Europe Gas Detection Equipment Market Size, Share, Trends, & Growth Forecast Report By Technology (Electrochemical, Infrared, Metal Oxide Semiconductor, Photoionization, and Ultrasonic), End Use Industry, Product Type, Sensing Technology, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Gas Detection Equipment Market Size

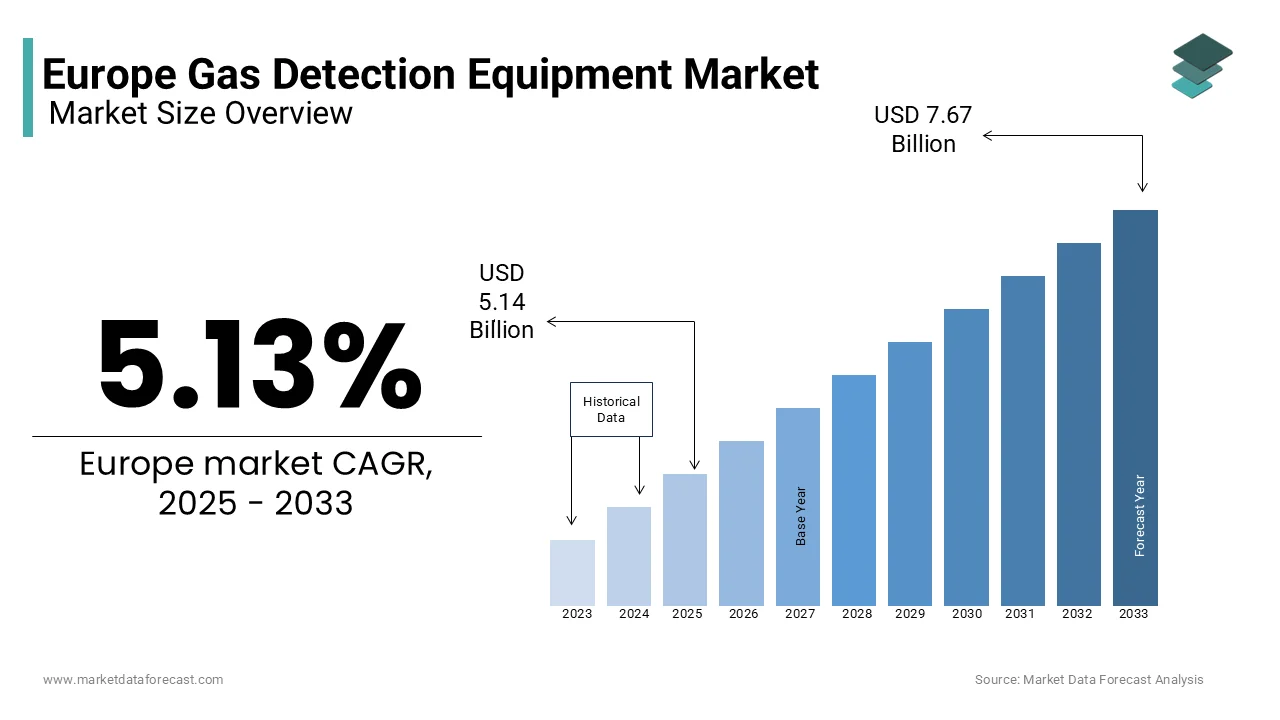

The Europe gas detection equipment market was worth USD 4.89 billion in 2024. The European market is expected to reach USD 7.67 billion by 2033 from USD 5.14 billion in 2025, rising at a CAGR of 5.13% from 2025 to 2033.

The gas detection equipment is critical for preventing accidents, protecting human health, and minimizing environmental damage caused by gas leaks or toxic emissions. The market covers a wide range of products including portable gas detectors, fixed gas detection systems, and wireless-enabled devices, each tailored to specific applications such as oil and gas, chemical manufacturing, mining, and fire safety.

The European gas detection equipment market projections indicating steady growth driven by stringent safety regulations and rising awareness of workplace hazards. A study by Eurostat found that over 40% of industrial facilities in Western Europe have adopted IoT-enabled gas detection systems to enhance real-time monitoring and data analytics capabilities.

