Europe Frozen Potatoes Market Size, Share, Trends & Growth Forecast Report By Product (Hash Brown, French Fries, Shapes, Mashed, Sweet Potatoes, Battered/Cooked, Twice Baked, Topped/ Stuffed), End User (Residential And Commercial), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 to 2033

Europe Frozen Potatoes Market Size

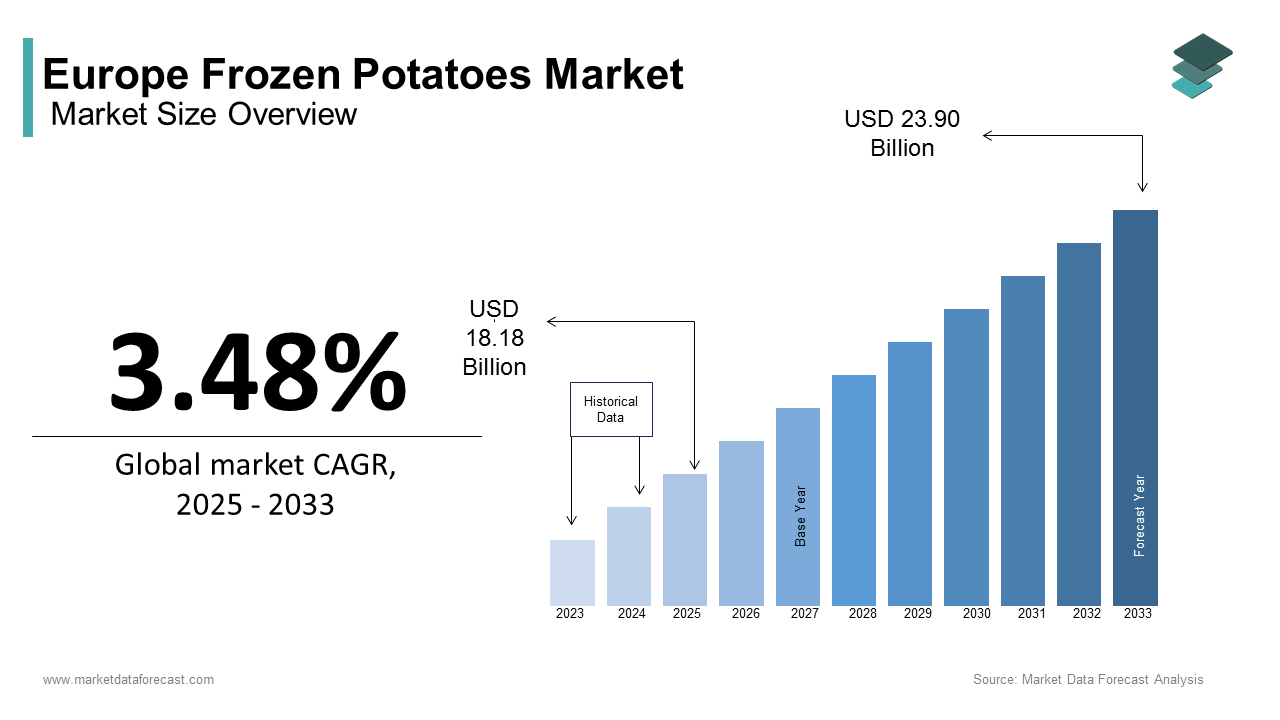

The frozen potatoes market size in Europe was worth USD 17.57 billion in 2024. The European market is anticipated to grow at a CAGR of 3.48% from 2025 to 2033 and be worth USD 18.18 billion in 2025 and USD 23.90 billion by 2033.

Potatoes are the most common staple food, followed by wheat, rice, and corn, ranking fourth in global output. In both households and restaurants, they are consumed fresh or processed. Frozen potatoes are one of the most common varieties of processed potatoes. They are efficient and adaptable in preparation time, storage period, and mineral and vitamin content. Fresh potatoes are processed into frozen potatoes and other items utilizing a range of modern machines and shallow temperatures. Potato chips, French fries, forms, mashed potatoes, sweet potatoes, cooking, twice baked, covered/stuffed, and other frozen potato goods are available on the market in a variety of shapes. These goods are consumed at QSRs (Quick Service Restaurants) or by customers at their homes via retail outlets. The most significant benefit of frozen potatoes is that they cook faster and are simpler to prepare. Furthermore, developing new product varieties with various flavors has significantly increased the frozen potato product consumer base and accelerated market growth.

MARKET DRIVERS

Frozen potato demand is quickly increasing around the world. The expansion of this market is fueled by an increase in the number of fast-food restaurants, higher demand for processed foods, urbanization, and an increase in frozen potato exports and imports, to name a few key drivers. In addition, the significant expansion in the female workforce is likely to stimulate demand for ready-to-eat meals such as potato chips and hash browns in the coming years, boosting the worldwide frozen potato industry. With more women in the workforce, demand for prepared foods rises, increasing the consumption of convenience foods such as frozen potato chips and dried potato products. The rise in fast-food restaurants is one of the primary factors projected to boost sales in the global market in the following years. In addition, increasing food spending, the food and beverage sector, the number of commercial restaurants, the desire for multi-food items, and demand in the food processing business are all expected to fuel revenue growth in the future years. Some of the primary factors that contribute to the expansion of the frozen potato market include the substantial growth of fast-service restaurants and an increase in consumer disposable income.

