Europe Enterprise Networking Market Size, Share, Trends, & Growth Forecast Report By Enterprise Size (Large Enterprises and Small & Medium Enterprises), Industry, Technology, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Enterprise Networking Market Size

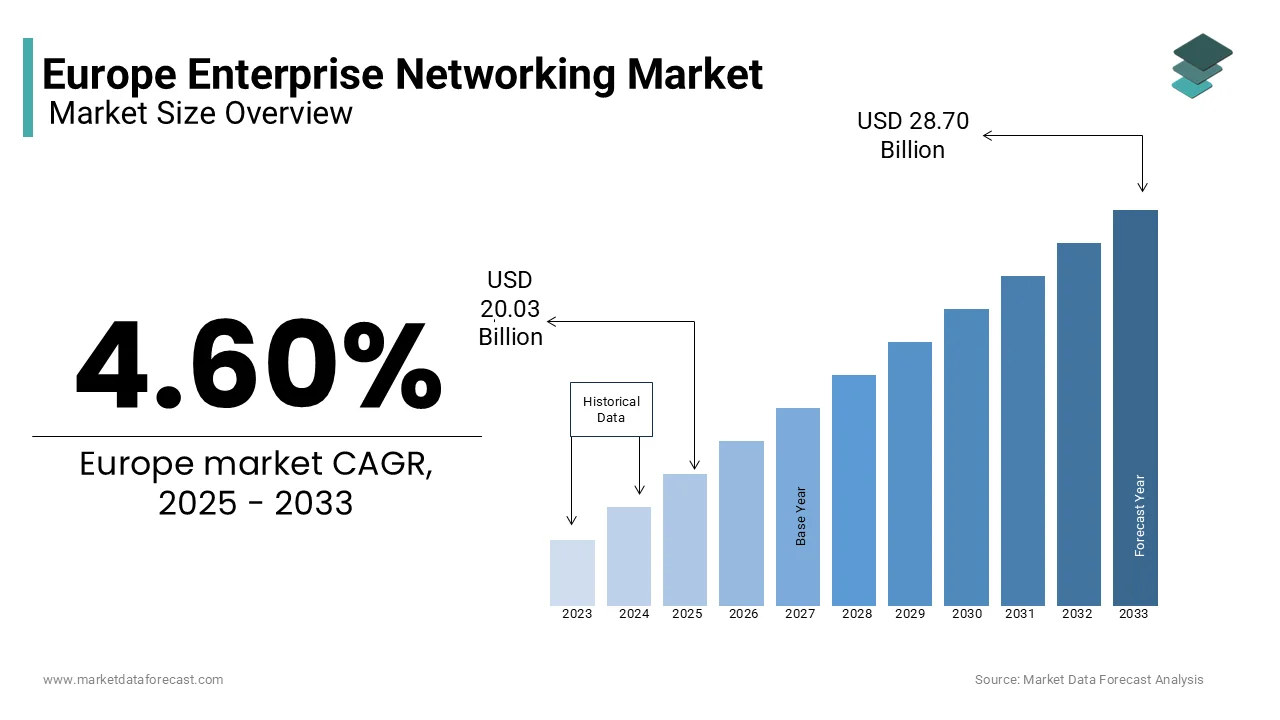

The Europe enterprise networking market was worth USD 19.15 billion in 2024. The European market is projected to reach USD 28.70 billion by 2033 from USD 20.03 billion in 2025, growing at a CAGR of 4.60% from 2025 to 2033.

Enterprise networking encompassing hardware, software and services that facilitate seamless communication, data exchange, and operational efficiency across organizations. Enterprise networking solutions are integral to modern businesses, enabling them to establish robust connectivity frameworks, enhance collaboration, and support digital transformation initiatives. These networks serve as the backbone for industries ranging from finance and healthcare to manufacturing and retail, ensuring secure and scalable infrastructure to meet growing demands.

