Europe Fire Protection System Market Research Report – Segmented By Offering ( products segment ,services segment ) Application ( commercial segment, residential segment ) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of EU) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Fire Protection System Market Size

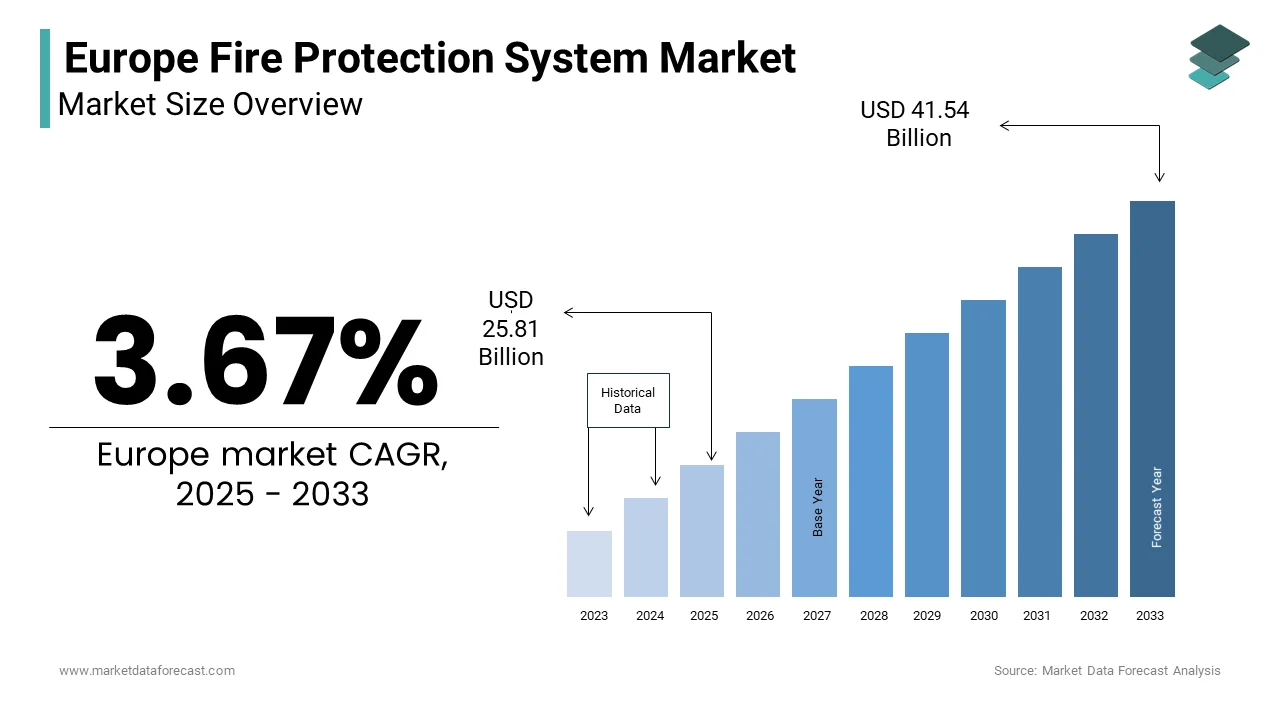

The Europe Fire Protection System Market Size was valued at USD 24.32 billion in 2024. The Europe Fire Protection System Market size is expected to have 3.67 % CAGR from 2025 to 2033 and be worth USD 41.54 billion by 2033 from USD 25.81 billion in 2025.

The Europe fire protection system market is witnessing steady growth due to the increasing urbanization, stringent safety regulations. According to Eurostat, the region’s construction sector grew by 5% in 2023, creating significant demand for advanced fire safety solutions. Additionally, the European Commission reports that over 70% of enterprises now prioritize fire safety compliance, underscoring the critical role of fire protection systems. Sustainability has also become a key focus, with companies adopting eco-friendly materials and energy-efficient designs.

MARKET DRIVERS

Stringent Safety Regulations in Europe

Stringent safety regulations is one of the key factors propelling the expansion of the Europe fire protection system market. According to the European Fire Safety Alliance, over 90% of commercial buildings in Europe are required to comply with fire safety standards such as EN 12845 and EN 54. These regulations mandate the installation of advanced fire detection and suppression systems, creating substantial demand for fire protection solutions. For instance, France implemented stricter fire safety codes in 2023, requiring all high-rise buildings to install automatic sprinkler systems. As per the French Ministry of Interior, this initiative led to a 15% increase in fire protection system installations in urban areas. Companies like Siemens have capitalized on this trend by offering integrated fire safety solutions tailored for compliance.

