Europe Fintech Market Size, Share, Trends & Growth Forecast Report By Deployment Mode, Technology, Application, End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Fintech Market Size

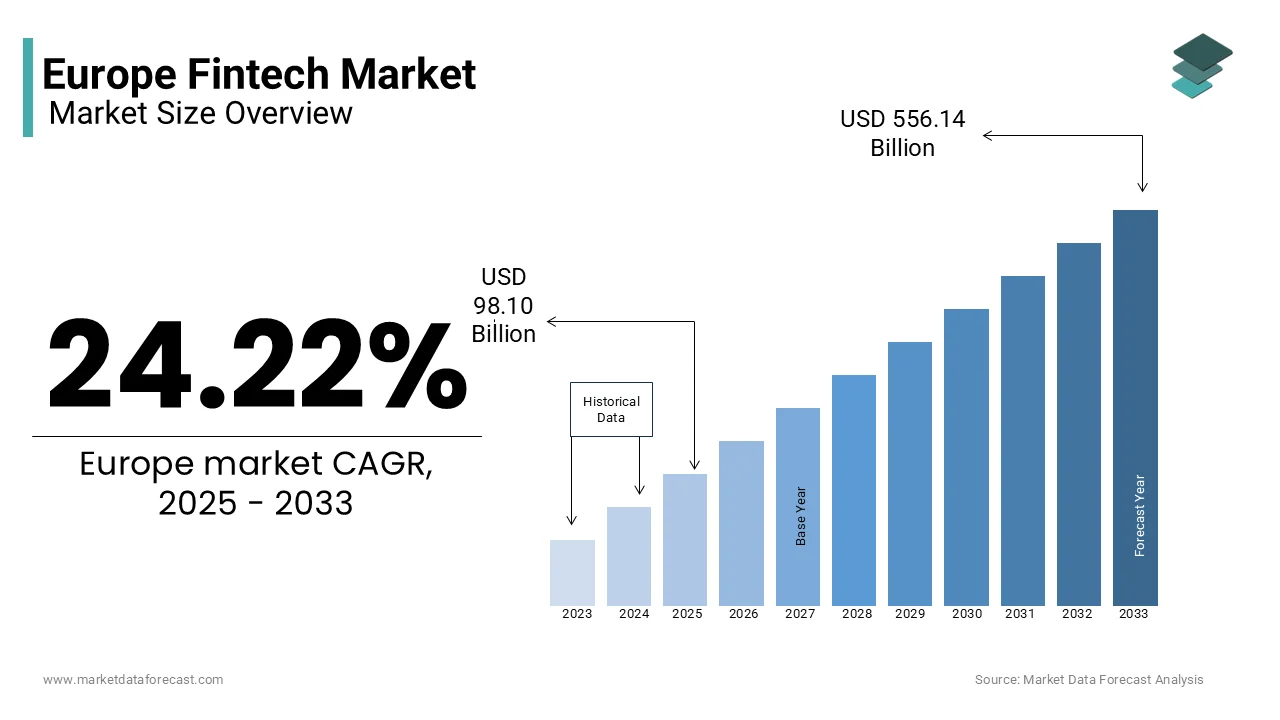

The fintech market size was worth USD 78.97 billion in 2024. The Europe market is expected to be worth USD 556.14 billion by 2033 from USD 98.10 billion in 2025, growing at a CAGR of 24.22% during the forecast period.

Fintech is a short form of financial technology that describes technological and innovative solutions developed to improve various areas of financial services, such as online banking and mobile payments. Europe offers a business environment characterized by stability, innovation, and technological developments. Europe is considered to be home to fintech success as the European market is interesting for Fintech companies to conduct business.

MARKET DRIVERS

Favorable Regulatory Environment for Fintech in Europe.

