Europe Exterior Sheathing Market Size, Share, Trends & Growth Forecast Report By Sheathing Type (Structural Exterior Sheathing, Non-Structural Exterior Sheathing), Product Type, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Exterior Sheathing Market Size

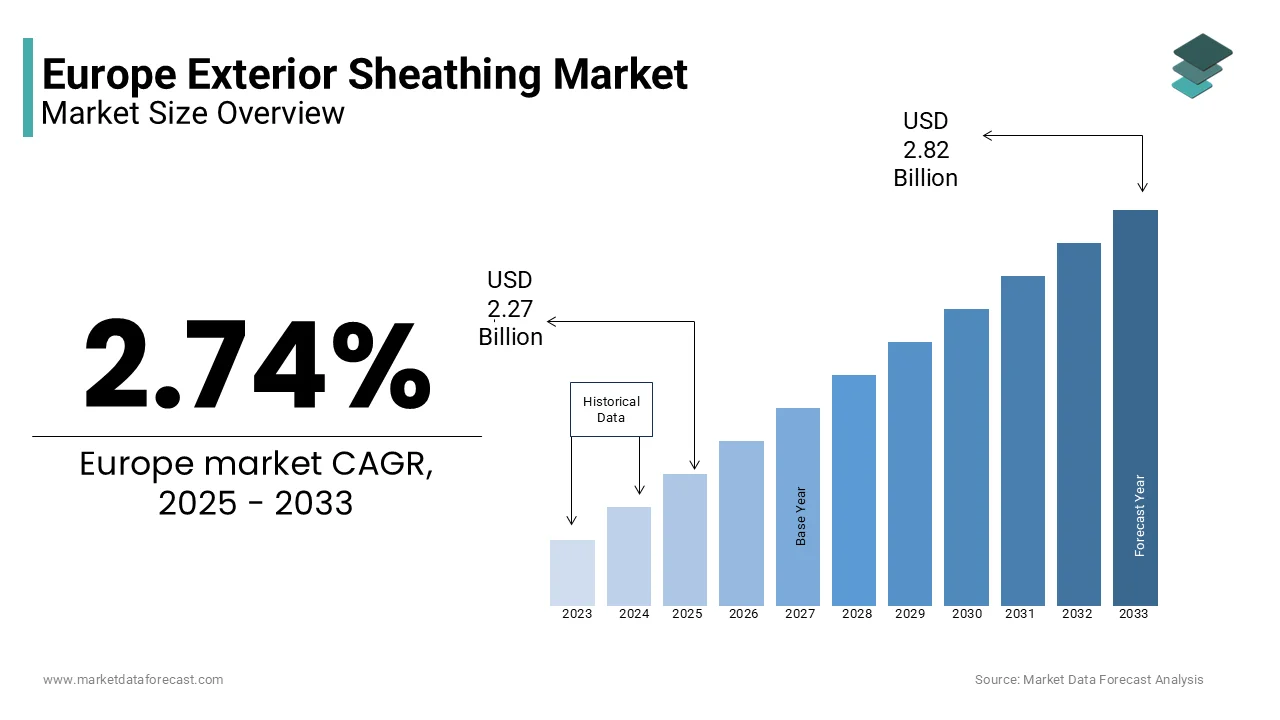

The Europe exterior sheathing market size was valued at USD 2.21 billion in 2024. The European market size is estimated to be worth USD 2.82 billion by 2033 from USD 2.27 billion in 2025, growing at a CAGR of 2.74% from 2025 to 2033.

The Europe exterior sheathing market demonstrates a robust presence with the region's emphasis on sustainable construction practices and energy-efficient building designs. Exterior sheathing is playing a pivotal role in enhancing structural integrity and thermal insulation. The market is further fueled by stringent EU regulations promoting eco-friendly building materials. Despite economic fluctuations, the market remains resilient with the innovations in material science and growing demand for durable, weather-resistant solutions.