Rising Urbanization and Infrastructure Development

Urbanization and infrastructure development are further fuelling the growth of the European fire protection systems market. According to Eurostat, over 75% of Europe’s population resides in urban areas, where fire safety is a priority. For example, the Italian National Institute of Statistics highlights that residential and commercial construction projects in Milan increased by 20% in 2023, driving demand for fire alarms and extinguishers. Government investments in smart cities have further bolstered demand. As per the European Smart Cities Association, cities like Stockholm and Amsterdam are integrating IoT-enabled fire detection systems into their urban planning. Additionally, rising awareness about fire hazards has encouraged homeowners and businesses to adopt proactive safety measures, enhancing market growth.

MARKET RESTRAINTS

High Initial Costs of Advanced Systems

High initial costs of advanced fire protection systems in Europe is hindering the growth of the European fire protection systems market. According to the European Construction Products Regulation, installing state-of-the-art fire safety solutions can cost up to 30% more than traditional alternatives. This financial barrier limits accessibility for small-scale contractors and budget-conscious homeowners. For instance, retrofitting older buildings with modern fire suppression systems in the UK has proven challenging due to high expenses, as reported by the British Fire Consortium. While these systems offer long-term savings through improved efficiency, the upfront investment remains a deterrent. Additionally, the complexity of integrating advanced systems with existing infrastructure often requires specialized expertise, further escalating costs.

Lack of Skilled Workforce

A shortage of skilled professionals in Europe is also hampering the expansion of the European fire protection systems market. According to the European Federation of Fire Safety Associations, over 60% of fire protection projects face delays due to a lack of qualified technicians. This issue is particularly pronounced in Eastern Europe, where training programs are limited. For example, Poland’s construction industry reported a 25% shortfall in certified fire safety engineers in 2023, as per the Polish Chamber of Civil Engineers. This scarcity not only hinders project timelines but also inflates labor costs, discouraging innovation and limiting market expansion. Such challenges underscore the need for workforce development initiatives to support market growth.

MARKET OPPORTUNITIES

Adoption of Smart Fire Safety Solutions

The growing adoption of smart fire safety solutions is a promising opportunity for the Europe fire protection system market. According to ABI Research, IoT-enabled fire detection systems are projected to grow at a CAGR of 12% through 2030, driven by their ability to provide real-time monitoring and predictive analytics. For instance, Bosch launched a smart smoke detector in 2023, capable of alerting users via smartphone apps, reducing response times significantly. As per the European Smart Cities Association, cities like Copenhagen and Barcelona are investing in smart fire safety infrastructure, creating demand for connected systems. Additionally, rising awareness about fire hazards has encouraged businesses to adopt advanced solutions, positioning this segment as a key growth driver.

Expansion into Emerging Markets

Emerging markets in Eastern Europe offer untapped opportunities for growth. According to the World Bank, countries like Romania and Hungary are witnessing rapid urbanization, with construction spending increasing by 25% annually. Fire protection providers are capitalizing on this trend by establishing local operations, catering to residential and commercial projects. For example, Johnson Controls opened a new facility in Budapest in 2023, targeting SMEs seeking affordable fire safety solutions.

MARKET CHALLENGES

Cybersecurity Risks in Smart Systems

Cybersecurity risks associated with IoT-enabled fire protection systems is a major challenge for the European fire protection systems market. According to Cybersecurity Ventures, cyberattacks targeting connected devices are projected to cause €10 billion in damages annually by 2025. Fire safety systems integrated with smart technologies are increasingly vulnerable to hacking attempts, which could compromise safety protocols. As per the European Network and Information Security Agency, many IoT-enabled systems lack robust encryption protocols, making them susceptible to breaches. For example, a 2023 incident involving hacked fire alarms in a German office building resulted in false alarms and operational disruptions. To address this, companies like Honeywell are investing in next-generation encryption technologies, but the transition is slow and costly.

Supply Chain Disruptions

Supply chain disruptions, particularly for critical components like sensors and control panels are further challenging the expansion of the European fire protection systems market. According to the European Logistics Association, semiconductor shortages caused by geopolitical tensions delayed the production of advanced systems by up to six months in 2023. This issue is compounded by reliance on imports for essential materials. As per the European Raw Materials Alliance, over 90% of rare earth metals used in sensor manufacturing are sourced from foreign markets, making the supply chain vulnerable to external shocks. For example, tariffs imposed on Chinese imports raised production costs for manufacturers, limiting their ability to meet growing demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.67 % |

|

Segments Covered |

By Offering,Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland,Switzerland, Netherlands, Rest of Europe. |

|

Market Leader Profiled |

Eaton Corp PLC, Gentex Corp, Halma PLC, Hitachi Ltd, Honeywell International Inc, Iteris Inc |

SEGMENT ANALYSIS

By Offering Insights

The products segment accounted for 66.1% of the Europe fire protection system market share in 2024. The dominating position of products segment in the European market can be credited to the widespread use of fire detectors, alarms, and extinguishers in residential and commercial buildings. For instance, the British Fire Consortium reports that product sales accounted for over 80% of total revenue in the UK, reflecting consumer preference for tangible safety solutions. Advancements in technology are further driving the expansion of the products segment in the European market. As per the International Fire Safety Standards Coalition, modern fire detectors now offer up to 30% higher accuracy compared to older models, boosting demand. Additionally, government incentives for fire safety compliance have encouraged investments in advanced products, solidifying the segment’s dominance.

