Europe Flax Seed Market Size, Share, Trends, & Growth Forecast Report, Segmented Based on Product, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Flax Seed Market Size

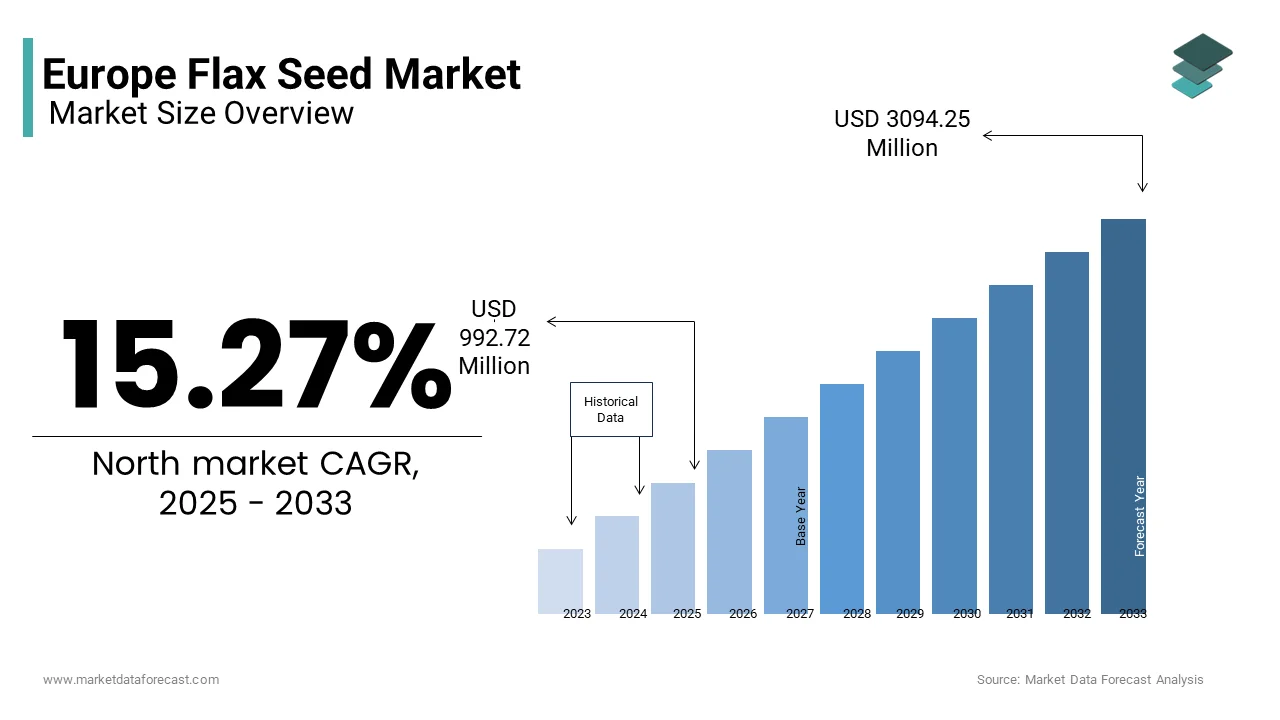

The European flaxseed market was valued at USD 861.21 million in 2024 and is anticipated to reach USD 992.72 million in 2025 from USD 3094.25 million by 2033, growing at a CAGR of 15.27% during the forecast period from 2025 to 2033.

The European flaxseeds market has established itself as a significant player within the agricultural commodities sector owing to the growing consumer awareness of health benefits and sustainability. As per Eurostat, the total production of flaxseeds in Europe reached approximately 1.2 million metric tons in 2022, with France and Germany collectively contributing over 50% of this volume. The market is characterized by its strong alignment with organic farming practices, which resonates well with regional preferences for clean-label products. According to a report by FiBL (Research Institute of Organic Agriculture), organic flaxseed cultivation accounted for nearly 30% of the total flaxseed production in Europe during 2021 is reflecting a robust demand for pesticide-free and naturally grown variants. Furthermore, regulatory frameworks promoting sustainable agriculture have provided a conducive environment for market growth. For instance, the European Green Deal aims to reduce chemical pesticide use by 50% by 2030 that is indirectly favoring flaxseed cultivation due to its low-input requirements.

