Europe Excavators Market Size, Share, Trends & Growth Forecast Report – Segmented By Machinery Type (Excavator, Loader), Drive Type (Hydraulic, Electric) By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

European Excavators Market Size

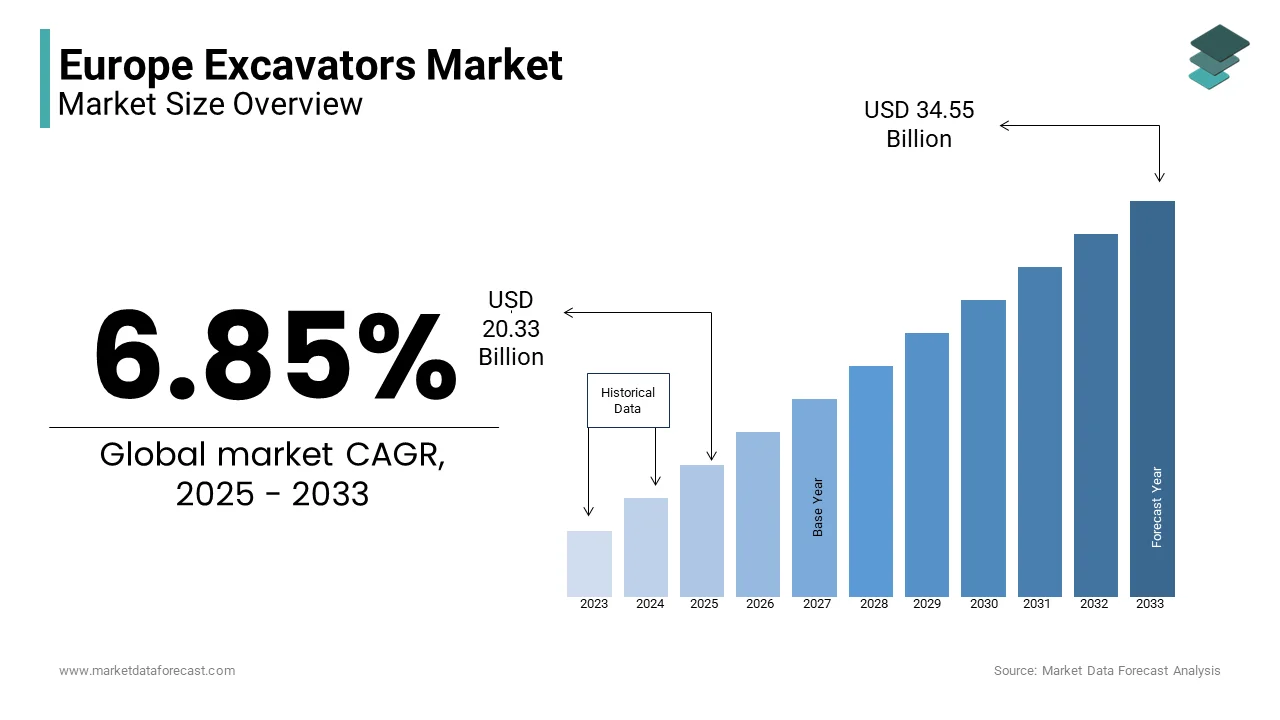

The European excavators market size was valued at USD 19.03 billion in 2024 and is anticipated to reach USD 20.33 billion in 2025 from USD 34.55 billion by 2033, growing at a CAGR of 6.85% during the forecast period from 2025 to 2033.

Excavators are versatile earthmoving machines equipped with hydraulic systems and are essential for digging, lifting, grading, and material handling tasks. The European excavators market is significantly favoured by growing infrastructure investments and urbanization. The European Investment Bank reported that infrastructure spending in the EU reached €60 billion in 2023, with major allocations to transportation, renewable energy projects, and urban development. Such investments drive demand for excavators capable of handling complex and large-scale tasks. Sustainability is also contributing to the regional market expansion as manufacturers focusing on electric and hybrid models to meet stringent EU emission regulations under the Green Deal initiative. For instance, compact electric excavators, which emit zero on-site emissions, are gaining traction in urban construction projects. Key market participants in Europe such as Caterpillar, Volvo Construction Equipment, and JCB, dominate the market by introducing advanced technologies such as telematics, automation, and AI-enabled controls to improve efficiency and reduce operational costs.