The demand for innovative solutions such as wearable gas detectors and AI-integrated systems has surged that too particularly in Germany, France, and the UK where industries prioritize worker safety and environmental compliance. Additionally, the increasing prevalence of urbanization and smart city initiatives has heightened the need for residential gas safety systems. The industries across Europe strive to balance productivity with safety and sustainability, so, the gas detection equipment market is poised to play a transformative role in fostering safer and more secure environments.

MARKET DRIVERS

Stringent Workplace Safety Regulations

The emphasis on workplace safety regulations is influencing the development of the European gas detection market. The European Agency for Safety and Health at Work stated that above 5,000 workers die annually due to occupational accidents, with hazardous gases being a major risk factor. To mitigate these risks, directives like the EU OSHA’s Framework Directive 89/391/EEC mandate the use of gas detection systems in high-risk industries such as oil and gas, chemicals, and mining. For example, Germany reported a 15% increase in industrial safety equipment adoption in 2022 following stricter safety protocols. These regulations are pushing companies to adopt advanced gas detection technologies, thereby boosting market growth as industries strive to comply with legal requirements and ensure worker safety.

Rising Natural Gas Consumption and Infrastructure Expansion

The growing demand for natural gas across the region also propels the growth of the European gas detection market. It is fuelled by its role as a cleaner energy source. Eurostat reports that natural gas consumption in the EU reached 376 billion cubic meters in 2021 is contributing to 25% of the region's total energy mix. Projects like the Nord Stream pipeline have expanded gas infrastructure, increasing the need for reliable gas leak detection systems. The International Energy Agency states that methane emissions from natural gas systems could be reduced by 75% using current technologies which is showcasing the importance of detection equipment. As European nations work toward climate goals under the European Green Deal, investments in gas detection systems are set to rise and is ensuring safer operations and compliance with emission reduction targets.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

The high initial investment required for advanced systems which often deters small and medium-sized enterprises (SMEs) is primarily hampering the development of the European gas detection market. A study by the European Investment Bank, SMEs account for 99% of all businesses in the EU but frequently face budget limitations for adopting cutting-edge safety technologies. For instance, a fixed gas detection system can cost between €5,000 and €20,000, depending on its complexity, as reported by Eurostat. Many companies, especially in economically strained regions like Eastern Europe, prioritize immediate operational needs over long-term safety investments. This financial barrier slows down market growth, as businesses delay upgrades or opt for cheaper, less effective alternatives. The European Commission notes that such constraints hinder the adoption of innovative solutions is impacting overall workplace safety standards.

Complexity of System Integration and Maintenance

The complexity involved in integrating gas detection systems with existing infrastructure, coupled with ongoing maintenance costs is a major factor decreasing the growth rate of the European gas leak market. According to the European Agency for Safety and Health at Work, improper integration can lead to system failures, with nearly 30% of industrial accidents linked to equipment malfunctions. Additionally, maintaining these systems requires specialized training and regular calibration, which adds to operational expenses. A report by the International Labour Organization estimates that annual maintenance costs for gas detection equipment can range from €500 to €2,000 per unit, depending on its sophistication. Many industries and particularly smaller players struggle with the technical expertise needed for seamless integration. This challenge limits the widespread adoption of advanced gas detection technologies, despite their potential to enhance safety and compliance.

MARKET OPPORTUNITIES

Advancements in IoT and Smart Gas Detection Technologies

The integration of Internet of Things (IoT) and smart technologies presents a significant opportunity for the Europe gas detection equipment market. As per the report by the European Commission, IoT adoption in industrial sectors is projected to grow by 20% annually, driven by the need for real-time monitoring and predictive maintenance. Smart gas detectors equipped with IoT capabilities can reduce operational risks by providing instant alerts and data analytics which is improving response times by up to 40%, as per Eurostat. For instance, industries leveraging IoT-enabled systems reported a 25% reduction in gas leak incidents in 2022. The European Environment Agency emphasizes that such innovations align with digital transformation goals under the EU Green Deal is encouraging investments in smart safety solutions. This technological shift is expected to drive market expansion as industries seek more efficient and connected safety systems.

