Europe Flooring Market Size, Share, Trends & Growth Forecast Report By Material (Resilient Flooring, Non-Resilient Flooring, Soft floor covering/ Carpets & Rugs), End Use, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Flooring Market Size

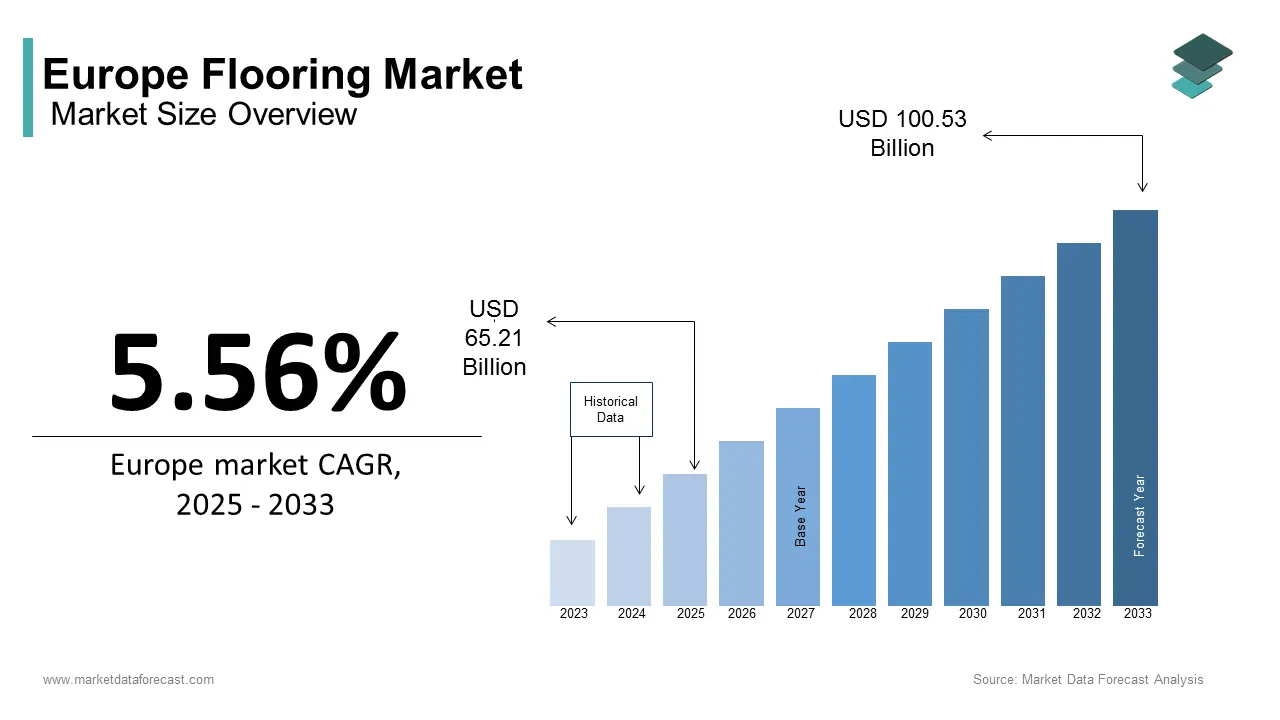

The Europe flooring market size was calculated to be USD 61.78 billion in 2024 and is anticipated to be worth USD 100.53 billion by 2033 from USD 65.21 billion In 2025, growing at a CAGR of 5.56% during the forecast period.

Flooring serves as a major component of interior design, functionality, and sustainability in both residential and commercial spaces. In 2023, the market is witnessing significant evolution due to the urbanization, technological advancements, and an increasing emphasis on eco-friendly solutions. The rising construction activities and renovation projects across the European region are expected to continue to drive the demand over the coming years. The flooring sector includes a wide array of materials, including carpet, hardwood, tile, vinyl, and laminate, each catering to distinct customer needs and aesthetic sensibilities. Hardwood flooring remains a popular choice due to its timeless appeal and durability, while luxury vinyl tiles (LVT) have gained traction for their cost-effectiveness and versatility.