The presence of a favorable regulatory landscape has supported the European region in becoming a hub for fintech activity. The growing advancements in digital technology, changes in consumer preferences, decreasing trust in the banking system, favorable regulations, and accessibility to venture capital funding have induced the importance of fintech companies across the European population, leading to adoption and boosting enhancements in the European market growth. Currently, Europe makes up 27% of the global cumulative valuation of the fintech industry. By receiving 20% of all venture capital investments, Fintech is Europe's most prominent venture capital investment category, a higher percentage than Asia and the United States. These factors are anticipated to accelerate the growth opportunities for the European fintech market in the forecast period.

YOY Growth in the Users of the Internet and Smartphones

In addition, the rising number of internet and smartphone users and the aftermath of the financial crises of the early 21st century have led to the digitalization of many financial products, which fuels the market growth of Fintech in Europe. The growing trend of digital payment solutions, including mobile wallets, mobile payments, payment apps, and contactless payments, is fueling the market share expansion due to wide adoption across the European people. The growing innovation in financial technology, which includes digital underwriting, claims processing, and personalized policy schemes in the insurance industry, is positively impacting the European fintech market. The primary two significant drivers for the fintech market in Europe are open banking and PSD2. The PSD2 is considered an excellent initiative for the open banking environment and allows the European Union to enhance fintech development. The PSD2 improves the competition by lowering the cost of financial services, benefiting the consumer, and opening access to banks' financial data to increase fintech innovations. The benefits of PSD2 are gaining traction among the European population and augmenting the regional market expansion.

The increasing market trend of the cryptocurrencies and blockchain platforms, which is developing novel ways to manage assets and transactions, is expected to positively influence the Europe fintech market, improving the growth opportunities during the forecast period. The emergence of decentralized finance (DeFi) is causing the adoption of blockchain technology, which is expected to offer lucrative growth opportunities to European market players. The growing technological advancements propel the market expansion due to the integration of artificial intelligence, data analytics, and blockchain, which reduces the cost of accessible and user-friendly financial services, which augments the fintech market in Europe.

MARKET RESTRAINTS

Lack of Awareness

Another significant factor is the data privacy and security concerns as the complete data is digitalized. Cyberattacks have a high chance, and cybersecurity risks are hindering the European market expansion. The need for sufficient knowledge for the person to operate digital payments, which is expected to be low in countries with low-income status, limits the European fintech market growth.

The broad risks of fraud and scams in the fintech industry are a significant challenge for expanding the European market. Fintech companies are highly vulnerable to cyberattacks, and the presence of limited human interaction as they rely entirely on technology is expected to limit market share growth. Fintech companies may offer a different range of financial products and services than traditional financial institutions, which impedes their adoption among the European population.

Impact of COVID-19 on the Europe fintech market

The pandemic had a mixed impact on the European fintech market as the early pandemic had affected the European economies by 11%, which impacted the fintech industry. Most fintech agreements had decreased as investors preferred to invest in larger companies rather than startups. Due to the government lockdown and investors taking stock, the industry experienced a downfall in the early pandemic. However, the industry has observed an increase in growth due to the transition to digital and banks' increased interest in new infrastructure, where the market size has increased compared to the last years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

24.22% |

|

Segments Covered |

By Deployment Mode, Technology, Application, End-User, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Adyen, Revolut, Paypal, Starling Bank, Klarna, N26, OakNorth, Trade Republic, Solarisbank and Cavalry Ventures. |

SEGMENTAL ANALYSIS

By Development Mode Insights

The cloud-based segment held the largest share in the European fintech market in 2024. The cloud-based deployment mode segment is anticipated to grow at a promising CAGR during the forecast period. The growth of the cloud-based segment is majorly driven by the increased adoption of cloud systems. Cloud systems are highly beneficial as any application or software program is stored, managed, and available through the cloud, which is driving the segment's growth.

By Technology Insights

The application programming interface (API) segment dominated the European fintech market in 2024. The API segment is gaining traction due to its advanced financial services, like open banking, which enable faster innovation and improve the customer experience. The APIs in fintech enable banks to provide customers with account access, payments, and financial data sharing through multiple channels, boosting the segment's growth. The APIs in banking act as a standard for secure communication and data exchange between multiple software systems.