In Europe, the significant adoption of advanced technologies such as cloud-based networking, Software-Defined Wide Area Networks (SD-WAN) and the integration of Internet of Things (IoT) are boosting the demand for enterprise networking. The European enterprise networking market is likely to have steady growth over the forecast period owing to the increasing investments in hybrid work models and cybersecurity measures. Furthermore, as per the research conducted by IDC, over 60% of European enterprises have prioritized network modernization to accommodate remote workforces and emerging applications like artificial intelligence and machine learning.

Germany, the United Kingdom and France are leading the enterprise networking market in Europe due to their strong industrial bases and high levels of technological adoption. However, emerging economies in Eastern Europe are also witnessing substantial growth owing to the government initiatives promoting digital infrastructure development. The ongoing emphasis on reducing latency, improving bandwidth, and ensuring compliance with stringent data protection regulations underlines the critical role of enterprise networking in shaping Europe’s digital future. According to a study published by Deloitte underscores this trend, noting that nearly 70% of European companies plan to increase their IT budgets specifically for network upgrades in the next two years.

MARKET DRIVERS

Adoption of Cloud Computing and Hybrid Work Models in Europe

The increasing adoption of cloud computing and hybrid work models is a key driver of the Europe enterprise networking market growth. The rapid shift towards remote and hybrid work environments, catalyzed by the COVID-19 pandemic, has created a pressing need for scalable and reliable networking solutions. According to Eurostat, over 40% of European enterprises reported using cloud services in 2022, reflecting a significant rise compared to previous years, with Germany and France at the forefront of this transformation. According to the Digital Economy and Society Index (DESI) of the European Commission, businesses leveraging cloud-based networking achieved a 25% improvement in operational efficiency. Furthermore, the International Data Corporation (IDC) projects that spending on cloud infrastructure in Europe will surpass €60 billion by 2024. This growing reliance on cloud technologies underscores the critical role of advanced networking solutions in enabling seamless connectivity and supporting digital transformation across industries.

Growing Emphasis on Cybersecurity and Data Protection Regulations

The rising focus on cybersecurity and compliance with data protection regulations is another key driver shaping the Europe enterprise networking market. The implementation of the General Data Protection Regulation (GDPR) has compelled organizations to adopt secure networking infrastructures to protect sensitive data. A report by ENISA, the European Union Agency for Cybersecurity, reveals that cyberattacks targeting enterprises surged by 30% in 2022, emphasizing the urgent need for robust network security measures. Additionally, the European Central Bank (ECB) notes that nearly 50% of financial institutions in Europe have upgraded their networking systems to align with regulatory standards. The UK National Cyber Security Centre (NCSC) further reports that businesses investing in secure networking technologies witnessed a 40% reduction in data breaches. These statistics highlight how regulatory compliance and the escalating threat landscape are driving investments in secure enterprise networking solutions, ensuring both data protection and trust in digital ecosystems.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

High cost of implementation and ongoing maintenance poses challenges for small and medium-sized enterprises (SMEs), which is one of the major factors restraining the European market growth. Advanced networking solutions, including SD-WAN, IoT integration, and cloud-based infrastructures, require substantial upfront investments in hardware, software, and skilled personnel. According to a report by the European Investment Bank (EIB), nearly 45% of SMEs in Europe cite budget limitations as a major barrier to adopting cutting-edge networking technologies. Additionally, Eurostat data indicates that only 20% of SMEs in Eastern Europe have fully transitioned to modern networking systems due to financial constraints. The UK Office for National Statistics (ONS) highlights that IT-related expenditures account for approximately 15% of total operational costs for SMEs, limiting their ability to invest in advanced solutions. These financial barriers hinder widespread adoption, particularly among smaller firms, slowing overall market growth.