The services segment is predicted to witness the fastest CAGR of 9.1% over the forecast period owing to the increasing demand for maintenance and installation services, particularly in industrial settings. According to the European Federation of Fire Safety Associations, over 60% of enterprises now outsource fire safety services to ensure compliance and operational efficiency. Innovations in predictive maintenance are favouring the growth of the services segment in the European market. For example, Siemens introduced AI-driven service solutions in 2023, enabling real-time diagnostics and reducing downtime by 25%.

By Application Insights

The commercial segment led the Europe fire protection system market by capturing 45.7% of the European market share in 2024. The leading position of commercial segment in the European market is attributed to the sector’s reliance on fire safety solutions to comply with stringent regulations. For instance, the European Commission mandates that all commercial buildings exceeding 2,000 square meters must install advanced fire detection systems. Technological advancements are further fuelling the growth rate of the commercial segment in the European market. As per the International Fire Safety Standards Coalition, IoT-enabled systems now offer real-time monitoring, enhancing safety protocols. Additionally, rising investments in smart office buildings have increased demand for integrated fire protection solutions, which is further boosting the domination of the commercial segment in the European market.

The residential segment is anticipated to register a promising CAGR of 10.4% over the forecast period owing to the increasing awareness about fire hazards and the rising adoption of smart home technologies. For example, the Swedish Home Safety Association reports that over 60% of homeowners installed smart smoke detectors in 2023, reflecting a shift toward proactive safety measures. Innovations in user-friendly designs are also contributing to the expansion of the residential segment in the European market. For instance, Nest Labs introduced a compact fire alarm system in 2023, specifically designed for residential use. These developments position residential applications as a key growth driver in the coming years.

Country Level Analysis

Germany held the leading share of 25.3% of the European fire protection system market share in 2024. The dominating position of Germany in the European market is driven by stringent safety regulations and a robust industrial base. Berlin, Munich, and Stuttgart are key hubs where advanced technologies like smart smoke detectors and automated sprinkler systems are widely adopted. Over 60% of installations occur in commercial and industrial sectors, reflecting Germany’s emphasis on workplace safety. The rise of smart building infrastructure has further amplified demand, with integrated fire protection systems growing by 18% annually since 2021, according to Statista. Additionally, government initiatives promoting energy-efficient buildings have encouraged the use of eco-friendly materials in fire safety equipment. Despite challenges like high installation costs, Germany’s focus on innovation ensures steady growth.

The UK held a substantial share of the European fire protection systems market in 2024. The urbanization and strict compliance with fire safety laws, particularly after incidents like the Grenfell Tower fire, is one of the major factors propelling the UK market growth. London, Manchester, and Birmingham lead adoption, with over 50% of investments directed toward residential and commercial buildings. According to the UK Fire Service, the demand for advanced systems like flame detectors and emergency lighting has surged by 20% annually since 2020. Retail giants like Screwfix and Toolstation have expanded their offerings to meet rising consumer demand. Moreover, the UK’s focus on sustainability aligns with EU goals, encouraging energy-efficient solutions. E-commerce platforms have also transformed distribution, capturing 25% of total sales. By prioritizing safety and innovation, the UK remains a cornerstone of Europe’s fire protection market.

France is predicted to exhibit a prominent CAGR in the European fire protection system market over the forecast period owing to its emphasis on cutting-edge technology and urban safety. Paris and Lyon are pivotal markets, where smart fire alarms and IoT-enabled systems dominate installations. Over 40% of systems are deployed in public infrastructure, including hospitals and schools, driven by government mandates. The rise of green buildings has spurred demand for eco-friendly systems, which grew by 25% annually since 2021, according to NielsenIQ. Additionally, France’s robust regulatory framework ensures compliance, fostering trust among consumers. Retailers like Leroy Merlin have introduced affordable yet high-quality options, broadening accessibility. By blending technology with regulation, France continues to thrive in Europe’s fire protection ecosystem.

