Europe Facial Injectable Market Size, Share, Trends & Growth Forecast Report By Type (Botulinum Toxin, Collagen, Hyaluronic Acid, Calcium Hydroxylapatite, Polylactic Acid, PMMA, Fat Injection, Others), Application (Wrinkle Reduction, Facelift, Acne Scar Treatment, Lipoatrophy Treatment, Lip Enhancement, Others) End-user (Hospitals & ASCs, Dermatology and Cosmetic Clinics, Others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Facial Injectable Market Size

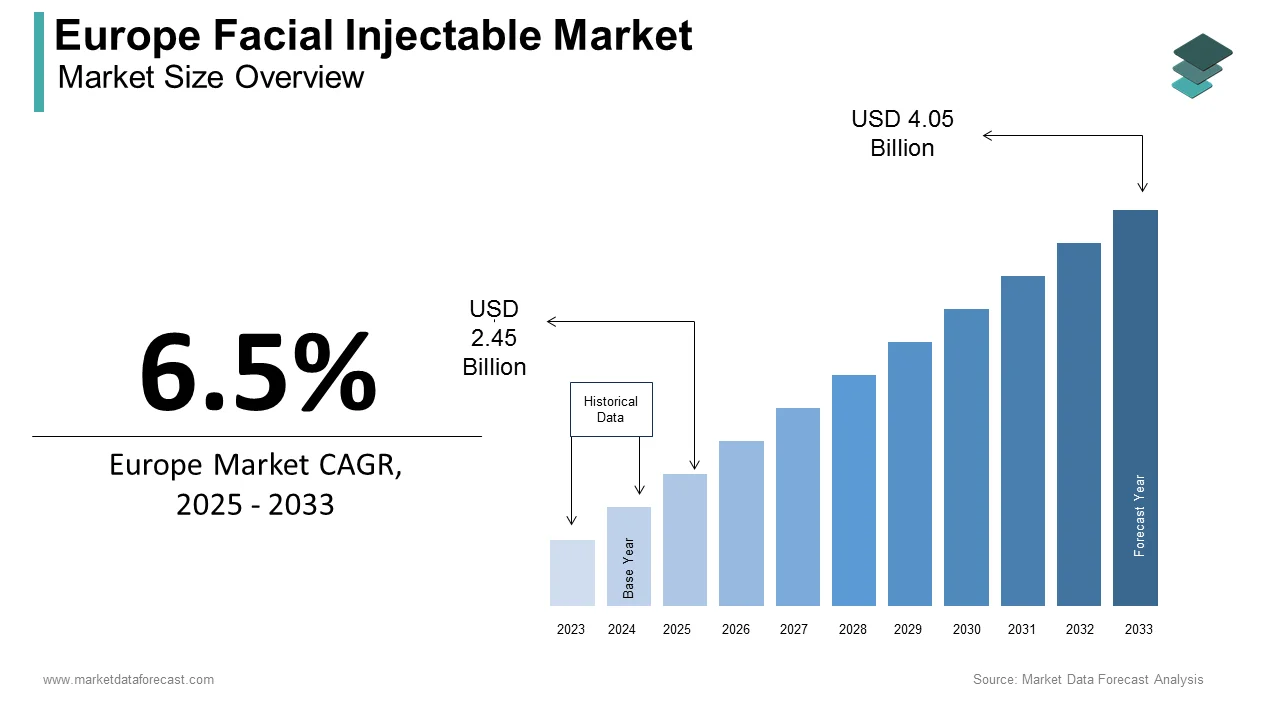

The facial injectable market size in Europe was valued at USD 2.3 billion in 2024. The European market is estimated to be worth USD 4.05 billion by 2033 from USD 2.45 billion in 2025, growing at a CAGR of 6.5% from 2025 to 2033.

The European facial injectable market has emerged as a dynamic and rapidly evolving segment within the broader aesthetics industry, reflecting growing consumer demand for minimally invasive cosmetic procedures. Facial injectables encompass a range of products, including botulinum toxins, dermal fillers, and other skin-enhancing solutions designed to address concerns such as wrinkles, volume loss, and facial contouring. These treatments are increasingly sought after by individuals seeking quick, effective, and non-surgical options to enhance their appearance.

Europe's aging population, coupled with rising awareness about aesthetic procedures, has been a key driver of this market. Additionally, the increasing influence of social media and celebrity culture has fueled demand among younger demographics, who are now more inclined toward preventive anti-aging treatments. A study by the International Society of Aesthetic Plastic Surgery (ISAPS) further underscores this trend, revealing that non-surgical procedures, including facial injectables, have witnessed a year-on-year growth rate of over 5% across Europe. As innovation continues to shape product offerings and expand accessibility, the European facial injectable market is poised for sustained expansion in the coming years.

