Europe Eyewear Market Size, Share, Trends & Growth Forecast Report By Product (Contact Lenses, Spectacles, Sunglasses), Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Eyewear Market Size

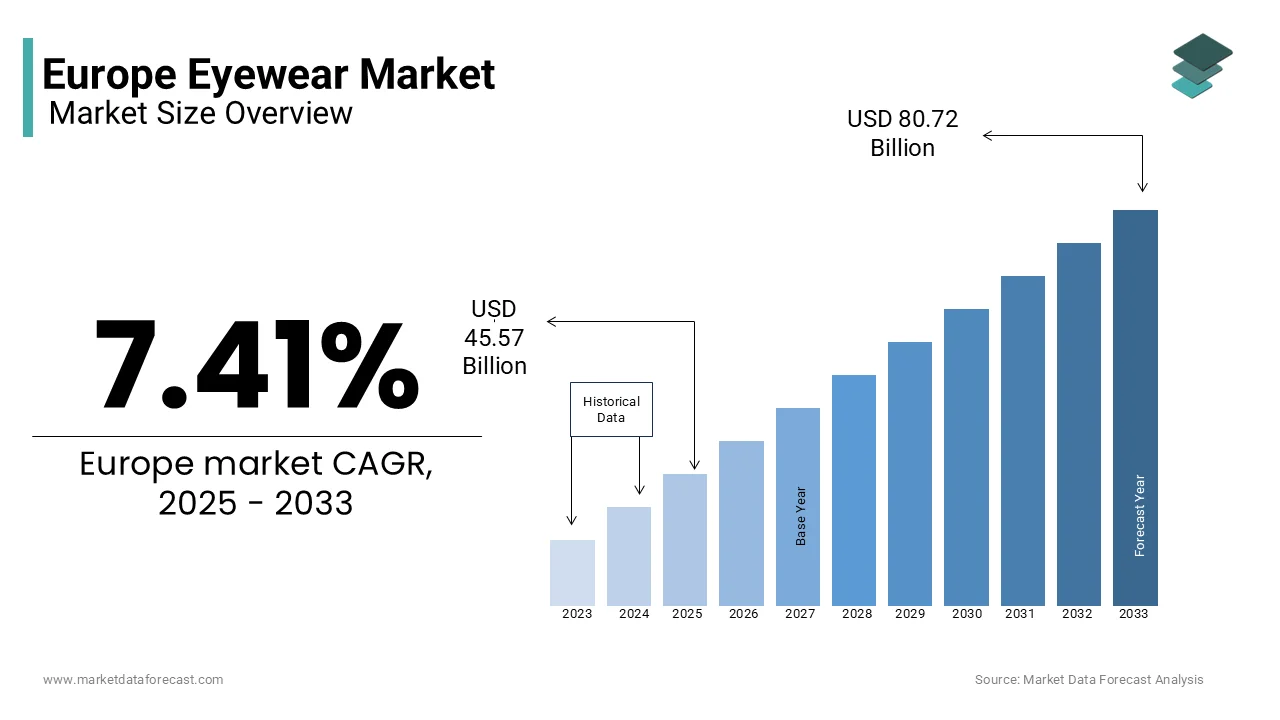

The Europe Eyewear market size was valued at USD 42.43 billion in 2024. The Europe market is estimated to be worth USD 80.72 billion by 2033 from USD 45.57 billion in 2025, growing at a CAGR of 7.41% from 2025 to 2033.

Eyewear serves both functional and aesthetic purposes, addressing vision correction needs while acting as a fashion accessory that reflects personal style. According to Eurostat, with steady growth the market is driven by rising awareness of eye health, increasing screen time, and evolving fashion trends. The International Agency for the Prevention of Blindness reported that over 60% of Europeans require vision correction which is underscoring the widespread demand for eyewear products. Germany, France, and Italy are the largest contributors, collectively accounting for nearly 50% of total revenue.

