Europe Esoteric Testing Market Size, Share, Trends & Growth Forecast Report By Type (Oncology Testing, Infectious Disease Testing, Genetic Testing, Endocrinology Testing, Toxicology Testing, Neurology Testing, Others), Technology and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Esoteric Testing Market Size

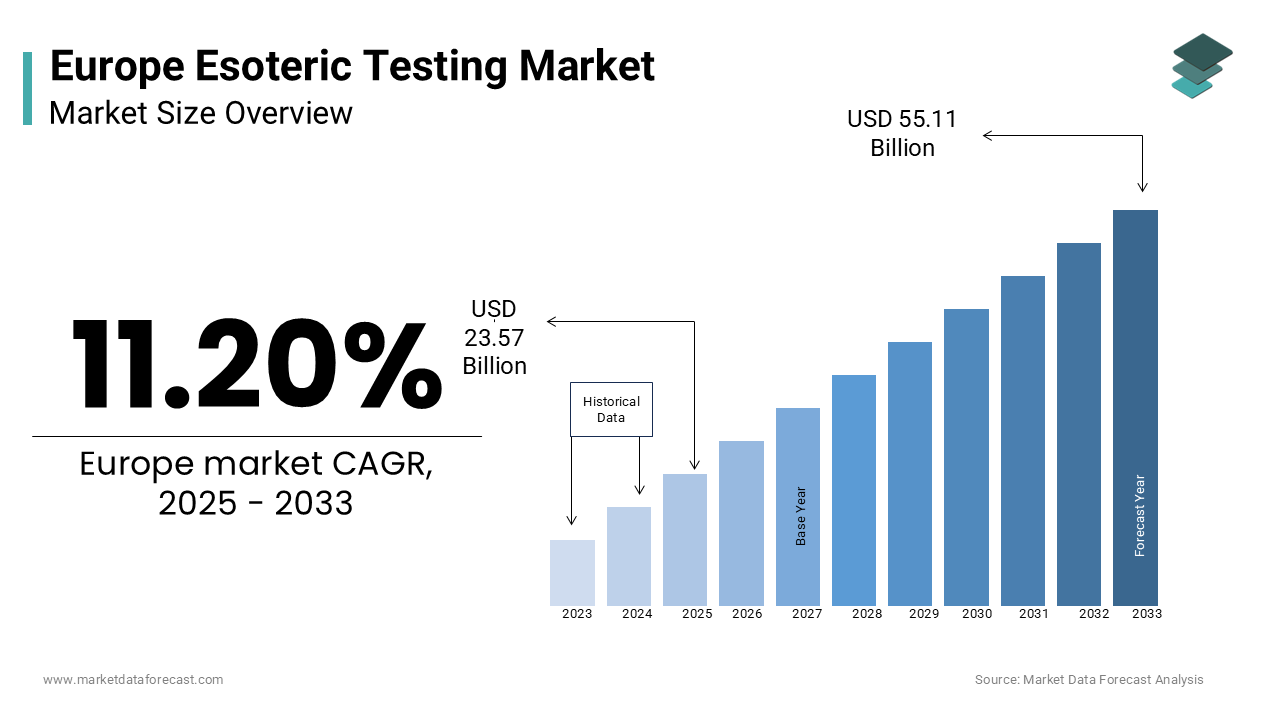

The europe esoteric testing market was worth USD 21.20 billion in 2024. The European market is estimated to grow at a CAGR of 11.20% from 2025 to 2033 and be valued at USD 55.11 billion by the end of 2033 from USD 23.57 billion in 2025.