MARKET DRIVERS

Increasing Demand for Energy-Efficient Buildings

The demand for energy-efficient buildings is a primary driver propelling the Europe exterior sheathing market. According to the International Energy Agency (IEA), buildings account for nearly 40% of total energy consumption in Europe, prompting governments to enforce stricter energy performance standards. Exterior sheathing materials, such as OSB and plywood, are integral to achieving superior insulation by reducing energy loss by up to 30%. For instance, Germany’s Energy Saving Ordinance mandates that new constructions must meet specific thermal insulation criteria, boosting the adoption of advanced sheathing solutions. As per a report by the European Insulation Manufacturers Association, the use of exterior sheathing in residential projects has increased by 18% since 2020. Additionally, the European Union’s Renovation Wave initiative aims to renovate 35 million buildings by 2030 is creating a substantial opportunity for sheathing materials.

Urbanization and Infrastructure Development

Urbanization is another factor driving the Europe exterior sheathing market. The European Environment Agency states that urban areas house over 75% of the EU population, necessitating extensive residential and commercial construction. Exterior sheathing plays a vital role in modern construction, offering durability and weather resistance. For example, in 2022, France witnessed a 12% increase in housing starts, primarily driven by government subsidies for affordable housing projects. The versatility of materials like MDF and particleboard, which cater to both aesthetic and functional requirements, has further amplified their adoption.

MARKET RESTRAINTS

High Cost of Advanced Materials

One of the significant restraints affecting the Europe exterior sheathing market is the high cost of advanced materials, which limits accessibility for smaller players and budget-constrained projects. According to PricewaterhouseCoopers (PwC), the average cost of premium sheathing materials, such as OSB and MDF, has increased by 20% over the past three years due to rising raw material prices and supply chain disruptions. For instance, the price of wood-based panels surged during the pandemic was exacerbated by logistical challenges and labor shortages. This price volatility poses a challenge for contractors and developers, particularly in regions like Southern Europe, where economic recovery remains sluggish. Furthermore, the lack of affordable alternatives restricts market penetration in rural areas, where demand for cost-effective solutions is high. These financial barriers hinder widespread adoption is slowing market growth despite increasing demand for sustainable construction practices.

Stringent Environmental Regulations

Stringent environmental regulations also act as a restraint for the Europe exterior sheathing market. While these regulations aim to promote sustainability, they often impose additional compliance costs on manufacturers. According to the European Chemicals Agency (ECHA), companies must adhere to REACH regulations, which require rigorous testing and certification of materials to ensure minimal environmental impact. Such compliance measures can increase production costs by up to 15%, as stated by the European Federation of Building and Woodworkers. For example, the ban on formaldehyde-emitting products has forced manufacturers to invest heavily in R&D to develop eco-friendly alternatives. Additionally, the carbon footprint associated with the production and transportation of sheathing materials has drawn scrutiny from environmental watchdogs. As per a report by the World Wildlife Fund, the construction sector contributes to 39% of global carbon emissions is prompting stricter emission targets. These regulatory pressures, while beneficial in the long term will pose immediate challenges for market players striving to balance profitability with sustainability.

MARKET OPPORTUNITIES

Growing Adoption of Prefabricated Construction

The growing adoption of prefabricated construction presents a lucrative opportunity for the Europe exterior sheathing market. Exterior sheathing materials, such as OSB and plywood, are integral to prefabricated modules, providing structural stability and insulation. For instance, Sweden has emerged as a leader in prefabricated housing, with many single-family homes built using modular techniques. As per the European Construction Industry Federation, prefabricated solutions can reduce construction waste by up to 90% by aligning with the EU’s circular economy goals.