Sustainability has emerged as a defining factor in the European flowing market. Considering the same, the manufacturers are increasingly adopting recycled materials and energy-efficient production processes. The stringent environmental regulations of the European Union further reinforce this shift. Moreover, the post-pandemic surge in home improvement initiatives has bolstered demand for premium and customizable flooring options. As noted by Eurostat, household expenditure on home renovations rose by nearly 15% in 2022 compared to pre-pandemic levels, which is indicating the growing consumer interest in enhancing living spaces. This confluence of factors positions the Europe flooring market as a vibrant arena ripe for innovation and growth.

MARKET DRIVERS

Urbanization and Infrastructure Development

The rapid pace of urbanization and infrastructure development stands as a pivotal driver for the Europe flooring market. The European Environment Agency highlights that urban areas in Europe are expanding at an annual rate of approximately 0.5%, with major cities such as Berlin, Paris, and Milan experiencing significant population growth. This demographic shift has created a surge in demand for both residential and commercial spaces, directly benefiting the flooring industry. Eurostat reports that construction output in the European Union grew by 3.2% in 2022, with non-residential construction playing a key role in this expansion. Flooring materials like ceramic tiles and luxury vinyl tiles (LVT) are increasingly preferred in urban projects due to their durability and design flexibility. Moreover, government-led initiatives, such as the EU’s Renovation Wave Strategy, aim to renovate 35 million buildings by 2030, further amplifying the need for modern and innovative flooring solutions.

Consumer Preference for Sustainable Flooring Solutions

The rising consumer preference for eco-friendly and sustainable flooring options is another critical factor propelling the Europe flooring market. According to the European Commission, over 60% of European consumers now prioritize environmentally responsible products during purchasing decisions. This shift in consumer behavior has led to increased adoption of flooring materials made from recycled or renewable resources, such as cork, bamboo, and reclaimed wood. The International Energy Agency emphasizes that the construction sector accounts for nearly 40% of energy consumption in Europe, prompting stricter regulations on carbon emissions and resource efficiency. In response, manufacturers are adopting sustainable production methods, achieving waste reductions of up to 25% in some cases. Statista predicts that the market share of green flooring solutions in Europe will grow by 8% annually through 2030, supported by incentives like tax breaks for eco-conscious builders and heightened awareness about climate change mitigation strategies.

MARKET RESTRAINTS

Economic Uncertainty and Inflationary Pressures

Economic uncertainty and inflationary pressures pose significant challenges to the Europe flooring market. The European Central Bank reports that inflation in the Eurozone reached a record high of 8.1% in 2022, driven by rising energy costs and supply chain disruptions. These economic conditions have increased the cost of raw materials such as timber, adhesives, and synthetic polymers, which are critical for flooring production. Eurostat highlights that construction material prices surged by nearly 20% in 2022, forcing manufacturers to pass these costs onto consumers. As a result, demand for premium flooring solutions has softened, particularly among price-sensitive buyers. Additionally, the International Monetary Fund warns that slower GDP growth in Europe, projected at 0.7% for 2023, may further dampen consumer spending on home improvement and renovation projects. This financial strain is expected to hinder market expansion, especially in economically vulnerable regions.

Stringent Environmental Regulations and Compliance Costs

Stringent environmental regulations and the associated compliance costs act as another major restraint for the Europe flooring market. The European Environment Agency notes that the construction sector is under increasing pressure to meet ambitious carbon neutrality targets by 2050, as outlined in the European Green Deal. While these regulations aim to promote sustainability, they also impose significant operational challenges for flooring manufacturers. For instance, the adoption of low-VOC (volatile organic compound) adhesives and water-based finishes often requires costly upgrades to existing production facilities. According to the European Commission, small and medium-sized enterprises (SMEs), which account for over 90% of businesses in the sector, face disproportionately high compliance costs. Furthermore, Statista reports that nearly 30% of flooring companies in Europe cited regulatory hurdles as a key barrier to innovation and profitability in 2022. These factors collectively limit the ability of firms to scale operations or invest in advanced technologies.

