Europe Floriculture Market Research Report – Segmented By Product Type, Application, And By Country (United Kingdom, France, Spain Germany And Italy, Russia, Sweden, Denmark, Switzerland, Netherlands And Rest of Europe) – Industry Analysis on Size, Share, Trends, and Growth Forecast From 2024 to 2032

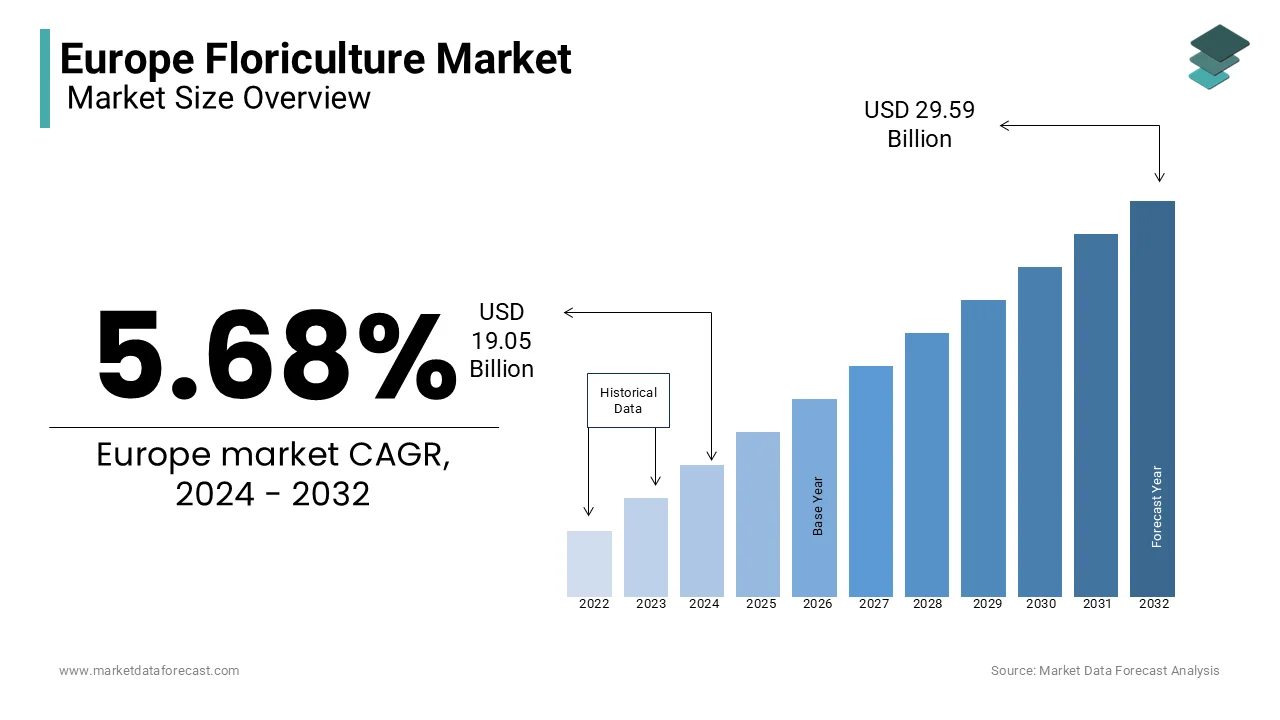

Europe Floriculture Market Size (2024 to 2032)

The European floriculture market was valued at USD 18 billion in 2023 it is anticipated to reach USD 19.05 billion in 2024 from USD 29.59 billion by 2032, growing at a CAGR of 5.68% from 2024 to 2032.

The Netherlands holds a leading position in Europe’s floriculture sector, with companies such as the Dutch Flower Group and Royal FloraHolland dominating the market. Royal FloraHolland operates the largest flower auction globally, generating billions of euros in revenue each year, and plays a crucial role in flower exports worldwide. Italy is also a significant player, with companies like Rosa Prima specializing in premium rose production for both domestic and international markets. Germany, while hosting numerous smaller-scale growers, has a strong emphasis on producing eco-friendly and sustainable flowers, catering to the growing demand for environmentally conscious products.

Floriculture is a crucial component of Europe’s agricultural landscape, contributing substantially to both economic expansion and employment generation. As one of the largest subsectors of horticulture, the floriculture industry generates approximately €20 billion in annual sales across the continent. Europe, particularly the Netherlands, plays a dominant role in global flower production and trade, accounting for 40% of the world’s flower and plant exports. This industry supports a broad range of jobs, from cultivation to distribution, providing employment opportunities in both rural and urban areas across Europe.

The floriculture sector significantly influences employment and export activities in Europe. In the Netherlands, the industry directly and indirectly supports over 250,000 jobs, underscoring its role as a vital economic driver. The Royal FloraHolland auction, responsible for 60% of global flower sales, highlights the sector’s extensive impact on international markets. Germany also maintains a robust domestic floriculture market, with annual flower consumption valued at approximately €8 billion, positioning it among the largest floral markets in Europe. Beyond its economic contributions, floriculture is also pivotal in advancing sustainable agricultural practices across the region.