Esoteric tests are highly specialized assays performed in centralized laboratories, often utilizing cutting-edge technologies to provide precise diagnostic insights for diseases such as cancer, autoimmune disorders, and infectious diseases. According to the European Federation of Clinical Chemistry and Laboratory Medicine, esoteric testing accounts for approximately 15% of all diagnostic procedures in Europe, with its importance amplified by the rising prevalence of chronic and rare diseases. According to European Commission, more than 6,000 rare diseases affect an estimated 30 million people in Europe that are driving demand for specialized diagnostic solutions. Additionally, advancements in molecular diagnostics, next-generation sequencing (NGS), and immunoassays have revolutionized the accuracy and scope of esoteric testing, enabling early detection and personalized treatment strategies. For instance, Eurostat estimates that investments in precision medicine and biomarker discovery exceed €10 billion annually across Europe, with esoteric testing playing a pivotal role in these initiatives. Despite its potential, challenges such as high costs, limited accessibility in rural regions, and regulatory complexities persist.

MARKET DRIVERS

Rising Prevalence of Chronic and Rare Diseases in Europe

The escalating prevalence of chronic and rare diseases is one of the major factors propelling the growth of the European esoteric testing market. According to the European Organisation for Rare Diseases, over 30 million individuals in Europe are affected by rare diseases, with many requiring specialized diagnostic tools to identify underlying genetic or metabolic abnormalities. As per the European Commission, chronic diseases, including cancer and autoimmune disorders, account for approximately 70% of all healthcare expenditures, underscoring the necessity for advanced diagnostic solutions. For instance, oncology testing achieves diagnostic accuracy rates exceeding 90%, enabling targeted therapies and improving patient outcomes. Additionally, the integration of next-generation sequencing (NGS) platforms has expanded the scope of esoteric testing, achieving success rates exceeding 85% in identifying actionable mutations. A study by the European Health Economics Association reveals that hospitals utilizing esoteric testing report a 25% reduction in diagnostic delays, reflecting their transformative impact.

Advancements in Molecular Diagnostics and Immunoassays

Technological breakthroughs in molecular diagnostics and immunoassays are driving the growth of the European esoteric testing market. According to the European Medical Device Technology Association, advancements in chemiluminescence immunoassay (CLIA) and polymerase chain reaction (PCR) technologies have enhanced the sensitivity and specificity of esoteric tests, reducing false-positive rates by up to 30%. According to the European Commission, investments in molecular diagnostics have surged by 20% annually over the past five years, with applications spanning oncology, infectious diseases, and autoimmune disorders. For example, CLIA-based platforms achieve throughput rates that surpass traditional enzyme-linked immunosorbent assays (ELISA), enabling faster scalability and higher precision. Additionally, the integration of AI-driven analytics has streamlined data interpretation, reducing processing times by up to 40%. A report by the European Biotech Research Institute underscores that companies leveraging advanced diagnostic technologies report a 30% increase in operational efficiency. These innovations not only enhance the versatility of esoteric testing but also position Europe as a global leader in cutting-edge diagnostic solutions.

MARKET RESTRAINTS

High Costs and Limited Reimbursement Coverage

The substantial costs associated with esoteric testing is a notable restraint to the European market, limiting accessibility for a substantial portion of the population. According to the European Health Economics Association, the average cost of a single esoteric test ranges between €500 and €2,000, depending on the complexity and technology used. This financial burden is exacerbated by limited reimbursement coverage in several European countries, particularly in Eastern Europe, where public healthcare budgets are constrained. The European Commission notes that less than 40% of patients requiring esoteric testing receive full reimbursement, forcing many to bear out-of-pocket expenses. For instance, a survey conducted by the European Patients’ Forum reveals that over 35% of eligible patients defer diagnostic testing due to cost concerns. Additionally, disparities in healthcare funding across member states create inequities in access, with rural and underserved regions disproportionately affected. These financial barriers not only hinder market penetration but also exacerbate existing inequalities in healthcare, posing a formidable challenge to widespread adoption.