MARKET DRIVERS

Rising Health Consciousness Among Consumers

A key driver propelling the European flaxseeds market is the increasing emphasis on health and wellness. Flaxseeds are rich in omega-3 fatty acids, fiber, and lignans by making them a preferred choice for individuals seeking functional foods that support cardiovascular health and digestion. According to a survey conducted by Euromonitor International, the demand for plant-based superfoods grew by 18% across Western Europe between 2019 and 2022, with flaxseeds emerging as one of the top five most consumed items. In France alone, retail sales of flaxseed-based products surged by 22% in 2021, as stated by Xerfi, a French economic research firm. This trend aligns with broader lifestyle changes, including veganism and vegetarianism, which have gained traction among millennials and Gen Z populations. Additionally, the incorporation of flaxseeds into mainstream food categories like cereals, bread, and smoothies has further amplified accessibility and consumption rates.

Expanding Applications in the Food Industry

Another critical factor fueling the flaxseeds market is their expanding applications in the food industry. These seeds are now integral to various product formulations by ranging from gluten-free baked goods to fortified beverages. Moreover, innovations in processing technologies have enabled manufacturers to develop value-added derivatives such as flaxseed oil and protein isolates, which cater to niche markets. According to Mintel, new product launches featuring flaxseeds increased by 35% in Europe between 2020 and 2022 with their versatility and appeal. This diversification not only boosts overall demand but also stabilizes market dynamics against seasonal fluctuations in raw material availability.

MARKET RESTRAINTS

Price Volatility Due to Weather Variability

One of the primary constraints affecting the European flaxseeds market is price volatility caused by unpredictable weather patterns. Flaxseed cultivation is highly sensitive to climatic conditions, particularly rainfall and temperature fluctuations, which can lead to inconsistent yields. For example, during the prolonged drought experienced in Central Europe in 2021, flaxseed output declined by an estimated 25%, as recorded by the German Farmers' Association. Such disruptions often result in sharp price hikes, impacting both farmers and end consumers. Additionally, the lack of advanced irrigation systems in certain regions exacerbates the problem by leaving growers vulnerable to environmental risks. While the EU Common Agricultural Policy offers subsidies to mitigate losses with these measures are insufficient to address long-term challenges posed by climate change.

Limited Awareness Regarding Non-Food Applications

Despite their potential, flaxseeds remain underutilized outside the food sector is limiting market expansion opportunities. Although they possess properties suitable for industrial applications, such as bio-composite materials and animal feed supplements, awareness remains minimal. A study by the European Biomaterials Consortium indicates that less than 10% of flaxseed production is currently allocated to non-food uses. The inadequate promotional efforts and limited R&D investments compared to other crops like soybeans or hemp are likely to hinder the growth of the market. Furthermore, stringent regulatory standards governing industrial usage create additional barriers.

MARKET OPPORTUNITIES

Growing Demand for Plant-Based Meat Alternatives

The burgeoning plant-based meat industry presents a lucrative opportunity for the European flaxseeds market. Flaxseeds serve as an excellent binding agent in plant-based meat analogs due to their high fiber content and ability to mimic texture. Companies like Beyond Meat and Impossible Foods are increasingly incorporating flaxseeds into their formulations, creating a ripple effect on procurement trends. Moreover, startups specializing in localized solutions are entering the fray, driving localized sourcing demands. For instance, Sweden-based Oatly recently launched a line of plant-based sausages using locally sourced flaxseeds by signaling a shift toward regional supply chains. This trend is expected to bolster demand significantly over the next decade.

Expansion into Eastern European Markets

Eastern Europe represents a largely untapped yet promising frontier for flaxseed producers. Countries like Poland, Romania, and Ukraine boast vast arable lands ideal for large-scale cultivation. According to the United Nations Food and Agriculture Organization, Ukraine alone produces around 20% of the world’s flaxseeds, yet domestic processing facilities are scarce. European companies can capitalize on this resource-rich region by establishing partnerships with local cooperatives and investing in infrastructure development. Additionally, rising disposable incomes and urbanization in Eastern Europe are fostering greater acceptance of health-centric diets, thereby enhancing prospects for flaxseed-based products. Initiatives such as the EU-Ukraine Trade Agreement provide tariff-free access by facilitating smoother trade flows and encouraging cross-border collaborations.