The UK Office for National Statistics notes that millennials and Gen Z consumers are driving demand for designer sunglasses and customizable frames, with luxury brands capturing a significant share of the market. Additionally, the European Commission reports that advancements in lens technology such as blue light filters and anti-glare coatings have gained traction due to the surge in digital device usage. Sustainability is also becoming a key focus, with eco-friendly materials like recycled plastics and biodegradable frames gaining popularity. Furthermore, aging demographics across Europe are boosting demand for presbyopia-correcting lenses. Urbanization and disposable incomes rise along with a growing emphasis on preventive eye care, so the European eyewear market is poised for continued expansion, blending innovation, functionality, and style to meet diverse consumer needs.

MARKET DRIVERS

Increasing Screen Time and Eye Health Awareness

A major propellent of the European eyewear market is the rising screen time and growing awareness of eye health which is fueled by digital device usage. The European Commission reports that over 70% of Europeans spend more than six hours daily on screens and is leading to increased demand for blue light filtering glasses. Eurostat stated that sales of computer glasses have surged by 25% since 2020 as consumers seek solutions to combat digital eye strain. Additionally, the International Agency for the Prevention of Blindness notes that regular eye check-ups have become a priority, with 65% of adults now scheduling annual appointments, driving prescription eyewear sales. The UK Office for National Statistics further reveals that 40% of remote workers have purchased new eyewear to address vision-related issues caused by prolonged screen exposure. This trend underscores the critical role of functional eyewear in modern lifestyles.

Fashion Trends and Brand Influence

Another key driver is the influence of fashion trends and luxury branding, which position eyewear as a style statement. The European Consumer Organisation states that 50% of eyewear purchases are influenced by brand reputation and design aesthetics and particularly among millennials and Gen Z. Italy’s Ministry of Economic Development found that designer sunglasses account for 35% of total eyewear revenue, with iconic brands like Gucci and Ray-Ban dominating the market. Furthermore, Eurostat reports that customizable frames and limited-edition collections have boosted consumer interest, with a 20% increase in premium eyewear sales in urban centers like Paris and Milan. The UK Office for National Statistics notes that influencer marketing has amplified this trend, with 60% of young consumers citing social media as a key factor in their purchasing decisions. This fusion of fashion and functionality continues to propel market growth across Europe.

MARKET RESTRAINTS

High Costs of Premium Eyewear

The high cost of premium products is a significant restraint in the European eyewear market, limiting accessibility for price-sensitive consumers. The European Commission stated that luxury eyewear brands often charge prices 3 to 5 times higher than mid-tier alternatives, making them unaffordable for low-income households. Eurostat reports that in Eastern European countries like Romania and Bulgaria, only 25% of consumers purchase branded eyewear, compared to over 60% in Western Europe. Additionally, the UK Office for National Statistics notes that the average cost of prescription glasses ranges from €200 to €500, deterring frequent upgrades. With lens coatings and specialized features like blue light filters adding to the expense, affordability remains a key concern. This financial barrier restricts market penetration, particularly among rural populations, where awareness of cost-effective options is limited, hindering overall growth potential.

Counterfeit Products and Market Saturation

Another major restraint is the prevalence of counterfeit eyewear products, which undermines consumer trust and impacts legitimate sales. The European Union Intellectual Property Office (EUIPO) estimates that counterfeit sunglasses and frames account for 10% of total market revenue, resulting in annual losses of approximately €2 billion for authentic brands. Additionally, Eurostat revealed that online platforms have exacerbated this issue, with 40% of consumers unknowingly purchasing counterfeit items due to attractive pricing. The Italian Ministry of Economic Development notes that regions like Milan, known for luxury eyewear manufacturing, face significant challenges from illicit trade. Furthermore, market saturation caused by an influx of low-cost imports from Asia intensifies competition, forcing smaller brands to struggle for differentiation. These factors not only erode brand equity but also pose reputational risks, complicating efforts to sustain long-term growth in the European eyewear market.

