Europe Environmental Testing Market Size, Share, Trends & Growth Forecast Report By Contaminant (Heavy Metal, Microbiological, Organic, Residue And Solids), Sample (Effluent, Water, Soil, Air), Technology (Rapid Method And Conventional Method) And By Country (U.K France, Germany, Spain, Italy, Sweden, Russia and Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 To 2033

Europe Environmental Testing Market Size

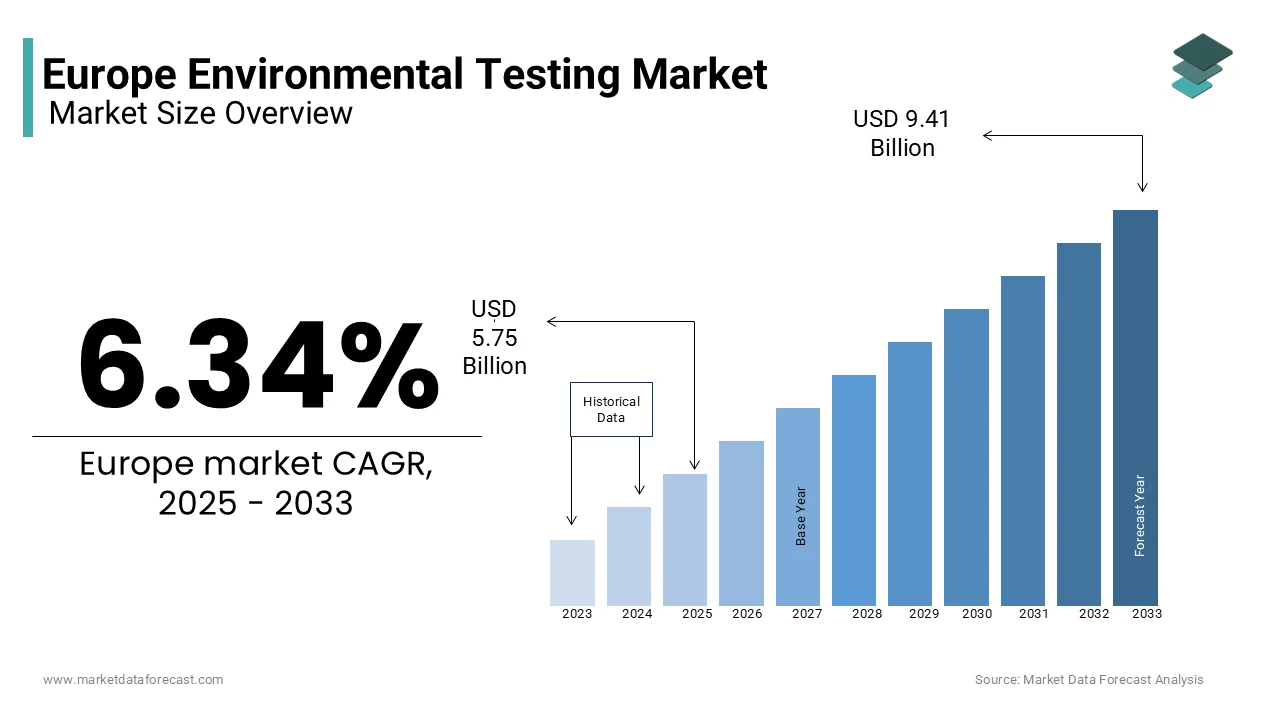

The environmental testing market size in Europe was valued at USD 5.41 billion in 2024. The European market size is further is expected to be worth USD 5.75 billion in 2025 from USD 9.41 billion by 2033, growing at a CAGR of 6.34% during the forecast period from 2025 to 2033.

Ecological testing refers to the analysis of various environmental media such as soil, water, air, and waste to identify contaminants and ensure compliance with environmental regulations, and safeguard public and ecological health. The process involves a range of methodologies, including physical, chemical, and microbiological testing, designed to detect pollutants and evaluate environmental safety.

In Europe, the growing concerns about pollution, climate change, and biodiversity loss are boosting the need for environmental testing. This region has established some of the most stringent environmental standards globally and reflected in initiatives such as the European Green Deal and the Waste Framework Directive. These regulations emphasize the importance of monitoring environmental conditions to mitigate risks to human health and ecosystems.

MARKET DRIVERS

Stringent Environmental Regulations

The European Union has implemented rigorous environmental policies to protect public health and the environment. For instance, the European Green Deal aims to achieve climate neutrality by 2050 and mandates comprehensive monitoring of environmental pollutants. Additionally, the Environmental Impact Assessment Directive requires thorough evaluations of potential environmental effects for certain projects to ensure adherence to environmental standards. These stringent regulations drive the demand for environmental testing services to ensure compliance and mitigate environmental risks.

Public Health Concerns Due to Pollution

Air pollution remains a significant health risk in Europe. According to the European Environment Agency, in 2022, exposure to fine particulate matter (PM2.5) led to approximately 239,000 premature deaths in the EU. Furthermore, 96% of the urban population was exposed to PM2.5 levels exceeding the recommended guidelines by the World Health Organization. These alarming statistics underscore the critical need for environmental testing to monitor and address pollution levels, thereby protecting public health.

MARKET RESTRAINTS

High Operational Costs

Environmental testing requires advanced analytical instruments, skilled technicians and strict adherence to quality standards, all of which incur significant costs. According to the European Commission, compliance with environmental regulations costs businesses over €30 billion annually across the EU. This financial burden disproportionately affects small and medium-sized enterprises (SMEs) and constitute approximately 99% of all businesses in Europe. According to the reports of the European Environment Agency (EEA), SMEs often struggle with the capital-intensive nature of environmental testing services and this limits their ability to implement advanced testing technologies or expand operations.