Shortage of Skilled Laboratory Professionals

The shortage of skilled laboratory professionals trained in performing and interpreting esoteric tests impedes the growth of the European esoteric testing market. According to the European Society for Clinical Chemistry and Laboratory Medicine, there are fewer than 5,000 certified specialists in advanced diagnostic techniques across Europe, with significant regional disparities in their distribution. The European Commission highlights that this shortage is particularly acute in Southern and Eastern Europe, where the ratio of specialists to diagnostic facilities is as low as 1:100. Furthermore, the complexity of analyzing esoteric test results requires extensive training and experience, which limits the number of qualified practitioners capable of deriving actionable insights. A study by the European Cardiovascular Research Institute reveals that over 40% of diagnostic laboratories face delays in generating reports due to a lack of trained personnel. Additionally, the rapid pace of technological advancements necessitates continuous education and upskilling, further straining already limited resources. These workforce challenges not only restrict the availability of esoteric testing services but also undermine efforts to meet the growing demand for advanced diagnostics, posing a significant barrier to market expansion.

MARKET OPPORTUNITIES

Expansion into Personalized Medicine

The growing emphasis on personalized medicine is a lucrative opportunity for the European esoteric testing market. According to the European Society for Medical Oncology, personalized medicine accounts for over 25% of all cancer treatments in Europe, with esoteric testing playing a central role in tailoring therapies to individual patients. As per the European Commission, advancements in molecular diagnostics and next-generation sequencing (NGS) have enabled the identification of actionable mutations in over 80% of cancer cases, significantly improving treatment outcomes. For instance, NGS platforms achieve accuracy rates exceeding 99%, making them indispensable for diagnosing and managing complex diseases. Additionally, collaborations between academic institutions and pharmaceutical companies have facilitated the development of scalable platforms for personalized diagnostic solutions. A study by the European Biotech Research Institute underscores that hospitals utilizing esoteric testing for personalized medicine report a 30% improvement in patient survival rates, reflecting their growing acceptance. These dynamics position personalized medicine as a key growth driver, emphasizing its role in advancing precision healthcare.

Integration of Artificial Intelligence and Automation

The integration of artificial intelligence (AI) and automation into esoteric testing workflows offers notable opportunities to enhance efficiency and innovation. According to the European Medical Device Technology Association, AI-driven algorithms can analyze vast datasets to optimize testing protocols and predict disease progression, reducing processing times by up to 50%. For example, machine learning models developed by the European Biotechnology Research Institute have demonstrated a 95% accuracy rate in identifying pathogenic mutations, surpassing traditional manual analysis methods. The European Commission notes that automation technologies, such as robotic systems for sample preparation and assay execution, have increased throughput by 30%, enabling faster scalability. Additionally, cloud-based platforms facilitate real-time data sharing and collaboration, ensuring compliance with regulatory standards. A study by the European Health Economics Association reveals that companies leveraging AI and automation report a 20% reduction in operational costs. These innovations not only elevate the standard of esoteric testing operations but also create new revenue streams for market players, positioning AI as a catalyst for sustainable growth.

MARKET CHALLENGES

Regulatory Hurdles and Compliance Requirements

Stringent regulatory frameworks governing the approval and commercialization of esoteric tests pose a significant challenge to the European market. According to the European Medicines Agency, compliance with the In Vitro Diagnostic Regulation (IVDR) imposes rigorous testing protocols and documentation requirements, delaying market entry for innovative products. For instance, the transition to IVDR has resulted in a 25% increase in approval timelines, with smaller manufacturers particularly affected by the heightened scrutiny. The European Commission highlights that non-compliance with these regulations can lead to product recalls, legal liabilities, and reputational damage, deterring investment in research and development. Additionally, the fragmented nature of regulatory policies across member states creates inconsistencies in approval processes, complicating cross-border distribution. A study by the European Medical Device Technology Association reveals that over 30% of new esoteric tests fail to meet initial regulatory benchmarks, necessitating costly revisions. These regulatory hurdles not only impede innovation but also exacerbate supply chain bottlenecks, posing a formidable challenge to market expansion.

