Europe Fertilizer Market Size, Share, Trends & Growth Forecast Report – Segmented By Form, Product, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Fertilizer Market Size

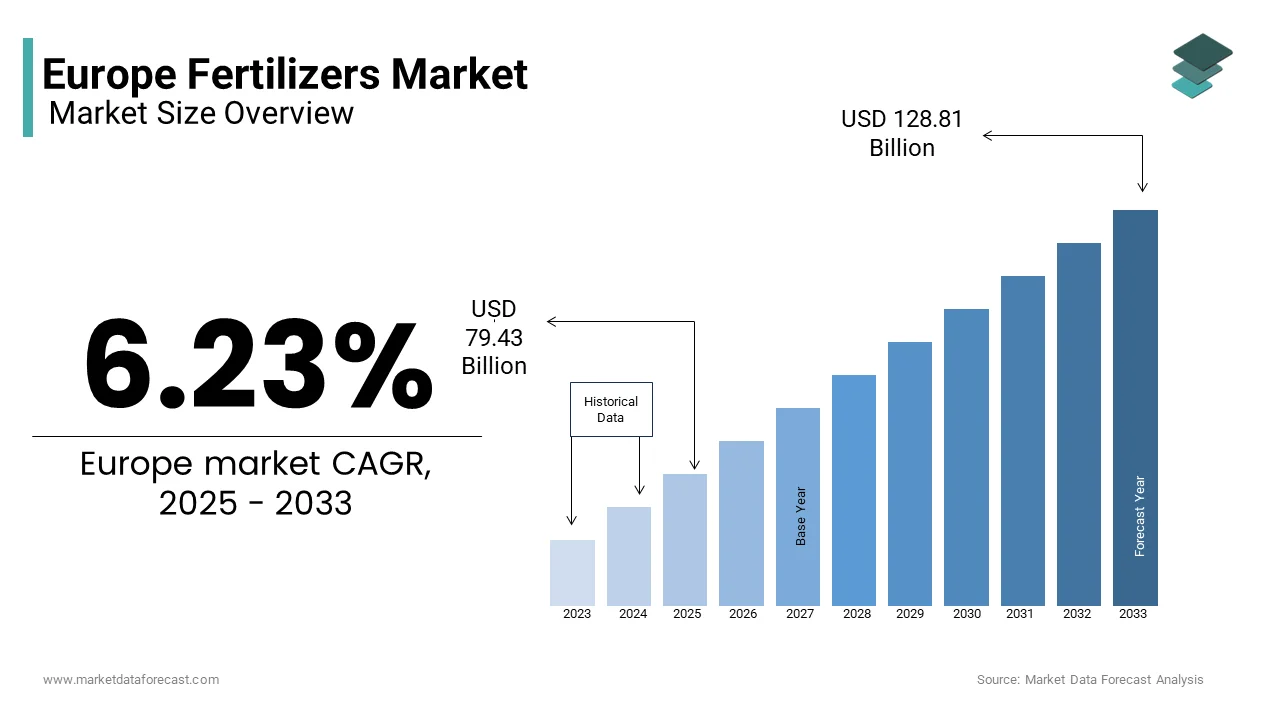

The Europe fertilizers market size was valued at USD 74.77 billion in 2024 and is anticipated to reach USD 79.43 billion in 2025 from USD 128.81 billion by 2033, growing at a CAGR of 6.23% during the forecast period from 2025 to 2033.

Fertilizers, including nitrogenous, phosphatic, potassic, and specialty variants, are indispensable for enhancing soil fertility and crop yields, particularly in regions with intensive agricultural activities. According to the European Fertilizer Manufacturers Association (EFMA), the fertilizer industry contributes over EUR 25 billion annually to the European economy and support millions of jobs directly and indirectly. In 2022, nitrogen-based fertilizers accounted for approximately 60% of total fertilizer consumption in Europe due to their widespread use in cereals and industrial crops like wheat and maize.