MARKET CHALLENGES

Competition from Substitute Crops

The flaxseeds market faces stiff competition from substitute crops like chia seeds and hemp seeds, which offer similar nutritional profiles at competitive prices. Chia seed imports into Europe doubled between 2018 and 2022, according to Agrarmarkt Informations-Gesellschaft (AMI), posing a direct threat to flaxseed dominance. Hemp seeds, meanwhile, benefit from relaxed regulations surrounding cannabis cultivation by enabling rapid adoption in multiple sectors. Unlike flaxseeds, these substitutes often enjoy stronger branding and marketing campaigns by overshadowing traditional offerings. The flaxseed stakeholders must focus on differentiation strategies, such as unique attributes like higher lignan content or emphasizing heritage farming traditions. However, achieving this requires substantial investment in promotional activities and consumer education programs.

Fragmented Supply Chain Dynamics

Supply chain fragmentation poses another significant hurdle for the European flaxseeds market. The absence of centralized distribution networks leads to inefficiencies is resulting in delayed deliveries and elevated costs. According to Logistics UK, small-scale farmers account for nearly 60% of total flaxseed suppliers is complicating coordination efforts. Additionally, fluctuating currency exchange rates and geopolitical tensions, such as Brexit-related disruptions, add layers of complexity. For example, post-Brexit tariffs imposed on UK-EU trade led to a 15% increase in transportation expenses, adversely affecting profitability margins. Streamlining logistics through digital platforms and fostering collaboration among stakeholders could alleviate some of these issues, though implementation hurdles persist.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.27% |

|

Segments Covered |

By Product, Application and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd, RICHARDSON INTERNATIONAL LIMITED, Johnson SeedS, AgMotion, Inc., CanMar Foods Ltd, Simosis; Stokes Seeds, Bioriginal Food & Science Corp. |

SEGMENTAL ANALYSIS

By Product Insights

The whole flax seeds segment was the largest in the Europe flaxseeds market and held prominent share in 2024. Consumers prefer whole seeds for sprinkling over salads, yogurt, or oatmeal, while bakeries utilize them as toppings for artisanal bread. Another driving force behind this segment's dominance is its cost-effectiveness; whole seeds require minimal processing by reducing production expenses. Additionally, the growing DIY health trend encourages individuals to grind seeds at home by ensuring freshness and maximizing nutritional benefits.

The ground flax seeds segment is likely to exhibit CAGR of 8.5% from 2025 to 2033 owing to the convenience and enhanced digestibility. Pre-ground options save time for busy consumers who prioritize ready-to-use formats. Furthermore, scientific studies conducted by the University of Copenhagen reveal that ground flax seeds release nutrients more efficiently than their whole counterparts, appealing to health-conscious buyers. Retail giants like Tesco and Carrefour have responded by expanding their private-label portfolios by offering affordable alternatives to premium brands. The rise of e-commerce platforms has also played a pivotal role, with Amazon reporting a 50% spike in ground flax seed purchases during Q4 2022.

By Application Insights

The food segment was the largest European flaxseeds market by capturing a prominent share in 2024. Its prominence arises from diverse applications spanning breakfast cereals, snacks, and bakery items. Rising obesity rates and associated health concerns have prompted governments to promote healthier eating habits is indirectly boosting flaxseed adoption. For example, the UK’s Public Health England initiative encouraged schools to incorporate nutrient-dense ingredients like flaxseeds into lunch menus is leading to a 20% uptick in institutional procurement. Similarly, celebrity endorsements and social media influencers advocating for clean eating have amplified visibility, driving household penetration rates.

The pet food segment is swiftly emerging with an expected CAGR of 9.2% from 2025 to 2033. This surge reflects escalating pet ownership levels and heightened spending on premium pet care products. Flaxseeds enrich pet diets by providing essential fatty acids that promote coat shine and joint health. Brands like Royal Canin and Hill’s Science Diet increasingly incorporate flaxseed derivatives into their formulations by capitalizing on evolving owner preferences.

COUNTRY ANALYSIS

Leading Countries in the European Flaxseeds Market

France flax seeds market was accounted in holding 35.3% of the share in 2024. The favorable climatic conditions and extensive agricultural expertise. Normandy, renowned for its fertile soils, serves as the epicenter of flaxseed cultivation,

Germany is ready to experience a potential CAGR of 11.2% in the next coming years. The country’s robust organic farming sector is covering 10% of total farmland, drives flaxseed production. According to the Federal Office for Agriculture and Food, German exports of flaxseed-based products exceeded €500 million in 2022, fueled by strong demand from neighboring nations.