Italy is projected to grow at a notable CAGR in the European fire protection system market over the forecast period. The dual focus of Italy on industrial safety and residential protection is propelling the growth of the Italian market growth. Milan and Rome are key cities, where demand is driven by manufacturing hubs and densely populated urban areas. Over 50% of installations occur in factories and warehouses, aligning with Italy’s industrial economy. The popularity of smart home systems has also contributed, with connected fire alarms growing by 15% annually since 2021. Government incentives promoting sustainable construction have encouraged the adoption of energy-efficient solutions. Retailers like Unieuro have expanded their product ranges, catering to diverse income groups. Despite challenges like regional disparities, Italy’s innovative approach ensures steady growth in the fire protection market.

Spain is anticipated to hold a noteworthy share of the European fire protection system market over the forecast period. The rapid urbanization and increased awareness of fire safety is propelling the fire protection system market growth in Spain. Madrid and Barcelona are pivotal markets, where demand is driven by commercial real estate and tourism infrastructure. Over 35% of installations occur in hotels and shopping malls, reflecting Spain’s booming hospitality sector. The rise of smart cities has amplified demand for integrated systems, which grew by 20% annually since 2021. Government campaigns promoting safer public spaces have further boosted adoption. Retailers like MediaMarkt have introduced budget-friendly options, ensuring accessibility. By embracing urban development and technological integration, Spain continues to emerge as a dynamic player in Europe’s fire protection market.

Top 3 Players in the market

Siemens AG leads the Europe fire protection system market, contributing significantly to the global industry through its innovative product portfolio. The company’s global reach extends to over 150 countries, making it a dominant player worldwide.

Johnson Controls is another major company in the European fire protection system market and is renowned for its expertise in integrated fire safety systems. The company’s strategic acquisitions and partnerships enhance its global footprint.

Honeywell is also a key performer in the European fire protection system market. By leveraging its strong brand presence and commitment to innovation, Honeywell gained a promising occupancy in this regional market. Its contributions to the global market include advanced solutions tailored for industrial and commercial sectors.

Top strategies used by the key market participants

Key players in the Europe fire protection system market employ diverse strategies to strengthen their positions. One prominent approach is product differentiation; Siemens launched a line of AI-driven fire detectors in 2023, enabling real-time data analytics. Another strategy is geographic expansion; Johnson Controls opened new facilities in Eastern Europe to tap into emerging markets.

Strategic collaborations also play a crucial role. In 2023, Honeywell partnered with a leading European IoT provider to enhance its service offerings, resulting in a 20% increase in client acquisition. Additionally, companies like Siemens are investing in digital platforms to engage customers, further solidifying their leadership in the competitive landscape.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the Europe fire protection system market are Eaton Corp PLC, Gentex Corp, Halma PLC, Hitachi Ltd, Honeywell International Inc, Iteris Inc, Johnson Controls International PLC, RTX Corp, Bosch, Siemens AG

The Europe fire protection system market is marked by intense competition, with established giants and emerging players vying for supremacy. According to the European Federation of Fire Safety Associations, the top five companies account for over 60% of total sales, reflecting the market’s oligopolistic structure. Siemens, Johnson Controls, and Honeywell dominate the landscape, leveraging their technological expertise and extensive distribution networks.

Smaller players, however, are gaining traction through niche offerings, such as eco-friendly systems and AI-driven solutions. The rise of e-commerce platforms has leveled the playing field, enabling smaller brands to reach wider audiences. Price wars and promotional campaigns are common, particularly in the residential segment. Despite these challenges, innovation remains a key differentiator, with companies continuously introducing advanced solutions to meet evolving consumer demands.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Siemens launched a series of AI-enabled fire detectors. This initiative aimed to provide real-time alerts and improve safety protocols.

- In March 2024, Johnson Controls acquired a Czech fire safety firm. This acquisition was intended to expand its product range and enhance local operations.

- In May 2024, Honeywell partnered with a European IoT provider. This collaboration aimed to integrate predictive analytics into its fire safety solutions.

- In July 2024, Bosch introduced a new line of eco-friendly fire extinguishers. This launch aimed to align with environmental regulations and appeal to sustainability-conscious consumers.

- In September 2024, UTC Fire & Security unveiled a smart home fire alarm system. This initiative aimed to cater to the growing demand for connected safety solutions.

MARKET SEGMENTATION

This research report on the Europe Fire Protection System Market has been segmented and sub-segmented into the following categories.

By Offering

- products segment

- services segment

By Application

- commercial segment

- residential segment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe.

Frequently Asked Questions

What are the key drivers of the Europe Fire Protection System Market?

Stringent fire safety regulations, increasing urbanization, and advancements in fire safety technology.

Which countries dominate the Europe Fire Protection System Market?

Germany, the UK, France, and Italy lead due to strong regulations and infrastructure growth.

Which industries have the highest demand for fire protection systems?

Commercial buildings, industrial facilities, oil & gas, healthcare, and transportation.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]