Europe Ferrite Magnets Market Size, Share, Trends & Growth Forecast Report By Type (Soft Ferrites Magnets, Permanent Ferrite Magnets, Others), Product Type, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Ferrite Magnets Market Size

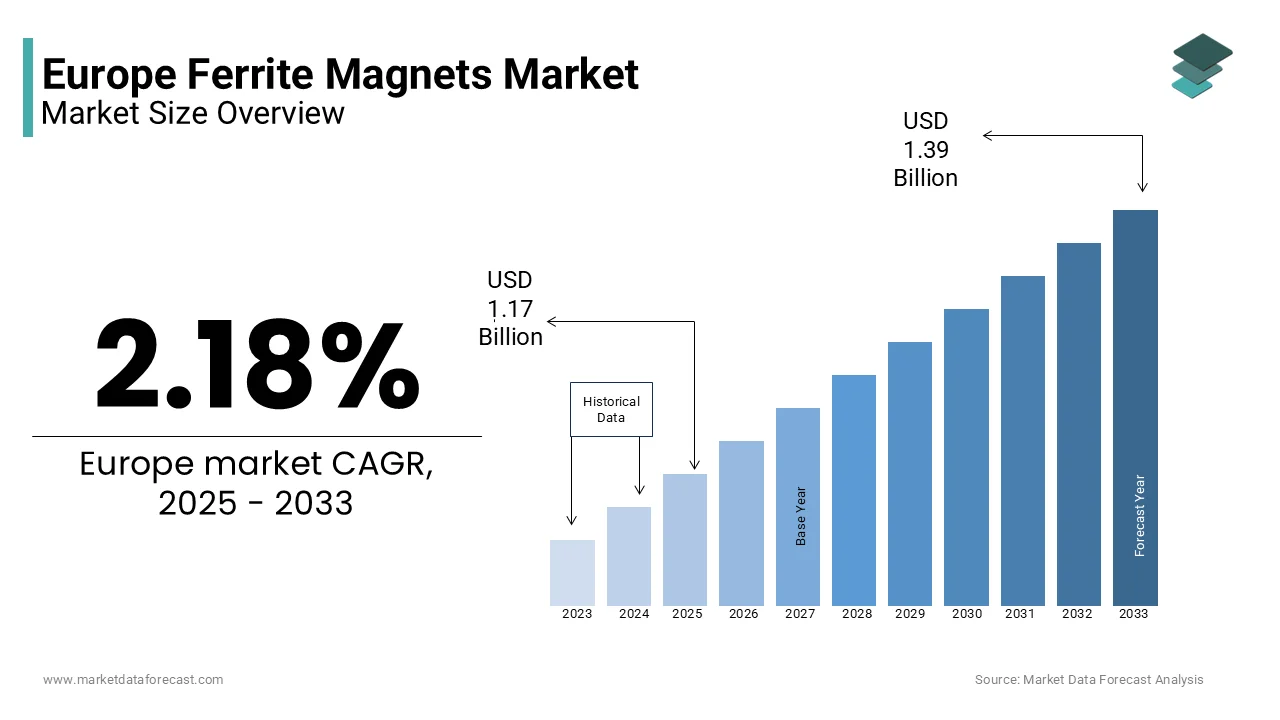

The Europe Ferrite Magnets market size was valued at USD 1.15 billion in 2024. The European market size is estimated to be worth USD 1.39 billion by 2033 from USD 1.17 billion in 2025, growing at a CAGR of 2.18% from 2025 to 2033.

Ferrite magnets, known for their cost-effectiveness and durability, are integral to industries such as automotive, electronics, and renewable energy. As per Eurostat, the European Union’s push for electric vehicles (EVs) has created significant demand for ferrite magnets in EV motors and wind turbines. The market is further supported by stringent EU regulations promoting energy-efficient appliances, which rely heavily on ferrite components. Rising investments in smart infrastructure and the Internet of Things (IoT) are expected to bolster demand for ferrite magnets in computer and office equipment by ensuring sustained growth across the region.