MARKET OPPORTUNITIES

Growing Demand for Smart and Functional Flooring Solutions

The rising demand for smart and functional flooring solutions presents a significant opportunity for the Europe flooring market. The European Commission highlights that the integration of technology into building materials is gaining traction, with smart flooring systems offering features like energy harvesting, motion detection, and temperature regulation. These innovations align with the EU’s Digital Decade initiative, which aims to make 75% of buildings in Europe smart by 2030. Eurostat reports that investments in smart home technologies have grown by 15% annually since 2020, creating a fertile ground for advanced flooring products. Additionally, the International Energy Agency notes that energy-efficient flooring solutions, such as those incorporating underfloor heating systems, can reduce household energy consumption by up to 20%. With the global smart flooring market projected to reach USD 2.4 billion by 2028, according to Statista, manufacturers in Europe are well-positioned to capitalize on this trend by developing cutting-edge, tech-enabled flooring options.

Expansion of Renovation and Retrofitting Projects

The expansion of renovation and retrofitting projects across Europe offers another promising opportunity for the flooring market. The European Union’s Renovation Wave Strategy aims to double the annual renovation rate of existing buildings by 2030, targeting energy efficiency and sustainability. The European Investment Bank estimates that this initiative will generate investments worth EUR 350 billion annually, benefiting industries like flooring that cater to retrofitting needs. Eurostat reveals that over 75% of Europe’s building stock is energy-inefficient, creating a vast potential market for modern flooring solutions that enhance thermal insulation and reduce carbon footprints. Furthermore, the International Labour Organization reports that the construction sector could create up to 160,000 new jobs annually through renovation projects, boosting demand for skilled labor and innovative materials. As consumer preferences shift toward durable and sustainable flooring, manufacturers have a unique chance to tap into this growing segment by offering eco-friendly and high-performance products tailored to retrofitting requirements.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages have emerged as significant challenges for the Europe flooring market. The European Central Bank reports that global supply chain bottlenecks, exacerbated by geopolitical tensions and the aftermath of the pandemic, have led to a 25% increase in lead times for key raw materials such as timber, adhesives, and synthetic resins since 2021. Eurostat highlights that over 40% of construction firms in Europe faced delays in project completions due to material shortages in 2022. These disruptions not only inflate production costs but also hinder timely delivery of flooring products, affecting customer satisfaction. The International Labour Organization notes that small-scale flooring manufacturers are particularly vulnerable, with nearly 30% reporting reduced profit margins due to rising procurement challenges. As global trade uncertainties persist, the industry must navigate these logistical hurdles while maintaining competitive pricing and product quality.

Intense Market Competition and Price Wars

Intense market competition and price wars pose another critical challenge for the Europe flooring market. The European Commission states that the flooring industry is highly fragmented, with over 10,000 companies competing across various segments, leading to margin pressures. Eurostat reveals that price undercutting has become a common strategy, with average profit margins shrinking by 10-15% in recent years. This competitive landscape is further intensified by the influx of low-cost imports from Asia, which account for nearly 20% of the market share, according to the International Trade Administration. While these imports offer affordability, they often compromise on quality and sustainability standards, creating an uneven playing field for local manufacturers. Additionally, Statista reports that over 60% of flooring companies struggle to differentiate their offerings in a saturated market, making it difficult to retain customer loyalty and achieve long-term growth amidst relentless pricing pressures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.56% |

|

Segments Covered |

By Material, End use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Tarkett, Forbo, Gerflor, Mohawk Industries, Armstrong Flooring, Interface Inc., Balta Group, and Shaw Industries. |

SEGMENTAL ANALYSIS

By Material Insights

The vinyl segment held the leading share of 51.4% of the European market share in 2024. The domination of the vinyl segment has majorly resulted from their affordability, water resistance, and design versatility that are making it ideal for both residential and commercial spaces. Luxury Vinyl Tiles (LVT) are particularly popular, with Eurostat highlighting that vinyl flooring accounts for 25% of total flooring installations in Europe. Its importance lies in meeting consumer demand for durable, low-maintenance solutions.