The Artificial Intelligence (AI) segment is expected to have the fastest growth during the forecast period due to the increasing penetration of AI in all industries, which is estimated to drive the fintech market in Europe. AI enhances financial services' speed, precision, and efficiency. Innovations in the fintech industry with AI accelerate the consumer experience and save costs, driving European fintech companies' market revenue. Artificial intelligence is estimated to revolutionize the finance industry in all aspects.

By Application Insights

The payment segment held the largest share of the European fintech market in 2024. The payment segment is projected to have the fastest growth during the forecast period. The growing adoption of digital payments across the region and the increasing effectiveness of digital payment transactions are augmenting the segment growth by enhancing the regional market revenue. The escalating e-commerce sector is influencing the adoption of digital payments among the population; rising demand for contactless payments propels market growth in the upcoming years.

The fund transfer segment is expected to grow prominently during the forecast period due to the increasing number of international money transfers. The cost-effectiveness, rapid process, and transparent alternative to traditional banking methods fuel the dominance of fund transfer services.

By End-User Insights

The banking segment dominated the regional market and held a prominent share of the European market in 2024. The growth of the banking segment is attributed to the increasing number of mobile banking apps, digital wallets, and lending platforms. These platforms are influencing people to adopt digital banking by shaping traditional banking systems. Various benefits, such as accessibility, convenience, and cost-effectiveness, are fueling the regional market growth in this segment.

The insurance segment is estimated to have prominent growth in the forecast period. The growing innovations in insurance, like digital underwriting and personalized policies, are driving the market in this segment.

REGIONAL ANALYSIS

The UK fintech market had the largest share of the European market in 2024. The United Kingdom dominated the European fintech market, with a dominant share in Europe and the world. The United Kingdom comprised 53% of Europe's fintech funding in 2019 and 41% until June 2021. The UK fintech share is followed by the Netherlands, which has Europe's second most dominant share. The United Kingdom is expected to remain a major financial hub in Europe and an attractive platform for startups as it has a prominent trade relationship with the United States and Asian fintech hubs. The increasing support from the governments of European countries for fintech innovation and initiatives like PSD2, which promotes open banking and data protection, is escalating the market value across Europe.

KEY MARKET PLAYERS

Companies that hold a prominent place in the European fintech market include Adyen, Revolut, Paypal, Starling Bank, Klarna, N26, OakNorth, Trade Republic, Solarisbank and Cavalry Ventures.

RECENT HAPPENINGS IN THIS MARKET

- In March 2022, Adyen, the global financial technology platform of choice for leading businesses, initiated an expansion beyond payments to build embedded financial products. These products are expected to enable platforms and marketplaces to create financial experiences for users, opening new revenue streams and increasing user loyalty.

- In June 2021, Raisin and Deposit Solutions, two big German fintech startups and rivals, planned to unite to form a pan-European group offering innovative, API-based B2B and B2C products in savings and portfolio management.

MARKET SEGMENTATION

This research report on the Europe fintech market has been segmented and sub-segmented based on the following categories.

By Deployment Mode

- On-Premises

- Cloud-based

By Technology

- Application Programming Interface (API)

- Artificial Intelligence

- Blockchain

- Data Analytics

- Robotic Automation Process

By Application

- Payment

- Fund Transfer

- Loans

- Insurance

- Personal Finance

- Wealth Management

- Others

By End-User

- Banking

- Insurance

- Securities

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key trends shaping the Europe fintech market?

The European fintech market is driven by digital banking adoption, embedded finance, open banking regulations, AI-driven financial solutions, and increasing investment in blockchain and crypto technologies.

How is digital banking evolving in Europe?

Digital banks, also known as neobanks, are growing rapidly, offering fully online banking services, personalized financial tools, and seamless mobile experiences without physical branches.

How are traditional banks responding to fintech disruption?

Traditional banks are collaborating with fintech firms, investing in digital transformation, launching their own fintech services, and leveraging AI and automation to enhance customer experience.

What is the future outlook for the fintech industry in Europe?

The future of European fintech looks strong, with continued growth in AI-driven solutions, expansion of embedded finance, further adoption of digital currencies, and increasing cross-border collaborations.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]