Europe Flexographic Printing Inks Market Size, Share, Trends & Growth Forecast Report By Application (Packaging, and others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Flexographic Printing Inks Market Size

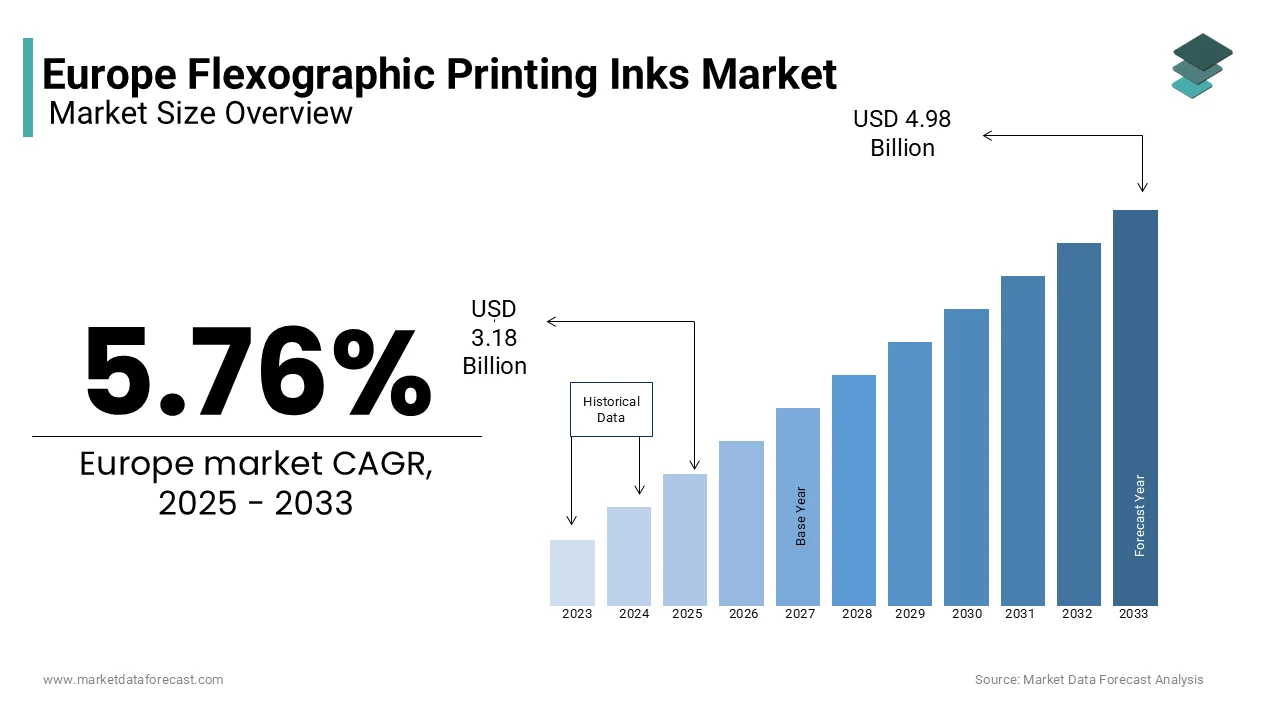

The Europe flexographic printing inks market size was valued at USD 3.01 billion in 2024. The European market is estimated to be worth USD 4.98 billion by 2033 from USD 3.18 billion in 2025, growing at a CAGR of 5.76% from 2025 to 2033.

Flexographic printing technique is widely employed in packaging, labels, and other applications due to its efficiency and versatility. Flexographic inks are formulated to meet the demands of high-speed printing processes, offering quick drying times and excellent adhesion to a variety of materials, including plastic, paper, and metal. The European flexographic printing inks market is experiencing robust growth due to the increasing demand for sustainable packaging solutions and the rise of e-commerce, which necessitates innovative printing technologies. The advancements in ink formulations, including the development of water-based and UV-curable inks that align with environmental regulations and consumer preferences for eco-friendly products are some of the notable trends in this regional market. As the market evolves, the focus on sustainability and technological innovation will continue to shape the landscape of flexographic printing inks in Europe.