Furthermore, advancements in refrigeration technology have aided the frozen potato market expansion. In addition, the move to easy-to-cook food products is intensifying, keeping the market growing, thanks to the busy lifestyles, rising income levels, and high spending power of consumers in the region. Majorly owing to lifestyle changes and consumer adoption of the Western diet culture, many people, including potato chips, nuggets, kibble, and shredded potato chips, are on the rise. This is a big trend that is currently sweeping the globe, affecting both industrialized and developing countries. Furthermore, the acceptance of Western culture and the growing demand for fresh food in developing Asia Pacific and Latin America, and the Caribbean (APAC and LAMEA) countries are cited as common reasons for the growth of prepared foods, which provide a diverse range of opportunities for frozen potato market expansion.

MARKET RESTRAINTS

High storage and transportation costs and product recalls are primary challenges that can stifle growth in the target market. Furthermore, in both emerging and developed countries, a greater interest in health and consumption of other healthy foods, primarily fruits and vegetables, may diminish the demand for frozen potato products. Furthermore, the worldwide frozen potato market's growth will be limited by the ongoing low-temperature requirements for keeping potato products frozen, as well as the high expenses connected with this.

Impact of COVID-19 on the Europe frozen potatoes market

The COVID-19 epidemic in 2020 had a significant influence on global frozen potato product consumption, such as fries, and, as a result, on FPP production in Belgium, France, Germany, and the Netherlands. On the other hand, Government Covid-19 assistance measures for potato growers had little effect on frozen potato prices. The temporary government COVID-19 support for potato growers in Belgium and the Netherlands only covered a small portion of the whole potato market. It reimbursed just an amount of the growers' potato production costs. Because these measures were disclosed later, there was no direct government support for the potato market and price formation. This also indicates that the national COVID-19 support had no impact on potato or frozen potato product pricing, as the support solely applied to potatoes not sold for processing.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.48% |

|

Segments Covered |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

McCain Foods, Lamb-Weston, J.R. Simplot Company, Aviko, Bart's Potato Company, Agrarfrost GmbH & Co. KG, Agristo NV, Himalya International Ltd., TaiMei Potato Industry Limited |

SEGMENTAL ANALYSIS

By Type Insights

The french fries segment dominated the market in Europe, accounting for 40.6% of the overall market share in 2023. The rapid spread of QSRs such as Subway, Burger King, McDonald's, Wendy's, and Dunkin' Donuts has increased the consumption of Western-style cuisine in emerging nations. Because of the creation of new products and variations by leading producers to match consumer tastes, the French fries industry has a lot of room for expansion.

By End User Insights

Due to rising demand and developing QSR operations in various nations, the commercial sector is the primary end-user of frozen potatoes and has a significant market opportunity for investment. Hotels, fast food franchises, and quick service restaurants all employ frozen potatoes and associated items commercially (QSRs). Because of their swift preparation time and ease of use, these goods are well-acknowledged in the marketplace. Furthermore, many caterers are inclined to utilize frozen food due to the convenience these goods offer and climate challenges, which fuel the use of frozen food products and complement the frozen potato market expansion.

REGIONAL ANALYSIS

Over the projection period, Europe is expected to have the highest CAGR in the market. During the projection period, Europe is expected to hold a significant share of the frozen potato market. The rapid growth of the frozen potato market in Europe can largely be ascribed to increasing women's employment rates. For example, Russia is one of the top countries in which women's employment has increased in recent years. In Europe, frozen potatoes are mainly utilized as convenience food. In addition, McCain Foods, Lamb Weston, and other manufacturers are expanding their market in Europe.

KEY MARKET PLAYERS

The companies covered in the report are McCain Foods, Lamb-Weston, J.R. Simplot Company, Aviko, Bart's Potato Company, Agrarfrost GmbH & Co. KG, Agristo NV, Himalya International Ltd., TaiMei Potato Industry Limited

RECENT HAPPENINGS IN THE MARKET

- McCain Foods declared that it has decided to pause its plans to expand a facility in the U.S. since, during the pandemic, the demand for food service has declined.

MARKET SEGMENTATION

This research report on the Europe Frozen Potatoes Market is segmented and sub-segmented based on product type, end user, and region

By Product Type

- Hash brown

- French fries

- Shapes

- Mashed

- Sweet Potatoes

- Battered/Cooked

- Twice Baked

- Topped/ Stuffed

By End User

- Residential

- Commercial

By Region

- United Kingdom

- Spain

- Germany

- Italy

- France

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest Of Europe

Frequently Asked Questions

1. Who consumes the most frozen potatoes in Europe?

Countries like Germany, France, the UK, and the Netherlands have high frozen potato consumption due to strong fast-food industries and consumer preferences for convenience foods.

2. What are the key factors driving the growth of the frozen potatoes market in Europe?

Rising demand for convenience foods, urbanization, and the expansion of fast-food chains are key drivers.

3. Which European country has the largest market for frozen potatoes?

Germany is the largest market, followed by France and the UK, due to high consumption rates and a well-established foodservice sector.

4. How is the frozen potatoes market expected to grow in the coming years?

The market is expected to grow at a steady CAGR due to increasing demand for convenience foods and the expansion of quick-service restaurants.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]