Complexity of Integration with Legacy Systems

Complexity associated with integrating new networking technologies into existing legacy systems is impeding the European market growth. Many European enterprises, especially in traditional industries like manufacturing and logistics, rely on outdated infrastructure that is incompatible with modern solutions. The European Commission’s Digital Transformation Scoreboard notes that over 60% of industrial enterprises face challenges in aligning legacy systems with advanced networking technologies. Furthermore, a study by the German Federal Ministry for Economic Affairs and Climate Action highlights that integration issues lead to an average delay of 12 months in project timelines for 30% of businesses attempting such upgrades. The French National Institute of Statistics and Economic Studies (INSEE) reports that nearly 25% of companies abandon network modernization projects due to technical complexities. This lack of compatibility not only increases costs but also discourages organizations from pursuing digital transformation, impeding the broader adoption of enterprise networking solutions across Europe.

MARKET OPPORTUNITIES

Emerging Demand for 5G-Enabled Networking Solutions

The rollout of 5G technology presents a significant opportunity for the Europe enterprise networking market, enabling faster connectivity and supporting innovative applications such as IoT, edge computing, and smart manufacturing. According to the European Commission’s 5G Observatory, over 70% of EU member states have initiated commercial 5G deployments, with countries like Germany, France, and Italy leading the charge. The UK Office of Communications (Ofcom) reports that 5G adoption could contribute up to €113 billion annually to the European economy by 2030, driven by enhanced network capabilities. Additionally, the European Investment Bank (EIB) highlights that investments in 5G infrastructure are expected to grow by 40% annually over the next five years, creating new avenues for enterprise networking solutions. As businesses seek to leverage ultra-low latency and high bandwidth, the demand for 5G-enabled networking systems is set to surge, unlocking transformative opportunities across industries.

Expansion of Smart City Initiatives Across Europe

The proliferation of smart city initiatives is another promising opportunity for the Europe enterprise networking market, as these projects rely heavily on robust and scalable networking infrastructures. The European Commission’s Smart Cities Marketplace estimates that over 300 cities in Europe are actively implementing smart city projects, ranging from intelligent transportation systems to energy-efficient buildings. According to Eurostat, public investments in smart city technologies are projected to reach €200 billion by 2025, with Germany and Spain accounting for nearly 40% of total spending. Furthermore, the French Ministry of Ecological Transition reports that smart city projects have already improved urban connectivity by 35%, driving demand for advanced networking solutions. These initiatives not only enhance urban living standards but also create a fertile ground for enterprises to deploy innovative networking technologies, fostering growth and innovation in the sector.

MARKET CHALLENGES

Cybersecurity Threats and Rising Vulnerabilities

The growing frequency and sophistication of cyberattacks is a significant challenge to the Europe enterprise networking market, threatening the integrity and reliability of network infrastructures. According to ENISA, the European Union Agency for Cybersecurity, ransomware attacks targeting enterprises increased by 45% in 2022, with an average cost of €1.5 million per incident. The UK National Cyber Security Centre (NCSC) reports that over 60% of businesses experienced at least one cyberattack in the past year, highlighting the vulnerabilities in existing systems. Additionally, the European Central Bank (ECB) emphasizes that financial institutions face heightened risks, with 30% reporting disruptions due to cyber incidents. As enterprises expand their networks to accommodate remote work and IoT devices, the attack surface widens, making it harder to ensure comprehensive protection. This rising threat landscape demands continuous investment in advanced security measures, straining resources and complicating network management.

Fragmented Regulatory Landscape Across Member States

Fragmented regulatory environment across European countries that creates inconsistencies in compliance requirements for enterprise networking solutions is another notable challenge to the European enterprise networking market. The Digital Single Market of the European Commission, differing national regulations on data privacy and cybersecurity have led to a 20% increase in operational complexities for multinational enterprises. For instance, Germany’s stringent Federal Data Protection Act often conflicts with less restrictive frameworks in Eastern Europe, as noted by the German Federal Ministry for Economic Affairs. Furthermore, Eurostat reveals that 40% of businesses operating in multiple EU countries face delays in deploying unified networking systems due to regulatory discrepancies. This lack of harmonization not only increases administrative burdens but also hinders cross-border collaboration and innovation. Enterprises must navigate these complexities to ensure compliance, diverting focus from strategic growth initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.60% |

|

Segments Covered |

By Enterprise Size, Industry, Technology, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Cisco Systems, Inc., Hewlett-Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Juniper Networks, Inc., Broadcom, Inc. (Brocade Communications Systems, Inc.), Alcatel-Lucent Enterprise (China Huaxin Post and Telecom Technologies Co., Limited), Nokia Corporation, Avaya, Inc. (Avaya Holdings Corp.), and ZTE Corporation. |