MARKET DRIVERS

Rising Demand for Sustainable Packaging Solutions in Europe

The increasing demand for sustainable packaging solutions is one of the key factors driving the growth of the Europe flexographic printing inks market. As consumers become more environmentally conscious, there is a growing preference for packaging materials that are recyclable, biodegradable, or made from renewable resources. According to a report by the European Commission, approximately 60% of consumers in Europe are willing to pay more for sustainable packaging options. This shift in consumer behavior is prompting manufacturers to adopt eco-friendly printing inks that align with sustainability goals. Flexographic printing inks, particularly water-based and UV-curable inks, are gaining traction due to their lower environmental impact compared to solvent-based inks. The European flexographic printing inks market is projected to benefit from this trend, with sustainable inks expected to account for over 30% of the market share by 2025. As companies strive to meet regulatory requirements and consumer expectations for sustainable practices, the demand for eco-friendly flexographic inks will continue to drive market growth, positioning the industry for a more sustainable future.

Growth of the E-commerce Sector

The rapid growth of the e-commerce sector is further fuelling the growth of the Europe flexographic printing inks market. The surge in online shopping has led to an increased demand for packaging solutions that are not only functional but also visually appealing. According to a report by Eurostat, e-commerce sales in the EU reached €717 billion in 2020, reflecting a 10% increase from the previous year. This growth is driving the need for high-quality printed packaging materials that enhance brand visibility and consumer engagement. Flexographic printing, known for its ability to produce vibrant colors and intricate designs at high speeds, is well-suited for the demands of e-commerce packaging. As companies seek to differentiate their products in a competitive online marketplace, the demand for flexographic printing inks is expected to rise significantly.

MARKET RESTRAINTS

Regulatory Challenges and Compliance Issues

Regulatory challenges and compliance issues is a significant restraint on the Europe flexographic printing inks market. The printing industry is subject to stringent regulations regarding the use of chemicals and materials, particularly concerning environmental and health safety standards. The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation imposes strict requirements on the use of certain substances in inks, which can complicate the formulation and production processes for manufacturers. Compliance with these regulations often requires substantial investments in research and development, as well as modifications to existing product lines. According to industry estimates, approximately 25% of printing ink manufacturers in Europe face challenges related to regulatory compliance, which can lead to increased operational costs and potential delays in product launches. As the regulatory landscape continues to evolve, companies must remain vigilant and adaptable to ensure compliance, which may hinder market growth and innovation in the flexographic printing inks sector.

Competition from Alternative Printing Technologies

The competition from alternative printing technologies is further hampering the growth of the Europe flexographic printing inks market. Digital printing, in particular, has gained significant traction in recent years due to its ability to produce high-quality prints with shorter lead times and lower setup costs. This shift towards digital solutions is driven by the increasing demand for customization and short-run printing, which flexographic printing may not efficiently accommodate. As more companies adopt digital printing technologies, the demand for flexographic inks may face pressure, particularly in applications where flexibility and rapid turnaround times are paramount. To remain competitive, flexographic ink manufacturers must innovate and adapt their offerings to meet the changing needs of the market, which may require significant investment in research and development.

MARKET OPPORTUNITIES

Technological Advancements in Ink Formulations

Technological advancements in ink formulations is one of the major opportunities for the Europe flexographic printing inks market. Innovations in ink chemistry, such as the development of low-VOC (volatile organic compounds) and high-performance inks, are enabling manufacturers to produce inks that meet stringent environmental regulations while maintaining high-quality performance. The demand for low-VOC flexographic inks is expected to grow rapidly in the coming years owing to the increasing regulatory pressures and consumer demand for sustainable products. These advancements not only enhance the performance characteristics of flexographic inks but also expand their applicability across various substrates and printing processes. As manufacturers invest in research and development to create innovative ink formulations, the flexographic printing inks market is poised for substantial growth. This focus on technological innovation will enable companies to differentiate their products and capture a larger share of the market, aligning with the broader trends of sustainability and efficiency in the printing industry.