Growing Focus on Hydrogen Economy and Renewable Energy

The emergence of the hydrogen economy offers another promising opportunity for the gas detection equipment market in Europe. The European Clean Hydrogen Alliance estimates that hydrogen production capacity in the EU could reach 40 gigawatts by 2030 is creating a demand for specialized detection systems to ensure safe handling. Hydrogen, being highly flammable, requires precise monitoring, which has led to a surge in demand for advanced gas detectors. The European Investment Bank notes that over €10 billion has been allocated for hydrogen infrastructure by 2025 which is boosting the need for reliable detection systems. This focus on renewable energy and hydrogen safety is set to propel market growth significantly.

MARKET CHALLENGES

Limited Awareness and Training Among End-Users

The limited awareness and inadequate training among end-users which often leads to improper usage and system failures is a notable factor affecting the expansion of the European gas detetction market. The European Agency for Safety and Health at Work reports that nearly 40% of industrial accidents involving hazardous gases are linked to human error or lack of proper training. For instance, a survey conducted by Eurostat in 2021 revealed that only 55% of workers in high-risk industries received comprehensive safety training on gas detection systems. This knowledge gap results in underutilization of advanced features and increased risks of accidents. The International Labour Organization stated that insufficient training programs in SMEs exacerbate the issue, as these businesses often lack resources to educate their workforce effectively. Addressing this challenge requires targeted awareness campaigns and standardized training protocols to ensure safer operations.

Stringent Environmental Regulations Impacting Manufacturing Costs

The rising manufacturing costs driven by stringent environmental regulations affects the production of gas detection equipment in Europe. The European Environment Agency states that manufacturers must comply with the EU’s REACH regulation, which imposes strict limits on hazardous substances used in electronic components. These compliance requirements increase production costs by up to 15%, as reported by the European Commission. Additionally, the shift toward sustainable manufacturing practices demands significant investments in eco-friendly technologies which is further straining smaller manufacturers. A study by Eurostat indicates that over 30% of European manufacturers face challenges in balancing cost-efficiency with regulatory compliance. This financial burden often leads to higher product prices and is making gas detection equipment less accessible to certain industries and hindering widespread adoption across the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.13% |

|

Segments Covered |

By Technology, End Use Industry, Product Type, Sensing Technology, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Teledyne Technologies, RKI Instruments, MSA Safety, Crowcon Detection Instruments, Honeywell, Dräger, Extech Instruments, GfG Instrumentation, Emerson Electric, Calibration Technologies, SGX Sensortech, Industrial Scientific, Aeroqual, Trolex, and Cambridge Sensyne. |

SEGMENTAL ANALYSIS

By Technology Insights

The Electrochemical gas detection segment held the largest market share at 40.2% in 2024. Factors like high sensitivity and cost-effectiveness in detecting toxic gases like carbon monoxide, critical for industries such as oil and gas and wastewater treatment are contributing the rise of this segment in the global market. Eurostat reports an annual adoption growth of 8% and is driven by stringent workplace safety regulations under EU OSHA directives. These sensors are vital due to their ability to provide precise readings at low concentrations, reducing industrial accidents. However, their limited lifespan of 2-5 years necessitates frequent replacements, sustaining market demand. Their widespread use underscores their importance in safeguarding worker health and ensuring compliance with emission standards.

The Ultrasonic gas detection segment is rising quickly and is predicted to witness the highest CAGR of 12% during the forecast period. This is because of Europe’s expanding natural gas infrastructure and the need for real-time leak detection in pressurized systems. The European Agency for Safety and Health at Work through its findings revealed that ultrasonic detectors prevent catastrophic failures, with over 20% of gas leaks identified using this technology in 2022. Unlike traditional methods, ultrasonic systems function effectively in adverse weather is making them indispensable for outdoor applications. Their non-invasive nature and ability to detect leaks without direct contact align with the EU Green Deal’s focus on safer energy systems which is driving their accelerated adoption across industries.

