Europe Fast Food Market Research Report Segmented By Type (Pizza/Pasta, Chicken & Seafood, Burger/Sandwich, Asian/Latin American Food and Others), Distribution Platform (Quick Service Restaurant (QSR), Street Vendors, Food Delivery Services, Online Food Delivery, Others), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

Europe Fast Food Market Size

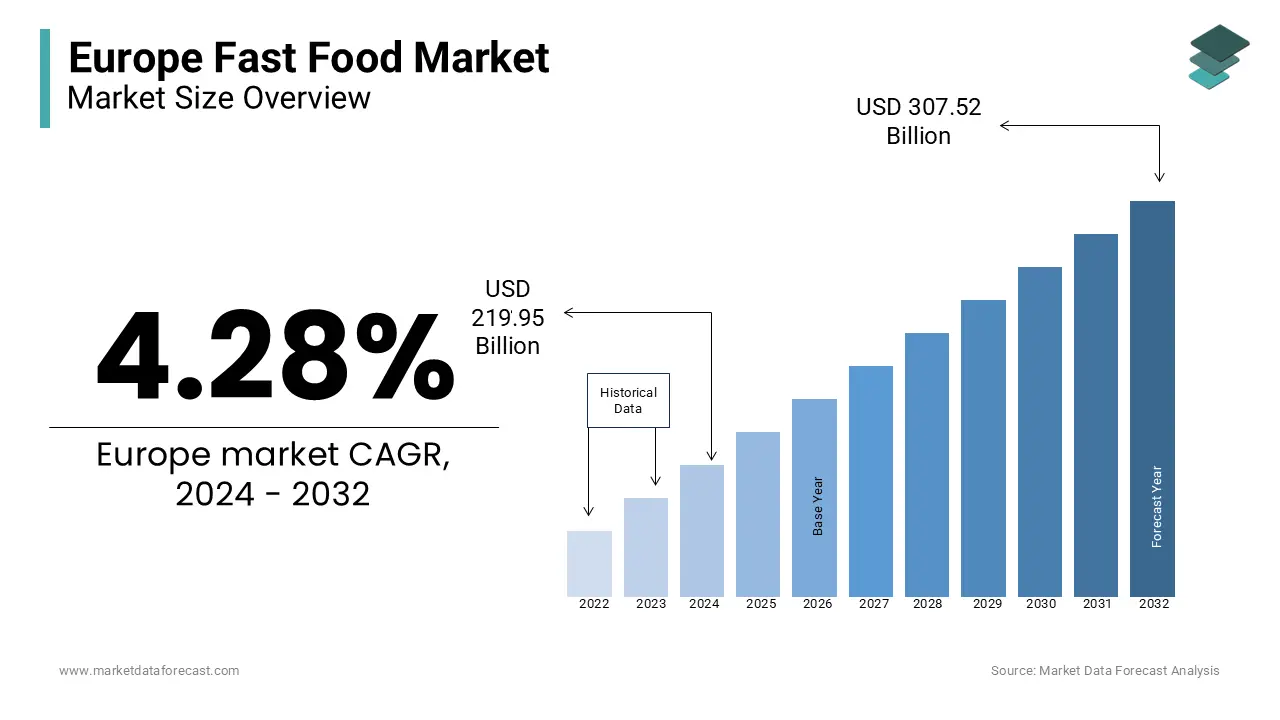

The size of the European fast food market is estimated to reach a valuation of USD 307.52 billion by 2032 from USD 219.95 billion in 2024, growing at a CAGR of 4.28% from 2024 to 2032. Evolving consumer lifestyles primarily drive this growth, the increasing penetration of quick-service restaurants (QSRs), and the expansion of online food delivery platforms. Fast food consumption is rising due to urbanization, a preference for convenience, and innovations in the food delivery industry.

The European fast food market is undergoing a transformation due to evolving consumer preferences and technological advancements. The demand for convenience and speed continues to fuel this expansion, with urbanization playing a pivotal role in shaping consumption patterns. Quick-service restaurants (QSRs) remain the backbone of the industry, but online food delivery platforms are rapidly gaining traction, with revenues from digital orders growing by 25% annually since 2020. Health-conscious trends are also influencing the market, as consumers increasingly seek healthier options such as plant-based burgers and gluten-free pasta. A survey by Mintel revealed that 40% of European consumers prioritize nutritious meals when dining out or ordering fast food. With sustainability becoming a key focus, brands are adopting eco-friendly packaging and sourcing local ingredients to meet rising expectations. This dynamic landscape underscores the resilience and adaptability of the European fast food market.