MARKET CHALLENGES

Rising Competition from Online Retailers

A significant challenge in the European eyewear market is the intense competition posed by online retailers, which disrupts traditional brick-and-mortar sales channels. Eurostat reports that e-commerce now accounts for 30% of total eyewear sales in Europe, with platforms like Amazon and ASOS offering competitive pricing and convenience. The UK Office for National Statistics stated that 45% of consumers prefer online purchases due to discounts and home try-on options, pressuring physical stores to adapt or risk obsolescence. Additionally, the European Commission notes that small, independent opticians face a 20% decline in footfall as digital-savvy consumers shift to online shopping. While online sales boost accessibility, they also lead to reduced customer engagement and limited opportunities for personalized fittings. This shift challenges traditional retailers to innovate their business models while maintaining profitability in an increasingly digital marketplace.

Environmental Concerns Over Plastic Usage

Another major challenge is the growing environmental scrutiny over plastic usage in eyewear manufacturing, driven by Europe’s sustainability goals. The European Environment Agency states that over 80% of eyewear frames are made from non-biodegradable plastics, contributing significantly to landfill waste. France’s Ministry of Ecology reported that only 15% of consumers actively seek eco-friendly eyewear options, despite increasing awareness of environmental issues. Furthermore, Eurostat reports that less than 10% of eyewear brands currently offer sustainable alternatives, such as bio-acetate or recycled materials. This gap between consumer expectations and product availability poses reputational risks for manufacturers. As regulatory pressures mount under initiatives like the EU Circular Economy Action Plan, companies must invest in sustainable practices to align with consumer values and regulatory standards, adding complexity to production and cost structures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.41% |

|

Segments Covered |

By Product, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Alcon, De Rigo S.p.A., EssilorLuxottica, Fielmann AG, MARCOLIN SPA, PRADA S.P.A., Rodenstock GmbH, SAFILO GROUP S.P.A., Zeiss International, and Silhouette International Schmied AG, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The Spectacle frames segment dominated the European eyewear market and held a 45.6% share in 2024 owing to their dual functionality as both vision correction tools and fashion accessories. According to the UK Office for National Statistics, rectangular frames account for 40% of frame sales due to their universal appeal and versatility. Additionally, premium frames made from acetate are highly sought after, with Italy’s Ministry of Economic Development noting that luxury frames drive significant revenue in Western Europe. The segment's importance lies in its ability to cater to diverse consumer preferences, from affordability to high-end customization. The growing demand for stylish and functional designs means spectacle frames remain pivotal in shaping the eyewear market's growth trajectory.

The Premium contact lenses segment is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 12% during the forecast period. The increasing awareness of eye health and the convenience of daily disposables, particularly among younger consumers are fuelling the growth of the segment in the global market. The UK Office for National Statistics reports that 70% of users aged 18-35 prefer premium lenses for their hygiene benefits. Additionally, advancements in materials such as silicone hydrogel enhance comfort and oxygen permeability, driving adoption. As per the International Agency for the Prevention of Blindness, premium lenses reduce long-term risks of eye infections, making them a preferred choice. As consumers prioritize health and convenience, this segment underscores innovation and addresses evolving lifestyle needs in the eyewear market.

By Distribution Channel Insights

The Brick-and-mortar stores segment led the European eyewear market and accounted for 65.8% share in 2024. Their position in the market is driven by the personalized services they offer including professional eye exams and frame fittings which are crucial for prescription eyewear. The UK Office for National Statistics stated that 70% of consumers aged 50 and above prefer in-store purchases due to trust in expert advice and the ability to physically try products. Italy’s Ministry of Economic Development notes that luxury brands rely on flagship stores to showcase exclusive collections, particularly in urban centers. This channel's importance lies in its ability to deliver tailored experiences, ensuring customer satisfaction while maintaining strong brand loyalty makes it indispensable despite the rise of e-commerce.

The E-commerce segment is expected to exhibit a noteworthy CAGR of 15% from 2025 to 2033owing to its convenience, competitive pricing, and innovations like virtual try-ons, appealing to tech-savvy millennials and Gen Z. The UK Office for National Statistics reports that 45% of these demographics now buy eyewear online. Additionally, e-commerce has expanded access to affordable options in rural areas, where physical stores are limited. According to the European Commission, platforms like Amazon have increased market penetration by offering diverse products. Digital adoption rises so e-commerce bridges gaps in accessibility and affordability which is reshaping the eyewear market by catering to evolving consumer preferences and driving innovation in retail strategies.