SEGMENTAL ANALYSIS

By Enterprise Size Insights

The large enterprises segment accounted for 65.7% of the European market share in 2024. The substantial IT budgets that enable investments in advanced solutions like SD-WAN and 5G-enabled networks is majorly propelling the domination of large enterprises segment in the European market. According to the UK Office for National Statistics, large enterprises allocate 15% of their revenue to digital infrastructure, driving innovation. These organizations prioritize scalability and compliance, with the European Commission reporting that 80% have adopted secure networking frameworks to meet GDPR standards. Their dominance is critical as they set benchmarks for smaller firms and contribute significantly to technological advancements.

The SMEs segment is anticipated to showcase a CAGR of 12.5%o over the forecast period. This growth is fueled by government initiatives; for instance, France’s Ministry of Economy notes a 30% rise in SMEs adopting cloud-based networking due to subsidies. The German Federal Ministry reports that SMEs upgrading networks achieve a 40% boost in operational efficiency. As digital transformation becomes essential, SMEs are investing in cost-effective solutions, bridging the technology gap. Their rapid adoption underscores their pivotal role in expanding the market and fostering inclusive digital growth across Europe.

By Industry Insights

The telecom & IT segment captured the largest share of 30.9% in the European market in 2024. The growth of the telecom & IT segment is attributed to its role in deploying 5G infrastructure and cloud-based solutions. According to Ofcom, telecom operators are projected to invest €100 billion in 5G by 2025, driving demand for advanced networking technologies. The sector’s focus on scalability and innovation has enabled it to support other industries’ digital transformation. With the International Data Corporation (IDC) reporting a 15% CAGR for SD-WAN adoption in IT firms, this segment’s dominance underscores its critical role in shaping Europe’s connectivity landscape and fostering technological advancements.

The retail & ecommerce segment is predicted to progress at a CAGR of 18.8% over the forecast period owing to the surge in online shopping, which accounted for 28% of total retail revenue in 2022, according to the UK Office for National Statistics. Investments in cloud-based networking and IoT-enabled systems have risen by 40%, enabling retailers to enhance customer experiences through personalized marketing and efficient logistics. The European Retail Forum notes that 60% of retailers have adopted advanced networking solutions to manage inventory and streamline operations. As consumer preferences shift toward digital channels, this segment’s rapid expansion highlights its importance in driving economic growth and operational agility across Europe.

By Technology Insights

The routers and switches segment occupied the leading share of 40.7% in the European market in 2024 due to their foundational role in ensuring seamless data transfer and network reliability. The UK Office for National Statistics highlights that over 70% of enterprises have upgraded their routing and switching infrastructure to support hybrid work models and cloud integration. Additionally, the European Commission’s Digital Economy and Society Index (DESI) notes a 25% annual growth in AI-driven switches, enabling smarter network management. This segment's importance lies in its ability to provide scalable, secure, and high-performance connectivity, making it indispensable for industries like BFSI, healthcare, and manufacturing.

The Wireless LAN segment is predicted to register a CAGR of 14.6% over the forecast period. The French Ministry of Economy reports that 50% of businesses have adopted WLAN solutions to enhance mobility and IoT integration. Furthermore, the UK Office for National Statistics highlights a 40% surge in Wi-Fi 6 deployments in 2022, driven by the demand for higher bandwidth and reduced latency. As enterprises embrace hybrid work environments and smart office initiatives, wireless LAN's flexibility and scalability make it a critical enabler of digital transformation, solidifying its role as a key growth driver in the enterprise networking market.