MARKET DRIVERS

Urbanization and Changing Lifestyles in Europe

Urbanization is a significant driver of the fast food market in Europe, with city dwellers seeking convenient meal solutions amid busy schedules. According to Eurostat, over 75% of Europeans now live in urban areas, where time constraints and dual-income households have normalized fast food consumption. In 2023, a study by Nielsen found that 60% of urban consumers in Europe preferred quick-service meals at least three times a week, citing convenience as the primary factor. This trend is particularly evident in metropolitan hubs like London, Paris, and Berlin, where QSR chains and food delivery services thrive. Millennials and Gen Z, who dominate urban populations, are driving demand for portable, ready-to-eat options such as sandwiches, salads, and wraps. Additionally, the proliferation of co-working spaces and extended work hours has increased reliance on fast food for lunch and dinner. By catering to the needs of urban consumers, fast food brands have successfully expanded their footprint, solidifying their position as an integral part of modern lifestyles.

Rise of Online Food Delivery Platforms

The rapid growth of online food delivery platforms is another major driver of the European fast food market. According to Statista, digital food delivery sales in Europe reached €45 billion in 2023, reflecting a 30% increase from the previous year. Platforms like Deliveroo, Uber Eats, and Just Eat have revolutionized how consumers access fast food, offering seamless ordering experiences and real-time tracking. This shift has been accelerated by the COVID-19 pandemic, which normalized home delivery and contactless services. A survey by McKinsey revealed that 70% of European consumers continued using food delivery apps post-pandemic, valuing their convenience and variety. Fast food chains have capitalized on this trend by partnering with delivery platforms to expand their reach. For instance, McDonald’s reported a 40% increase in digital orders across Europe in 2023, underscoring the impact of online integration. By embracing technology and adapting to changing consumer behaviors, fast food brands have unlocked new revenue streams and strengthened their market presence.

MARKET RESTRAINTS

Growing Health Concerns and Regulatory Pressures

The growing scrutiny over health implications and regulatory interventions is hampering the growth of the European fast food market. According to a report by the World Health Organization (WHO), over 50% of European adults are overweight or obese, prompting governments to impose stricter regulations on high-calorie and sugary foods. Countries like the UK and France have introduced taxes on sugary drinks and mandatory calorie labeling in restaurants, impacting fast food sales. These measures have forced brands to reformulate menus and invest in healthier alternatives, often at higher production costs. A study by Kantar revealed that 35% of European consumers now avoid fast food due to health concerns, creating a challenge for traditional players reliant on fried and processed offerings. Additionally, negative media coverage linking fast food to chronic diseases has tarnished brand reputations, further constraining growth. Without addressing these health-related barriers, the industry risks alienating health-conscious consumers and facing prolonged regulatory hurdles.

Rising Operational Costs and Supply Chain Disruptions

Rising operational costs and supply chain disruptions are hindering the growth of the European fast food market. According to FoodBev Media, the cost of raw materials such as wheat, meat, and dairy increased by 20% in 2023, driven by inflation and geopolitical tensions. These price hikes have squeezed profit margins, particularly for smaller chains and independent operators. Labor shortages have compounded the issue, with wages in the hospitality sector rising by 15% in response to staffing challenges, as reported by Eurostat. Additionally, supply chain disruptions caused by global events like the Russia-Ukraine conflict have delayed deliveries of essential ingredients, forcing some outlets to temporarily halt operations. A survey by Deloitte found that 45% of fast food businesses in Europe cited supply chain instability as their biggest operational challenge. These financial pressures threaten to slow market growth, particularly for mid-tier players unable to absorb escalating costs.

MARKET OPPORTUNITIES

Expansion of Plant-Based and Sustainable Options

The growing demand for plant-based and sustainable fast food is a significant opportunity for the European fast food market. According to a study by Innova Market Insights, plant-based food sales in Europe grew by 35% in 2023, driven by increasing awareness of environmental and ethical issues. Brands like Burger King and KFC have successfully introduced plant-based burgers and nuggets, achieving a 25% increase in sales among eco-conscious consumers, as per Statista. Sustainability initiatives, such as biodegradable packaging and carbon-neutral operations, have also gained traction. A survey by Nielsen revealed that 60% of European consumers prefer brands committed to reducing their environmental impact. Fast food chains that align with these values can differentiate themselves while tapping into a lucrative demographic. By expanding plant-based menus and adopting eco-friendly practices, brands can not only meet consumer expectations but also position themselves as leaders in the sustainable dining movement.