The Europe fertilizer market has faced significant challenges in recent years, including supply chain disruptions and escalating prices due to geopolitical tensions, particularly the Russia-Ukraine conflict, which impacted natural gas supplies. The International Fertilizer Association reports that fertilizer prices surged by nearly 150% between 2021 and 2022, forcing farmers to explore alternative solutions such as precision agriculture and biofertilizers. Meanwhile, stringent environmental regulations imposed by the European Union, aimed at reducing greenhouse gas emissions and nitrate pollution, have further shaped the market landscape. Eurostat highlights that organic farming in Europe grew by 7% annually from 2019 to 2022, reflecting a shift toward sustainable agricultural practices.

MARKET DRIVERS

Increasing Demand for High-Value Crops

One of the major drivers of the European fertilizer market is the rising demand for high-value crops, such as fruits, vegetables, and industrial crops like rapeseed and sunflower. According to the reports of the European Commission, the production of these crops has grown by approximately 5% annually over the past five years, driven by consumer preferences for healthier diets and biofuel production. High-value crops require precise nutrient management, increasing the demand for specialty fertilizers, including water-soluble and slow-release variants. According to Eurostat, the use of precision agriculture technologies in Europe has risen by 12% since 2020, enabling farmers to optimize fertilizer application and reduce waste. Furthermore, as per the International Fertilizer Association, nitrogenous fertilizers account for nearly 60% of total fertilizer usage in Europe, which is indicating their critical role in boosting yields. This trend is further amplified by the growing export demand for European agricultural products, which reinforces the need for efficient fertilization practices.

Stringent Environmental Regulations Promoting Sustainable Solutions

The implementation of stringent environmental regulations aimed at reducing greenhouse gas emissions and nitrate pollution that have spurred innovation in sustainable fertilizer solutions is further boosting the expansion of the Europe fertilizer market. According to the European Environment Agency, nitrate pollution from excessive fertilizer use affects over 13% of groundwater resources in Europe, which is prompting stricter enforcement of the Nitrates Directive. As a result, there has been a surge in demand for eco-friendly alternatives, such as biofertilizers and organic fertilizers. Additionally, according to the European Investment Bank, investments in circular economy initiatives, including nutrient recovery from wastewater, exceeded EUR 2 billion in 2022. These regulatory frameworks not only promote sustainable farming practices but also encourage the adoption of innovative fertilizers, driving market expansion while aligning with Europe’s Green Deal objectives.

MARKET RESTRAINTS

Volatility in Raw Material Prices and Supply Chain Disruptions

One of the major restraints affecting the European fertilizer market is the volatility in raw material prices, particularly natural gas, which is a critical feedstock for nitrogen-based fertilizers. As per the European Commission, natural gas prices surged by over 400% between 2021 and 2022 due to geopolitical tensions, notably the Russia-Ukraine conflict, which disrupted supply chains. This price instability has significantly increased production costs, with nitrogen fertilizer prices rising by approximately 150% during the same period, as reported by the International Fertilizer Association. Such cost escalations have forced many small-scale farmers to reduce fertilizer usage, impacting crop yields. Additionally, according to the Eurostat, the reliance of Europe on imported phosphates and potash further exacerbates supply vulnerabilities, which is making the market susceptible to global trade disruptions. These challenges hinder the affordability and accessibility of fertilizers, constraining market growth.

Stringent Environmental Regulations Limiting Conventional Fertilizer Use

The stringent environmental regulations imposed by the European Union that are aimed at curbing nitrate pollution and greenhouse gas emissions from conventional fertilizers are inhibiting the growth of the European fertilizer market. According to the reports of the European Environment Agency, more than 13% of groundwater resources of Europe are affected by nitrate contamination, which is prompting stricter enforcement of the Nitrates Directive. While these measures are essential for environmental sustainability, they impose operational challenges for farmers and manufacturers. For instance, as per the statements of the European Commission, certain regions in Europe have introduced mandatory reductions in fertilizer application rates, which is leading to a decline in demand for traditional nitrogenous fertilizers. Furthermore, according to the European Investment Bank, compliance with these regulations requires significant investments in alternative solutions, such as biofertilizers, which currently account for less than 5% of the market. These regulatory pressures limit the growth potential of conventional fertilizers in the short term.