MARKET DRIVERS

Growing Demand in the Automotive Sector

The automotive sector is a primary driver of the Europe ferrite magnet market with the rapid adoption of electric vehicles (EVs). Ferrite magnets play a critical role in EV traction motors by offering a cost-effective alternative to rare-earth magnets while maintaining high performance. For instance, companies like Volkswagen and BMW have incorporated ferrite-based systems into their EV designs by reducing reliance on expensive neodymium magnets. Additionally, the European Commission’s mandate for zero-emission vehicles by 2035 has accelerated investments in EV technology, driving ferrite magnet demand. The trend towards the material’s importance in achieving sustainability goals while addressing affordability concerns in mass-market applications.

Expansion of Renewable Energy Infrastructure

The expansion of renewable energy infrastructure is another key driver propelling the Europe ferrite magnet market. According to the International Renewable Energy Agency (IRENA), Europe accounted for 30% of global renewable energy capacity additions in 2022, with wind energy being a dominant contributor. Ferrite magnets are essential components in wind turbine generators by providing efficient energy conversion and durability under harsh environmental conditions. For example, Siemens Gamesa, a leading wind turbine manufacturer, relies on ferrite-based systems to optimize cost-performance ratios in its products. As per the European Wind Energy Association, offshore wind installations in Europe are projected to grow by 12 GW annually through 2028 by creating substantial demand for ferrite magnets. These initiatives ensure sustained growth for the ferrite magnet market by positioning it as a vital enabler of Europe’s clean energy transition.

MARKET RESTRAINTS

Limited Performance in High-Temperature Applications

One significant restraint affecting the Europe ferrite magnet market is the limited performance of ferrite magnets in high-temperature applications. According to the European Magnetic Materials Association, ferrite magnets lose up to 20% of their magnetic strength when exposed to temperatures exceeding 250°C. This limitation restricts their use in industries requiring extreme thermal stability, such as aerospace and advanced manufacturing. For instance, manufacturers in France and Germany often opt for rare-earth magnets like neodymium-iron-boron (NdFeB) for high-performance applications, despite their higher costs. The potential ferrite magnet applications are lost to rare-earth alternatives due to these performance gaps. Additionally, the inability to meet stringent requirements in specialized sectors hinders market penetration in Southern Europe, where industrial demands are diverse.

Fluctuating Raw Material Prices

Fluctuating raw material prices pose another significant challenge to the Europe ferrite magnet market. According to the European Federation of Chemical Industries, the cost of key raw materials like iron oxide and strontium carbonate has increased by 25% since 2020 due to geopolitical tensions and supply chain disruptions. For example, the Russia-Ukraine conflict disrupted the supply of iron ore, a critical component in ferrite production, by leading to price volatility. As per Deloitte, rising input costs have forced manufacturers to increase product prices by up to 10% is impacting profit margins and customer affordability. Additionally, the lack of local sourcing options in regions like Eastern Europe exacerbates dependency on imports, further amplifying risks. These financial pressures hinder market growth for small and medium enterprises (SMEs) that lack the resources to absorb cost fluctuations. Addressing these challenges requires strategic investments in localized supply chains and alternative material sourcing.

MARKET OPPORTUNITIES

Rising Adoption of Smart Home Devices

The rising adoption of smart home devices presents a lucrative opportunity for the Europe ferrite magnet market. According to McKinsey & Company, the European smart home market is projected to reach €45 billion by 2025, driven by increasing consumer demand for connected appliances and security systems. Ferrite magnets are integral to the functioning of actuators, sensors, and speakers used in these devices, offering cost-effective and reliable performance. For instance, Philips Hue smart lighting systems utilize ferrite-based components to enhance energy efficiency and durability. Additionally, government initiatives promoting smart city development, such as Germany’s €1 billion funding for IoT infrastructure, have amplified demand for ferrite magnets. Innovations in ferrite formulations, such as enhanced magnetic properties, further position the material as a preferred choice for emerging applications, ensuring long-term market growth.