Expansion into Emerging Markets

Expansion into emerging markets within Eastern Europe represents another significant opportunity for the Europe exterior sheathing market. According to the World Bank, countries like Poland, Romania, and Hungary are witnessing rapid urbanization, with urban populations increasing by 5% annually. The shift has spurred demand for affordable housing and infrastructure development is creating a fertile ground for sheathing material suppliers. Similarly, Romania’s government has allocated €29 billion for public investments under the National Recovery and Resilience Plan, further boosting construction activities. The region’s lower labor costs and favorable business environment make it an attractive destination for manufacturers seeking to diversify their operations.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the Europe exterior sheathing market by impacting production timelines and material availability. For instance, the Russia-Ukraine conflict has disrupted timber supplies, as Russia accounted for 15% of Europe’s wood imports prior to the war. This scarcity has forced manufacturers to source materials from alternative regions, often at higher costs. Additionally, rising fuel prices have exacerbated transportation costs will strain profit margins. These disruptions escalate the vulnerability of the market to external shocks with the growing need for diversified sourcing strategies and localized production capabilities to mitigate risks and ensure consistent supply.

Competition from Alternative Materials

Intense competition from alternative materials is another pressing challenge for the Europe exterior sheathing market. The emergence of composite materials and metal-based solutions has intensified rivalry within the construction sector. For example, fiber cement boards and aluminum composites are gaining traction due to their durability and fire-resistant properties, posing a threat to traditional wood-based sheathing materials. Furthermore, advancements in nanotechnology have enabled the development of innovative materials with superior performance attributes is appealing to architects and developers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.74% |

|

Segments Covered |

By Sheathing Type, Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Georgia-Pacific LLC, Huber Engineered Woods LLC, Louisiana-Pacific Corporation (LP Building Solutions), Weyerhaeuser Company, Norbord Inc. (Arauco), Knauf Insulation, CertainTeed Corporation (Saint-Gobain), James Hardie Industries plc, Fermacell GmbH (Xella Group), and others. |

SEGMENT ANALYSIS

By Sheathing Type Insights

Structural exterior sheathing dominated the Europe market by holding prominent share in 2024. The growth of the segment is primarily driven by its critical role in enhancing building stability and load-bearing capacity. The increasing focus on multi-story residential and commercial projects in urban areas, has amplified demand for structural sheathing. For instance, Germany’s construction boom, with over 300,000 housing units approved in 2022, has significantly contributed to this segment’s growth. Additionally, the European Union’s mandate for earthquake-resistant structures in seismic zones has bolstered the adoption of structural sheathing. According to the European Seismic Hazard Model, nearly 20% of Europe’s population resides in high-risk areas by necessitating robust building materials. Furthermore, the segment benefits from advancements in engineered wood products, such as cross-laminated timber (CLT), which offer enhanced strength and sustainability.

The non-structural exterior sheathing segment is likely to experience a CAGR of 8.7% during the forecast period. The growth of the segment can be fueled by the rising demand for aesthetic and weather-resistant solutions in residential renovations and light commercial projects. Additionally, the segment’s compatibility with energy-efficient systems, such as solar panels and green roofs, aligns with Europe’s sustainability goals. According to the European Insulation Manufacturers Association, non-structural sheathing reduces heat loss by up to 25% is making it a preferred choice for eco-conscious builders. Moreover, innovations in composite materials, including fiber-reinforced polymers, have expanded the segment’s application scope. These advancements, coupled with supportive government policies, position non-structural sheathing as a key growth driver in the coming years.

By Product Type Insights

OSB segment was the largest in the Europe exterior sheathing market by occupying 40.2% of share in 2024 with its cost-effectiveness, versatility, and superior load-bearing capacity by making it a preferred choice for structural applications. The surge in residential construction in Germany and France, has propelled OSB demand, with housing starts increasing every year. Additionally, OSB’s compatibility with modern prefabricated construction methods has further propelled its position. Furthermore, advancements in resin technology have enhanced OSB’s moisture resistance, addressing previous limitations. These factors, combined with supportive EU policies promoting sustainable construction will ensure OSB remains the leading product type in the exterior sheathing market.