The LVT segment is another major segment and predicted to showcase the fastest CAGR of 7.5% over the forecast period. Factors such as urbanization, rising renovation projects, and increasing preference for cost-effective yet premium aesthetics are propelling the LVT segment in the European market. The European Environment Agency notes LVT’s eco-friendly variants, made from recycled materials, further boost its appeal. Its ability to mimic natural wood and stone at lower costs makes it indispensable in modern interiors.

By End-use industry Insights

The residential segment dominated the market by accounting for 60.8% of the European market share in 2024. The growth of the residential segment is majorly driven by rising home renovation activities, with Eurostat reporting a 15% increase in household spending on renovations in 2022. Hardwood flooring dominates this segment, accounting for over 30% of installations due to its durability and aesthetic appeal. The European Commission highlights that urbanization and remote work trends have fueled demand for comfortable, stylish living spaces. This segment's importance lies in its alignment with consumer preferences for sustainability, as seen in the growing adoption of eco-friendly materials like bamboo and cork, which are expected to grow by 8% annually through 2030.

The non-residential segment is predicted to witness the fastest CAGR of 6.2% over the forecast period owing to the urban infrastructure development and commercial construction, which expanded by 5% in 2022. Luxury Vinyl Tiles (LVT) lead this segment due to their durability and low maintenance, making them ideal for offices and retail spaces. The European Investment Bank notes that green building initiatives, such as LEED certifications, are driving demand for sustainable flooring solutions. This segment's importance lies in supporting economic activities and modernizing urban infrastructure, ensuring long-term growth potential in line with Europe’s sustainability goals.

REGIONAL ANALYSIS

Germany captured the largest share of 26.12% of the European flooring market share in 2024. The robust construction activities in Germany is one of the major factors boosting the German market growth. The emphasis of Germany on sustainability aligns with the European Green Deal, driving demand for eco-friendly flooring solutions like cork and recycled vinyl. Additionally, Germany’s strong manufacturing base supports innovation in luxury vinyl tiles (LVT) and engineered wood, catering to both domestic and export markets. The International Labour Organization highlights that Germany’s skilled workforce and advanced infrastructure further solidify its dominance, making it a hub for high-quality and sustainable flooring products.

France is another regional market for flowing in Europe and is predicted to register a CAGR of 5.3% over the forecast period. The French Ministry of Ecology reports that government initiatives promoting energy-efficient renovations have spurred demand for premium flooring materials like hardwood and ceramic tiles. France’s focus on aesthetic appeal and luxury living has made it a leader in high-end flooring, particularly in urban areas like Paris. Eurostat highlights that renovation spending in France grew by 12% in 2022, driven by tax incentives for home improvements. Furthermore, the growing adoption of smart flooring technologies, such as underfloor heating systems, underscores France’s role in advancing innovative and functional flooring solutions across Europe.

Italy held a notable share of the Europe flooring market in 2024. The expertise of Italy in ceramic tile production that accounts for over 40% of its flooring exports is boosting the expansion of flooring market in Italy. The Italian ceramics industry benefits from advanced manufacturing techniques and a reputation for design excellence, appealing to both domestic and international markets. The European Environment Agency notes that Italy’s commitment to sustainable practices, including water recycling in tile production, enhances its competitive edge. Additionally, the country’s booming tourism sector drives demand for durable and stylish flooring in hospitality spaces, reinforcing its prominence in the regional market.

MARKET SEGMENTATION

This research report on the european flooring market has been segmented and sub-segmented based on material, end-use, and region.

By Material

- Resilient Flooring

- Vinyl

- Others

- Non-Resilient Flooring

- Ceramic tiles

- Wood

- Laminate

- Stone

- Others

- Soft floor covering/ Carpets & Rugs

By End-use industry

- Non-residential

- Residential

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the European flooring market?

Increasing renovation projects, demand for eco-friendly flooring, urbanization, and technological advancements in flooring materials.

2. Which European countries have the highest demand for flooring?

Germany, the UK, France, Italy, and Spain lead in flooring demand due to construction and renovation activities.

3. How are technological advancements influencing flooring?

Digital printing, waterproof laminates, smart flooring with sensors, and enhanced installation methods are transforming the industry.

4. Who are the primary consumers of flooring in Europe?

Residential homeowners, commercial properties, industrial facilities, and public infrastructure projects.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]