Growth in Emerging Markets

Expansion into emerging markets within Eastern Europe represents another significant opportunity for the Europe ferrite magnet market. This economic shift has spurred demand for ferrite magnets in consumer electronics, automotive components, and industrial machinery. For example, Poland’s automotive sector, supported by investments from global OEMs like Volkswagen and Hyundai, has increased ferrite magnet consumption by 12% since 2021. Similarly, Romania’s government has allocated huge investments for industrial modernization under the National Recovery Plan, further boosting market potential. Companies can capitalize on this untapped potential while mitigating logistical challenges associated with cross-border trade by establishing localized production facilities. These dynamics position Eastern Europe as a key growth driver for the ferrite magnet market.

MARKET CHALLENGES

Competition from Rare-Earth Magnets

Intense competition from rare-earth magnets poses a significant challenge to the Europe ferrite magnet market. According to Frost & Sullivan, rare-earth magnets, such as neodymium-iron-boron (NdFeB), will dominate high-performance applications due to their superior magnetic properties. For instance, NdFeB magnets offer up to three times the magnetic strength of ferrite magnets is making them indispensable in industries like aerospace and robotics. Additionally, advancements in rare-earth recycling technologies have reduced production costs. For example, Belgium-based Umicore has developed innovative methods to recover rare-earth elements by enhancing supply chain efficiency.

Stringent Environmental Regulations

Stringent environmental regulations also present a challenge for the Europe ferrite magnet market. According to the European Environment Agency, manufacturers must comply with REACH regulations, which impose rigorous restrictions on hazardous substances used in production processes. For example, the ban on hexavalent chromium coatings, commonly used in ferrite magnet manufacturing, has forced companies to invest heavily in alternative solutions. As per KPMG, compliance costs have increased by 15% annually, impacting smaller players disproportionately. Additionally, the carbon footprint associated with ferrite production has drawn scrutiny from environmental watchdogs.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.18% |

|

Segments Covered |

By Type, Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Hitachi, Lynas Corp. Ltd., Molycorp Chemicals and Oxides, Shin-Etsu Chemical Co Ltd., Hangzhou Permanent Magnet Group, Ningbo Yunsheng High-tech Magnetics Co., Ltd, Daido Steel Co., Ltd., and JPMF Guangdong Co. Ltd, and others. |

SEGMENT ANALYSIS

By Type Insights

The permanent segment dominated the Europe ferrite magnate market with a prominent share in 2024. The growth of the segment is due to the widespread adoption in cost-sensitive applications, such as consumer electronics and automotive components. The affordability and durability of permanent ferrite magnets make them ideal for mass-market products like speakers and refrigerator seals. For instance, Germany’s electronics industry relies heavily on ferrite magnets for its audio and communication devices. Additionally, the segment benefits from government incentives promoting energy-efficient appliances, which require reliable magnetic components. According to Eurostat, the demand for energy-efficient products grew by 10% annually in 2022. Furthermore, advancements in magnet design, such as improved coercivity and temperature resistance, have expanded the application scope by ensuring sustained demand across diverse industries.

The soft segment is anticipated to register a CAGR of 8.3% during the forecast period. The growth of the segment is likely to be driven by the rising demand for high-frequency components in telecommunications and renewable energy systems. For example, the deployment of 5G networks across Europe has increased the adoption of soft ferrite cores in antennas and transformers, contributing to a 15% annual rise in sales. Additionally, the segment’s compatibility with green technologies, such as wind turbines and solar inverters, aligns with Europe’s sustainability goals. Moreover, innovations in nanotechnology have enhanced magnetic permeability is addressing previous limitations. These dynamics position soft ferrite magnets as a key growth driver in the coming years.