KEY MARKET PLAYERS

Archer Daniels Midland (ADM), Cargill Incorporated, TA Foods Ltd, RICHARDSON INTERNATIONAL LIMITED, Johnson SeedS, AgMotion, Inc., CanMar Foods Ltd, Simosis; Stokes Seeds, Bioriginal Food & Science Corp. are the market players that are dominating the Europe flax seeds market.

Top 3 Players in the Europe Flaxseeds Market

Linseed Company Ltd.

Linseed Company Ltd., headquartered in the UK, specializes in premium flaxseed products catering to both B2B and B2C segments. With state-of-the-art processing facilities, the company ensures superior quality and consistency. It plays a pivotal role in advancing sustainable agriculture practices by collaborating with farmers to adopt eco-friendly techniques.

Flax Farm GmbH

Based in Germany, Flax Farm GmbH focuses on organic flaxseed cultivation and innovation. Its commitment to R&D has resulted in patented extraction methods for flaxseed oil, setting industry benchmarks. The company actively participates in international trade fairs by amplifying its global footprint.

BioPlanète SAS

BioPlanète SAS, a French pioneer, excels in crafting organic flaxseed oils and supplements. Leveraging cutting-edge technology, it maintains rigorous quality checks throughout the supply chain. Strategic alliances with retail chains enhance its reach across Europe.

Top Strategies Used By Key Players

Strategy 1: Strategic Partnerships

Leading players forge strategic partnerships to expand their distribution networks. For instance, Linseed Company Ltd. partnered with major supermarket chains in Scandinavia to introduce exclusive product lines, enhancing brand visibility and market penetration.

Strategy 2: Investment in R&D

Investments in research and development enable companies to innovate and stay ahead. Flax Farm GmbH allocates 15% of its annual revenue to R&D, focusing on developing novel applications for flaxseeds, such as bioplastics and pharmaceuticals.

Strategy 3: Sustainability Initiatives

Sustainability initiatives resonate well with environmentally conscious consumers. BioPlanète SAS launched a carbon-neutral certification program, incentivizing farmers to adopt regenerative farming practices, thereby strengthening supplier relationships.

Overview Of Competition In The Europe Flaxseed Market

The European flaxseed market operates within a moderately consolidated landscape, characterized by intense rivalry among established players and emerging entrants. Large-scale enterprises leverage economies of scale to maintain competitive pricing, while smaller firms emphasize niche markets to carve out distinct identities. Mergers and acquisitions represent a common strategy, with Linseed Company Ltd.’s acquisition of a Polish processor in 2022 exemplifying consolidation efforts. Simultaneously, startups disrupt traditional paradigms through innovative business models, such as subscription-based services offering customized flaxseed blends. Regulatory compliance adds another layer of complexity, necessitating continuous adaptation to evolving standards. Overall, the market exhibits dynamic interactions shaped by technological advancements by shifting consumer preferences, and geopolitical influences.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Flax Farm GmbH acquired a Dutch organic farm specializing in flaxseed cultivation. This move aims to secure raw material supplies and enhance vertical integration capabilities.

- In June 2023, BioPlanète SAS partnered with a French agritech startup to pilot smart irrigation systems, improving water efficiency and crop yields.

- In September 2023, Linseed Company Ltd. launched a zero-waste packaging initiative, replacing plastic containers with biodegradable alternatives made from recycled flax fibers.

- In November 2023, Flax Farm GmbH invested €10 million in a new R&D facility dedicated to exploring medicinal applications of flaxseeds by reinforcing its leadership in innovation.

- In January 2024, BioPlanète SAS signed a memorandum of understanding with Spanish cooperatives to establish a regional hub for flaxseed processing, targeting Iberian markets.

MARKET SEGMENTATION

This research report on the Europe flaxseeds market is segmented and sub-segmented into the following categories.

By Product

- Ground Flax Seed

- Whole Flax Seed

By Application

- Food

- Pet Food

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the flaxseed market in Europe?

Rising health awareness and demand for plant-based nutrition are key drivers.

Which countries lead flaxseed production in Europe?

Russia, France, and Germany are among the top producers.

How is flaxseed used across industries in Europe?

It's widely used in food, cosmetics, and nutraceuticals for its omega-3 and fiber content.

What are the main challenges in the European flaxseed market?

Climate variability and strict import regulations pose major hurdles.

Is organic flaxseed gaining popularity in Europe?

Yes, organic flaxseed demand is rising due to clean-label and sustainable trends.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]