Europe Fitness Equipment Market Size, Share, Trends & Growth Forecast Report By Type (Cardiovascular Training Equipment, Treadmills, Stationary Cycles, Strength Training Equipment, and Others), End-User, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Fitness Equipment Market Size

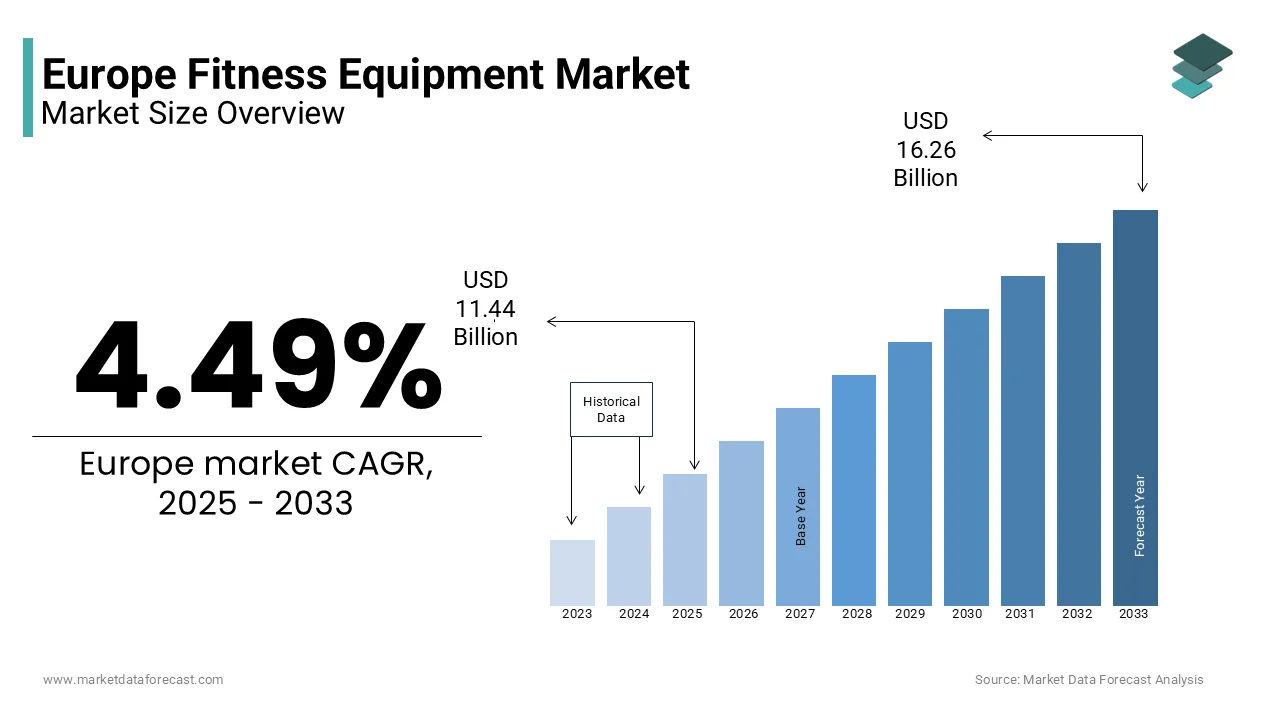

The Fitness Equipment market size in Europe was valued at USD 10.95 billion in 2024. The European market is estimated to be worth USD 16.26 billion by 2033 from USD 11.44 billion in 2025, growing at a CAGR of 4.49% from 2025 to 2033.

Fitness equipment is designed to support physical exercise and overall health and wellness. Key product categories in the fitness equipment include cardiovascular equipment such as treadmills and stationary bikes, strength training machines, and free weights, along with modern innovations like connected fitness devices and virtual training platforms. The demand for fitness equipment in Europe is majorly driven by growing awareness of health and fitness, particularly after the COVID-19 pandemic, which heightened interest in at-home fitness solutions. According to Eurostat, physical inactivity among Europeans decreased by 10% between 2020 and 2023, reflecting a shift toward healthier lifestyles. Additionally, the European Union's initiatives to combat obesity and promote active living, such as the HealthyLifestyle4All campaign, have encouraged fitness adoption.

The rise of smart fitness equipment integrated with IoT and AI technologies has revolutionized the fitness equipment market. For example, connected devices offering real-time performance tracking and virtual coaching are increasingly popular in residential settings. Furthermore, the increasing number of boutique fitness studios and corporate wellness programs has amplified demand for high-quality fitness equipment. Major players, including Technogym, Life Fitness, and Precor, dominate the market by continuously innovating and aligning with consumer preferences for sustainability, digital connectivity, and versatile exercise solutions.