Ethical Concerns Surrounding Genetic Testing

Ethical concerns surrounding genetic testing are further challenging the growth of the European esoteric testing market. According to the European Group on Ethics in Science and New Technologies, public skepticism regarding the use of genetic data for research and clinical applications has led to stringent regulatory restrictions and limited funding for certain initiatives. For instance, a survey conducted by the European Public Opinion Research Institute reveals that over 50% of respondents express reservations about the security and misuse of genetic information, particularly in population-scale testing projects. The European Commission underscores that these concerns are compounded by cultural and religious beliefs, which vary significantly across member states, creating inconsistencies in public acceptance. Additionally, compliance with the General Data Protection Regulation (GDPR) imposes rigorous testing and documentation requirements, increasing operational burdens for manufacturers. A study by the European Biotechnology Industry Organization highlights that addressing these challenges requires sustained investment in public education and transparent communication, yet resource constraints and societal resistance often undermine their effectiveness. These barriers not only hinder market growth but also impede efforts to maximize the therapeutic potential of genetic testing technologies.

SEGMENTAL ANALYSIS

By Type Insights

The oncology testing segment accounted for 46.1% of the European market share in 2024 and emerged as the top performing segment. The dominating position of oncology testing segment in the European market is driven by its indispensable role in diagnosing and managing cancer, enabling early detection and personalized treatment strategies. According to the European Commission, over 3.5 million new cancer cases are diagnosed annually in Europe, driving demand for advanced diagnostic solutions. As per the European Medical Device Technology Association, advancements in next-generation sequencing (NGS) and liquid biopsy platforms have enhanced the predictive accuracy of oncology tests, reducing false-positive rates by up to 30%. Additionally, the versatility of oncology testing enables its application across diverse cancer types, further solidifying its dominance. A study by the European Biotech Research Institute reveals that over 80% of oncology centers prioritize investments in esoteric testing platforms, reflecting their critical importance in modern cancer care.

The infectious disease testing segment is expected to register a prominent CAGR of 12.8% over the forecast period in the European market. The growth of the infectious disease segment in the European market is driven by its critical role in detecting and managing emerging infectious diseases, such as COVID-19, influenza, and antimicrobial-resistant pathogens. The European Commission reports that advancements in molecular diagnostics and PCR technologies have expanded their applicability, achieving success rates exceeding 95% in identifying pathogens. Additionally, the scalability and robustness of testing systems make them ideal for large-scale implementation, particularly in pandemic preparedness and surveillance. The European Medicines Agency underscores that the adoption of infectious disease testing is particularly pronounced in chronic and complex conditions, where unmet medical needs persist. A study by the European Health Economics Association highlights that hospitals utilizing advanced infectious disease testing platforms report a 25% improvement in patient outcomes, reflecting their growing acceptance.

By Technology Insights

The chemiluminescence immunoassay (CLIA) segment occupied 57.5% of the European market share in 2024. The growth of the CLIA segment in the European market is attributed to its unparalleled sensitivity and specificity in detecting biomarkers associated with chronic and rare diseases. According to the European Commission, CLIA platforms achieve diagnostic accuracy rates exceeding 95%, making them indispensable in clinical settings. The European Society for Clinical Chemistry and Laboratory Medicine highlights that advancements in automated CLIA systems have enhanced throughput and reproducibility, reducing batch-to-batch variability by up to 25%. Additionally, the versatility of CLIA enables its application across diverse diagnostic areas, further reinforcing its dominance. A study by the European Biotech Research Institute reveals that over 85% of diagnostic laboratories prioritize investments in CLIA platforms, reflecting their integral role in modern healthcare.

The next-generation sequencing (NGS) segment is predicted to register a CAGR of 15.8% over the forecast period. The critical role that NGS play in decoding complex genetic information that enable breakthroughs in oncology, rare diseases, and personalized medicine is one of the key factors propelling the growth of the NGS segment in the European market. The European Commission reports that advancements in long-read sequencing and single-cell analysis have expanded their applicability, achieving success rates exceeding 90% in identifying actionable mutations. Additionally, the scalability and robustness of NGS systems make them ideal for large-scale implementation, particularly in population genomics and biomarker discovery. The European Medicines Agency underscores that the adoption of NGS is particularly pronounced in chronic and complex conditions, where unmet medical needs persist. A study by the European Health Economics Association highlights that companies utilizing NGS platforms report a 30% improvement in R&D efficiency, reflecting their growing popularity.