REGIONAL ANALYSIS

Germany held the leading share of 26.1% in the Europe enterprise networking market in 2024. Germany is the largest economy of Europe, with strong investments in Industry 4.0 initiatives driving demand for advanced networking solutions. The European Commission’s Digital Economy and Society Index (DESI) notes that 70% of German manufacturers have adopted IoT-enabled networks, enhancing operational efficiency. Additionally, the country’s robust IT infrastructure and high adoption of cloud-based systems contribute to its dominance. According to Eurostat, Germany accounts for 30% of all enterprise networking projects in the EU, supported by government funding for digital transformation. Its focus on innovation, coupled with stringent cybersecurity measures, ensures its position as a market leader.

The UK played a prominent role in the European market in 2024. The rapid adoption of cloud computing and 5G technologies in the UK is majorly driving the UK market growth. The UK Office for National Statistics reports that over 65% of British enterprises have upgraded their networks to support hybrid work models, a trend accelerated by Brexit and the pandemic. The UK’s leadership is further bolstered by significant investments in smart city projects, with London and Manchester leading the charge. According to the European Investment Bank, the UK’s spending on 5G infrastructure reached €20 billion in 2022. Additionally, the UK National Cyber Security Centre highlights that secure networking solutions have reduced cyberattack-related losses by 35%. These factors underscore the UK’s pivotal role in shaping Europe’s digital future.

France is one of the major markets for enterprise networking in Europe. The growth of the French market is driven by the strong government initiatives and a thriving tech ecosystem. The French Ministry of Economy reports that public funding has enabled 40% of SMEs to adopt modern networking solutions, boosting productivity. France’s leadership is also driven by its focus on green technologies, with the European Commission highlighting that 50% of French enterprises have integrated energy-efficient networking systems into their operations. According to Eurostat, France leads in smart city development, with Paris investing €15 billion in IoT-enabled networks by 2023. Furthermore, ENISA notes that France has reduced cybersecurity vulnerabilities by 40% through advanced network upgrades. This strategic emphasis on sustainability and innovation solidifies France’s position as a key player in the market.

KEY MARKET PLAYERS

The major players in the Europe enterprise networking market include Cisco Systems, Inc., Hewlett-Packard Enterprise Company, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Juniper Networks, Inc., Broadcom, Inc. (Brocade Communications Systems, Inc.), Alcatel-Lucent Enterprise (China Huaxin Post and Telecom Technologies Co., Limited), Nokia Corporation, Avaya, Inc. (Avaya Holdings Corp.), and ZTE Corporation.

MARKET SEGMENTATION

This research report on the Europe enterprise networking market is segmented and sub-segmented into the following categories.

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Industry

- BFSI

- Government & Defense

- Manufacturing

- Telecom & IT

- Retail & Ecommerce

- Healthcare & Life Sciences

- Others

By Technology

- Routers & Switches

- Enterprise Telephony

- Wireless LAN

- Storage Area Network

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe enterprise networking market?

The key drivers include increasing adoption of cloud computing, rising demand for high-speed internet connectivity, growing investments in data centers, and the expansion of remote work solutions.

Which industries contribute the most to enterprise networking demand in Europe?

The top industries driving demand are IT & telecom, banking & finance, healthcare, manufacturing, and retail, as they require secure and scalable networking solutions.

What is the impact of IoT on enterprise networking in Europe?

The increasing adoption of IoT devices is driving demand for robust and scalable networks that can handle large volumes of real-time data efficiently.

How are European regulations influencing the enterprise networking market?

Regulations like GDPR and the NIS Directive are shaping networking investments by requiring companies to prioritize data privacy, security, and network resilience.

How does cybersecurity affect the enterprise networking market in Europe?

Growing cyber threats are pushing enterprises to invest in secure networking solutions like Zero Trust Architecture, AI-driven security, and next-gen firewalls.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]