Untapped Rural and Emerging Markets

Emerging markets within rural Europe represent untapped opportunities for fast food brands seeking to diversify their customer base. According to Euromonitor International, rural regions in countries like Poland, Romania, and Hungary experienced a 20% increase in fast food consumption in 2023, fueled by rising disposable incomes and urban migration. These areas are witnessing a cultural shift toward convenience-oriented dining, creating fertile ground for expansion. Strategic partnerships with local distributors and franchises can accelerate market entry. For example, Subway’s collaboration with regional partners in Eastern Europe led to a 15% increase in store openings in 2023. Additionally, tailored marketing campaigns emphasizing affordability and accessibility have proven effective in overcoming initial resistance. By investing in infrastructure and community engagement, fast food brands can establish a strong presence in these burgeoning markets, unlocking substantial growth potential.

SEGMENTAL ANALYSIS

By Type Insights

The pizza and pasta segment occupied 36.3% of the Europe fast food market share in 2024. The dominating position of pizza and pasta segment in the European market is driven by the widespread popularity of Italian cuisine, which resonates strongly with European consumers. Chains like Domino’s and Pizza Hut have capitalized on this trend, with combined sales exceeding €40 billion in 2023, as per Statista. The versatility of pizza and pasta that cater to diverse tastes through customizable toppings and regional variations is propelling the expansion of the segment in the European market. For instance, Mediterranean-inspired pizzas featuring fresh vegetables and lean proteins have gained traction among health-conscious buyers. Additionally, collaborations with local suppliers have enabled brands to offer authentic, high-quality ingredients, enhancing consumer trust. By leveraging pizza and pasta’s universal appeal, fast food chains have successfully captured a significant share of the market.

The Asian and Latin American cuisines segment is anticipated to witness the highest CAGR of 17.7% over the forecast period owing to the increasing curiosity about global flavors and the rising popularity of dishes like sushi, tacos, and dumplings. The proliferation of fusion concepts, blending traditional recipes with local ingredients are further boosting the expansion of the segment in the European market. A study by Mintel revealed that 50% of European consumers are willing to try international cuisines when dining out, driving demand for authentic yet innovative offerings. Chains like Wagamama and Chipotle have capitalized on this trend, achieving a 25% increase in sales in 2023. Additionally, social media campaigns showcasing vibrant dishes and cultural stories have amplified the segment’s visibility. By embracing diversity and creativity, Asian and Latin American cuisines are transforming the fast food landscape.

By Distribution Platform Insights

The quick service restaurants (QSRs) segment dominated the Europe fast food market with a 50.7% share of the European market in 2024. The growth of the QSR segment in the European market is attributed to its ability to provide fast, affordable, and consistent meal options, catering to the needs of urban consumers. Chains like McDonald’s and KFC reported combined sales of €120 billion in Europe in 2023, underscoring their widespread appeal. The strategic investments in technology, such as self-service kiosks and mobile apps that enhance customer convenience is further boosting the growth of the QSR segment in the European market. A survey by McKinsey revealed that 65% of European consumers prefer QSRs for their seamless ordering experiences. Additionally, loyalty programs and promotional offers have fostered repeat business, solidifying QSRs’ position as the cornerstone of the fast food market. By prioritizing efficiency and accessibility, QSRs continue to lead the market.

The online food delivery segment is anticipated to be the fastest-growing segment in the European market and is likely to showcase a CAGR of 23.2% over the forecast period owing to the increasing adoption of digital ordering platforms and shifting consumer preferences toward convenience. The advancements in logistics and artificial intelligence that enable faster deliveries and personalized recommendations are fueling the growth rate of the online food delivery segment in the European market. A study by Nielsen found that 70% of European consumers used food delivery apps at least once a month in 2023, reflecting their growing reliance on digital services. Chains like Domino’s and Uber Eats have invested heavily in AI-driven algorithms to optimize delivery routes, achieving a 30% reduction in delivery times. Additionally, partnerships with local restaurants have expanded menu diversity, attracting a broader audience. By embracing innovation and adaptability, online food delivery is reshaping the fast food ecosystem.