By End Use Industry Insights

The oil and gas industry had the biggest share of end-use for gas detection equipment in Europe i.e. 35.3%. The sector's high exposure to hazardous gases like methane and hydrogen sulphide which is necessitating robust monitoring systems to prevent leaks and ensure compliance with EU safety regulations is mainly pushing the segment ahead. The International Energy Agency reports that natural gas consumption in Europe reached 376 billion cubic meters in 2021, driving demand for advanced detection technologies. Electrochemical and infrared sensors are widely used due to their precision in detecting toxic and combustible gases. The critical role of gas detection in preventing accidents and environmental damage underscores its importance in this high-risk industry.

On the other hand, the manufacturing sector rose rapidly in the recent years and is likely to experience the fastest CAGR of 9.5% during the forecast period. This growth of this segment is credited to the increasing automation, IoT integration, and stricter workplace safety regulations under EU OSHA directives. Eurostat revealed that over 20% of industrial accidents occur in manufacturing facilities, emphasizing the need for reliable gas detection systems. The EU Green Deal further accelerates adoption by promoting sustainable practices, requiring industries to monitor emissions effectively. Metal Oxide Semiconductor (MOS) and photoionization detectors are gaining traction for detecting VOCs and toxic gases. Manufacturers prioritize worker safety and regulatory compliance. The demand for advanced gas detection solutions is set to rise significantly, making this segment pivotal for market expansion.

By Product Type Insights

The Fixed gas detectors segment grabbed the dominant market share of 45.1% in 2024 owing to their critical role in continuous monitoring of hazardous gases in high-risk industries like oil and gas and chemical manufacturing. The European Agency for Safety and Health at Work emphasizes that fixed systems are vital for compliance with safety regulations, such as the Industrial Emissions Directive, which mandates real-time monitoring to prevent accidents. These detectors, often using infrared or electrochemical sensors, provide reliable, long-term operation, reducing risks from toxic and combustible gases. Their ability to offer uninterrupted protection in industrial environments underscores their importance. With over 60% of industrial facilities adopting fixed systems, they remain indispensable for safeguarding infrastructure and ensuring regulatory adherence.

The wireless gas detectors segment emerged as the top performing category and is anticipated to witness the fastest CAGR of 13.2%. Its growth is propelled by advancements in IoT and the demand for flexible, real-time monitoring solutions in industries like construction and mining. A study by the Eurostat found that wireless systems reduce installation costs by up to 25% compared to wired alternatives, making them ideal for remote or dynamic environments. The EU Green Deal further accelerates adoption by promoting digitalization and energy-efficient technologies. Wireless detectors enhance operational efficiency by enabling seamless integration with smart safety systems, improving response times by 40%. The industries are prioritizing cost-efficiency and connectivity, so, wireless gas detectors has become pivotal for modernizing safety protocols and addressing evolving industrial challenges.

By Sensing Technology Insights

The Catalytic sensors segment held the top position under this category of the European gas detection market and captured a market share of 35.3% in 2024 due to their comprehensive use in detecting combustible gases like methane and propane. Eurostat stresses that these sensors are critical in high-risk industries such as oil and gas and mining, where explosive atmospheres are common. With a response time of less than 10 seconds, catalytic sensors provide reliable performance in harsh conditions, ensuring compliance with EU safety regulations. They require regular calibration and are susceptible to poisoning by certain chemicals, but their cost-effectiveness and robustness make them indispensable. Over 40% of industrial facilities rely on catalytic sensors, underscoring their importance in preventing accidents and safeguarding workers in hazardous environments.

