Europe Frozen Finger Chips Market Size, Share, Trends & Growth Forecast Report By End User (Food Service (Hotels, Restaurants, Fast Food Chains), Household/Retail), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Frozen Finger Chips Market Size

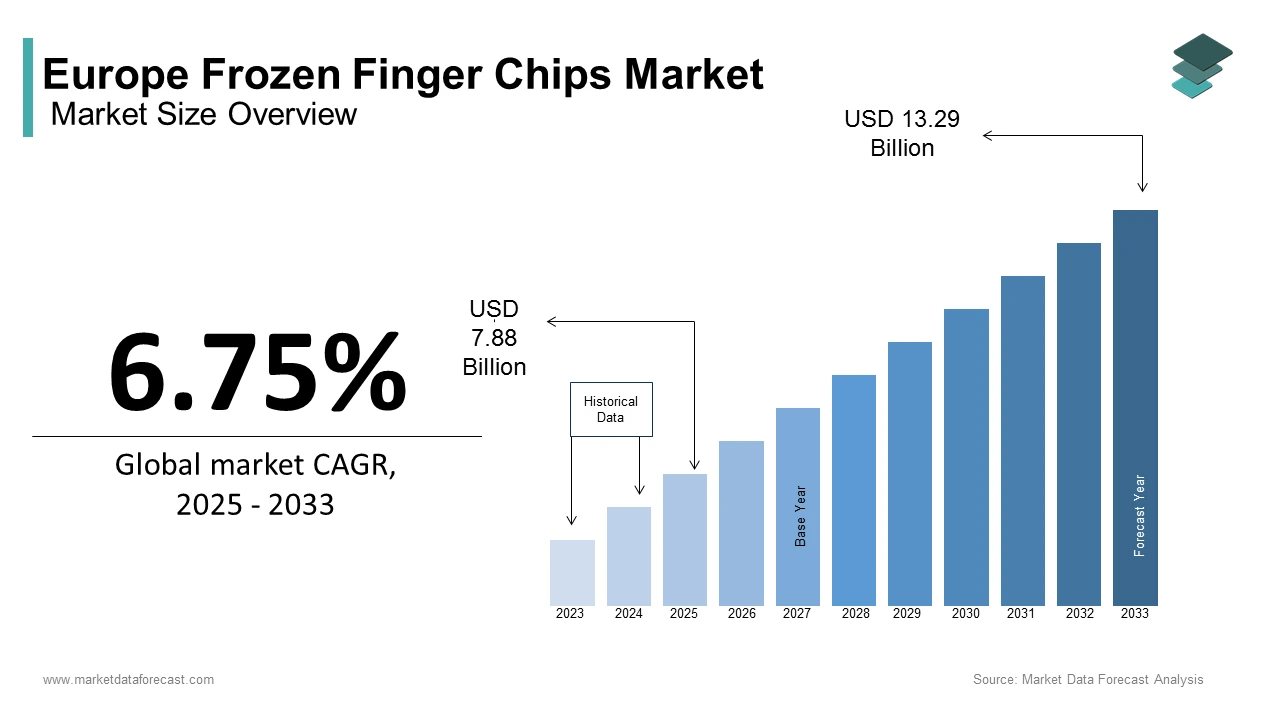

The Europe frozen finger chips market size was calculated to be USD 7.38 billion in 2024 and is anticipated to be worth USD 13.29 billion by 2033 from USD 7.88 billion in 2025, growing at a CAGR of 6.75% during the forecast period.

The European frozen finger chips are widely consumed across various sectors, including food service, retail, and home cooking. The market has experienced significant growth due to the increasing demand for convenient and ready-to-cook food options among consumers. The growth of this market is driven by several factors, including the rising popularity of fast food and casual dining, which heavily feature frozen finger chips on their menus. Additionally, the growing trend of snacking and the convenience of frozen products have further fueled demand. As consumers increasingly seek quick and easy meal solutions, the frozen finger chips market is well-positioned to capitalize on these trends. Furthermore, advancements in freezing technology and product innovation, such as the introduction of healthier options, are expected to enhance the appeal of frozen finger chips in the European market.

MARKET DRIVERS

Increasing Demand for Convenience Foods

The increasing demand for convenience foods is a primary driver of the European frozen finger chips market. As lifestyles become busier and consumers seek quick meal solutions, the popularity of frozen products has surged. The convenience of frozen finger chips, which require minimal preparation and cooking time makes them an attractive option for consumers looking for quick meal solutions. The importance of convenience foods lies in their ability to cater to the fast-paced lifestyles of modern consumers. Frozen finger chips can be easily prepared in various ways, including baking, frying, or air frying by making them versatile for different meal occasions. Additionally, the growing trend of snacking has further fueled the demand for frozen finger chips, as they are often consumed as a side dish or snack.