Expansion of the Packaging Industry

The expansion of the packaging industry is another significant opportunity for the Europe flexographic printing inks market. As global consumption patterns shift and e-commerce continues to grow, the demand for innovative and visually appealing packaging solutions is on the rise. Flexographic printing is particularly well-suited for packaging applications due to its ability to produce high-quality prints at high speeds, making it an ideal choice for manufacturers looking to meet the demands of the evolving packaging landscape. The increasing focus on sustainable packaging solutions, including recyclable and biodegradable materials, further enhances the growth potential for flexographic inks. As companies seek to differentiate their products and enhance brand visibility through innovative packaging, the flexographic printing inks market is expected to benefit significantly from the expansion of the packaging industry.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the Europe flexographic printing inks market, particularly in the wake of the COVID-19 pandemic. The pandemic has exposed vulnerabilities in global supply chains, leading to delays in the delivery of raw materials and increased costs. According to a survey conducted by the European Printing Industry Federation, approximately 60% of printing companies reported experiencing supply chain issues in 2021, with many citing difficulties in sourcing key materials for ink production. These disruptions can hinder production schedules, increase operational costs, and ultimately impact the overall growth of the flexographic printing inks market. Furthermore, geopolitical tensions and trade restrictions can exacerbate supply chain challenges, leading to further uncertainty in the availability of essential materials. As the industry grapples with these supply chain issues, stakeholders must develop strategies to mitigate risks and ensure a stable supply of materials to support ongoing and future projects.

Market Saturation and Price Competition

Market saturation and price competition are further challenging the growth of the Europe flexographic printing inks market. As the market matures, the number of players has increased, leading to heightened competition and pressure on profit margins. According to industry analyses, the average selling price of flexographic inks has declined by approximately 10% over the past five years due to competitive pricing strategies. This price competition can make it difficult for manufacturers to maintain profitability while investing in research and development to innovate and improve their product offerings. Additionally, the proliferation of low-cost ink suppliers, particularly from emerging markets, further intensifies the competitive landscape. As companies strive to differentiate themselves in a crowded market, they must balance the need for competitive pricing with the imperative to deliver high-quality, innovative products. This challenge requires strategic planning and investment in marketing and product development to ensure long-term sustainability in the flexographic printing inks market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.76% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Sun Chemical Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Toyo Ink SC Holdings Co., Ltd., ALTANA AG, Antonine Inks, Fujifilm, RUCO Druckfarben A.M. Ramp & Co GmbH, Needham-Ink, and T&K TOKA Co. Ltd, and others. |

SEGMENTAL ANALYSIS

By Application Insights

The flexible packaging segment accounted for the leading share of 41.2% of the European flexographic printing inks market in 2024. Flexible packaging is widely utilized in various industries, including food and beverage, pharmaceuticals, and consumer goods, due to its lightweight, cost-effective, and versatile nature. The demand for flexible packaging is driven by the increasing consumer preference for convenience and the need for longer shelf life for products. The demand for flexible packaging in Europe is projected to grow steadily in the coming years, which is expected to boost the demand for flexographic printing inks. As manufacturers continue to innovate and develop sustainable packaging solutions, the flexible packaging segment is expected to maintain its leading position in the flexographic printing inks market, supporting the overall growth of the industry.

The labels and tags segment is anticipated to register a CAGR of 5.5% over the forecast period owing to the increasing demand for product labeling, driven by regulatory requirements and consumer preferences for information transparency, is propelling the growth of this segment. Labels and tags are essential for branding, marketing, and providing essential product information, making them a critical component of the packaging process. As companies seek to improve their branding and marketing strategies, the demand for flexographic printing inks for labels and tags is expected to rise, positioning this segment for substantial growth in the coming years.

REGIONAL ANALYSIS

Germany dominated the Europe flexographic printing inks market in 2024 by accounting for 24.9% of the European market share in 2024. The robust industrial base and advanced manufacturing capabilities of Germany are propelling the growth of the German flexographic printing inks market. Germany is home to numerous packaging manufacturers and printing companies, which are major consumers of flexographic inks. According to the German Printing and Media Industries Association, the printing sector in Germany generated over €15 billion in revenue in 2021, underscoring the critical role of flexographic printing in the overall industry. Additionally, Germany's commitment to sustainability and innovation is driving the development of high-performance inks that meet the evolving needs of various applications. The increasing demand for flexible packaging and labels in the German market is further propelling the growth of flexographic printing inks. As the country continues to invest in advanced printing technologies and sustainable practices, Germany's position as a market leader is expected to remain strong, reinforcing its influence in the European flexographic printing inks market.