MARKET OPPORTUNITIES

Growing Adoption of Precision Agriculture Technologies

One of the major opportunities in the European fertilizer market lies in the growing adoption of precision agriculture technologies, which optimize fertilizer application and enhance sustainability. According to the reports of the European Commission, precision farming practices have expanded by 12% annually since 2020 due to the advancements in GPS-guided equipment and soil sensors. These technologies enable farmers to apply fertilizers more efficiently by reducing waste and environmental impact while improving crop yields. According to Eurostat, more than 30% of European farms have adopted precision agriculture tools, particularly in high-value crop production such as fruits and vegetables. Additionally, as per the International Fertilizer Association, slow-release and controlled-release fertilizers that align with precision farming goals are projected to grow at a brisk pace over the forecast period. This shift not only supports Europe’s Green Deal objectives but also opens new revenue streams for innovative fertilizer manufacturers catering to tech-savvy farmers.

Rising Demand for Biofertilizers and Organic Farming

The rising demand for biofertilizers and organic farming due to the stringent environmental regulations and consumer preferences for sustainable agriculture are opening new avenues for the market participants in the European fertilizer market. According to the European Biostimulants Industry Council, biofertilizer market is expected to grow at a notable CAGR in the coming years due to the policies promoting circular economy practices. In addition, as per the reports of the European Environment Agency, organic farming has grown by 7% annually from 2019 to 2022, with over 14.6 million hectares of farmland now under organic management. Furthermore, according to the European Investment Bank, investments in sustainable agricultural practices exceeded EUR 3 billion in 2022 to support the development of eco-friendly fertilizers. As governments incentivize organic farming and reduce reliance on chemical fertilizers, biofertilizers present a lucrative opportunity for manufacturers to tap into this expanding segment while addressing environmental concerns.

MARKET CHALLENGES

High Dependency on Fertilizer Imports

One of the major challenges facing the European fertilizer market is its high dependency on imports for critical raw materials such as phosphates and potash, which are not abundantly available within the region. According to the reports of the European Commission, over 70% of phosphatic fertilizers and 90% of potassic fertilizers consumed in Europe are imported, primarily from Morocco, Russia, and Canada. This reliance on external suppliers makes the market vulnerable to geopolitical tensions and trade disruptions, as mentioned by the International Fertilizer Association. For instance, the Russia-Ukraine conflict led to a 30% reduction in fertilizer imports from these regions in 2022. Additionally, according to Eurostat, import costs surged by nearly 50% during the same period, which is further straining farmers and manufacturers. This dependency not only threatens supply chain stability but also increases price volatility, posing significant challenges to market sustainability.

Balancing Agricultural Productivity with Environmental Sustainability

The difficulty in balancing agricultural productivity with environmental sustainability due to the stringent regulations imposed by the European Union is further challenging the growth of the Europe fertilizer market. According to the European Environment Agency, nitrate pollution from excessive fertilizer use affects approximately 13% of groundwater resources of Europe and is prompting stricter enforcement of the Nitrates Directive. While these measures aim to protect ecosystems, they often limit fertilizer application rates, reducing crop yields and impacting farmer incomes. As per the European Commission, certain regions have mandated a 20% reduction in nitrogen fertilizer usage by 2030, which is creating operational hurdles for conventional farming practices. Furthermore, according to the European Investment Bank, transitioning to sustainable alternatives like biofertilizers requires significant investments, which many small-scale farmers cannot afford. This regulatory push creates a delicate trade-off between productivity and compliance, challenging market growth.

