Europe Fuel Card Market Size, Share, Trends, & Growth Forecast Report By Type (Branded Cards, Universal Cards, and Merchant Cards), Application (Fuel Refill, Parking, Vehicle Service, Toll Charge, and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Fuel Card Market Size

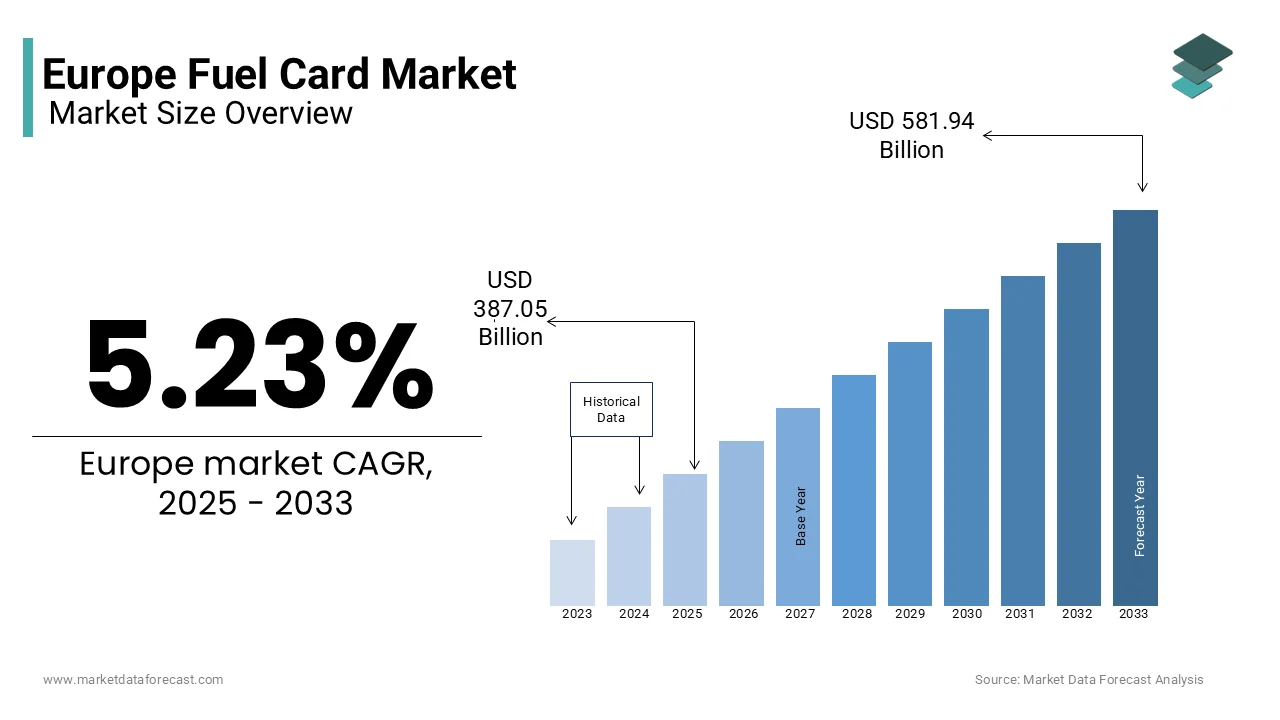

The Europe fuel card market was valued at USD 367.81 billion in 2024. The European market is projected to reach USD 581.94 billion by 2033 from USD 387.05 billion in 2025, growing at a CAGR of 5.23% from 2025 to 2033.

A fuel card, also known as a fleet card, is a specialized payment card designed to facilitate fuel purchases for commercial vehicles while providing detailed transaction records, cost controls, and additional benefits such as discounts on fuel, maintenance services, and toll payments. In recent years, the adoption of fuel cards has surged across Europe is driven by the growing emphasis on optimizing fleet operations, reducing administrative burdens, and addressing environmental concerns through improved fuel efficiency.