MARKET DRIVERS

Rising Infrastructure Development Across Europe

The increasing focus on infrastructure development is a significant driver of the European excavator market. Governments across the region are investing heavily in projects such as transportation networks, renewable energy facilities, and urban regeneration. According to the European Investment Bank, infrastructure financing in the EU reached €60 billion in 2023, with significant allocations to road construction and public transport upgrades. Excavators are essential in these projects for activities such as earthmoving, grading, and trenching. For instance, large-scale rail projects like the Rail Baltica initiative and urban development schemes in cities like Paris and Berlin are contributing to the growing demand for advanced excavators, including those equipped with GPS and automation technologies for precision work.

Shift Towards Sustainable and Electric Equipment

The shift towards sustainable and low-emission machinery is propelling the European excavator market. The European Green Deal’s commitment to carbon neutrality by 2050 has driven the adoption of electric and hybrid excavators, which align with strict emission standards. The European Environment Agency reported that non-road mobile machinery, including excavators, accounted for 15% of total transport emissions in 2022, prompting regulatory measures. Manufacturers are responding by introducing battery-powered compact excavators for urban projects and hybrid models for large-scale operations. For example, Volvo Construction Equipment recorded a 20% increase in sales of electric excavators in 2023, reflecting the growing preference for eco-friendly solutions in both public and private sectors.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

The high upfront costs and maintenance expenses associated with excavators are significant restraints in the European market. Advanced excavators, particularly those equipped with hybrid or electric systems, are substantially more expensive than traditional models. According to the European Investment Bank, the average cost of a medium-sized excavator ranges from €100,000 to €300,000, with electric models costing up to 25% more. Additionally, maintenance expenses, including hydraulic system repairs and battery replacements for electric excavators, add to operational costs. These financial challenges limit the adoption of newer models, particularly among small and medium-sized enterprises, which account for 99% of Europe’s construction sector, as reported by Eurostat. This hinders market growth in price-sensitive segments.

Volatility in Raw Material Prices

The fluctuating prices of raw materials, such as steel and aluminum, pose a challenge to the European excavator market. These materials are integral to the manufacturing of excavators, and their price volatility impacts production costs and profitability. The World Steel Association reported that European steel prices increased by 30% in 2022 due to supply chain disruptions and geopolitical tensions, including the Russia-Ukraine conflict. Such increases have led to higher equipment prices, which can deter potential buyers. Furthermore, prolonged supply chain issues, as reported by the European Commission, have caused delays in component availability, slowing down production and delivery timelines, thus impacting the overall growth of the excavator market.

MARKET OPPORTUNITIES

Growing Demand for Compact and Mini Excavators

The increasing preference for compact and mini excavators in urban construction and landscaping projects presents a significant opportunity for the European excavator market. These machines are valued for their maneuverability, low operating costs, and suitability for confined spaces, such as city construction sites. According to Eurostat, urban areas account for over 75% of Europe’s population as of 2022, driving demand for infrastructure and residential developments. Compact excavators are especially popular in countries with dense urbanization, like the Netherlands and Switzerland. The European Equipment Manufacturers Association reported a 15% year-over-year increase in sales of mini excavators in 2023, reflecting this growing demand. Manufacturers can capitalize on this trend by offering advanced, fuel-efficient, and electric compact models.

Integration of Automation and Telematics Technologies

The integration of automation and telematics technologies in excavators represents a transformative opportunity for the European market. These advancements improve operational efficiency, enhance safety, and reduce costs through features like GPS-guided systems, remote monitoring, and autonomous functions. The European Commission reported in 2023 that construction companies adopting digital solutions saw a 20% reduction in project completion times. Furthermore, telematics-enabled excavators allow operators to track fuel usage, maintenance needs, and equipment performance in real time, aligning with the region's push for smart construction practices. Leading manufacturers, such as Caterpillar and Volvo Construction Equipment, are actively developing intelligent excavators to cater to this demand, positioning themselves to benefit from the growing digitalization of the construction industry.