The MDF is ascribed to grow with a CAGR of 9.3% during the forecast period. The growth of the segment is attributed with its smooth surface finish and ease of customization, which is making it ideal for non-structural applications. The rise in interior design trends emphasizing aesthetics has increased MDF adoption in wall panelling and decorative facades. Additionally, MDF’s compatibility with digital printing technologies has expanded its appeal among architects and designers. According to the European Panel Federation, the segment’s growth is further supported by innovations in low-formaldehyde variants, aligning with stringent environmental regulations.

By Application Insights

The Wall applications segment dominated the Europe exterior sheathing market with 50.4% of the total share in 2024. The growth of the segment is attributed to the critical role walls play in providing insulation and structural support. The increasing focus on energy-efficient buildings in colder regions like Scandinavia, has amplified demand for high-performance sheathing materials. According to the European Insulation Manufacturers Association, wall sheathing reduces thermal bridging by up to 40% that will enhance energy savings in next coming years. Furthermore, innovations in vapor-permeable membranes have improved wall sheathing’s durability is addressing moisture-related challenges. These factors collectively reinforce the segment’s dominance by ensuring sustained growth across residential and commercial sectors.

The roof applications segment is projected to witness a fastest CAGR of 8.9% in the next foreseen years. The growth of the segment is driven by the rising adoption of green roofs and solar panel installations, which require durable and weather-resistant sheathing materials. For example, Germany’s Renewable Energy Act mandates solar installations on new buildings is boosting roof sheathing demand by 18% annually. Additionally, the segment’s compatibility with lightweight materials, such as OSB, has expanded its application scope. According to the European Construction Technology Platform, roof sheathing enhances wind uplift resistance by 30% by making it indispensable for hurricane-prone regions. Furthermore, advancements in fire-retardant coatings have addressed safety concerns is solely to propel the growth of the segment in next coming years.

REGIONAL ANALYSIS

Germany was the largest contributor in the Europe exterior sheathing market with 22.3% of the share in 2024 owing to a well-established construction sector and stringent energy efficiency regulations. The German government’s funding for energy-saving renovations has significantly increased demand for high-performance sheathing materials. According to the Federal Ministry for Economic Affairs and Climate Action, over 40% of buildings in Germany are being retrofitted with advanced insulation solutions is propelling the adoption of structural and non-structural sheathing. Additionally, Germany’s robust manufacturing ecosystem ensures a steady supply of premium materials like OSB and MDF by making it a hub for innovation and quality in the region.

Spain is more likely to witness a CAGR of 10.5% during the forecast period. This rapid growth is driven by urbanization and large-scale infrastructure project. The plan prioritizes sustainable housing and green building initiatives, creating significant opportunities for exterior sheathing materials. For instance, the surge in solar panel installations on residential rooftops has amplified demand for durable roof sheathing. Furthermore, Spain’s focus on earthquake-resistant construction in regions like Andalusia has bolstered the adoption of structural sheathing solutions that is ensuring long-term market expansion.

France, Italy, and the UK are expected to exhibit steady growth, supported by government-led initiatives. France’s eco-loan scheme for energy-efficient renovations, has spurred demand for wall and roof sheathing, as per the French Environment and Energy Management Agency. Italy’s Superbonus program, which provides tax deductions of up to 110% for energy-saving upgrades, has similarly driven market expansion. Meanwhile, the UK’s £5 billion Home Upgrade Grant is accelerating the adoption of sheathing materials in residential retrofitting projects, particularly in London and Manchester. These initiatives ensure consistent demand across these regions, positioning them as key contributors to market growth.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Georgia-Pacific LLC, Huber Engineered Woods LLC, Louisiana-Pacific Corporation (LP Building Solutions), Weyerhaeuser Company, Norbord Inc. (Arauco), Knauf Insulation, CertainTeed Corporation (Saint-Gobain), James Hardie Industries plc, Fermacell GmbH (Xella Group) are playing dominating role in the Europe exterior sheathing market.