MARKET DRIVERS

Increasing Aging Population in Europe

The aging population in Europe is a key driver of the facial injectable market, as older adults seek treatments to address age-related concerns. According to Eurostat, the statistical office of the European Union, individuals aged 65 and above constituted 20.8% of the EU population in 2021, reflecting a steady increase from 19.2% in 2011. This demographic trend has led to heightened demand for minimally invasive procedures like Botox and dermal fillers. According to the International Society of Aesthetic Plastic Surgery, non-surgical cosmetic procedures have grown by 10.4% annually in Europe over the past decade. Countries with high life expectancy, such as Italy and Germany (exceeding 83 years), are key contributors to this trend, as aging individuals increasingly prioritize aesthetic enhancements to maintain youthful appearances.

Influence of Social Media and Celebrity Culture

Social media platforms and celebrity endorsements play a pivotal role in shaping beauty standards and driving demand for facial injectables. The European Commission reports that over 70% of Europeans aged 16–74 actively use social media, with platforms like Instagram and TikTok influencing beauty trends. The British Association of Aesthetic Plastic Surgeons notes a 30% rise in non-surgical procedures among younger adults (18–35) since 2018, fueled by viral content promoting idealized appearances. Influencers and celebrities frequently share their experiences with injectables, normalizing their use. For example, the French National Health Authority reveals that nearly 50% of women aged 25–40 consider facial injectables due to inspiration from online trends. This cultural shift underscores the growing acceptance of aesthetic treatments across Europe.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

The facial injectable market in Europe faces grave challenges due to stringent regulatory frameworks that govern the approval and use of aesthetic products. The European Medicines Agency (EMA) enforces rigorous safety and efficacy standards, which often delay the introduction of new products. According to a report by the European Commission, the average time for a medical device or injectable product to receive CE marking approval is approximately 12–18 months creates barriers for smaller companies. Additionally, post-market surveillance requirements have increased compliance costs for manufacturers. A study by the European Association of Medical Devices Manufacturers shows that nearly 30% of companies face delays in launching new products due to regulatory hurdles. These strict regulations, while ensuring safety, limit innovation and market growth, particularly for emerging players.

Rising Concerns Over Safety and Side Effects

Growing concerns over the safety and potential side effects of facial injectables act as a restraint on market growth in Europe. The World Health Organization (WHO) has flagged issues such as allergic reactions, infections, and long-term complications associated with improper use of injectables. In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) reported a 25% increase in adverse event reports related to cosmetic injectables between 2019 and 2022. Furthermore, a survey conducted by the European Society of Aesthetic Surgery revealed that 40% of potential consumers hesitate to undergo procedures due to fears of complications. High-profile cases of botched treatments have amplified public scepticism and is leading to stricter scrutiny from both regulators and consumers and thereby slowing market expansion.

MARKET OPPORTUNITIES

Growing Demand for Non-Invasive Aesthetic Procedures

The increasing preference for non-invasive aesthetic treatments presents a potential opportunity for the Europe facial injectable market. According to Eurostat, over 60% of Europeans aged 25–55 are inclined toward minimally invasive procedures due to their convenience, affordability, and reduced recovery time compared to surgical alternatives. The International Society of Aesthetic Plastic Surgery identified that non-surgical treatments accounted for 65% of all cosmetic procedures performed in Europe in 2021, with facial injectables like hyaluronic acid fillers and botulinum toxin leading the segment. Additionally, the European Commission reports that the aesthetic industry is projected to grow substantially in the coming years, driven by advancements in injectable technologies. This shift underscores the potential for market expansion as consumer demand continues to rise.

Expansion of Medical Tourism in Eastern Europe

The rise of medical tourism in Eastern Europe offers a lucrative opportunity for the facial injectable market. The European Travel Commission states that countries like Hungary, Poland, and the Czech Republic have become popular destinations for affordable yet high-quality aesthetic treatments is attracting over 5 million medical tourists annually. These countries offer injectable procedures at costs 40–60% lower than in Western Europe, as reported by the European Medical Tourism Association. Furthermore, the Hungarian Ministry of Foreign Affairs estimates that medical tourism contributes approximately €1.5 billion annually to the country’s economy with facial injectables being a key driver. As accessibility and awareness increase, Eastern Europe’s competitive pricing and skilled practitioners position it as a hub for international patients seeking cost-effective aesthetic solutions.