Growth of the Food Service Industry

The growth of the food service industry is another key driver propelling the European frozen finger chips market. The increasing number of restaurants, cafes, and fast-food outlets across Europe has led to a higher demand for frozen potato products, particularly French fries. The significance of the food service industry lies in its ability to drive volume sales of frozen finger chips. Restaurants and food outlets often prefer frozen products due to their consistent quality, ease of preparation, and longer shelf life. Additionally, the growing trend of casual dining and fast food has further increased the demand for frozen finger chips, as they are a popular choice among consumers.

MARKET RESTRAINTS

Price Volatility of Raw Materials

One of the significant restraints affecting the European frozen finger chips market is the price volatility of raw materials, particularly potatoes. Fluctuations in potato prices can significantly impact the production costs of frozen finger chips, leading to increased prices for consumers. This volatility can create challenges for manufacturers in maintaining consistent pricing and profitability. Moreover, the reliance on a single raw material for production can expose manufacturers to supply chain risks. Any disruption in potato supply, whether due to adverse weather conditions or changes in agricultural policies, can lead to production delays and increased costs. As a result, manufacturers may face difficulties in managing their operations and meeting consumer demand. Addressing the issue of raw material price volatility will be crucial for the long-term sustainability and growth of the European frozen finger chips market.

Health Concerns and Changing Consumer Preferences

Another notable restraint is the growing health concerns and changing consumer preferences regarding food products. As consumers become more health-conscious, there is an increasing demand for healthier food options, which can impact the sales of traditional frozen finger chips. According to a survey conducted by the European Food Safety Authority, approximately 60% of consumers in Europe are actively seeking to reduce their intake of processed foods and unhealthy snacks. This shift in consumer behavior can pose challenges for manufacturers of frozen finger chips, as they may need to adapt their product offerings to meet evolving preferences.

Additionally, the rise of alternative snack options, such as baked or air-fried products, can further intensify competition in the market. Consumers are increasingly looking for healthier alternatives that align with their dietary preferences, which can lead to a decline in demand for traditional frozen finger chips. To address these challenges, manufacturers must focus on product innovation, such as developing healthier versions of frozen finger chips that incorporate whole ingredients or reduced fat content.

MARKET OPPORTUNITIES

Expansion of Retail Distribution Channels

The expansion of retail distribution channels presents a significant opportunity for the European frozen finger chips market. There is a growing trend towards online grocery shopping and the expansion of frozen food sections in supermarkets and convenience stores as consumer shopping habits evolve. The importance of expanding retail distribution channels lies in the ability to reach a broader consumer base. Online platforms allow consumers to conveniently purchase frozen finger chips from the comfort of their homes, increasing accessibility and driving sales. Additionally, the growth of convenience stores and smaller retail outlets provides opportunities for manufacturers to introduce their products to new markets.

Innovation in Product Offerings

Innovation in product offerings represents another promising opportunity for the European frozen finger chips market. Manufacturers have the chance to develop new and improved frozen finger chip products that cater to these demands as consumer preferences shift towards healthier and more diverse food options. The introduction of healthier alternatives, such as baked or air-fried finger chips, as well as unique flavor profiles, can attract health-conscious consumers and expand market reach. Additionally, the development of organic and sustainably sourced frozen finger chips can appeal to environmentally conscious consumers. Manufacturers can enhance their competitive edge and capture a larger share of the growing European frozen finger chips market.

MARKET CHALLENGES

Intense Competition in the Market

One of the primary challenges facing the European frozen finger chips market is the intense competition among manufacturers. The market is characterized by a large number of players, ranging from established brands to smaller, niche producers. This competitive landscape can create challenges for manufacturers in terms of pricing, product differentiation, and market positioning. Additionally, the presence of private label products in retail channels can further intensify competition, as retailers often offer lower-priced alternatives to branded products. To address this challenge, manufacturers must focus on building strong brand identities by enhancing product quality, and investing in marketing strategies that boost the unique attributes of their frozen finger chips.

Supply Chain Disruptions

Another significant challenge is the potential for supply chain disruptions, which can impact the availability and pricing of frozen finger chips. The COVID-19 pandemic has elevated the vulnerabilities in global supply chains by leading to shortages and delays in the procurement of raw materials and packaging. According to a survey conducted by the European Food and Drink Federation, nearly 50% of food manufacturers reported disruptions in their supply chains due to the pandemic by affecting their ability to meet production demands.