MARKET DRIVERS

Growing Health Awareness and Lifestyle Changes

Increasing health awareness and a shift toward active lifestyles are significant drivers of the European fitness equipment market. The COVID-19 pandemic underscored the importance of physical health, leading to a rise in exercise participation rates. According to Eurostat, the percentage of Europeans engaging in regular physical activity increased by 12% between 2020 and 2023. This trend is further supported by governmental initiatives, such as the European Commission’s HealthyLifestyle4All program, which promotes active living to combat rising obesity rates. The surge in health consciousness has amplified demand for both home fitness solutions and gym memberships, driving the market for cardiovascular and strength training equipment across residential and commercial segments.

Technological Advancements in Fitness Equipment

Technological innovation has become a cornerstone of the European fitness equipment market, transforming traditional exercise routines into engaging, personalized experiences. The adoption of IoT-enabled and AI-driven equipment allows users to monitor their progress, set personalized goals, and access virtual training sessions. According to the European Digital Strategy, digital fitness solutions grew by 25% in 2022, reflecting a strong consumer preference for connected devices. Products like interactive treadmills and smart stationary bikes with real-time feedback are increasingly popular in both home and gym settings. Leading manufacturers, such as Technogym and Peloton, have capitalized on this trend by introducing equipment that integrates seamlessly with fitness apps and wearable devices, further driving demand.

MARKET RESTRAINTS

High Cost of Advanced Fitness Equipment

The high cost of advanced fitness equipment poses a significant restraint on market growth in Europe. Modern fitness machines equipped with IoT connectivity, AI features, and virtual training systems are often priced beyond the budget of individual consumers and smaller gyms. According to Eurostat, household spending on recreational goods in the EU rose by only 5% in 2022, indicating limited flexibility for high-value purchases. For instance, premium smart treadmills and interactive stationary bikes can cost between €2,000 and €5,000, which deters widespread adoption. Additionally, small fitness studios and independent gyms often face financial constraints in upgrading their equipment, slowing market penetration for technologically advanced products.

Limited Space in Residential Settings

Limited living space in European households is another restraint affecting the fitness equipment market, particularly in urban areas. With 74% of the EU population residing in cities, as reported by Eurostat in 2023, compact and multi-functional equipment is in demand but not always feasible for many consumers. Apartments and smaller homes often lack the space to accommodate large fitness machines like treadmills or strength training stations. This limitation reduces the market potential for high-value residential fitness equipment, forcing manufacturers to focus on compact or foldable designs. Despite innovations in space-saving equipment, the issue remains a challenge for reaching broader demographics, especially in densely populated regions like France, the UK, and Germany.

MARKET OPPORTUNITIES

Expansion of Corporate Wellness Programs

The increasing adoption of corporate wellness programs across Europe presents a significant opportunity for the fitness equipment market. Companies are prioritizing employee health to enhance productivity and reduce healthcare costs. According to the European Network for Workplace Health Promotion, 70% of organizations in the EU implemented some form of workplace wellness initiative by 2022. These programs often include the provision of on-site gyms or subsidized access to fitness facilities, driving demand for high-quality fitness equipment. For example, treadmills, stationary bikes, and resistance training equipment are commonly installed in corporate wellness centers. Manufacturers and suppliers have the opportunity to cater to this growing market segment by offering customized equipment packages tailored to workplace environments.

Rising Demand for Home Fitness Equipment

The surge in demand for home fitness equipment offers another major growth opportunity. This trend has been fueled by post-pandemic lifestyle shifts, with consumers prioritizing health and convenience. According to Eurostat, the European home fitness equipment market grew by 18% in 2022, driven by individuals seeking alternatives to traditional gyms. Compact and multifunctional equipment such as foldable treadmills, resistance bands, and smart exercise bikes are particularly popular. Additionally, the integration of virtual workout platforms with home equipment has increased engagement and accessibility. Manufacturers can capitalize on this trend by innovating compact, smart, and affordable solutions to cater to urban consumers with limited living space and time constraints.

MARKET CHALLENGES

Economic Uncertainty and Consumer Spending Constraints

Economic volatility in Europe, driven by inflation and geopolitical tensions, poses a significant challenge for the fitness equipment market. Rising costs of living and reduced disposable incomes have constrained consumer spending on non-essential goods, including fitness equipment. According to Eurostat, inflation in the EU reached 8.3% in 2022, impacting household budgets and delaying fitness-related purchases. This economic strain has particularly affected middle-income households, who are less likely to invest in high-cost equipment like smart treadmills or elliptical machines. The commercial segment also faces challenges, as smaller gyms and fitness studios delay upgrades or expansion plans due to financial uncertainty, hindering overall market growth.

