out of non-condensing boilers. The UK Department for Business, Energy & Industrial Strategy emphasizes retrofitting programs which drive demand for modern gas boilers. Moreover, the UK’s commitment to achieving net-zero emissions by 2050 has led to policies mandating the replacement of inefficient heating systems. Additionally, initiatives like the Boiler Upgrade Scheme provide financial support for transitioning to energy-efficient technologies. These measures combined with the UK’s large housing stock of over 28 million homes creates a strong foundation for sustained market growth and leadership in the European gas-fired boiler sector.

Italy's position in Europe's gas-fired boiler market is strong, with a positive growth trajectory. The Italian Ministry of Economic Development notes that tax incentives like the "Superbonus 110%" scheme have spurred upgrades to energy-efficient systems, making Italy a key player in the regional market. This initiative allows homeowners to deduct up to 110% of renovation costs, including the installation of high-efficiency boilers, driving rapid adoption. Italy’s aging building infrastructure, coupled with growing consumer awareness about energy savings, further supports market expansion. As one of Europe’s largest economies with over 25 million households, Italy’s proactive approach to incentivizing sustainable heating solutions ensures its leading position in the gas-fired boiler market.

KEY MARKET PLAYERS

The major players in the Europe gas-fired boiler market include A.O. Smith, Ariston Holding N.V., Babcock & Wilcox Enterprises, BAXI, Bosch Industriekessel, Bradford White Corporation, BURNHAM COMMERCIAL BOILERS, Carrier, Daikin, FERROLI, Hurst Boiler & Welding, Ideal Heating, Miura America, Slant/Fin Corporation, The Fulton Companies, Vaillant Group, Viessmann, and WM Technologies.

MARKET SEGMENTATION

This research report on the Europe gas-fired boiler market is segmented and sub-segmented into the following categories.

By Capacity

- ≤ 10 MMBtu/hr

- > 10 - 50 MMBtu/hr

- > 50 - 100 MMBtu/hr

- > 100 - 250 MMBtu/hr

- > 250 MMBtu/hr

By Technology

- Condensing

- Non-Condensing

By Application

- Residential

- Commercial

- Offices

- Healthcare Facilities

- Educational Institutions

- Lodgings

- Retail Stores

- Others

- Industrial

- Food Processing

- Pulp & Paper

- Chemical

- Refinery

- Primary Metal

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the Europe gas-fired boiler market?

The market is primarily driven by increasing demand for energy-efficient heating solutions, stringent emission regulations, and the transition from coal-based heating to cleaner natural gas alternatives.

What types of gas-fired boilers are commonly used in Europe?

The most commonly used types include condensing boilers, non-condensing boilers, and combi boilers, with condensing boilers being the most preferred due to their higher efficiency and compliance with EU regulations.

How is the commercial sector contributing to the gas-fired boiler market in Europe?

The commercial sector, including hotels, hospitals, and office buildings, significantly contributes to the market by demanding high-capacity boilers for space and water heating needs.

How is the gas-fired boiler market expected to evolve in the coming years?

The market will likely see gradual growth with increased adoption of energy-efficient and hydrogen-ready boilers, though long-term trends may shift towards electrification and heat pumps.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]