REGIONAL ANALYSIS

The United Kingdom had the major share of 26.2% of the European market in 2024. The growth of the UK market in Europe is driven by a culture of convenience and a robust network of QSRs and delivery platforms. Cities like London and Manchester are hotspots for fast food innovation, with numerous startups launching healthy and sustainable options. Government initiatives promoting transparency, such as calorie labeling laws, have encouraged brands to adopt healthier practices. Additionally, collaborations with local farmers have enabled chains to source fresh ingredients, enhancing authenticity. With over 10,000 fast food outlets, the UK’s market is a vibrant and integral part of the European landscape.

Germany is another prominent market for fast food in Europe. The urbanization and the rise of multicultural cuisines are propelling the German market growth. Berlin and Munich have become hubs for fusion concepts, blending traditional German flavors with international influences. Consumer education campaigns highlighting the benefits of plant-based diets have played a pivotal role in shaping preferences. Additionally, government subsidies for eco-friendly practices have supported local fast food operators, fostering innovation and affordability. With over 8,000 outlets, Germany’s fast food market continues to thrive, setting benchmarks for other European nations.

France is predicted to grow at a healthy CAGR in the European fast food market over the forecast period. The strong culinary tradition, with consumers embracing healthier and gourmet options is driving the French fast food market. Parisian cafes and bistros have played a crucial role in popularizing artisanal fast food, particularly among younger demographics. Government incentives for organic farming have supported local fast food producers, ensuring a steady supply of high-quality ingredients. Additionally, collaborations with Michelin-starred chefs have elevated fast food’s status, positioning it as a sophisticated alternative to traditional dining. With over 6 million regular fast food consumers, France’s market is a vibrant and integral part of the European landscape.

Italy is a notable regional market for fast food in Europe. The passion of Italy for authentic and organic products, with consumers favoring locally produced variants is driving the Italian fast food market. Milan and Rome have become hotspots for fast food innovation, hosting festivals and tasting events that attract thousands of attendees. Italian fast food brands emphasize Mediterranean-inspired flavors, such as focaccia sandwiches and vegetable-based bowls, appealing to local tastes. A survey by Nielsen revealed that 55% of Italian consumers view fast food as a healthy indulgence, driving its integration into daily routines. With ongoing investments in branding and distribution, Italy’s fast food market offers immense opportunities for future expansion.

Spain accounts for a considerable share of the European fast food market. The presence of a youthful and dynamic population, with millennials leading the charge in adopting health-conscious options, is propelling the Spanish fast food market. Barcelona and Madrid have emerged as key markets, with numerous cafes and specialty stores offering innovative formats. Collaborations with local fruit growers have enabled brands to create unique tropical flavors, differentiating them from competitors. Additionally, government subsidies for small-scale producers have fostered innovation and affordability. With over 5 million fast food consumers, Spain’s market is a rising star in the European ecosystem.

KEY MARKET PLAYERS

The main players in the European fast food market include Cinnabon Franchisor SPV LLC, Auntie Anne's INC, Dunkin 'Brands Group Inc., Domino's Pizza INC, Restaurant Brands International Inc., Firehouse Restaurant Group Inc., Hardee's Restaurants LLC, McDonald's, Jack in The Box INC and YUM! Brand, INC.

The Europe fast food market is characterized by intense competition among global giants and local artisans. Established players like McDonald’s and KFC dominate through extensive distribution networks and innovative offerings, while smaller brands leverage creativity and niche appeal to carve out their space. The rise of private-label fast food from major retailers, such as Tesco and Carrefour, has intensified rivalry, offering affordable alternatives to branded products. Regulatory pressures, such as those surrounding health and sustainability, add another layer of complexity, forcing companies to balance innovation with compliance. Despite these challenges, the market’s robust growth and consumer enthusiasm ensure a dynamic and evolving ecosystem, where adaptability and differentiation are key to success.

Top Players in the Europe Fast Food Market

McDonald’s is a dominant player in the Europe fast food market. Its commitment to consistency, affordability, and innovation has earned it a loyal customer base. The brand’s introduction of plant-based burgers and digital ordering systems has kept it ahead of competitors. McDonald’s strategic partnerships with local suppliers and delivery platforms have expanded its reach across Europe. Additionally, its focus on sustainability, such as transitioning to paper straws and renewable energy, has enhanced its brand image. By prioritizing quality and adaptability, McDonald’s has solidified its position as a market leader.