By Product Type Insights

The strontium segment was the largest and held 55.4% of the Europe ferrite magnet market share in 2024. The growth of the market is driven by the superior magnetic properties compared to barium variants by making them suitable for demanding applications like automotive actuators and industrial machinery. The increasing focus on lightweight and durable materials has amplified demand, particularly in Germany and France. Additionally, the segment benefits from advancements in production techniques, such as sintering, which enhance performance and reliability. According to Statista, strontium ferrite magnets reduce energy consumption by up to 25% by aligning with EU energy efficiency mandates.

The barium segment is experiencing a significant CAGR of 7.8% in the coming years. This growth is fueled by their cost-effectiveness and suitability for low-frequency applications, such as loudspeakers and magnetic recording media. Additionally, the segment’s compatibility with emerging technologies, such as IoT-enabled devices, has expanded its application scope. According to the European Smart Home Association, barium ferrite magnets enhance signal clarity in wireless communication systems, driving demand in smart home devices. Furthermore, advancements in material science have improved coercivity, addressing previous limitations. These trends position barium ferrite magnets as a key contributor to market expansion in the foreseeable future.

By Application Insights

The computer and office equipment segment was the largest by accounting for 30.11% of the Europe ferrite magnet market share in 2024. The growth of the market is driven by the widespread use of ferrite magnets in hard drives, printers, and cooling fans. The increasing adoption of remote work and digitalization has amplified demand for office equipment in urban centers like London and Paris. Additionally, the segment benefits from government initiatives promoting digital infrastructure, such as France’s €3 billion investment in smart offices.

The automobile segment is expected to exhibit a CAGR of 9.5% during the forecast period. The growth of the segment can be fueled by the rapid adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which rely on ferrite magnets for motors and sensors. For example, the UK’s EV market, supported by £2.8 billion in government subsidies, has seen a 40% annual rise in ferrite magnet demand. Additionally, the segment’s compatibility with green technologies, such as regenerative braking systems, aligns with Europe’s sustainability goals. Furthermore, innovations in magnet design, such as enhanced thermal stability, have expanded the application scope. These dynamics position automobile applications as a key growth driver in the coming years.

REGIONAL ANALYSIS

Germany was the largest contributor to the Europe ferrite magnet market by holding 29.1% of share in 2024, owing to a robust manufacturing ecosystem and high demand for automotive and renewable energy applications. The German government’s €10 billion investment in green technologies has significantly boosted ferrite magnet adoption in wind turbines and electric vehicles (EVs). Additionally, Germany’s advanced industrial base supports innovation in magnet design, enabling manufacturers to meet stringent EU regulations. For instance, Siemens Gamesa, a leading wind turbine manufacturer, relies heavily on ferrite magnets for its products is driving regional demand. Furthermore, the country’s focus on sustainability aligns with the growing use of ferrite magnets in energy-efficient appliances is likely to fuel the growth of the market.

Spain is gearing up with the fastest CAGR of 10.5% during the forecast period. The rise of renewable energy projects, such as solar farms and wind parks, has amplified demand for ferrite magnets in power generation equipment. For example, Iberdrola, a major energy company, has integrated ferrite-based components into its renewable energy systems, enhancing efficiency. Additionally, Spain’s focus on digital transformation has increased ferrite magnet adoption in smart home devices and telecommunications.

France, Italy, and the UK are expected to exhibit steady growth, supported by government-led initiatives and rising industrial activities. France’s digital transformation program has spurred demand for ferrite magnets in computer and office equipment. In the UK, the EV subsidy program has created significant opportunities for ferrite magnets in automotive applications. According to national statistics agencies, these regions are poised to maintain consistent demand by ensuring balanced market expansion across Europe.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Hitachi, Lynas Corp. Ltd., Molycorp Chemicals and Oxides, Shin-Etsu Chemical Co Ltd., Hangzhou Permanent Magnet Group, Ningbo Yunsheng High-tech Magnetics Co., Ltd, Daido Steel Co., Ltd., and JPMF Guangdong Co. Ltd. are playing dominating role in Europe ferrite magnet market.