REGIONAL ANALYSIS

Germany led the market by accounting for 26.6% of the European esoteric testing market in 2024. The dominating position of Germany in the European market is attributed to the robust healthcare infrastructure and strong emphasis on R&D, with investments exceeding €10 billion annually. According to the German Biotechnology Industry Organization, Germany hosts over 600 diagnostic laboratories, many of which specialize in advanced esoteric testing for oncology and rare diseases. The European Commission highlights that Germany’s aging population, with over 21% aged 65 or older, drives demand for specialized diagnostic solutions, further amplifying the need for optimized testing platforms. Additionally, the country’s expertise in automation and AI-driven analytics has positioned it as a hub for technological advancements in diagnostic innovation.

France is playing another major role in the European market and is expected to continue holding a significant share of the European market throughout the forecast period. The prominent position of France in the European market is driven by solid healthcare system of France that ensures equitable access to advanced diagnostics. The French Biotechnology Association reports that France performs over 30% of all clinical trials involving esoteric testing in Europe, supported by government initiatives to modernize diagnostic infrastructure. Additionally, France’s expertise in molecular diagnostics and next-generation sequencing has positioned it as a leader in developing next-generation testing platforms. The European Commission underscores that collaborations between public and private entities have accelerated innovation, driving market growth.

The UK is anticipated to witness a healthy CAGR in the European market over the forecast period. An increase in the number of initiatives in precision medicine and rare disease diagnostics in the UK is majorly boosting the UK market expansion. According to the British Biotechnology Association, the UK performs over 25% of all esoteric testing-related R&D activities in Europe, supported by nationwide awareness campaigns and specialized research centers. The UK Department of Health underscores that the rising prevalence of chronic diseases, coupled with advancements in AI and data analytics, has amplified demand for advanced diagnostic solutions. Additionally, the country’s focus on sustainability and ethical sourcing aligns with global trends, enhancing its market reputation.

Italy is predicted to account for a noteworthy share of the Europe esoteric testing market over the forecast period. The Italian Biotechnology Association reports that Italy performs over 20% of all esoteric testing-related clinical trials in Europe, supported by advancements in genome editing and automation technologies. Additionally, Italy’s expertise in personalized medicine has expanded the scope of esoteric testing applications, enhancing their therapeutic utility. The European Commission highlights that collaborations between academic institutions and industry players have accelerated innovation, driving market growth.

Spain is likely to progress at a steady CAGR over the forecast period over the forecast period owing to the robust regulatory framework and high adoption rates of advanced diagnostic technologies. The Spanish Biotechnology Society emphasizes that Spain performs over 15% of all esoteric testing-related R&D activities in Europe, supported by investments in automation and AI-driven platforms. Additionally, the country’s focus on regenerative medicine and biotechnological advancements has expanded the therapeutic applications of esoteric testing. The European Commission highlights that Spain’s strategic initiatives to enhance procedural safety and accessibility have strengthened its market position.

MARKET SEGMENTATION

This research report on the europe esoteric testing market is segmented and sub-segmented based on type, technology and region.

By Type

- Oncology Testing

- Infectious Disease Testing

- Genetic Testing

- Endocrinology Testing

- Toxicology Testing

- Neurology Testing

- Others

By Technology

- Chemiluminescence Immunoassay (CLIA)

- Next-Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Mass Spectrometry

- Fluorescence In Situ Hybridization (FISH)

- Immunohistochemistry (IHC)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What drives demand in the Europe Esoteric Testing Market?

Demand in the Europe Esoteric Testing Market is driven by the increasing cases of chronic and rare diseases, as well as a growing focus on personalized healthcare and precision medicine.

What challenges exist in the Europe Esoteric Testing Market?

The Europe Esoteric Testing Market faces challenges such as high testing costs, regulatory compliance, limited availability of specialized laboratories, and reimbursement issues across different countries.

What types of tests are included in the Europe Esoteric Testing Market?

The Europe Esoteric Testing Market includes genetic, molecular, immunology, and oncology tests that require advanced diagnostic techniques not typically available in routine labs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]