SEGMENTAL ANALYSIS

Europe Fertilizers Market By Form

The dry fertilizers segment dominated the European market by holding 70.7% of the European market share in 2024. The domination of dry fertilizers segment is majorly driven by their cost-effectiveness and widespread use in staple crops like wheat and maize that cover over 50% of Europe’s arable land. Dry variants, such as urea and ammonium nitrate, are favored for their ease of storage and transportation, making them ideal for large-scale farming. The International Fertilizer Association highlights that nitrogen-based dry fertilizers remain the most affordable option, ensuring high demand. Their compatibility with precision agriculture technologies further enhances efficiency, solidifying their importance in maintaining agricultural productivity across Europe.

The liquid fertilizers segment is projected to expand at a CAGR of 6.2% over the forecast period due to factors such as increasing adoption in high-value crops like fruits and vegetables, particularly in fertigation systems that optimize water and nutrient use. According to the European Commission, liquid fertilizers reduce waste by enabling precise nutrient delivery to align with sustainability goals. Their compatibility with biofertilizers also supports organic farming expansion, which grew by 7% annually from 2019 to 2022, per Eurostat. As Europe prioritizes sustainable agriculture, liquid fertilizers play a pivotal role in enhancing crop quality while minimizing environmental impact, which is making them a key driver of innovation in the fertilizer market.

Europe Fertilizers Market By Product

The nitrogen-based segment dominated the Europe fertilizer market by accounting for 60.4% of European market share in 2024. Among these, urea and ammonium nitrate are the most widely used, particularly in staple crops like wheat, barley, and maize. As per the International Fertilizer Association, nitrogen fertilizers are favored for their cost-effectiveness and ability to significantly boost crop yields. For instance, Urea is the most affordable nitrogen source, while ammonium nitrate is preferred for its high efficiency in cooler climates prevalent in Northern Europe. Their widespread adoption is further supported by advancements in slow-release technologies, ensuring sustained nutrient delivery. As a cornerstone of agricultural productivity, nitrogen-based fertilizers remain indispensable for meeting food security needs of Europe.

The organic plant-based fertilizers segment is expected to exhibit a CAGR of 9.1% over the forecast period owing to the rising demand for sustainable agricultural practices and the expansion of organic farming. Plant-based fertilizers that are derived from sources like compost, seaweed, and leguminous plants are gaining popularity due to their eco-friendly nature and ability to improve soil health. As per the European Environment Agency, these fertilizers align with the EU’s Green Deal objectives and reduce reliance on chemical inputs while mitigating nitrate pollution. Additionally, their compatibility with precision agriculture and biofertilizers makes them ideal for high-value crops like fruits and vegetables. As Europe prioritizes sustainability, plant-based fertilizers are poised to play a pivotal role in transforming the agricultural landscape.

Europe Fertilizers Market By Application

The agriculture segment ruled the Europe fertilizer market by application by holding 81.8% of the European market share in 2024. The growth of the agriculture segment in the European market is primarily driven by the extensive use of fertilizers in staple crops such as wheat, barley, and maize. Nitrogen-based fertilizers like urea and ammonium nitrate are particularly critical for enhancing yields in large-scale farming operations. According to the International Fertilizer Association, agricultural productivity in Europe relies heavily on fertilizers to meet the food demands of a growing population. Additionally, advancements in precision agriculture technologies have further optimized fertilizer application, ensuring efficient nutrient delivery while minimizing environmental impact. As the backbone of Europe’s food security, the agriculture segment remains pivotal to the fertilizer market.

The horticulture segment is anticipated to record a promising CAGR of 7.3% over the forecast period. Factors such as the increasing demand for high-value crops such as fruits, vegetables, and ornamental plants, particularly in Mediterranean countries like Spain and Italy is fuelling the growth of the horticulture segment in the European market. According to the European Commission, horticulture benefits significantly from liquid fertilizers and biofertilizers that enable precise nutrient delivery and improve crop quality. Additionally, the expansion of organic farming has further boosted demand for sustainable fertilizers in this segment. The focus of Horticulture on premium produce aligns with consumer preferences for healthier and environmentally friendly products is making it a key driver of innovation and growth in the European fertilizer market.