MARKET CHALLENGES

High Cost of Treatments and Economic Disparities

The high cost of facial injectable treatments poses a major challenge to market accessibility, particularly in economically diverse regions of Europe. According to the European Commission, aesthetic procedures like Botox and dermal fillers can cost between €300 and €800 per session, making them unaffordable for a large segment of the population. Eurostat revealed that nearly 22% of Europeans are at risk of poverty or social exclusion which is limiting their ability to invest in non-essential cosmetic procedures. Additionally, economic disparities between Western and Eastern Europe exacerbate this issue with the latter having lower average disposable incomes. The European Health Consumer Index reports that only 15% of individuals in low-income brackets consider aesthetic treatments, compared to 45% in higher-income groups. This financial barrier restricts market penetration in less affluent regions.

Lack of Standardization in Practitioner Training

The absence of standardized training and certification for practitioners administering facial injectables is a growing concern in Europe. The European Federation of Societies for Ultrasound in Medicine and Biology states that inconsistent training standards lead to variability in treatment quality and safety outcomes. A report by the UK’s Medicines and Healthcare Products Regulatory Agency (MHRA) reveals that over 35% of adverse events related to injectables are linked to inadequately trained practitioners. Furthermore, the European Society of Aesthetic Plastic Surgery estimates that only 60% of providers in the industry undergo accredited training programs. This lack of regulation undermines consumer confidence and increases the risk of complications, hindering the market's reputation and long-term growth potential across the region.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, End User, and Country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

Allergan Aesthetics (AbbVie Inc.) (U.S.) Ipsen Pharma (France) Merz Pharma (Germany) GALDERMA (Switzerland) BIOPLUS CO., LTD. (South Korea) BIOXIS Pharmaceuticals (France) Teoxane (Switzerland) Sinclair (Huadong Medicine Co., Ltd.) (U.K.) Prollenium Medical Technologies (Canada) , and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Hyaluronic acid is the largest segment in the European facial injectable market, holding a 35% market share, as reported by the European Commission. Its dominance stems from its versatility in addressing multiple aesthetic concerns, such as lip augmentation and wrinkle reduction. As per the British Association of Aesthetic Plastic Surgeons, hyaluronic acid-based fillers are preferred due to their natural results and reversibility and over 2.5 million procedures are performed annually in Europe. Its biocompatibility reduces risks of adverse reactions, making it a trusted choice. Priced between €400 and €800 per session, it balances affordability with quality, driving its widespread adoption across all demographics.

The Polylactic acid segment is predicted to witness the highest CAGR of 14.7% over the forecast period. Its ability to stimulate collagen production for long-lasting results appeals to consumers seeking sustainable solutions. The European Medicines Agency notes that polylactic acid’s increasing use in facial rejuvenation has led to a 20% rise in demand since 2020. Its importance lies in catering to aging populations, particularly in Germany and Italy, where life expectancy exceeds 83 years. With costs ranging from €600–€1,000 per treatment, it offers premium value, attracting affluent consumers focused on advanced anti-aging solutions.

By Application Insights

The Wrinkle reduction segment led the market by occupying a share of 40.8% of the total market share in 2024. This dominance is driven by the increasing aging population and the growing demand for minimally invasive procedures to combat visible signs of aging. Eurostat reports that over 60% of individuals aged 40–65 seek treatments like botulinum toxin and hyaluronic acid fillers for wrinkle reduction. The British Association of Aesthetic Plastic Surgeons found that wrinkle reduction procedures grew by 15% between 2019 and 2022 and is reflecting their widespread acceptance. With an average cost of €300–€600 per session, these treatments are accessible and effective and is making them a cornerstone of the aesthetic industry.

The Lip enhancement segment is likely to experience the fastest CAGR of 16.3% during the forecast period due to social media trends and celebrity culture, which have normalized fuller lips as a beauty standard. The French National Health Authority notes that lip augmentation procedures increased by 25% annually since 2020, particularly among younger adults aged 18–35. Hyaluronic acid-based fillers dominate this segment due to their safety and natural results. With costs ranging from €400–€800 per treatment and lip enhancement appeals to a broad demographic especially in urban areas where aesthetic trends are most influential which is strengthening its importance in the market.

By End-user Insights

The Dermatology and cosmetic clinics segment was the largest end-users in the European facial injectable market by capturing 65.2% of the total market share in 2024 and is attributed to the specialized expertise and personalized care offered by these facilities, which are often equipped with advanced technologies for safe and effective treatments. The British Association of Aesthetic Plastic Surgeons reports that over 70% of facial injectable procedures in Europe are performed in such clinics due to their focus on aesthetic services. Additionally, Eurostat reported that the number of accredited dermatology clinics has grown by 12% annually since 2019 and is demonstrating increased consumer trust. With competitive pricing and skilled practitioners, these clinics remain the preferred choice for patients seeking high-quality aesthetic solutions.