The Europe exterior sheathing market is highly competitive, characterized by intense rivalry among top players striving to innovate and capture market share. Companies differentiate themselves through advanced technologies, sustainable practices, and tailored solutions for diverse applications. Stora Enso, for example, focuses on bio-based materials, while Kronospan emphasizes cost-effective production methods. The market’s competitive landscape is further shaped by stringent EU regulations, which compel manufacturers to adopt greener practices. Additionally, the rise of prefabricated construction and modular housing has intensified competition to provide materials that meet evolving customer needs. This dynamic environment fosters continuous innovation by ensuring that only the most adaptable players thrive in the long term.

TOP PLAYERS IN THIS MARKET

The Europe exterior sheathing market is dominated by three major players: Stora Enso , Kronospan , and Norbord (a division of West Fraser). Stora Enso leads globally through its innovative product portfolio, including cross-laminated timber (CLT) and OSB. Kronospan follows closely by leveraging its expansive production network across Eastern Europe to cater to both residential and commercial sectors. Norbord specializes in OSB and plywood. These companies have established themselves as leaders by focusing on sustainability, technological advancements, and strategic expansions. Their contributions to the global market are evident in their ability to meet rising demand for eco-friendly and high-performance materials.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe exterior sheathing market employ a range of strategies to maintain their competitive edge. Mergers and acquisitions are a primary focus, enabling companies to expand their production capacities and geographic reach. For instance, Kronospan’s acquisition of smaller manufacturers has strengthened its foothold in emerging markets. Partnerships and collaborations are also prevalent, with Norbord partnering with German firms to enhance its distribution network. Additionally, companies invest heavily in R&D to develop sustainable materials that comply with EU regulations, such as low-formaldehyde MDF and fire-retardant OSB. These strategies not only enhance product portfolios but also align with the growing demand for environmentally friendly solutions.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Stora Enso launched a new line of low-carbon OSB panels designed to reduce carbon emissions by 30%. This move aligns with the European Green Deal and positions the company as a leader in sustainable construction materials.

- In June 2023, Kronospan acquired a Polish manufacturer specializing in MDF production. This acquisition expanded Kronospan’s production capacity and enhanced its ability to serve Eastern European markets.

- In February 2023, Norbord partnered with a German firm to develop fire-retardant OSB panels. This collaboration addressed safety concerns and broadened the material’s application scope in commercial projects.

- In September 2022, Pfleiderer introduced an eco-friendly MDF variant with reduced formaldehyde emissions, meeting REACH compliance standards. This innovation strengthened its position in the non-structural sheathing segment.

- In January 2022, Swiss Krono expanded its production facility in France, increasing its annual output by 20%. This expansion enabled the company to meet rising demand in Western Europe and solidify its market presence.

MARKET SEGMENTATION

This research report on the Europe exterior sheathing market is segmented and sub-segmented into the following categories.

By Sheathing Type

- Structural Exterior Sheathing

- Non-Structural Exterior Sheathing

By Product Type

- OSB (Oriented-Strand Board)

- Plywood

- Particle Board

- Medium Density Fibreboard (MDF)

- Others

By Application

- Wall

- Roof

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the Europe exterior sheathing market size forecast for 2025 and 2033?

The market is estimated to be worth USD 2.27 billion in 2025 and is projected to reach USD 2.82 billion by 2033, growing at a CAGR of 2.74% from 2025 to 2033

2. What are the key drivers of market growth?

Growth is driven by increasing demand for energy-efficient and sustainable buildings, stringent building codes, urbanization, and a focus on affordable housing.

3. Which countries are major contributors to the Europe exterior sheathing market?

Germany, France, and the United Kingdom are leading contributors due to their robust construction industries and investments in infrastructure.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]