MARKET CHALLENGES

Labor Shortages and Skill Gaps in Equipment Operation

The European excavator market faces a significant challenge due to labor shortages and skill gaps in operating advanced machinery. Modern excavators often feature technologies like automation and telematics, requiring specialized training for operators. According to the European Centre for the Development of Vocational Training (Cedefop), the EU construction sector experienced a 15% decline in skilled workers between 2015 and 2022, exacerbating this issue. These shortages result in delays in project completion and underutilization of technologically advanced excavators. Smaller firms, in particular, struggle to invest in training programs, further limiting the adoption of high-tech equipment. Addressing this challenge will require collaborative efforts between governments, manufacturers, and training institutions to improve workforce capabilities.

Stringent Emission Regulations and Compliance Costs

Stringent emission regulations across Europe pose a challenge to the excavator market, as manufacturers must invest heavily in research and development to meet these standards. The European Green Deal and Stage V emissions standards require non-road mobile machinery, including excavators, to significantly reduce particulate matter and nitrogen oxide emissions. According to the European Environment Agency, compliance costs for emissions standards have increased by 25% since 2020, raising the production costs of advanced, eco-friendly excavators. These costs are often passed on to customers, making new models less accessible for smaller companies. Additionally, delays in regulatory certification processes can slow the launch of compliant machinery, impacting manufacturers’ ability to meet market demand.

REGIONAL ANALYSIS

Germany had the leading share of the European excavator market in 2024 due to its advanced construction sector, robust infrastructure investments, and focus on adopting sustainable technologies. The German Federal Statistical Office reported that infrastructure projects accounted for €150 billion in 2023, driving demand for high-performance excavators. The country’s focus on renewable energy projects, such as wind farms and solar installations, further fuels demand for specialized excavators. Germany is also home to leading manufacturers like Liebherr and Wirtgen Group, which consistently introduce innovative, eco-friendly models.

The United Kingdom is one of the key regional markets for excavators in the European market. The significant housing and infrastructure projects in the UK is majorly driving the UK market growth. According to the UK Department for Transport, £24 billion was allocated in 2023 for road and rail upgrades, requiring advanced excavators for earthmoving and grading tasks. The UK’s strong rental equipment market also supports the high utilization of excavators. Manufacturers like JCB dominate the market by offering versatile and technologically advanced machinery.

France is anticipated to account for a substantial share of the European excavator market during the forecast period due to extensive urban renewal projects and sustainability initiatives. The French Ministry of Ecological Transition reported that €40 billion was allocated to urban infrastructure upgrades in 2023, including public transportation and residential developments. France’s commitment to reducing emissions has spurred the adoption of electric and hybrid excavators, aligning with EU regulatory goals. Market leaders like Caterpillar and Volvo have a strong presence in France, further bolstering its position.

KEY MARKET PLAYERS

Caterpillar Inc., Komatsu Corp., Liebherr Group, Volvo Construction Equipment, Deere & Company, Hyundai Construction Equipment. These are the market players that are dominating the Europe excavators market.

MARKET SEGMENTATIONS

This research report on the Europe excavators market is segmented and sub-segmented int the following categories.

By Machinery Type

- Excavator

- Loader

By Drive Type

- Hydraulic

- Electric

- Hybrid

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size od the Europe excavators market?

The current market size of the europe excavators market was valued at USD 20.33 billion in 2025

What market drivers are driving the Europe excavators market?

Rising Infrastructure Development Across Europe and Shift Towards Sustainable and Electric Equipment are the market drivers in the Europe excavators market

Who are the market players that are dominating the Europe excavators market?

Caterpillar Inc., Komatsu Corp., Liebherr Group, Volvo Construction Equipment, Deere & Company, Hyundai Construction Equipment. These are the market players that are dominating the Europe excavators market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]