Complex Regulatory Landscape

The environmental regulations of Europe are among the most intricate globally and frameworks such as the EU REACH legislation (Registration, Evaluation, Authorisation, and Restriction of Chemicals) require compliance across multiple sectors. As per the European Chemicals Agency (ECHA), more than 23,000 substances were registered under REACH as of 2021 and this involves significant data collection and reporting requirements. Regulatory compliance efforts reportedly consume up to 10% of annual revenues for some companies, as per the European Commission. These complexities can lead to delays and additional costs for testing providers and create barriers to market entry and operational efficiency.

MARKET OPPORTUNITIES

Expansion of the Environmental Goods and Services Sector

The environmental goods and services sector (EGSS) in the European Union has demonstrated significant growth and is contributing to the demand for environmental testing services. According to Eurostat, the EGSS's gross value added increased from 2.1% of the EU's GDP in 2010 to 2.5% in 2021, surpassing EUR 315 billion in 2010 prices. This growth is primarily attributed to activities related to renewable energy production, energy efficiency, and waste management. As the sector expands, the need for comprehensive environmental testing to ensure compliance with environmental standards and support sustainable development initiatives is expected to rise.

Job Creation in the Environmental Sector

Employment within the environmental goods and services sector of the EU has been on an upward trajectory, which shows a robust and expanding market. As per the reports of Eurostat, employment in this sector grew from 2.1% of total employment in 2010 to 2.5% in 2021, and the number of full-time equivalent employees reached 5.2 million. This increase is largely due to job creation in renewable energy, energy efficiency, and waste management. The growing workforce in the environmental sector promotes the increasing importance of environmental testing services to support various environmental protection and resource management activities.

MARKET CHALLENGES

Resource Consumption and Waste Generation

The high levels of resource consumption and waste generation in Europe present substantial challenges for environmental testing services. According to the European Environment Agency, the average European uses approximately 14 tonnes of materials annually and generates about 5 tonnes of waste, which ranks among the highest globally and exceeds sustainable limits. This extensive material usage and waste production require comprehensive testing to monitor environmental impacts, resulting in a considerable demand for testing facilities and resources.

Environmental Degradation and Biodiversity Loss

Persistent environmental issues such as biodiversity loss and resource overuse exacerbate the challenges faced by the environmental testing market. According to the "State and Outlook 2020" report of the European Environment Agency, Europe continues to experience significant biodiversity decline and unsustainable resource consumption despite policy measures. These ongoing environmental degradations increase the complexity and scope of testing required and challenge the capacity and capabilities of existing testing infrastructures.

SEGMENTAL ANALYSIS

Based on the sample, the effluent segment held the major share of the European market in 2023, owing to the generation of wastewater in industries.

Based on contamination, the organic contamination segment is projected to have a prominent share of the market during the forecast period due to the health concerns caused by organic contaminants.

Based on technology, the rapid technology segment is likely to account for the largest share of the European market. The rapid technology is quick, accurate, and user-friendly, which is majorly driving segmental growth.

REGIONAL ANALYSIS

Germany dominated the environmental testing market in Europe in 2023. Germany stands as a leader in the environmental economy within the European Union. In 2021, Germany reported substantial gross value added from environmental goods and services, which has shown its commitment to sustainable practices. The robust industrial base and stringent environmental regulations of Germany demand comprehensive testing services to ensure compliance and environmental protection. The emphasis of Germany on renewable energy and waste management further drives the demand for environmental testing and strengthens its leading position in the European market.

France is on the rise in the European market and is anticipated to account for a significant share of the European market during the forecast period. France witnessed significant growth in its environmental economy with notable increases in gross value added from environmental goods and services. The diverse industrial activities and proactive environmental policies of France create a substantial need for environmental testing services. The initiatives of France in renewable energy and resource management contribute to its prominent role in the European environmental testing market.

Italy has shown remarkable progress in its environmental economy, with a significant increase in gross value added from environmental goods and services in 2021. This growth is attributed to Italy's focus on sustainable development and environmental protection. The advancements of Italy in waste management and renewable energy sectors demand extensive environmental testing services and aid the position of Italy in the European market.

KEY MARKET PLAYERS

Eurofins Scientific SE, SGS S.A., Bureau Veritas S.A., Agilent Technologies Inc., Intertek Group PLC, ALS Limited, Romer Labs Diagnostic GmbH, AB Sciex LLC, R J Hill Laboratories Ltd., Suburban Testing Labs, and Asure Quality Limited are some of the notable companies in the Europe environmental testing market.

MARKET SEGMENTATION

This European environmental testing market research report is segmented and sub-segmented into the following categories.

By Sample

- Effluent

- Water

- Oil

- Air

By Contamination

- Microbiological

- Organic

- Heavy metals

- Residues

- Solids

By Technology

- Conventional

- Rapid

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. what is the market current market size of the Europe environmental testing market?

As per the Market Data Forecast report analysis Europe environmental testing market size is expected to reach USD 5.41 Bn in 2025

2. In Europe which country is leading in the environmental testing market?

In Europe environmental testing market, Germany leads the Environmental Testing market, followed by France and U.K

3. who are the market players that are dominating the in the Europe environmental testing market?

Eurofins Scientific SE, SGS S.A., Bureau Veritas S.A., Agilent Technologies Inc., Intertek Group PLC, ALS Limited, Romer Labs Diagnostic GmbH, AB Sciex LLC, R J Hill Laboratories Ltd., Suburban Testing Labs, and Asure quality Limited.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]