France was the second-largest market for flexographic printing inks in Europe and captured a substantial share of the regional market in 2024. The French printing industry is characterized by significant investments in packaging and labeling, driven by the growing demand for consumer goods and e-commerce. According to the French National Printing Federation, the printing sector in France generated around €10 billion in revenue in 2021, reflecting a robust market for flexographic inks. The emphasis on sustainable packaging solutions and the use of eco-friendly inks is also shaping the market landscape in France. As the country continues to prioritize innovation and sustainability in its printing practices, the flexographic printing inks market is poised for continued growth, reinforcing France's position as a key player in the European market.

Italy is anticipated to grow at a prominent CAGR in the European flexographic printing inks market over the forecast period. The Italian printing sector is experiencing a resurgence, driven by government initiatives aimed at revitalizing the manufacturing industry and promoting sustainable practices. According to the Italian National Institute of Statistics, the printing industry in Italy generated over €8 billion in revenue in 2021. The increasing focus on high-quality packaging and labeling solutions is propelling the demand for flexographic inks in Italy. Additionally, Italy's strategic location within Europe facilitates trade and distribution, further enhancing its position in the flexographic printing inks market. As the country continues to invest in modernization and innovation, the flexographic printing inks market is expected to benefit from these developments.

The UK is also a key player in the Europe flexographic printing inks market and is likely to register a healthy CAGR in this regional market over the forecast period. The UK printing industry is characterized by a diverse range of applications, including packaging, labels, and commercial printing. According to the UK Printing Industry Federation, the printing sector in the UK generated around £9 billion in revenue in 2021, reflecting a strong demand for flexographic inks. The emphasis on high-performance inks and sustainable printing practices is driving innovation in the UK market. Furthermore, the UK's commitment to regulatory compliance and environmental sustainability is influencing the development of eco-friendly flexographic inks, aligning with broader market trends. As the UK navigates post-Brexit challenges, the flexographic printing inks market is expected to adapt and evolve, presenting opportunities for growth.

Spain is predicted to witness a steady CAGR in the European flexographic printing inks market over the forecast period. The Spanish printing industry is experiencing significant growth, driven by a resurgence in packaging and labeling projects. According to the Spanish Association of Printing and Media, the printing sector in Spain generated over €6 billion in revenue in 2021. The increasing focus on sustainable packaging solutions and the demand for high-quality printed materials are propelling the growth of flexographic inks in Spain. Additionally, Spain's growing e-commerce sector is driving the need for innovative packaging solutions that enhance brand visibility and consumer engagement. As the country continues to develop its industrial capabilities and invest in sustainable practices, the demand for flexographic printing inks is anticipated to rise, reinforcing its position in the European market.

KEY MARKET PLAYERS

The major key players in Europe flexographic printing inks market are Sun Chemical Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Toyo Ink SC Holdings Co., Ltd., ALTANA AG, Antonine Inks, Fujifilm, RUCO Druckfarben A.M. Ramp & Co GmbH, Needham-Ink, and T&K TOKA Co. Ltd, and others.

MARKET SEGMENTATION

This research report on the Europe flexographic printing inks market is segmented and sub-segmented into the following categories.

By Application

- Packaging

- Flexible Packaging

- Corrugated Containers

- Folding Cartons

- Tags and Labels

- Others

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the Europe Flexographic Printing Inks market?

The market is anticipated to grow at a compound annual growth rate (CAGR) of 5.76% from 2025 to 2033.

2. What factors are driving the growth of the Flexographic Printing Inks market in Europe?

Key drivers include rising demand for flexible packaging, advancements in printing technologies, and increased production in industries such as food and beverages.

3. Which segment holds the largest market share within the Europe Flexographic Printing Inks market?

The packaging segment holds the largest market share due to the growing demand for corrugated boxes and flexible packaging solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]