The Europe ferrite magnet market is highly competitive, characterized by intense rivalry among top players striving to innovate and capture market share. Companies differentiate themselves through advanced technologies, sustainable practices, and tailored solutions for diverse applications. TDK Corporation, for example, focuses on bio-based materials and low-carbon alternatives, while Hitachi Metals emphasizes high-performance magnets for industrial applications. The market’s competitive landscape is further shaped by stringent EU regulations, which compel manufacturers to adopt greener practices. Additionally, the rise of smart infrastructure and IoT-enabled devices has intensified competition, as companies vie to provide materials that meet evolving customer needs. This dynamic environment fosters continuous innovation by ensuring that only the most adaptable players thrive in the long term.

TOP PLAYERS IN THIS MARKET

The Europe ferrite magnet market is dominated by TDK Corporation, Hitachi Metals, and Arnold Magnetic Technologies. TDK Corporation leads globally in the market through its innovative product portfolio, including eco-friendly ferrite solutions tailored for renewable energy and EV applications. Hitachi Metals follows closely by leveraging its expertise in rare-earth alternatives and high-performance magnets for industrial machinery. Arnold Magnetic Technologies specializes in custom ferrite solutions by catering to niche applications like aerospace and defense. These players collectively drive innovation and set benchmarks for quality and sustainability by ensuring their dominance in the global market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe ferrite magnet market employ a range of strategies to maintain their competitive edge. Mergers and acquisitions are a primary focus, enabling companies to expand their production capacities and geographic reach. For instance, Hitachi Metals’ acquisition of a French soft ferrite manufacturer has strengthened its foothold in Western Europe. Partnerships and collaborations are also prevalent, with Arnold Magnetic Technologies partnering with German OEMs to integrate ferrite magnets into emerging EV designs. Additionally, companies invest heavily in R&D to develop sustainable materials that comply with EU regulations, such as low-carbon ferrite variants and enhanced magnetic properties. These strategies not only enhance product portfolios but also align with the growing demand for environmentally friendly solutions.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, TDK Corporation launched a new line of eco-friendly ferrite magnets designed to reduce carbon emissions by 25%. This initiative aligns with the European Green Deal and positions TDK as a leader in sustainable magnet solutions.

- In June 2023, Hitachi Metals acquired a French soft ferrite manufacturer specializing in high-frequency components. This acquisition expanded Hitachi’s production capacity and enabled it to cater to the growing demand for telecommunications applications.

- In February 2023, Arnold Magnetic Technologies partnered with a German firm to develop high-performance ferrite magnets for EV motors. This collaboration addressed performance gaps and broadened the material’s application scope in the automotive sector.

- In September 2022, Vacuumschmelze introduced a low-cost ferrite variant for smart home devices, meeting EU REACH compliance standards. This innovation strengthened its position in the consumer electronics segment.

- In January 2022, EPCOS expanded its Italian facility, increasing annual output by 15%. This expansion enabled the company to meet rising demand in Southern Europe and solidify its market presence.

MARKET SEGMENTATION

This research report on the Europe Ferrite Magnets market is segmented and sub-segmented into the following categories.

By Type

- Soft Ferrite Magnets

- Permanent Ferrite Magnets

- Others

By Product Type

- Strontium Ferrite Magnets

- Barium Ferrite Magnets

By Application

- Electro-Acoustic Products

- Computer and Office Equipment

- Automobile

- Electronics Industry

- Power Play Tools

- Car Line Industry

- Calculating Machines

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the market by 2033?

The Europe Ferrite Magnets market is estimated to reach USD 1.39 billion by 2033, with a projected volume of 41.0 thousand tons

2. What factors are driving Europe Ferrite Magnets market growth?

Growth is driven by rising demand in automotive and electronics, expansion in renewable energy, cost-effectiveness, and advancements in manufacturing techniques

3. Who are the key players in the Europe Ferrite Magnets market?

Major players include TDK Corporation, Magneti Ljubljana, and JFE Chemical Corporation4

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]