According to Eurostat, the European Union’s transportation sector accounts for approximately 25% of total greenhouse gas emissions, which is prompting governments and organizations to adopt measures that promote sustainable practices. According to the International Energy Agency (IEA), fuel consumption by commercial fleets in Europe exceeded 150 billion liters in 2022 that is anticipated to elevate the use of fuel cards in managing this vast expenditure. As per the European Automobile Manufacturers' Association, there are over 35 million commercial vehicles operating in Europe, with fuel costs constituting up to 30% of total fleet operating expenses. This financial burden has accelerated the demand for fuel cards, which enable businesses to monitor fuel usage, prevent fraud, and negotiate favorable terms with fuel providers.

Countries like Germany, France, and the United Kingdom lead the adoption of fuel cards due to their large logistics industries and stringent regulatory frameworks aimed at reducing carbon footprints. The increasing integration of digital technologies and telematics into fleet management systems.

MARKET DRIVERS

Increasing Demand for Fleet Optimization and Cost Management

The growing emphasis on fleet optimization and cost management is a significant driver of the Europe fuel card market. According to the European Automobile Manufacturers' Association, there are over 35 million commercial vehicles in operation across Europe, with fuel expenses accounting for up to 30% of total fleet operating costs. This financial burden has led businesses to adopt fuel cards, which provide real-time transaction data, spending controls, and discounts on fuel purchases. A study by the International Energy Agency (IEA) shown that the commercial fleets in Europe consumed over 150 billion liters of fuel in 2022 with the increasing need for efficient expense tracking. Fuel cards also reduce administrative overhead by consolidating payments and offering detailed reporting features. As per Eurostat, logistics companies using fuel cards have reported a 15–20% reduction in unauthorized fuel purchases that is further driving their adoption across industries.

Rising Focus on Sustainability and Regulatory Compliance

Stringent environmental regulations and the push for sustainability are propelling the adoption of fuel cards in Europe. According to the European Commission, member states reduce greenhouse gas emissions from the transportation sector by 15% by 2030, as part of broader climate goals. Fuel cards play a pivotal role in achieving this by enabling businesses to monitor fuel consumption patterns and promote eco-friendly driving practices. As per the International Transport Forum, telematics-integrated fuel cards have helped reduce fuel wastage by up to 10% in fleets adopting such technologies. According to the UK Department for Transport, companies using fuel cards with carbon-tracking features have achieved a 12% improvement in fuel efficiency. These benefits align with regulatory requirements by making fuel cards an essential tool for compliance and sustainability initiatives across Europe.

MARKET RESTRAINTS

Limited Adoption Among Small and Medium Enterprises

The limited adoption of fuel cards among small and medium enterprises (SMEs) poses a significant restraint to the Europe fuel card market. According to Eurostat, SMEs account for over 99% of all businesses in the European Union, yet many remain hesitant to adopt fuel cards due to perceived complexity and upfront costs. According to the European Commission, nearly 60% of SMEs with fleets of fewer than 10 vehicles do not utilize advanced fleet management tools by including fuel cards, primarily due to budget constraints. Additionally, the UK Department for Business, Energy & Industrial Strategy, 45% of SMEs cite a lack of awareness about the benefits of fuel cards as a barrier. Smaller businesses often find the transition challenging by limiting the overall market penetration of fuel cards across Europe.

Cybersecurity Concerns and Fraud Risks

Cybersecurity concerns and the risk of fraudulent transactions represent another major restraint for the Europe fuel card market. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks on digital payment systems, including fuel cards, which was increased by 25% in 2022. The raising fears among businesses about data breaches and financial losses is quietly to degrade the growth rate of the market. According to the International Chamber of Commerce, fraud related to fuel purchases costs European businesses approximately €3 billion annually, with stolen or misused fuel cards being a significant contributor. Furthermore, as per the French National Cybersecurity Agency, 30% of companies using fuel cards have experienced at least one instance of unauthorized transactions. These risks deter potential users, particularly those with limited cybersecurity infrastructure, from adopting fuel cards, thereby hindering market growth despite their operational benefits.