Saturation in the Commercial Fitness Sector

The European fitness equipment market is facing saturation in the commercial gym segment, particularly in developed countries such as Germany, the UK, and France. According to the European Health & Fitness Market Report by Deloitte, membership penetration rates in these countries reached nearly 10% of the population in 2022, indicating a mature market with limited room for new growth. This saturation has led to intense competition among equipment providers, with businesses focusing on price reductions and aggressive marketing strategies. As new gym openings decline in saturated regions, manufacturers must seek opportunities in emerging markets or focus on other segments, such as home fitness, to maintain revenue growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.49% |

|

Segments Covered |

By Type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Suunto Oy (Amer Sports Corporation), Nautilus, Inc., Brunswick Corporation, Johnson Health Tech Co., Ltd., True Image Interactive, Inc., Life Fitness (Cybex International, Inc.), Impulse (Qingdao) Health Tech Ltd. Co., Icon Health & Fitness, Inc. (IHF Holdings Inc.), Torque Fitness LLC., Core Health & Fitness, LLC, and others. |

REGIONAL ANALYSIS

Germany held the largest share of the European fitness equipment market in 2024. The domination of Germany in the European market is majorly attributed to the strong gym culture of Germany, extensive network of fitness centers, and high consumer spending on health and wellness. The European Health & Fitness Market Report by Deloitte noted that Germany had over 12 million fitness club members in 2022, the highest in Europe. This robust demand drives significant investments in advanced gym equipment. Additionally, Germany’s aging population has fueled demand for rehabilitation and low-impact fitness equipment, enhancing market diversity. Local manufacturers like Technogym and Life Fitness dominate by offering innovative solutions tailored to both commercial and residential needs.

The UK is another key regional segment for fitness equipment in the European market and is estimated to account for a substantial share of the regional during the forecast period. The rapid growth of boutique fitness studios and home fitness solutions in the UK are driving the UK fitness equipment market growth. According to the UK Active organization, the fitness and leisure industry contributed £5 billion to the UK economy in 2022. The popularity of personalized and technology-integrated equipment, such as smart treadmills and virtual training platforms, has driven growth in both commercial and home segments. Companies like Peloton and NordicTrack have established strong presences in the UK market by catering to tech-savvy consumers seeking convenience and versatility.

France ranks among the top fitness equipment markets in Europe due to its increasing health awareness and government-backed wellness campaigns. The French Ministry of Health reported a 15% rise in gym memberships from 2020 to 2023, reflecting a growing focus on fitness. Urban centers like Paris and Lyon host numerous high-end gyms, driving demand for advanced cardiovascular and strength training equipment. France’s emphasis on sustainability has also encouraged the adoption of eco-friendly fitness machines, further strengthening its market position.

KEY MARKET PLAYERS

The major key players in Europe fitness equipment market are Suunto Oy (Amer Sports Corporation), Nautilus, Inc., Brunswick Corporation, Johnson Health Tech Co., Ltd., True Image Interactive, Inc., Life Fitness (Cybex International, Inc.), Impulse (Qingdao) Health Tech Ltd. Co., Icon Health & Fitness, Inc. (IHF Holdings Inc.), Torque Fitness LLC., Core Health & Fitness, LLC, and others.

MARKET SEGMENTATION

This research report on the Europe fitness equipment market is segmented and sub-segmented into the following categories.

By Type

- Cardiovascular Training Equipment

- Treadmills

- Stationary Cycles

- Strength Training Equipment

- Others

By End-user

- Home Consumers

- Fitness Centers/Gyms

- Others

By Distribution Channel

- Offline

- Online

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth rate of the Europe fitness equipment market from 2025 to 2033?

The Europe fitness equipment market is expected to grow from USD 11.44 billion in 2025 to USD 16.26 billion by 2033, at a CAGR of 4.49% during this period.

2. Which factors are driving the demand for fitness equipment in Europe?

Key drivers include increasing health awareness, lifestyle changes post-pandemic, technological advancements in fitness equipment, and government initiatives promoting active living.

3. How is technology influencing the fitness equipment market in Europe?

Technological innovations, such as IoT-enabled and AI-driven equipment, are transforming traditional exercise routines into engaging, personalized experiences, leading to increased demand for smart fitness solutions.

4. Who are the leading companies in the Europe fitness equipment market?

Major players include Technogym, Life Fitness, and Precor, known for their continuous innovation and alignment with consumer preferences for sustainability and digital connectivity.

5. How are sustainability and eco-friendly trends impacting the Europe fitness equipment market?

Consumers are showing interest in eco-friendly gym equipment made from recycled materials and energy-efficient designs, pushing brands to focus on sustainability.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]