Europe Floriculture Market Trends

-

Adoption of Vertical Farming for Flower Cultivation

Vertical farming is gaining prominence as a space-efficient method of flower cultivation, particularly in urban areas where land is limited. This technique, which involves growing flowers in stacked layers, maximizes output while minimizing resource consumption. Agritecture reports that vertical farming can reduce water usage by up to 90%, making it a sustainable option for flower production. Countries like the Netherlands and Sweden have adopted advanced technologies, such as LED lighting and hydroponics, to enhance flower growth and meet the increasing demand for environmentally responsible floriculture.

-

Advances in Eco-Friendly Floriculture Practices

As sustainability becomes a priority, European floriculture producers are increasingly implementing eco-friendly practices to minimize environmental impact. The widespread use of biodegradable pots, organic fertilizers, and integrated pest management systems has contributed to the sector’s sustainability efforts. In 2023, the European Commission's promotion of organic floriculture resulted in a 12% rise in the adoption of sustainable practices across major markets such as Germany and Denmark. These innovations are playing a key role in reducing the carbon footprint of European flower production.

-

Digital Transformation and Automation

Digitalization is transforming the floriculture industry by streamlining processes such as cultivation, packaging, and distribution. Automated greenhouses, like those employed by Royal FloraHolland, utilize artificial intelligence (AI) to monitor soil conditions, optimize irrigation, and reduce labor costs. Platforms like Floriday have revolutionized the flower trade by directly connecting growers with buyers, improving operational efficiency. By 2022, 35% of European flower farms had adopted automation, a trend expected to accelerate, enhancing both scalability and productivity.

MARKET DRIVERS

-

Consumer Preferences for Flowers

European consumers have a strong tradition of purchasing flowers for personal use and special occasions. According to the European Association of Horticultural Producers, the demand for fresh flowers and plants increased by 15% in 2023, driven by holidays such as Valentine’s Day and Mother’s Day. Environmentally conscious consumers are also gravitating towards locally grown, organic flowers, particularly in markets like Germany and France. The trend towards sustainability and ethical sourcing is shaping consumer demand and encouraging the growth of domestic floriculture markets.

-

Technological Advancements

Innovations in technology, such as automated greenhouses and precision agriculture, are fueling growth in the floriculture industry. These greenhouses, equipped with AI and Internet of Things (IoT) sensors, monitor plant health in real time, optimizing conditions such as light, water, and nutrients. In 2023, flower farms in the Netherlands reported a 20% increase in productivity following the adoption of smart greenhouse technologies. Additionally, advances in propagation techniques, such as tissue culture, are improving cultivation efficiency, reducing costs, and boosting flower production across Europe.

-

E-Commerce and Distribution Channels

E-commerce is reshaping the floriculture market by providing consumers with the convenience of purchasing flowers online for delivery. In 2022, the European online flower market grew by 22%, with companies like Interflora and Bloom & Wild expanding their digital platforms. Advances in cold-chain logistics now enable the delivery of fresh flowers across Europe within 24 hours, ensuring quality and freshness. The shift towards online sales, accelerated during the pandemic, has established e-commerce as a critical driver of growth in the floriculture industry, with continued expansion projected over the next decade.

MARKET RESTRAINTS

-

Environmental Concerns

The floriculture sector faces increasing scrutiny over its environmental footprint, particularly in terms of water consumption, pesticide use, and the carbon emissions associated with transportation. A 2022 study by Wageningen University revealed that flower production in Europe consumes approximately 8,000 liters of water per square meter annually, a significant environmental burden. In response, the European Commission is advocating for stricter environmental regulations, which could elevate operational costs for producers as they transition to more sustainable farming practices. As consumer awareness of environmental issues rises, floriculture businesses may risk losing market share to eco-friendly alternatives if they fail to meet sustainability expectations.

-

Labor Shortages

Labor shortages present a major challenge to the floriculture industry, particularly in countries such as Italy and Spain, where the sector relies heavily on seasonal labor. The European Labour Authority reported a 10% decline in the availability of agricultural workers in 2023, a situation worsened by the COVID-19 pandemic and stricter immigration policies. These shortages are driving up labor costs and hindering the industry’s ability to meet peak seasonal demand. Although automation offers a potential solution, the high capital investment required for mechanization remains a barrier for smaller producers, limiting their ability to adapt quickly to labor market challenges.

-

Impact of Climate Change

Climate change is increasingly affecting floriculture in Europe, with extreme weather events such as droughts and heatwaves disrupting flower production. In 2023, Southern Europe experienced its hottest summer on record, leading to a 12% decrease in flower yields across regions like Spain and Italy. Rising temperatures and increasing water scarcity are creating additional hurdles for growers who are striving to maintain consistent production levels. While investments in climate-resilient infrastructure are underway, the high costs of adaptation pose challenges, particularly for smaller enterprises with limited financial resources.