Additionally, geopolitical tensions and trade disputes can further exacerbate supply chain challenges are leading to increased costs and uncertainty in the market. They must implement effective supply chain management strategies to mitigate the impact of these disruptions as manufacturers strive to maintain consistent production levels. Ensuring a reliable supply of raw materials and packaging is crucial for the long-term sustainability and competitiveness of the European frozen finger chips market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.75% |

|

Segments Covered |

By End User, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

McCain Foods Limited, Lamb Weston Holdings, Aviko, Farm Frites, Agristo, Intersnack Group GmbH & Co. KG, Agrarfrost GmbH & Co. KG. |

SEGMENTAL ANALYSIS

By End Use Insights

The food services segment was the largest in the European frozen finger chips market by accounting for 60.3% of the share in 2024. This dominance is primarily driven by the extensive use of frozen finger chips in restaurants, cafes, and fast-food outlets, where they are a staple menu item. The importance of the food services segment lies in its ability to drive volume sales of frozen finger chips. Restaurants and food outlets prefer frozen products due to their consistent quality with the ease of preparation, and longer shelf life. Additionally, the growing trend of casual dining and fast food has further increased the demand for frozen finger chips, as they are a popular choice among consumers.

The retail segment is lucratively growing with a CAGR of 8.6% during the forecast period. This growth can be attributed to the increasing demand for frozen finger chips in supermarkets and grocery stores, where consumers seek convenient meal solutions. The growing trend of online grocery shopping has also contributed to the expansion of the retail segment. Consumers are increasingly purchasing frozen finger chips through e-commerce platforms by enhancing accessibility and driving sales.

REGIONAL ANALYSIS

The United Kingdom frozen finger chips market was the largest and held 25.4% of the share in 2024. This dominance can be attributed to the UK's robust food service sector and the increasing popularity of frozen potato products among consumers. Moreover, the UK's commitment to sustainability and reducing food waste further enhances the market for frozen finger chips. The growing trend of convenience and ready-to-cook meals aligns with consumer preferences is driving demand for frozen products.

Germany is likely to experience a CAGR of 5.6% during the forecast period in the European frozen finger chips market. The German market is characterized by a strong emphasis on quality and innovation in food products. The importance of the German market lies in its commitment to sustainability and environmental responsibility. The country has implemented various initiatives aimed at reducing food waste and promoting the consumption of frozen products as a means of extending shelf life. Germany is well-positioned to capitalize on the opportunities in the European frozen finger chips market as the demand for convenient and high-quality frozen food options continues to rise.

France frozen finger chips market is more likely to have lucrative growth opportunities in the next coming years. The French market growth is driven by a diverse range of frozen food products, with frozen finger chips being a popular choice among consumers. The significance of the French market lies in its commitment to quality and culinary excellence. French consumers are increasingly seeking high-quality frozen products that align with their preferences for taste and texture. France is well-positioned to capitalize on the opportunities in the European frozen finger chips market as the focus on expanding the frozen food sector continues to grow.

Spain frozen finger chips market is deemed to have steady growth in future period. The significance of the Spanish market lies in its commitment to convenience and quality. Spanish consumers are increasingly seeking ready-to-cook meal solutions that align with their busy lifestyles. The focus on expanding the frozen food sector is growing continuously which is ascribed to fuel the growth of the market.

KEY MARKET PLAYERS

Major Players of the Europe frozen finger chips market include McCain Foods Limited, Lamb Weston Holdings, Aviko, Farm Frites, Agristo, Intersnack Group GmbH & Co. KG, and Agrarfrost GmbH & Co. KG.

DETAILED SEGMENTATION OF EUROPE FROZEN FINGER CHIPS MARKET INCLUDED IN THIS REPORT

This research report on the europe frozen finger chips market has been segmented and sub-segmented based on end user & region.

By End User

- Food Service (Hotels, Restaurants, Fast Food Chains)

- Household/Retail

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key factors driving the growth of the frozen finger chips market in Europe?

The market is driven by factors such as the rising demand for convenience foods, increasing fast-food consumption, expanding retail and food service sectors, and advancements in freezing technology that enhance product quality and shelf life.

2. How is the demand for frozen finger chips affected by health trends?

Consumers are becoming more health-conscious, leading to an increased demand for low-fat, organic, and gluten-free frozen finger chips, as well as options with reduced sodium and preservatives.

3. Which distribution channels are used for frozen finger chips in Europe?

Frozen finger chips are primarily distributed through supermarkets and hypermarkets, convenience stores, online retail platforms, and food service providers such as fast-food chains, restaurants, and catering services.

4. Who are the key players in the Europe Frozen Finger Chips Market?

Some leading companies in this market include McCain Foods, Lamb Weston, Aviko, Farm Frites, Agristo, and Simplot Foods.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com