The Photoacoustic sensors segment is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 14.8% because of their unmatched precision in detecting low-concentration gases, achieving sensitivity at parts-per-billion (ppb) levels, as reported by Eurostat. The EU Green Deal’s emphasis on reducing industrial emissions has accelerated their adoption in chemical and pharmaceutical sectors. Unlike other technologies, photoacoustic sensors minimize cross-sensitivity which is ensuring accurate readings. Their ability to support environmental monitoring aligns with stricter emission standards, driving demand. Industries prioritize high-precision solutions for regulatory compliance. Photoacoustic sensors are becoming pivotal in advancing gas detection technology and addressing modern industrial challenges effectively.

REGIONAL ANALYSIS

Germany spearheaded the European gas detection equipment market and captured a 22.4% share in 2024 which can be attributed to its robust industrial base and particularly in chemical manufacturing and automotive sectors and that demands advanced safety systems. The European Environment Agency notes that Germany’s strict adherence to EU OSHA regulations drives investments in cutting-edge technologies like infrared and electrochemical sensors. The country’s focus on digitalization and smart manufacturing under Industry 4.0 further accelerates adoption. Germany accounts for over 30% of European gas detection equipment sales. Its leadership reflects a strong commitment to workplace safety and technological innovation, ensuring compliance with stringent environmental and safety standards.

France stands at a crucial junction and is quickly moving ahead at a CAGR of 6.5%. The country’s push toward renewable energy including green hydrogen projects, has increased demand for advanced gas detection systems to ensure safe operations. Eurostat reported that France’s chemical and petrochemical industries are also significant adopters of these technologies. Additionally, stringent workplace safety regulations under the French Labor Code mandate the use of reliable gas detectors, boosting market growth. France’s proactive approach to sustainability and safety when coupled with its diverse industrial landscape, reinforces its position as a key contributor to the European gas detection equipment market.

The UK made notable strides in the European gas detection market, driven by its oil and gas sector and post-Brexit emphasis on workplace safety, according to the UK Health and Safety Executive. The UK’s aging industrial infrastructure and increasing regulatory scrutiny have fueled investments in advanced gas detection technologies. The European Agency for Safety and Health at Work notes that the UK’s construction and manufacturing sectors are also adopting IoT-enabled detectors to enhance operational safety. Furthermore, the UK’s commitment to achieving net-zero emissions by 2050 has spurred demand for precise monitoring systems in renewable energy projects. These factors, combined with a strong focus on reducing industrial accidents, position the UK as a leading player in the European gas detection equipment market.

KEY MARKET PLAYERS

The major players in the Europe gas detection equipment market include Teledyne Technologies, RKI Instruments, MSA Safety, Crowcon Detection Instruments, Honeywell, Dräger, Extech Instruments, GfG Instrumentation, Emerson Electric, Calibration Technologies, SGX Sensortech, Industrial Scientific, Aeroqual, Trolex, and Cambridge Sensyne.

MARKET SEGMENTATION

This research report on the Europe gas detection equipment market is segmented and sub-segmented into the following categories.

By Technology

- Electrochemical

- Infrared

- Metal Oxide Semiconductor

- Photoionization

- Ultrasonic

By End Use Industry

- Oil and Gas

- Manufacturing

- Mining

- Construction

- Chemical

By Product Type

- Fixed Gas Detectors

- Portable Gas Detectors

- Wireless Gas Detectors

- Multi-Gas Detectors

By Sensing Technology

- Semiconductor Sensors

- Thermal Conductivity Sensors

- Photoacoustic Sensors

- Catalytic Sensors

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe gas detection equipment market?

The market is driven by increasing industrial safety regulations, rising incidents of gas leaks, growing demand from the oil & gas sector, and advancements in sensor technology.

Which industries are the major consumers of gas detection equipment in Europe?

Major industries include oil & gas, chemical manufacturing, mining, power generation, pharmaceuticals, food & beverage, and wastewater treatment.

What technological advancements are influencing the Europe gas detection equipment market?

Innovations include wireless gas detection systems, real-time data monitoring, AI-based predictive maintenance, and improved sensor sensitivity.

How does the adoption of IoT impact gas detection equipment in Europe?

IoT-enabled gas detection allows remote monitoring, automated alerts, predictive maintenance, and integration with smart industrial safety systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]