This research report on the European floriculture market is segmented and sub-segmented into the following categories.

Europe Floriculture Market Analysis By Product Type

- Cut Flowers

- Foilage Plants

- Potted Plants

- Bedding Plants

- Others

The cut flowers segment dominated the floriculture market in Europe, representing 55.7% of total market share in 2023. High consumer demand for fresh flowers, particularly for personal use and events, drives this segment. Popular varieties such as roses, tulips, and lilies are in high demand, with the Netherlands playing a key role as the largest global exporter of cut flowers. Technological advancements in cold-chain logistics have further supported the efficient export of cut flowers throughout Europe.

Europe Floriculture Market Analysis By Application

- Personal Use

- Cosmetics

- Pharmaceuticals

- Others

The personal use segment constituted 60.4% of the European floriculture market share in 2023, making it the largest application category. This demand is largely driven by the tradition of gifting flowers, particularly during holidays and special occasions. In Germany, personal use accounts for €6 billion of annual flower sales, reflecting strong consumer preferences. Additionally, the growing trend of incorporating flowers into home decor has further expanded this segment. As consumer preferences continue to shift toward locally sourced, eco-friendly flowers, the personal use market is expected to sustain robust growth over the forecast period.

Europe Floriculture Market Analysis By Country

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of the Europe

The Netherlands leads the European floriculture market, accounting for 40% of global flower exports. The Royal FloraHolland auction, the world’s largest flower auction, generates over €4.5 billion in annual revenue, underscoring the Netherlands' pivotal role in the global floriculture trade. Additionally, 80% of Dutch flower farms have adopted eco-friendly practices, further reinforcing the country’s leadership in sustainable flower production. In terms of floriculture’s contribution to agricultural exports, the Netherlands leads with the sector generating over €6 billion annually, a substantial portion of the country's overall export economy.

Germany boasts one of the largest domestic floriculture markets in Europe, with annual sales exceeding €8 billion in 2023. The country has a strong tradition of flower gifting, with peak sales occurring during Mother’s Day and Christmas. Germany's focus on sustainability has spurred demand for locally grown, organic flowers, contributing to the sector's growth. The German floriculture market is expected to grow at a notable CAGR during the forecast period, driven by increasing consumer interest in eco-friendly floral products. Germany, with its robust domestic market, generates around €8 billion in annual sales, focusing largely on sustainable flower production.

Italy is renowned for its production of decorative plants and high-end cut flowers, particularly roses, with an increasing focus on organic and sustainable practices that align with rising consumer demand for environmentally friendly products.

France is another significant player in the European floriculture market, with flower consumption valued at approximately €3.6 billion in 2023. The Île-de-France region, particularly Paris, serves as a major hub for flower sales, especially in high-end retail outlets and florists. France is also witnessing a growing shift toward organic and sustainable flower farming, spurred by government initiatives aimed at promoting eco-friendly agriculture. The French floriculture market is projected to grow at a steady CAGR, as consumer demand for sustainable floral products continues to rise.

KEY MARKET PLAYERS

Some of the major players in the Floriculture market are Syngenta Flowers, Karuturi, Rosebud, Beekenkamp, Queens Group, Dutch Flower Group, Washington Bulb, Finlays, Selecta One, and Dümmen Orange.

RECENT MARKET DEVELOPMENTS

- In January 2024, the Dutch Flower Group launched a new range of eco-friendly flower products, catering to the increasing demand from environmentally conscious consumers across Europe. This initiative reflects the broader shift in the industry towards sustainability.

- In April 2023, Royal FloraHolland entered into a strategic partnership with Philips to introduce LED lighting systems for vertical farming in flower production. This collaboration aims to improve the efficiency of flower cultivation while reducing energy consumption, further reinforcing the Netherlands’ leadership in sustainable floriculture.

- In March 2024, Bloom & Wild expanded its e-commerce operations by acquiring Poppy’s Flowers, a major online floral retailer in Europe. This acquisition is expected to enhance Bloom & Wild’s digital presence and strengthen its position in the European market, particularly in the growing online segment.

- In July 2023, Schneider Greenhouse invested €15 million in upgrading its automation capabilities in Germany, focusing on potted plant production. The automation upgrade is expected to improve production efficiency, allowing the company to better meet market demand for sustainably grown plants.

- In October 2023, Rosa Prima opened a new production facility in Italy dedicated to the organic cultivation of roses. This facility aims to meet the rising consumer demand for eco-friendly flowers, positioning Rosa Prima as a leader in sustainable floriculture practices in Europe.

- In November 2023, Interflora expanded its logistics capabilities across key European markets by launching a same-day delivery service for flowers and plants. This service enhancement is designed to meet consumer expectations for fast, reliable delivery, further strengthening Interflora's presence in the European floriculture industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]