The Hospitals and ambulatory surgical centers (ASCs) emerges as the fastest-growing end-user category with a CAGR of 10.8% over the forecast period. The increasing demand for safer and more regulated environments for facial injectable procedures is one of the main reasons behind the growth of this segment in the market. The European Medicines Agency notes that hospitals and ASCs are gaining popularity due to stringent safety protocols and access to emergency care which reassures patients concerned about potential complications. Furthermore, the French National Health Authority reports a 30% rise in injectable procedures conducted in hospitals since 2020 and particularly among older adults seeking comprehensive medical oversight. These facilities are becoming pivotal in addressing safety concerns while expanding access to advanced aesthetic treatments across Europe.

COUNTRY ANALYSIS

Germany dominated the European facial injectable market and held a 22.5% share in 2024. A high aging population with life expectancy exceeding 83 years is driving demand for anti-aging treatments like botulinum toxin and hyaluronic acid fillers which ultimately contributing to its position in the regional market. The German Federal Statistical Office reports that over 60% of adults aged 45–70 invest in aesthetic procedures annually. Additionally, the country’s robust healthcare infrastructure and stringent regulatory standards ensure safe and effective treatments. The International Society of Aesthetic Plastic Surgery stated that Germany accounts for nearly 18% of all non-surgical procedures in Europe, supported by high disposable incomes and widespread awareness of aesthetic innovations.

UK is a key player in the European facial injectable market and is expected to achieve a CAGR of 10.2% over the forecast period due to its advanced medical tourism sector and high consumer spending on cosmetic procedures. The Medicines and Healthcare Products Regulatory Agency (MHRA) notes that over 1.5 million non-surgical treatments were performed in 2022 alone and is driven by social media trends and celebrity endorsements. London, in particular, serves as a hub for cutting-edge clinics offering premium services. With affordability and accessibility improving, younger demographics are increasingly opting for injectables further strengthens the UK’s position as a market leader.

France’s dominance in the facial injectables market underscores its role as a leader in aesthetic medicine innovation and a key driver of market growth in Europe. The country’s prominence is attributed to its reputation for luxury beauty and advanced dermatological expertise. Paris is known as a global fashion capital which attracts consumers seeking high-end aesthetic treatments, particularly lip enhancements and wrinkle reduction. Additionally, the French government’s support for medical advancements ensures access to state-of-the-art technologies. The International Society of Aesthetic Plastic Surgery reports that a 11.2% increase in cosmetic procedures worldwide in 2022. This included more than 14.9 million surgical and 18.8 million non-surgical procedures and it exhibits a strong consumer confidence and demand for premium solutions.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe facial injectable market profiled in this report are Allergan Aesthetics (AbbVie Inc.) (U.S.) Ipsen Pharma (France) Merz Pharma (Germany) GALDERMA (Switzerland) BIOPLUS CO., LTD. (South Korea) BIOXIS Pharmaceuticals (France) Teoxane (Switzerland) Sinclair (Huadong Medicine Co., Ltd.) (U.K.) Prollenium Medical Technologies (Canada) , and Others.

MARKET SEGMENTATION

This Europe facial injectable market research report is segmented and sub-segmented into the following categories.

By Type

- Botulinum Toxin

- Collagen

- Hyaluronic Acid

- Calcium Hydroxylapatite

- Polylactic Acid

- PMMA

- Fat Injection

- Others

By Application

- Wrinkle Reduction

- Facelift

- Acne Scar Treatment

- Lipoatrophy Treatment

- Lip Enhancement

- Others

By End-user

- Hospitals & ASCs

- Dermatology and Cosmetic Clinics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. How fast is the Europe facial injectable market expanding?

It is projected to grow from USD 2.45 billion in 2025 to USD 4.05 billion by 2033, at a CAGR of 6.5%.

2. What factors drive the Europe facial injectable market?

The aging population, social media influence, and demand for non-invasive cosmetic procedures.

3. What challenges impact the Europe facial injectable market?

Stringent regulations, safety concerns, and high treatment costs.

4. What trends are shaping the Europe facial injectable market?

Medical tourism and advancements in injectable technologies.

5. Which products dominate the Europe facial injectable market?

Botulinum toxin, hyaluronic acid fillers, and polymer-based injectables.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]