MARKET OPPORTUNITIES

Integration of Advanced Technologies and Telematics

The integration of advanced technologies such as telematics and data analytics presents a significant opportunity for the Europe fuel card market. As per the European Commission, telematics-enabled fuel cards can reduce fuel consumption by up to 15% through real-time monitoring of driver behavior and route optimization. According to the International Transport Forum, businesses adopting telematics-integrated fuel cards have reported a 20% improvement in fleet efficiency, alongside enhanced compliance with environmental regulations. Furthermore, Eurostat estimates that over 60% of commercial fleets in Europe are expected to adopt connected vehicle technologies by 2025 by creating a robust demand for smart fuel cards. These innovations not only streamline expense management but also align with sustainability goals by making them attractive to logistics companies. The incorporation of IoT and AI into fuel cards is poised to unlock new growth avenue as digital transformation accelerates.

Expansion into Emerging Markets and Untapped Sectors

The expansion of fuel card services into emerging markets and untapped sectors across Europe offers another lucrative opportunity. According to the European Automobile Manufacturers' Association, Eastern European countries, including Poland and Romania, have witnessed a 10% annual increase in commercial vehicle registrations since 2020 with the growing demand for efficient fleet management solutions. As per the UK Department for Transport, sectors such as agriculture and construction, which traditionally lag in fuel card adoption, are now showing interest due to rising fuel costs and regulatory pressures. According to the International Energy Agency (IEA), these underserved industries account for nearly 20% of Europe’s total fuel consumption.

MARKET CHALLENGES

Fragmented Regulatory Landscape Across Europe

The fragmented regulatory landscape across European countries poses a significant challenge to the fuel card market. The European Commission study revealed that varying tax policies, fuel pricing structures, and compliance requirements create operational complexities for fuel card providers operating across multiple regions. For instance, as per the UK Department for Transport, discrepancies in value-added tax (VAT) rates on fuel purchases can lead to inconsistencies in savings offered by fuel cards by reducing their appeal to cross-border fleets. According to the Eurostat, administrative costs for businesses managing multi-country operations increase by up to 25% due to these regulatory differences. This lack of harmonization complicates the scalability of fuel card solutions for smaller providers is hindering market expansion and creating barriers to achieving economies of scale.

Resistance to Digital Transformation Among Traditional Fleets

Resistance to digital transformation among traditional fleet operators remains a key challenge for the Europe fuel card market. According to the International Transport Forum, nearly 40% of older fleet operators in Europe are reluctant to adopt digital tools like fuel cards due to concerns about technological complexity and disruptions to established workflows. According to the French National Cybersecurity Agency, 35% of traditional fleets cite a lack of technical expertise as a barrier to implementing advanced fuel management systems. As per Eurostat, only 50% of fleets with vehicles older than 10 years have adopted modern payment solutions, including fuel cards. This resistance slows the transition to more efficient and transparent fuel management practices by limiting the market's potential growth and delaying the realization of cost-saving benefits offered by fuel cards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.23% |

|

Segments Covered |

By Type, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Engen Petroleum Ltd., Libya Oil Holdings Ltd., BP P.L.C., FirstRand Bank Limited, FleetCor Technologies, Inc., U.S. Bancorp, Royal Dutch Shell PLC, WEX Inc., Puma Energy, and Exxon Mobil Corporation. |

SEGMENTAL ANALYSIS

By Type Insights

The branded cards dominated the Europe fuel card market with 49.9% of share in 2024. Their strong brand loyalty and exclusive benefits such as fuel discounts and loyalty rewards, which appeal to fleet operators. According to the International Energy Agency (IEA), branded cards offer savings of up to 5% on fuel purchases which is driving their widespread adoption. As per Eurostat, over 60% of urban fleets prefer branded cards due to their reliability within proprietary networks. Their importance lies in providing cost-effective solutions for businesses with localized operations by ensuring consistent service quality and ease of use.

The universal cards segment is anticipated to experience CAGR of 12.3% during the forecast period. Their rapid growth is fueled by increasing demand for cross-border fleet operations and flexibility across multiple fuel brands. As per the European Automobile Manufacturers' Association, universal cards reduce administrative burdens by consolidating payments into a single platform by appealing to logistics companies operating in diverse regions. This adaptability addresses the needs of dynamic fleets is making universal cards indispensable for modern fleet management and positioning them as a key driver of innovation in the fuel card market.