REGIONAL ANALYSIS

Germany led the European eyewear market by holding a 22% share in 2024. A strong emphasis on eye health and accessibility to advanced eyewear solutions is influencing its growth. The German Federal Ministry of Health revealed that over 70% of Germans undergo regular eye check-ups, boosting demand for prescription glasses and contact lenses. Additionally, Germany’s robust retail infrastructure including both brick-and-mortar stores and e-commerce platforms ensures widespread availability of products. Italy’s Ministry of Economic Development notes that Germany is also a key importer of luxury eyewear, with cities like Munich and Berlin serving as fashion hubs. Furthermore, government initiatives promoting sustainability have encouraged eco-friendly eyewear adoption, aligning with consumer values and solidifying Germany’s position as a market leader.

France is expected to grow at a CAGR of 9.2% during the forecast period owing to its reputation as a global fashion capital, as per the French Ministry of Economy. Paris, home to iconic luxury brands like Chanel and Dior, drives demand for high-end sunglasses and designer frames. Eurostat reports that premium eyewear accounts for 40% of sales in France reflectes the population’s affinity for style and exclusivity. Additionally, as per the UK Office for National Statistics, French consumers prioritize quality and innovation, with a growing preference for sustainable materials like bio-acetate. France’s aging population also contributes to demand for presbyopia-correcting lenses. By blending fashion, functionality, and sustainability, France continues to shape trends and influence the broader European eyewear market.

Italy made notable strides in the European eyewear market and is supported by its status as a global manufacturing hub for luxury frames. Regions like Lombardy and Veneto are home to world-renowned brands such as Luxottica, which supplies over 80% of global designer eyewear. Eurostat found that Italian exports account for 35% of Europe’s total eyewear trade emphasizes its pivotal role in the market. Additionally, the European Commission notes that Italy’s focus on craftsmanship and innovation attracts affluent consumers seeking bespoke designs. The country’s expertise in producing high-quality acetate frames and polarized lenses further strengthens its leadership. By combining heritage, design excellence, and export prowess, Italy remains a cornerstone of the European eyewear market.

KEY MARKET PLAYERS

The major key players in Europe Eyewear market are Alcon, De Rigo S.p.A., EssilorLuxottica, Fielmann AG, MARCOLIN SPA, PRADA S.P.A., Rodenstock GmbH, SAFILO GROUP S.P.A., Zeiss International, and Silhouette International Schmied AG, and others.

MARKET SEGMENTATION

This research report on the Europe eyewear market is segmented and sub-segmented into the following categories.

By Product

- Contact Lenses

- Premium Contact Lenses

- Mass Contact Lenses

- Spectacles

- Spectacle Frames

- Spectacle Frames, by Type

- Premium Spectacle Frames

- Mass Spectacle Frames

- Spectacle Frames, by Style

- Round

- Square

- Rectangle

- Oval

- Others

- Spectacle Lenses

- Sunglasses

- Sunglasses, by Lens Type

- Polarized Sunglasses

- Non-Polarized Sunglasses

- Sunglasses, by Lens Material

- CR-39

- Polycarbonate

- Polyurethane

- Others

By Distribution Channel

- Brick & Mortar

- E-commerce

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the current size of the Europe Eyewear Market?

The Europe Eyewear Market was valued at USD 42.43 billion in 2024 and is projected to grow significantly in the coming years.

2. What are the key challenges faced by the Europe Eyewear Market?

The key challenges faced by the Europe Eyewear Market include the high presence of counterfeit eyewear products, regulatory restrictions on optical products, fluctuating raw material costs impacting pricing, and economic uncertainties affecting luxury eyewear sales.

3. Which regions in Europe have the highest demand for eyewear?

The top regions driving the Europe Eyewear Market are Germany for premium eyewear, France for luxury sales, the UK for online purchases, Italy for manufacturing, and Spain for vision health awareness.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]