REGIONAL ANALYSIS

France was the largest contributor to the European fertilizer market and occupied 22.7% of the regional market share in 2024. The domination of France in the Europe fertilizer market is majorly attributed to the position of France as the largest agricultural producer in Europe, with over 50% of its land dedicated to farming. The robust demand of France for nitrogenous and phosphate fertilizers and the focus of France on high-value crops like wheat, rapeseed and wine grapes are further fuelling the growth of the French fertilizer market. According to the International Fertilizer Association, France has also been at the forefront of adopting precision agriculture technologies by optimizing fertilizer use while reducing environmental impact. Additionally, the investments of French government in sustainable farming practices, including biofertilizers, align with EU Green Deal objectives are further contributing to the expansion of the French fertilizer market.

Germany is one of the top performers in the European fertilizer market. The advanced agricultural sector of Germany that extensively adopts precision farming technologies to enable efficient fertilizer application is driving the German fertilizer market growth. According to the reports of Eurostat, Germany leads Europe in organic farming, with over 10% of its agricultural land dedicated to organic practices, which is increasing demand for eco-friendly fertilizers. As per the European Biostimulants Industry Council, the strong R&D ecosystem of Germany fosters innovation in slow-release and biofertilizers to align with sustainability goals. Furthermore, the emphasis of Germany on reducing nitrate pollution through stricter regulations has accelerated the adoption of advanced fertilizer solutions, ensuring steady growth in this segment.

Spain is a prominent regional segment for fertilizers in the European market and is estimated to progress at a CAGR of 6.2% over the forecast period. The thriving horticulture sector of Spain, particularly in regions like Andalusia, where high-value crops such as fruits, vegetables, and olives are cultivated, is boosting the Spanish market growth. According to Eurostat, Spain accounts for over 30% of Europe’s organic farming area, which is driving demand for organic and biofertilizers. As per the International Fertilizer Association, liquid fertilizers are widely used in fertigation systems to optimize water and nutrient use in arid regions. Additionally, the strategic focus of Spain on sustainable agriculture that is supported by EU subsidies has encouraged the adoption of innovative fertilizers. These factors, combined with favorable climatic conditions, position Spain as a key player in the European fertilizer market.

KEY MARKET PLAYERS

CF Industries Holdings, Inc., Eurochem Group, ICL Group Ltd, OCI NV, Yara International ASA. These are the market players that are driving the Europe fertilizers market.

MARKET SEGMENTATION

This research report on the Europe fertilizers market is segmented and sub-segmented into the following categories.

By Form

- Dry

- Liquid

By Product

- Organic

- Plant based

- Animal based

- Mineral based

- Inorganic

- Nitrogen

- Urea

- Anhydrous ammonia

- CAN

- UAN Solution

- Ammonium sulfate

- Phosphorus

- Diammonium phosphate

- Monoammonium phosphate

- Triple superphosphate

- Ordinary superphosphate

- Ammonium polyphosphate

- Others

- Potassium

- Potassium chloride

- Potassium sulfate

- Potassium nitrate

- Nitrogen

By Application

- Agriculture

- Horticulture

- Gardening

- Others

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe fertilizer market?

The current market size of the European fertilizer market was valued at USD 79.43 billion in 2025.

What are the market drivers that are driving the Europe fertilizers market?

The increasing demand for high-value crops and stringent environmental regulations promoting sustainable solutions these are the market drivers that are driving the europe fertilizers market.

Who are the market players that are dominating the Europe fertilizers market?

CF Industries Holdings, Inc., Eurochem Group, ICL Group Ltd, OCI NV, Yara International ASA. These are the market players that are driving the Europe fertilizers market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]