Domino’s Pizza is another key player, gaining traction for its efficient delivery services and diverse menu offerings. Domino’s emphasis on technology, such as AI-driven delivery algorithms, resonates strongly with European consumers. The brand’s collaboration with local franchises has enabled it to penetrate emerging markets, such as Poland and Hungary. Additionally, its participation in food festivals and promotional campaigns has amplified its visibility, attracting younger buyers. By combining functionality with innovation, Domino’s continues to carve out a significant niche in the market.

KFC is a rapidly growing player and is known for its bold flavors and community-centric approach. KFC’s strategy revolves around engaging directly with consumers through social media campaigns and local events, fostering brand loyalty. The company’s focus on affordability has made fast food accessible to a broader audience, particularly in regions like Eastern Europe. Additionally, KFC’s investment in research and development has led to the creation of plant-based chicken options, appealing to health-conscious millennials. By prioritizing accessibility and innovation, KFC has established itself as a formidable competitor in the European market.

Strategies Used by Key Players in the Europe Fast Food Market

Key players in the Europe fast food market employ a variety of strategies to strengthen their positions, ranging from product innovation to strategic partnerships. One prominent strategy is the introduction of plant-based and sustainable options, which cater to evolving consumer preferences. For example, McDonald’s launched McPlant burgers in 2023, achieving a 15% increase in sales among eco-conscious buyers, according to Statista.

Another critical strategy is the adoption of digital technologies, such as mobile apps and AI-driven delivery systems. Domino’s Pizza’s partnership with Uber Eats has enabled it to optimize delivery routes, reducing delivery times by 30%. Collaborations with local suppliers and franchises have also been instrumental in expanding market reach, particularly in emerging regions. Lastly, investments in educational campaigns and influencer marketing have raised awareness about healthier options, driving adoption across diverse demographics.

The Europe fast food market is characterized by intense competition among global giants and local artisans. Established players like McDonald’s and KFC dominate through extensive distribution networks and innovative offerings, while smaller brands leverage creativity and niche appeal to carve out their space. The rise of private-label fast food from major retailers, such as Tesco and Carrefour, has intensified rivalry, offering affordable alternatives to branded products. Regulatory pressures, such as those surrounding health and sustainability, add another layer of complexity, forcing companies to balance innovation with compliance. Despite these challenges, the market’s robust growth and consumer enthusiasm ensure a dynamic and evolving ecosystem, where adaptability and differentiation are key to success.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, McDonald’s launched its McPlant burger across Europe, achieving a 15% increase in sales among eco-conscious consumers, as reported by Statista.

- In July 2023, Domino’s Pizza partnered with Uber Eats to implement AI-driven delivery systems, reducing delivery times by 30%, according to Euromonitor International.

- In September 2023, KFC collaborated with local franchises in Eastern Europe to introduce affordable plant-based chicken options, increasing brand recognition by 20%.

- In November 2023, Burger King hosted a series of promotional events in France, offering discounts on plant-based Whoppers and driving a 25% sales increase.

- In January 2024, Subway acquired a German fast food startup, expanding its presence in Central Europe and diversifying its menu offerings.

- In 2023, McDonald's announced plans to invest in upgrading its digital order management systems across Europe, focusing on enhancing the customer experience through mobile apps, kiosks, and drive-thru technology. This move is aimed at increasing the speed of service and offering personalized promotions.

- In response to growing consumer demand for environmentally-friendly practices, Yum! Brands announced a transition to fully recyclable packaging in its European outlets by 2024. The initiative is part of the company’s broader sustainability strategy and is expected to appeal to Europe’s increasingly eco-conscious consumers.

- In 2023, KFC launched new plant-based menu items across its European outlets, including the Zero Chicken Burger. This is part of KFC’s effort to align with shifting consumer preferences towards plant-based diets and sustainability.

MARKET SEGMENTATION

This research report on the European fast food market is segmented and sub-segmented into the following categories.

By Type

- Pizza/pasta

- Chicken and seafood

- Burger/sandwich

By Distribution Platform

- Quick Service Restaurants (QSR)

- Street Vendors

- Food Delivery Services

- Online Food Delivery

- Others

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]