By Application Insights

The fuel refill segment was the largest by capturing 62.5% of the Europe fuel card market share in 2024. As per the International Energy Agency (IEA), fuel cards reduce administrative burdens by 20% while offering real-time tracking and discounts of up to 5% at partner stations. As per Eurostat, over 70% of fleets prioritize fuel cards for refills due to their cost-saving benefits and ease of use. This segment’s importance lies in addressing the primary expense driver for businesses by ensuring efficient fuel management and transparency by making it indispensable for fleet operators.

The toll charge applications segment is projected to exhibit a fastest CAGR of 14.1% during the forecast period. This growth is driven by expanding electronic toll systems across Europe in France and Germany. According to the International Transport Forum, 40% of cross-border fleets now use fuel cards for toll payments by benefiting from consolidated billing and reduced administrative complexity. According to the European Automobile Manufacturers' Association, integrating toll payments into fuel cards enhances operational efficiency for logistics providers.

REGIONAL ANALYSIS

Germany dominated the Europe fuel card market with 22.3% of share in 2024 owing to the country’s advanced logistics sector, which manages over 3.5 million commercial vehicles, according to the European Automobile Manufacturers' Association. The integration of telematics and digital solutions into fuel cards has further propelled adoption by enabling real-time tracking and enhanced fleet efficiency. According to the International Transport Forum, German fleets using telematics-enabled fuel cards have reduced fuel consumption by 15%. Additionally, stringent environmental regulations, enforced by the German Environment Agency, incentivize businesses to adopt fuel cards for better compliance and sustainability.

The United Kingdom is anticipated to grow with a CAGR of 8.2% during the forecast period. The logistics industry, which handles over 400 billion tonne-kilometers annually in this country is likely to contribute for the growth of the market. Universal fuel cards, widely adopted in the UK, offer cross-border flexibility, appealing to fleets operating across Europe. According to the British Vehicle Rental and Leasing Association, 60% of UK fleets use fuel cards to streamline expenses and improve operational efficiency. Furthermore, the UK’s focus on digital transformation, supported by government initiatives has accelerated the adoption of smart fuel cards integrated with data analytics by enhancing their appeal among tech-savvy fleet operators.

France fuel card market is likely to grow rapidly in the next coming years due to its commitment to sustainability, with the French Ministry of Ecology mandating a 20% reduction in fleet emissions by 2030. Fuel cards equipped with carbon-tracking features align with these goals, driving their adoption. According to the International Energy Agency (IEA), French fleets using eco-friendly fuel cards have improved fuel efficiency by 12%. Additionally, France’s extensive network of toll systems and service stations supports the versatility of fuel cards, making them indispensable for modern fleet management and reinforcing France’s prominence in the market.

KEY MARKET PLAYERS

The major players in the Europe fuel card market include Engen Petroleum Ltd., Libya Oil Holdings Ltd., BP P.L.C., FirstRand Bank Limited, FleetCor Technologies, Inc., U.S. Bancorp, Royal Dutch Shell PLC, WEX Inc., Puma Energy, and Exxon Mobil Corporation.

MARKET SEGMENTATION

This research report on the European fuel card market is segmented and sub-segmented into the following categories.

By Type

- Branded Cards

- Universal Cards

- Merchant Cards

By Application

- Fuel Refill

- Parking

- Vehicle Service

- Toll Charge

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the main benefits of using a fuel card in Europe?

Fuel cards provide cost savings through discounts, better expense management, cashless transactions, VAT recovery services, and access to a wide network of fuel stations.

Which industries use fuel cards the most in Europe?

The transport and logistics industry, corporate fleets, and construction companies are the primary users of fuel cards in Europe.

What are the security features of European fuel cards?

Most fuel cards come with PIN protection, real-time transaction monitoring, spending limits, and alerts for unusual purchases to prevent fraud.

What additional services do fuel cards in Europe offer?

Many fuel cards provide access to toll payments, vehicle maintenance, roadside assistance, and parking solutions, making them useful for fleet management beyond just fuel purchases.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]